SBI Mini Statement Toll Free Number | SBI Mini Statement SMS Number | SBI Mini Statement PDF Download | SBI Statement On Mobile

SBI Mini Statement includes all of your transaction information from multiple mediums such as NEFT, RTGS, IMPS, UPI, and others. If you have your mobile number on file with the bank, however, you may be able to obtain the small statement via a variety of methods.

Table of Contents

How Can I Obtain an SBI Mini Statement?

After you’ve registered your mobile number with the bank, you can choose from the following alternatives to receive your SBI Mini Statement:

- Through Missed Call: SBI Quick Missed Call service allows you to examine your mini statement promptly. You will receive an SMS containing your mini statement if you make a missed call from your registered mobile phone to 09223866666.This is one of the simplest ways to check the mini statement because it can be accessed even if you don’t have access to the internet.

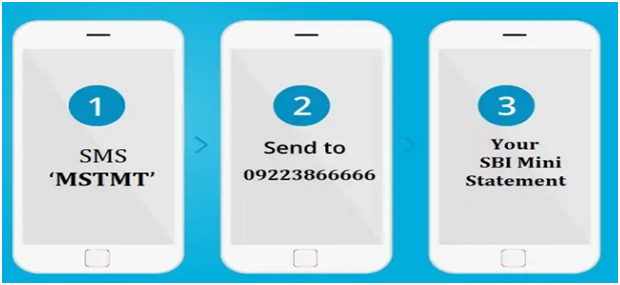

- Through SMS Banking: From your registered cellphone number, send an SMS to 09223866666 with the text “MSTMT.” Following that, you will receive an SMS containing the information of your most recent 5 transactions.

- Through Mobile Banking:SBI has released its mobile banking application, YONOSBI Lite, which is accessible for Android and iOS smartphones. This app is available for download on the Google Playstore and the Apple App Store. You shall be required to enter your Username and Password to log in. After that, you can examine your transactions by going to account information.Customers must have a smartphone and an internet connection to use this service.

- Through SBI Net Banking: Account holders can log in to the SBI Net Banking Portal using their User ID and password, in addition to SBI Quick banking and mobile banking. After login in, go to the ‘Account Details’ section to see a detailed list of all transactions. With the SBI Net Banking interface, you can easily manage multiple accounts, view account statements, transaction history, and more. The consumer must have a decent internet connection in order to use this service.

- SBI ATM: One of the most popular methods for obtaining account mini statements is through SBI ATM. Select the ‘Mini Statement’ option on the screen, input your 4-digit PIN, and read your statement at your nearest SBI or other bank ATM.

How To Add Nominee in SBI Bank Account

Register phone Number for SBI Mini Statement

Only the registered phone number can use the Mini Statement Service. As a result, registering a mobile number and activating SMS banking are both required in order to receive an SBI mini statement. The number is usually registered when the account is first opened. If this has not been done, the account holder can register the mobile number using the steps outlined below.

The account user needs to jot down the account number and simply send an SMS to the bank to register the mobile phone for mini statement services using SBI Quick – a free service from SBI that delivers missed call banking and SMS banking services. The SMS should be formatted as follows:

REG<space>Account Number

to

09223488888

The account holder must text the above-mentioned message to 09223488888. The mobile number will be registered with SBI after the SMS is sent.

The account holder must submit the following SMS code to register for SBI mobile banking services:

<MBSREG>

To

9223440000

SBI Debit Card Types and Annual Charges

Mini Statement Number from SBI

Give a missed call to – to acquire your SBI Mini Statement at:

09223866666

Account-holders can request an SBI Mini Statement by calling the SBI Mini Statement number at 09223866666. The account holder can request an Mini Statement by making a missed call from the registered mobile number.

Users can access the SBI Mini Statement through the Missed Call Service by following the instructions listed below. –

1. To learn about the last 5 transactions, call SBI Mini Statement number 09223866666.

2. After two rings, the call will be disconnected.

3. The customer will receive an SMS containing the SBI Mini Statement, which contains the account’s most recent 5 transactions.

How to obtain an SBI Mini Statement via SMS Banking

Account-holders can also receive SBI mini account statements by SMS. To receive the Mini Statement via SMS, send an SMS to 09223866666 with the word ‘MSTMT’ in the subject line. The SBI Mini Statement will be delivered to the registered mobile number, detailing the latest five transactions.

- SMS ‘MSTMT’ to get an statement via SMS banking.

- Text the message to 09223866666

- Examine the State Bank of India’s Mini Statement, which contains information on the previous five transactions.

Note: If an account holder has numerous accounts with SBI, he or she can only register for SBI Quick for one of the accounts at any one time. If the account holder wants to alter the registered account number for SBI Quick, he or she can de-register SBI Quick from the first account and re-register with the other.

How to obtain an SBI Mini Statement with Mobile Banking

The ways to obtain a statement utilizing mobile banking services are as follows:

- From the Google Play Store or the Apple App Store, download the ‘SBI Anywhere Personal‘ – SBI Mobile Banking app.

- Use the login credentials to access the SBI Anywhere app.

- Select “My Accounts” from the SBI Mobile Banking app’s home screen.

- Select the ‘Mini Statement’ option from the next menu.

- Review the statement, which shows the account’s 10 most recent transactions.

SBI Balance Check Service Benefits

Customers can take advantage of a variety of features, including the mini statement service, with automated and integrated services like those provided by SBI Quick. This has the following advantages:

- Customers do not need to connect into their SBI online banking accounts to view their bank account statement information.

- It’s a faster and easier way to get an SBI micro account statement with details on the bank account’s latest five transactions (recent 10 transactions in case of mobile banking).

- It is not necessary to have a laptop, computer, or even a smartphone to complete the process. To get these details, all you need is a simple phone with SMS capability.

- The need to go to the bank, wait in lines, and have the passbook updated for such minor data is no longer necessary. The procedure helps you save time and effort. All that is required is to send an SMS, and the information will be transmitted to the phone.

- It’s a painless, stress-free, easy-to-understand, and hassle-free approach that even those from the country’s most rural and backward regions can comprehend and apply.

An account holder may be eligible for the missed call banking service if the bank is an SBI linked bank. SBI has also extended this service to some former SBI affiliated banks. Account-holders can verify this with their bank or simply send an SMS to verify for themselves.

Find Cash Deposit Machine Near You

FAQ’s

There are several ways to check your SBI micro statement. You can call 09223866666 or text ‘MSTMT’ to the same number, download and utilize the SBI mobile app, or log in to the SBI net banking page. Mini Statements are also available at any SBI or other bank’s ATM.

If you don’t have access to the internet, you can leave a miss call at 09223866666 or text “MSTMT” to 09223866666 from your registered phone number. You’ll get an SMS with the information of your previous five purchases right away.

You may quickly verify the information of your last 5 debit/credit transactions in SBI by sending an SMS to 09223866666 or calling the same number. If you have a smartphone and an internet connection, you can view the statement using the SBI mobile app. You can also examine your transactions by logging into the SBI Net Banking Portal with your customer ID. Users can check statements at bank ATMs as well.

Send REGspace>Account Number to 09223488888 to register for SBI Quick services, which include missed calls and SMS services. Send MBSREG> to 9223440000 to register for SBI mobile banking services. You can simply go to the bank and register with the required documents.