HDFC Bank, headquartered in Mumbai, Maharashtra, is a significant private-sector bank. Bank HDFC is a bank of the next generation. HDFC offers its customer a wide range of banking services. In this article, you will learn how to view your HDFC Debit Card EMI Loan Statement Online.

In this article, we are covering various topics like how to check the status of HDFC debit card loan online, how to get a copy of an HDFC loan statement, and the procedure of obtaining an EMI statement of a Loan.

Table of Contents

Online Statement for HDFC Debit Card Loans

If your email address is linked to your bank account, you can receive your HDFC debit card loan statement immediately in your inbox. As you may be aware, the HDFC Card EMI loan feature is only available to a small group of HDFC clients. Simply give a missed call on 9643 22 22 22 from your registered mobile number to confirm your eligibility for a pre-approved loan on the card.

If you are eligible you can also find out your card limit for EMI purchases. Once you’ve taken out the loan, your EMIs will be deducted automatically from your savings account, so you won’t have to worry about paying them individually.

Here’s how to verify the specifics of your HDFC card loan EMI statement.

Get an Online Copy of the HDFC Debit Card EMI Loan Statement

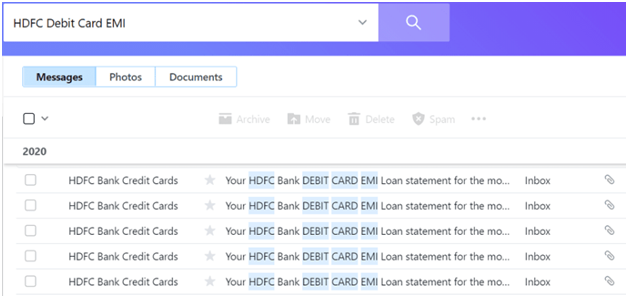

First and foremost, you must link your bank account to your email address. If your email address is linked to your savings account, you will receive your EMI loan statement in your inbox every month.

Simply check your email inbox. In your inbox, look for the HDFC card loan statement email.

To open it, simply click on it. As an attachment, you will find a PDF file. To examine the details of the statement, download it.

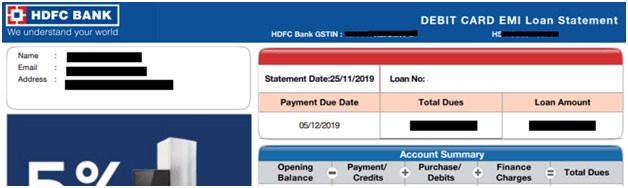

Debit Card Loan Statement of HDFC Bank

To check the specifics of your card loan, simply open the PDF file attached. You can see how many EMIs are active for your card on this statement. Check to see how many EMIs you’ve already paid off on your purchases.

Remember that a password is needed to open the PDF file. The password is eight characters long. It’s made up of the first four letters of your name in CAPITAL, plus the day and month of your date of birth.

As an example,

The password would be ROHA1612 if your name is ROHAN KUMAR and your date of birth (DD/MM/YY) is 16.12.1976.

HDFC Bank Debit Card EMI Loan Statement through SMS

You will also receive an SMS on your registered cellphone number whenever a debt is raised.

Check Eligibility for an HDFC Bank Debit Card EMI

Send SMS “DCEMI ” to 56767 from your registered cellphone number to check your HDFC debit card EMI eligibility.

HDFC Bank EMI Debit Cards

HDFC is one of our country’s biggest banks, and it offers EMIs on your debit card to help you get the most out of your money. You can choose from a repayment period of 3 to 24 months with HDFC bank. You also get rapid approvals and disbursements.

Features and Advantages

- You can take advantage of “No extra cost EMI” from renowned manufacturers such as Sony, LG, and Samsung.

- There is no requirement for documentation.

- Receive funds in your account right away.

- Repayment terms range from three to twenty-four months.

- Purchase your items and services with 100% financing.

- There will be no money blocked in your account.

EMI Facility

- Users with an HDFC Debit Card can text MYHDFC to 5676712. You will receive information on the loan amount, legitimacy, expiration date, and merchant name where the offer can be used after sending the message.

- You can pay with a debit card after visiting the merchant.

- Choose the ‘HDFC Debit Card EMI’ option when making a payment.

- Select a repayment period and take advantage of the offer.

- The first installment will be deducted 30 days after the money in the account is reversed.

EMI Fee/ Charges

| Fee Type | Details |

| Auto-debit Return Penal Rate | 2% plus GST @18% (minimum Rs. 550) |

| Late Payment Fee | Rs. 550 plus GST @18% |

| Pre-closure Charges | 3% of the balance principal outstanding plus GST @18% |

| Rate of Interest | 16% |

Avail HDFC Bank Debit Card EMI Brands Available

| Category | Brands |

| Health & Wellness/Hospitals | Dr Batra, Total Dental (Sabka Dentist), Vibes, Kaya, VLCC, Indira IVF, Clove Dental, Kolors, Apollo |

| Furniture/Home Decor | Livspace, Royal Oak, Homelane, Home Town, Damro |

| Apparel, Shoes & Accessories | Alda, Manyawar, Indian Terrain, Hush Puppies, Bath & Body Works, Adidas, Sephora, Charles & Keith, Central, USPA, Puma, Ethos, Shoppers Stop, Flying Machine, Titan Helios |

| Electronics and Smartphones | Apple, OnePlus, LG, Samsung (electronics & mobile), Sony, Whirlpool |

| Laptop/ Tablets | Apple (Macbook, iPad), Dell, Samsung (tablets), HP |

| Education | Classroom, Whitehat Jr, Unacademy, BYJUs, Lido Learning, Vedantu |

Frequently Asked Questions

Simply send an SMS from your registered cellphone number to 5676712 to check your loan eligibility on your card.

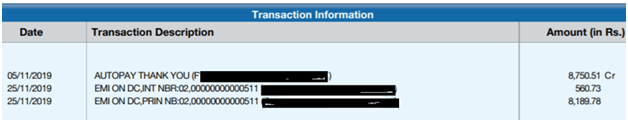

View the transaction information by opening the loan statement with the password. You can check how many EMIs have been deducted from your savings account in this section. Take a look at the image below.

Simply text MYHDFC to 5676712 from your registered cellphone number to see if you’re eligible for HDFC Bank Debit EMI.

It’ll be on your card’s EMI statement.

hdfcbank.com is the official website of HDFC Bank.