SBI Debit Card Types | SBI Debit Card Annual Charges | SBI ATM Card Limit |

The State Bank of India is India’s largest and most reputable commercial bank. The State Bank of India has a wide network of ATMs and branches all across the country. State Bank of India provides retail and corporate customers with a wide range of banking products and services. In this article we will discuss SBI Debit Cards – SBI Debit Card Types and costs.

Customers of the State Bank of India can choose from a wide variety of Debit Cards and ATM cards. The features, privileges, withdrawal limitations, and perks of each SBI Debit Card Type vary. These SBI ATM cards were created to fulfill the needs of a vast number of account holders.

Table of Contents

SBI Debit Card Types

If you have a State Bank account and want to apply for an SBI Debit Card, then this is the place to go. After that, you can choose from the several SBI Debit Card Types listed below. Check out the Different SBI Debit Card Types and the perks they provide.

SBI Classic Debit Card

You can enjoy the ease of cashless shopping and simple account access with the SBI Classic Debit Card. Your purchases can also earn you Freedom Rewardz points. You can use this to withdraw cash from SBI ATMs or any other bank’s ATM. In India, it can be used to make purchases at merchant businesses and to make online payments.

Features:

- Widely Accepted – Your State Bank Classic Debit Card is accepted at over 5 lakh merchant outlets across India, allowing you to shop until you drop.

- Secure Online Transactions – When you use the Classic Debit Card, you can rest confident that all of your online transactions and purchases, such as buying flights, paying for groceries, and so on, are protected by the MasterCard Secure Code or Verified by Visa.

- ATM Access – Get cash quickly and easily with the Classic Debit Card, which may be used not only at SBI ATMs but also at non-SBI ATMs throughout India.

Fees & Charges:

The annual cost for the State Bank Classic Debit Card is Rs 100. This card’s cash withdrawal limit is set at Rs 40,000 per day. At a cost of Rs. 200, replacement debit cards are available.

Rewards & Benefits:

You will receive 2.5 reward points for every Rs. 100 spent on your card. You can earn points for a variety of expenditures made with your card, including gas, food, entertainment, travel bookings, internet purchases, and more.

SBI Platinum Debit Card

You can enjoy cashless shopping with the SBI Platinum Debit Card and earn SBI reward points on transactions. With this card, you can access your account anytime and anywhere. SBI Platinum Debit Card can be used to make purchases in stores and to make online payments. You can also withdraw money from ATMs in India and throughout the world.

The SBI Platinum Debit Card comes in Visa and MasterCard versions. Aside from the convenience of cashless transactions and ATM withdrawals, the card provides clients with a slew of other benefits. The card also comes with an insurance policy of Rs 5 lakhs.

Features

- The maximum amount you can withdraw is Rs.1 lakh.

- The maximum purchasing amount is Rs.2 lakh.

- Facility for international use

- For every Rs.200 spent, you will receive 1 point.

| Cash Withdrawal Limit | Up to ₹ 1,00,000 |

| Purchase Limit | Up to ₹ 2,00,000 |

| Card Replacement Charge | ₹ 300 |

| Annual Maintenance Charge | ₹ 175 |

| Issuance Charge | ₹ 100 |

Features:

Usage of the SBI Platinum International Debit Card has the following features:

- Use: International use is possible with the SBI Platinum Debit Card. With your debit card, you can travel the world and buy things without carrying cash.

- Association: The SBI Platinum Debit Card is a VISA or MasterCard-affiliated card.

- ATM’s access: The Platinum Debit Card allows you to use ATMs all around the country and the world. Each day, you can withdraw up to Rs.1 lakh.

- Transaction Purchase: You can make purchases of up to Rs.2 lakhs every day using your debit card.

- Rewards: Under the State Bank Rewardz program, the Platinum Debit Card is eligible to collect reward points. For every Rs.200 spent on your card, you will receive 1 point.

- Insurance: You are eligible for complimentary accidental death insurance. You’ll be protected for a total of Rs.5 lakhs.

- Purchase Insurance: All of your purchases will be insured against theft and damage for up to Rs.50, 000 for up to 90 days from the date of purchase.

- Reward Points: You may earn reward points by using your debit card to shop, fill up your fuel, transact online, book vacation, and eat out, among other things. For every Rs.200 spent on your debit card, you will receive one State Bank Rewardz point. You can also earn points on your first three transactions after receiving your debit card. You can earn 200 bonus points by using your debit card for three transactions within the first calendar month after it is issued.

- You can receive 50 State Bank Rewardz bonus points if you make your first transaction within one month of receiving your card.

- One can earn 50 State Bank Rewardz extra points if you make your second transaction within one month of receiving your card.

- You can receive 100 State Bank Rewardz extra points if you make your third transaction within one month of receiving your card.

The Rewardz points you earn will be added to your account. On the State Bank Rewardz website or mobile app, you can then exchange it for thrilling prizes.

Fees & Charges:

Some of the fees associated with the State Bank of India Platinum International Debit Card are listed below.

| Details | Charges |

| Issuance Fee | Rs.306 |

| Annual Fee | Rs.200 plus GST |

| Duplicate Card | Rs.200 plus GST |

| Cash limit at domestic ATMs | Rs.1 lakh |

| Cash limit at international ATMs | Subject to a maximum of foreign currency equivalent to Rs.1 lakh |

| POS limit at domestic outlets | Rs.2 lakhs |

| POS limit at international outlets | Subject to a maximum of foreign currency equivalent to Rs.1 lakh |

| Transaction charges at SBI ATMs | Free |

| Transaction charges at other ATMs | The First 5 transactions are free for savings account holders. |

SBI Global International Debit Card

SBI Gold International Debit Card is a Mastercard and Visa card that is one of SBI’s customer-oriented debit cards. The card can be obtained from the bank using both offline and online methods, including net banking, a written application, or by contacting the bank’s customer service department. It can be used to withdraw cash, check balances, deposit funds, and make payments.

You can access your bank account anytime and wherever you choose with the SBI Gold International Debit Card. With the SBI Gold Debit Card, you can also go cashless and earn State Bank Rewardz points. It can be used to make purchases, make payments, and withdraw cash from ATMs all over the world.

Features:

SBI Gold International Debit Card works in the same way as any other debit card, allowing you to withdraw cash and make purchases both online and offline. However, the card features vary from each other on the basis of various aspects. The following are the features of the SBI Gold International Debit Card:

- The users of this card have higher transactional restrictions.

- The card is valid in India as well as the rest of the world.

| Maximum Cash withdrawal | No Limit |

| Maximum Purchase limit | No Limit |

| Annual maintenance charge | ₹ 175 |

| Card replacement charge | ₹ 300 |

| Issuance Charge | ₹ 100 |

Benefits:

The following are some of the features provided by the SBI Gold International Debit Card signature card:

- The SBI Gold International Debit Card is simple to obtain, as it requires only the bare minimum of qualifications and documents.

- Also, debit cards are significantly more advantageous than a credit card in terms of debt management. A credit card allows you to make purchases that exceed your account limit, but a debit card allows you to make purchases based on your available cash.

- Cash can be withdrawn using the SBI Gold International Debit Card signature card.

- Even if the card is stolen, the funds on the SBI Gold International Debit Card are safe. Because the card can be blocked immediately, debit cards are a safer way to store money than cash.

- Another advantage of the SBI Gold International Debit Card is that it can be used at all points of sale, both offline and online, and it enables for hassle-free purchases.

- Apart from the optimal utilization of one’s funds, SBI Gold International Debit Card provides the added benefit of incentives such as cashback offers and reward points

SBI Gold International Debit Card

You may access your bank account anytime and wherever you choose with the SBI Gold International Debit Card. With the SBI Gold Debit Card, you can also go cashless and earn State Bank Rewardz points. It can be used to make purchases, make payments, and withdraw cash from ATMs all over the world.

Features:

The following are some of the most prevalent characteristics of the SBI Gold International Debit Card:

- This card provides users with increased transactional limits.

- The card is valid in India as well as the rest of the world.

- You can earn 1 SBIRewardz point for every 200/- spent on shopping, dining out, gasoline purchases, and travel using the SBI Gold International Debit Card.

The following are some of the characteristics of the SBI Gold International Debit Card:

| Cash Withdrawal Limit | Upto ₹ 50,000 |

| Purchase Limit | Upto ₹ 2,00,000 |

| Annual Maintenance Charge | ₹ 175 |

| Card Replacement Charge | ₹ 300 |

| Issuance Charge | ₹ 100 |

Eligibility:

To be eligible for an SBI Gold International Debit Card, you must meet the following requirements:

- SBI Gold International Debit Card applicants must be at least 18 years old.

- On behalf of minors, parents and guardians can obtain a debit card.

- Aadhar card, PAN card, passport, driving license, or Voter ID car are examples of government-approved identification and address that will be needed.

- To obtain a debit card, one must have a bank saving or current account.

sbiINTOUCH Tap and Go Debit Card

The sbiINTOUCH Tap & Go Debit Card is a contactless debit card that is accepted worldwide. It has a contact and contactless chip, as well as a magstripe and an NFC antenna. You may make electronic payments with this by just waving it near a PoS terminal. In this manner, it will be in your possession at all times.

SBI INTOUCH Tap and Go Debit Card have the following features:

- This is a multi-purpose International Debit Card featuring contactless technology.

- Electronic payments can be made with this card simply by waving the contactless card near the PoS terminal; the customer does not need to dip or swipe the card on the PoS terminal.

- The card is protected by the EMV contactless standard, making it safe to use for online purchasing and e-commerce.

- The reward points for that quarter are doubled if you use this card for at least 3 purchase transactions in a quarter.

The following are some of the benefits of the SBI INTOUCH Tap and Go Debit Card:

| Cash Withdrawal Limit | Upto ₹ 40,000 |

| Purchase Limit | Upto ₹ 75,000 |

| Annual Maintenance Charge | ₹ 175 |

| Card Replacement Charge | ₹ 300 |

| Issuance Charge | Nil |

SBI Mumbai Metro Combo Card

With the SBI Mumbai Metro Combo Card, you can shop at over 10 lakh merchant outlets across India. It provides a slew of advantages to metro riders. SBI Mumbai Metro Combo Card can be used at the Mumbai Metro as a payment and access card. It gives you quick access to your account and allows you to earn SBIRewardz points on your transactions.

Features:

The following are some of the most common features of the SBI Mumbai Metro Combo Card:

- This card may be used to make online payments and withdraw cash in India and overseas at over 10 lakh merchant outlets in India.

- The card can also be used to travel by metro in Mumbai.

- This card has two functions: 1) payment – cum -access card and 2) shopping-cum-ATM debit card.

For every 200/- spent on shopping, dining out, fuel purchases, and travel, cardholders can earn one SBIRewardz point.

The following are some of the characteristics of the SBI Mumbai Metro Combo Card:

| Cash Withdrawal Limit | Up to ₹ 40,000 |

| Purchase Limit | Upto ₹ 75,000 |

| Annual Maintenance Charge | ₹ 175 |

| Card Replacement Charge | ₹ 300 |

| Issuance Charge | ₹ 100 |

SBI My Card International Debit Card

This card allows you to express your individual personality and flair. To customize it, you can choose from a variety of vivid and intriguing photographs in our gallery. You can shop without cash and earn Freedom Rewardz points with this contactless card.It can be used to make purchases, make online payments, and withdraw money from an ATM. It is equipped with an EMV chip, which provides further fraud protection.

SBI Business Debit Cards

The SBI Business Debit Card was designed specifically for commercial users’ business needs. It allows you to keep track of and manage business expenses, as well as make payments and get more control over your spending. It can be used to withdraw money from ATMs as well as deposit money at CDM (Cash Deposit Machines).

State Bank Premium Debit Card

The SBI Premium Debit Card is available to State Bank of India’s high-net-worth customers. It has a daily withdrawal limit of Rs.2 lakh and a daily e-commerce transaction limit of Rs.5 lakh. It comes with a complimentary life insurance policy for the cardholder of up to Rs.5 lakhs.

State Bank Pride Debit Card

The SBI Pride Debit Card is designed for self-employed people. High cash withdrawal limits of up to Rs.1 lakh per day are available with this card. Purchase transaction limits of up to Rs.2 lakh per day are also available. It’s one of the few cards that have access to complimentary airport lounges.

SBI Debit Card Types and Charges

| Card Types | Issuance Charges | Annual Charges | Replacement Charges |

| SBI Classic Debit Card | Nil | Rs.125/- + GST | Rs.300/- plus GST |

| SBI Global International Debit Card | Nil | Rs.175/- + GST | Rs.300/- plus GST |

| SBI Gold Debit Card (International) | Rs.100/- plus GST | Rs.175/- + GST | Rs.300/- plus GST |

| Platinum Debit Card SBI (Intl.) | Rs.100/- plus GST | Rs.175/- + GST | Rs.300/- plus GST |

| sbiINTOUCH Tap and Go Debit Card | Nil | Rs.175/- + GST | Rs.300/- plus GST |

| SBI Mumbai Metro Combo Card | Rs.100/- at the time of issuance of the card. Metro Card comes pre-loaded with Rs.50/- | Rs.175/- + GST | Rs.300/- + GST |

| SBI My Card Intl. Debit Card | Rs.250 + GST | Rs.175/- + GST per annum from the second year of issue. | No card was issued as a replacement against your lost “My Card” Debit Card. However, you can apply for a fresh “My Card” Debit Card against an issuance charge of Rs.250/- + GST. |

| State Bank Premium | Nil | Rs.350/- + GST | Rs.300/- + GST |

| State Bank Pride | Nil | Rs.350/- + GST | Rs.300/- plus GST |

Note: Charges for SBI Debit Cards are subject to change at any time.

Different SBI Debit Card Types Limit

Let’s have a look at the daily withdrawal and purchase limits of the various varieties of State Bank of India debit cards.

| Card Types | Daily withdrawal limit | Daily purchase limit | ||

| Minimum | Maximum | Minimum | Maximum | |

| SBI Classic Debit Card | Rs.100/- | Rs.20,000/- | No such limit | Rs.50,000/- |

| SBI Platinum Intl. Debit Card | Rs.100/ | Rs.1,00,000/- | No such limit | Rs.2,00,000/- |

| SBI Gold Intl. Debit Card | Rs.100/ | Rs.40,000/- | No such limit | Rs.2,00,000/- |

| SBI Global International Debit Card | Rs.100/ | Rs.40,000/- | No such limit | Rs.75,000/- |

| SBI Mumbai Metro Combo Card | Rs.100/ | Rs.40,000/- | No such limit | Rs.75,000/- |

| sbiINTOUCH Tap and Go Debit Card | Rs.100/ | Rs.40,000/- | No such limit | Rs.75,000/- |

| SBI My Card Intl. Debit Card | Rs.100/ | Rs.40,000/- | No such limit | Rs.75,000/- |

| State Bank Premium | Rs.2,00,000 | Rs.5,00,000 | ||

| State Bank Pride | Rs.1,00,000 | Rs.2,00,000 |

Apply for Different SBI Debit Card Types Online

Following are the steps to apply for SBI Debit Card Online:

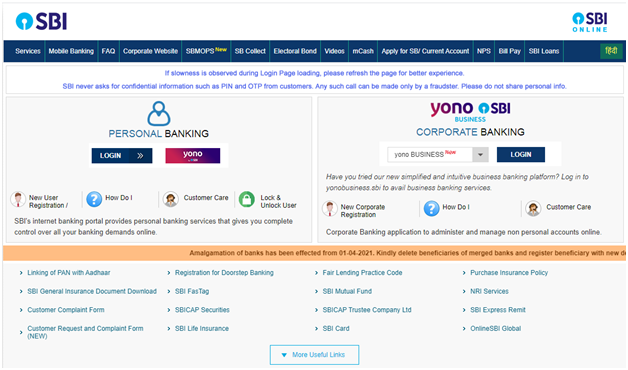

- First of all visit the official website of SBI i.e. www.onlinesbi.com.

- Enter your username and password to access your State Bank of India Net banking account.

- Under the “e-Services” page, click the “ATM Card Services” link.

- Select “Request ATM/Debit Card”.

- You must verify your request using your internet banking credentials and an OTP gave to your registered cell phone number.

- You must choose the bank account from which the card will be issued.

- Choose the SBI debit card type and enter the name that will be printed on it.

- You will be notified of the card’s delivery after you submit your request successfully.

Ways to Block SBI Debit Card Types

SBI Debit Cards can be blocked in the following ways.

Block SBI ATM Card through SMS

From your registered number send an SMS “BLOCK XXXX” to 567676. In this format, XXXX is the last four digits of your card.

Block SBI ATM Card by Dialing Toll-Free Numbers

Simply dial the Toll-Free numbers of State Bank of India from your registered mobile number to block the card.

SBI Toll-free numbers are 1800 112 211 or 1800 425 3800.

Block SBI Debit Card through Internet Banking

- Go to the official website of SBI and use your username and password to log in to the State Bank of India website.

- After that under the “e-Services” page, click the “ATM Card Services” link.

- Select the “Block ATM Card” option.

- Choose the card you want to block.

- From the drop-down menu, select the reason for blocking.

- Select the “Submit” tab.

- Choose OTP as your authentication method.

- Click the “Confirm” button and enter the OTP received on the registered mobile number.

- A notice with a ticket number will appear once it has been effectively blocked.

- Make a mental note of the ticket number for future reference.

Block SBI ATM Card through YONO Lite SBI App

With the YONO Lite App, you may simply block SBI Debit Cards in just a few steps.

1. Log in to the app and select the “Manage Cards” icon.

2. Select “Debit Card Hotlisting”

3. After that, choose your debit account.

4. Select the card number here.

5. Next, decide why you’re blocking your card.

6. An OTP will be sent to your registered phone number.

7. Tap the “Submit” tab after entering the OTP.

FAQ’s

If you’ve misplaced your SBI debit card, please contact customer service right once to report it. Your card will be blocked, and a new one will be sent to you.

You can either use your SBI online account or call the customer service number to redeem your points.

The maximum withdrawal limit allowed by the SBI Gold International Debit Card is 1 lakh, and the maximum purchasing limit is 2 lakh.

The SBI Gold International Debit Card has an annual maintenance fee of 175.