Axis Bank guarantees hassle-free signup for internet banking in just a few simple steps. With Netsecure’s additional two-step authentication method, online banking is secure. To register for Internet banking and begin doing your banking online, simply follow the steps below. Simple, quick steps for logging in and beginning online banking

Customers who have access to Axis Bank Internet Banking can now manage a variety of banking activities, including:

- Opening savings accounts

- Paying bills requesting credit cards/debit cards

- Opening fixed deposits

- Viewing account activity

- Requesting a cheque book and

- Downloading past account statements online.

Table of Contents

Axis Bank Internet Banking Registration

In just a few simple steps, Axis Bank ensures trouble-free internet banking registrations. With Net secure’s new 2-step authentication system, online banking is safe and secure. To begin net banking, follow the steps below to register for Internet banking. These are the steps to login and start net banking quickly and easily:

Check Axis Bank Account Balance

For Retail / Agri-Rural Customers

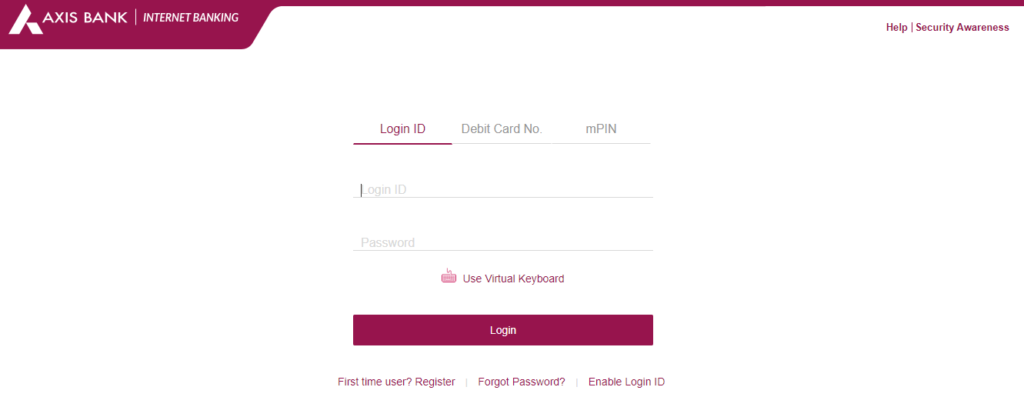

- First of all, you’ll need your login ID, which is the same as your 9-digit Customer ID, to use internet banking. It’s mentioned in the welcome letter and printed with your login password on your checkbook.

- You can also acquire your Customer ID by sending an SMS CUSTID to 5676782.

- The ‘First-time user option’ allows new users to create a password online. Using your debit card’s 4-digit ATM pin and your registered cellphone number, you can establish a login password.

- If you have not applied for a Debit Card, you will receive a printed password through courier.

- To log in for the first time, go to the official Portal or click here

- If you’ve forgotten your password, go to the login page and click the “Forgot Password” link to create a new one.

For NRI customers

- NRI Customers will need login ID, which is the same as your 9-digit Customer ID, to use internet banking.

- It’s mentioned in the welcome letter and is printed with your login password on your checkbook.

- You may also acquire your Customer ID by sending an SMS CUSTIDto +919717000002.

- You can use your KYC credentials to log in as an NRI customer.

- In order to login for the first time, go to the login page or click here

- If you forget your password, go to the login page and click the “Forgot Password” link to reset your password.

- If you want any assistance, please contact us at nri.services@axisbank.com or callour 24×7 Phone Banking numbers

Axis Bank Internet Banking Benefits

Following are the benefits of Axis Bank Net Banking:

- Fund Transfer: Using internet banking, you can transfer payments in a secure manner. It’s worth noting that you can move funds between Axis Bank accounts as well as non-Axis accounts without any difficulty.

- Account Information:Any consumer can access information about his or her Axis Bank savings account in a simple method. Customers can investigate the following:

- Account balances

- Prior account statements

- Account details for Demat or Loan accounts

- credit cards, and much more

- Access Service Requests: Customers can request:

- Fresh cheque books

- Reward point redemption

- Demand drafts

- Stop cheque requests, and other banking services with ease.

- Invest Online: Customers can access Axis Bank Net Banking to check their total banking portfolio, as well as investment opportunities such as IPOs, NFOs, Fixed Deposits, Financial Planning, and more.

Benefits of Various Value-Added Services

This online banking portal offers a number of additional benefits, mobile recharges, including utility bill payment, e-statement registration, Credit Card (Visa) bill payments, SMS banking registration for notifications, and so on.

What is Axis Bank Netsecure?

Netsecure is Axis Bank’s enhanced security tool for ensuring safe online transactions. The customer receives an OTP through SMS as soon as he or she applies for Netsecure.

This would use as the transaction password for any online transactions. Because the customer is participating in every online transaction by manually inputting the password, this technique tends to make the transaction even safer and secure.

Types of Netsecure

Following are the types of Netsecure

- 1-Touch Device Netsecure: With the use of a 1-Touch device provided by the bank, the customer can produce Netsecure code.

- Netsecure using SMS: The Netsecure Code will delivere to the candidate’s registered cellphone number in this case. Axis Bank currently only offers this service to domestic customers.

- Web Pin Option: The customer must record one or more of his or her frequently used computers in order to access a web pin. The Netsecure code must be obtained by the customer using the Web pin.

- Mobi-Token: For OTP generation, the customer must download and install the Axis Net secure application from the Play Store or App Store. Axis Bank currently solely offers this service to NRI customers.

Steps for Netsecure Registration

- Customers must list their mobile number in their bank records in order to register for Netsecure.

- For mobile number registration, the consumer must go to the nearest Axis Bank branch or ATM.

- If the candidate has already gotten mobile alerts from the bank on his or her phone, it is safe to assume that their phone number has already been registered.

- After the mobile number has been listed, the customer must go to the Axis Bank Net Banking portal and select the “Netsecure with SMS” button.

- The Netsecure registration process is completed after selecting the “Netsecure with SMS” tab on the registration screen.

What are Net secure Fees & Charges?

It is vital to note that each user applying for Net secure will require to pay a one-time fee of Rs. 1000, which is non-refundable.

Axis Bank Internet Banking Registration Via Mobile App

Customers have the option of registering for Netsecure using a mobile app. The following procedures must do in order to register with the Mobile App:

- To install Netsecure through mobile app, make sure you have an IOS or Android phone.

- In the case of domestic consumers, it is required to verify whether or not their phone number has been registered with the bank. It’s important to keep your phone number up to date if you use it frequently. This is due to the fact that all alerts will send to your registered mobile number only.

- It is vital for NRI customers to check if their email address has registered with the bank.

- The processes outlined above are for both domestic and NRI clients who want to use Axis Bank Net Banking.

- Customers must select the “Netsecure with mobile App” tab on the registration page.

- Existing customers who want to switch to the “Netsecure with mobile app” service can do so using their bank’s net banking service.

- You can install the “Axis Netsecure” application on your mobile phones by downloading the app from the app store.

- After that, finish your registration by following the instructions under Internet Banking.

What are the Benefits of Using the App?

The following are the benefits of using the app for Axis Bank Net Banking:

- Customers can check the balance of bank account online

- There are no fees and you may examine your whole transaction history.

- Money transfers from your Axis Bank account to any bank account in India in real-time.

- Transfer of funds without naming a recipient.

- You can pay utility bills for power, water, gas, broadband internet, and landline telephones, as well as recharge your mobile or DTH.

- Payment of medical insurance premiums and BHIM UPI services are also available.

Process to Activate and Practice Internet Banking for Axis Bank

The process to activate and practice internet banking for Axis Bank has given below:

- First of all, you need to install the app after downloading it.

- Next step is to Verify your phone number

- After that from the list of banks, you need to select Axis Bank.

- Your Axis Bank accounts will instantly register for mobile banking and linked to the app.

- You can check your account balance and make real-time transfers.

Startup India Seed Fund Scheme

How Can I Register for Axis Bank Internet Banking?

You must complete a few basic steps in order to register for Axis Bank Net Banking. With the introduction of online banking, you may avoid long lines at bank branches and conveniently manage your personal bank accounts 24 hours a day, 7 days a week from the comfort of your own home. Follow the steps outlined below to register for an internet banking service:

- You must first access Axis Bank’s net banking official website. Navigate to the tab that prompts you to register for Internet banking.

- You will ask to enter your Account Number, Customer ID, and registered mobile number on the website.

- Following that, you will be asked to verify your debit/credit card information.

- This is followed by the delivery of an OTP to your registered email address or mobile number.

- After that, you’ll be requested to create a password for the Login purpose. It is recommended that you create a strong password, which you can do with the help of password generation guidelines.

Change Axis Bank Net Banking User ID

You’ve gone over the step-by-step instructions for opening a new Axis Bank Net banking account up to this point. After you’ve completed the registration process, you’ll be able to conduct a variety of fund transactions and other activities. When you first set up your net banking account, you will use the credentials provided with the package. After the first activation, you have one chance to alter or personalize your User ID. Follow these procedures if you wish to update your login ID:

- To begin, go to the Axis Bank Net Banking page on their official website.

- The Login button may find on the home page, and you can just tap it.

- You’ll take to the following page, where you’ll need to provide your current customer ID and debit card number.

- After you’ve entered all of your information correctly, click the Login button.

- After you’ve logged into your account, click the downward arrow button and choose the option “Change Login ID.”

- On the following screen, you must input your new login ID and then press the Next button.

- Make sure the new Login ID has at least one alphabet.

- You must confirm your request to change your login ID.

- Check to see if your Net Banking login ID has successfully changed.

- After that, simply log into your account using the new User Id obtained from the axis bank website.

Reset Axis Bank Net Banking Password

Customers can reset their Axis Bank net banking password by following the simple steps outlined below:

- To begin, go to Axis Bank’s official website.

- Simply use the ‘Forgot Password button to reset your password.

- After that, simply enter your login ID and press the submit button to create a new password.

- You must first enter your debit card information, such as the ATM number, 4-digit PIN, and expiration date, before pressing the submit button.

- Now you can proceed after selecting Transaction password as the password type.

- You may now conveniently set your new Axis Bank net banking transaction password.

Regenerate Axis Bank Net Banking Login & Transaction Password

Online Process: Passwords for login and transactions can be recovered in the same way. To regenerate either of the passwords, follow the steps outlined below:

- Go to the Axis personal banking page and log in.

- Tap on ‘Forgot Login Password‘ after entering your ‘User ID.’

- You’ll be asked to re-create your Axis Bank online password.

- Fill in your username as well as the required information, such as your 16-digit debit card number, ATM PIN, and expiration date.

- Select the ‘Proceed’ option.

- You can now choose between a ‘Login password’ and a ‘Transaction Password.’

- Replace the old password with the new one and confirm it.

- Enter the 6-digit OTP supplied to your registered mobile number and press the ‘Submit’ button right away.

- Your online banking password has been reset.

Offline Process through Bank: If the online method does not work for you, you can go to a nearby bank branch and fill out a transaction password reset form. Then, together with a self-attested copy of your id proof, submit it. Carry an original copy of your id proof and passbook with you for confirmation.

The request will forward after submission, and a new temporary password will send to your postal address within 2-3 days.

Conclusion

Aside from financial transactions, customers can use online banking to

- Submit a variety of banking-related requests.

- Stop cheque requests

- New chequebook requests

- Demanding draft requests

- Opening a fixed deposit

- Receiving e-statements and

- SMS banking registration are among the services available.

FAQ’s

Axis Net Banking allows you to access your account(s) wherever and whenever you choose, 24 *7. All of your daily transactions can be completed online. You may access your account information, order checkbooks, make fund transfers, request DDs, pay your bills, and even buy online.

To register your cellphone number for internet banking, follow the steps below:

Visit an Axis Bank ATM or go to the Axis Bank website to access the net banking section.

Select Registrations, then click Netsecure button.

Enter and verify your mobile phone number.

An SMS will be sent to you in order to confirm your registration.

Yes, this service is also available to NRIs. A transfer of funds from one NRE account to another NRE, NRO, or Resident account is possible. As a result, funds can be transferred from one NRO account to another. However, funds cannot be transferred from resident accounts to NRE accounts.

You can use Net Banking to get the following benefits:

Dashboard: View all of your Axis Bank relationships, including your accounts, deposits, loans, and credit cards.

Check out your most recent transactions.

Create FDs and RDs in an instant.

Shop on a variety of websites and pay with your Internet Banking account.

Money can be simply transferred to other bank accounts.

Keep track of the status of issued and cleared checks.

Every time a button on the NETSECURE 1-Touch is pressed and held, it generates a unique NETSECURE Code. To access Axis Bank Net Banking, you’ll need to enter this NETSECURE Code in addition to your login ID and password.

To register for Netsecure, go to Internet Banking and click the register for Netsecure link.

You can choose between SMS and Mobitoken. Choose the mode you want to use. That mode will provide you with the password.

Submit your mobile phone number.

You will receive a message saying “Mobile number not as per records” if your mobile number does not match the Bank’s records.

If you forget your Net Banking password, you can create one online. You’ll need your 16-digit ATM/debit card number as well as your ATM PIN. If you do not have a debit card, please contact the call center or your nearest branch to request a PIN.