HDFC Bank Account Transfer | Add HDFC Bank Beneficiary | HDFC New Payee Add | How to Add Hdfc Beneficiary

People nowadays are enamored with online banking. HDFC net banking allows you to transfer money from one bank account to another. To send money via Internet banking, you must first add the individual as a beneficiary. In this article, you will learn How To Add a Beneficiary in HDFC Net Banking to make a money transfer.

Transferring funds with internet banking from the comfort of your own home is fairly simple. However, if the other individual is not on your beneficiary list, we will not be able to transfer money to his or her account right once.

Table of Contents

Add Beneficiary in HDFC Net Banking

Within 24 hours of adding a beneficiary to your HDFC account, you can begin transferring money to them. It’s only necessary to add a beneficiary once. You can transfer money to a beneficiary at any moment after adding them as a beneficiary.

You can transfer money both within HDFC and to other banks’ accounts. IMPS, NEFT and RTGS are all options for transferring funds to other bank accounts.

Transferring Money within HDFC Bank

You can move money from one HDFC account to another HDFC account. You must add a beneficiary to transfer funds to other HDFC accounts.

This post will show you how to add a beneficiary in HDFCNetbanking.

Requirements to add a beneficiary to your HDFC Bank account

You’ll need the following to add a beneficiary to your HDFCNetbanking account:

1. Account Number

2. Type of Account

3. IFSC code

4. The person’s name

How can I add a beneficiary to an HDFC Bank money transfer?

I’ll show you how to add a payee to your HDFC Net banking account. Beneficiary addition is a quick and painless process, however, beneficiary activation takes 30 minutes. Simply follow the instructions outlined below:

1. Go to the official HDFC Bank website (www.hdfcbank.com).

2. Enter your HDFC net bankingUser ID and Password to log in.

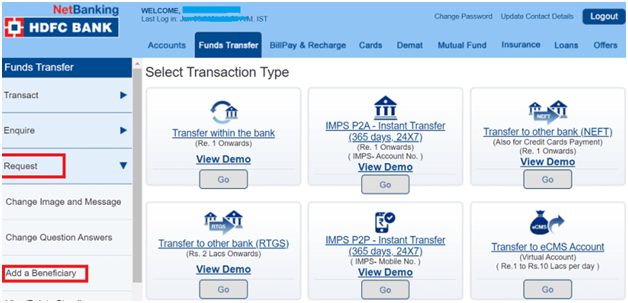

3. Next, go to the main menu and select “Funds Transfer.”

4. On the left-hand side of the screen, select the “Request” option.

5. In the left menu bar, select “Add a Beneficiary” from the “Request” option.

6. Choose a transaction type: transfer within HDFC Bank, transfer to another bank using NEFT/RTGS/IMPS. To continue, select the option and then click the “Go” tab. I’ve chosen the option to “transfer to another bank via NEFT/RTGS/IMPS.”

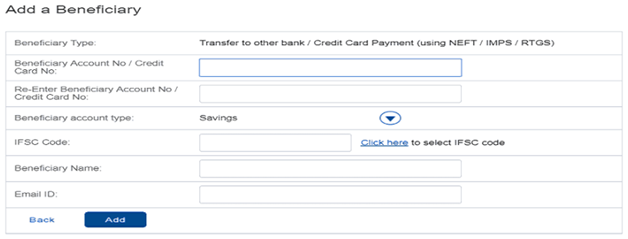

7. Fill in the beneficiary’s bank account number, account type, IFSC Code, name, and email address on the next screen. When adding a beneficiary from another bank, the IFS Code is only required. Select the “Add” tab.

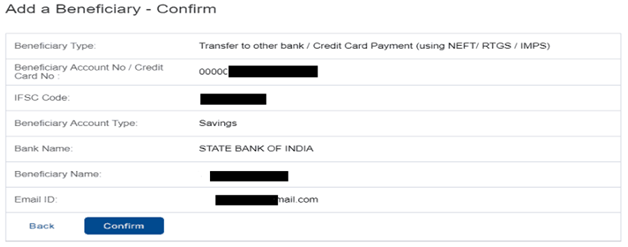

8. Here you must double-check your information and click the “Confirm” tab.

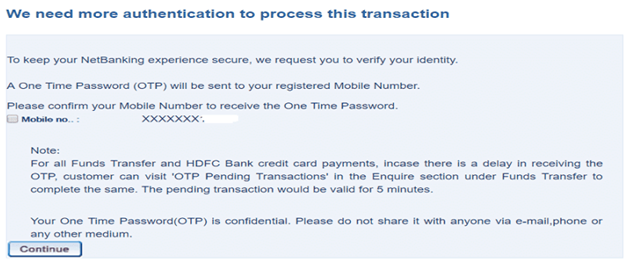

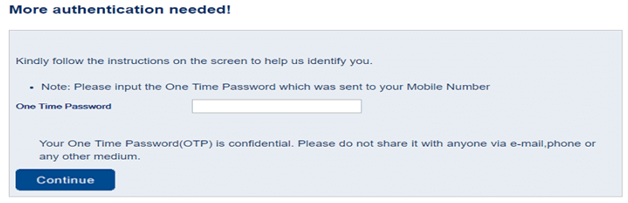

9. Confirm your mobile number to receive an OTP on the next screen (One Time Password). To receive OTP on your mobile number, click the “Continue” option.

10. On the next page, enter the one-time password (OTP) that was provided to your phone number. Select the “Continue” tab.

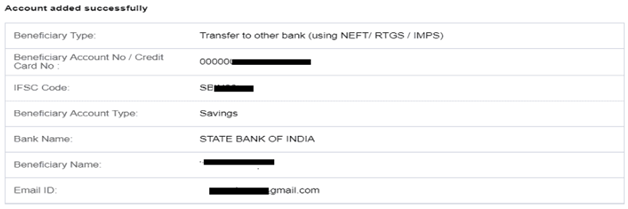

11. When the process is finished, the page displays a message stating that the beneficiary was successfully added.

12. After 30 minutes, the newly added beneficiary will be enabled.

13. After it’s been activated, you’ll be able to send money to the newly added account.

This is how you add a payee to your HDFC Bank Account.

Points to Consider

When adding a beneficiary to HDFC Bank Netbanking, keep the following considerations in mind.

1. After 30 minutes, the newly added beneficiary becomes active.

2. Please keep the following in mind for newly added Beneficiaries:

a) NEFT/IMPS – In the first 24 hours after addition, a maximum of Rs.2 lakh (in full or in portions) can be transferred to that beneficiary.

b) RTGS – In the first 24 hours after the beneficiary is added, a maximum of Rs.5 lakh (in full or in parts) can be transferred to the beneficiary.

c) The Third Party Transfer limitations will apply after this cooling time.

d) To check beneficiary status, go to “View List of Beneficiaries.”

3. If no funds are transferred for more than 24 months, an added beneficiary is recognized as a new beneficiary in all respects.

How to Add a Beneficiary to the HDFC App

In this post, you will learn how to add a beneficiary to the HDFC App. If you have the HDFC Bank Mobile Banking App, you can add beneficiaries to your account. If you haven’t already done so, download this app and register.

The steps for adding a beneficiary to the HDFC Bank App are outlined below.

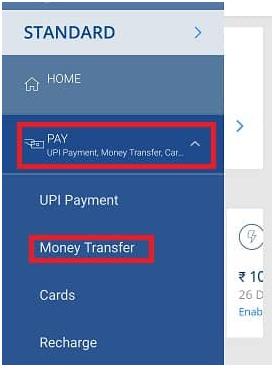

1. Open the HDFC Mobile Banking App and log in.

2. After you’ve logged in, go to the menu.

3. On the next screen, select the “PAY” tab.

4. Select the “Money Transfer” tab.

5. Now press the “ADD NEW PAYEE” link.

6. Select “Bank Accounts” as the next step.

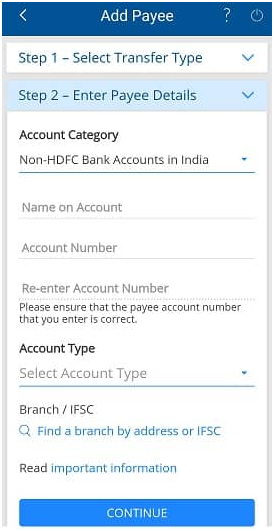

7. Select your account category – HDFC Bank Account or Non-HDFC Bank Accounts in India – from the drop-down menu. I’ve chosen the option “Non-HDFC Bank Accounts in India.”

8. Fill in the beneficiary’s name, bank account number, account type, IFSC Code, and email address on the next screen. When adding a beneficiary from another bank, only IFSC Code require. Select the “Continue” tab.

9. Review your information and click the “Confirm” button.

10. Confirm your mobile number on the next page to receive an OTP. To obtain an OTP on your mobile number, click the “Continue” button.

11. Enter the OTP on the next screen and select the “Continue” tab.

12. When the process will complete, the page will display a message stating that the beneficiary account has successfully added.

13. It will enable in 30 minutes after adding.

14. You can now send money to the newly added beneficiary account when it will activate.

15. This is the process that you need to follow in order to add a beneficiary to the HDFC mobile app.

FAQs (Frequently Asked Questions)

After 30 minutes, the newly added beneficiary will be enabled in your account.

a) NEFT/IMPS:

For the first 24 hours, you will be able to can transfer a maximum of Rs.2 lakh (in full or in parts) to the newly added beneficiary.

b) RTGS:

For the first 24 hours after addition, you can transfer a maximum of Rs.5 lakh (in full or in parts) to the beneficiary.

c) The Third Party Transfer limitations will apply after this cooling time.

The beneficiary information can be found under the “Enquire” section’s “View Beneficiary” option.

Simply select “Funds Transfer” from the top menu. After that, select “Enquire” and then “View List of Beneficiaries.” Then, under “Transaction Type,” select the “Go” tab. Scroll all the way to the bottom of the list to find the “Delete” button. To remove a beneficiary, click on it.

After you’ve added a beneficiary to your HDFC bank account, it will be activated in 30 minutes. As a result, you’ll have to wait half an hour for the funds to be transferred to the newly registered beneficiary account.

The nearly added beneficiary in HDFC bank has a 24-hour cooling period. You can do a limited amount of transfers within 24 hours.