Cleartax Login | Cleartax Income Tax Software | www.cleartax.in Free ITR Filling | Cleartax Business Login | Cleartax Download

E-filing has grown in popularity in recent years because it is simpler, does not require the printing of documents, and maybe done for free! You can file your income tax returns online at www.cleartax.in. Cleartax Login makes income tax filing and e-filing simple. In just 7 minutes, you may e-file your taxes!

The last date for submitting an income tax return (ITR) for the fiscal year 2020-21 has been extended by the authorities until the 31st of December 2021. The ITR filing deadline is usually July 31 of the year in which the returns for the relevant assessment year can be filed.

Table of Contents

Documents Required to file ITR Returns on Cleartax Login

Following are the documents that you must keep ready before starting the process of filing ITR Returns on Cleartax Login:

- PAN Number

- Form -16

- Form 26AS

- Bank account Details

- Additional Investment

Process to File ITR through Cleartax Login

The step by step process to file ITR through the Cleartax Login website is given below:

- First of all visit the Clear Tax website i.e https://cleartax.in/

- On the home page click on Login option.

- If you are using for the first time, sign up with your email ID or else you can login using your email Id and password and click Login button.

- After clicking on login option the new page will appear on the screen. Here you need to import or enter details. Manually enter salary details or import form-16 using uploadForm-16 PDF button.

- Drop the file on the space shown on the screen. Select the appropiate file and click on open

- Click on proceed button.

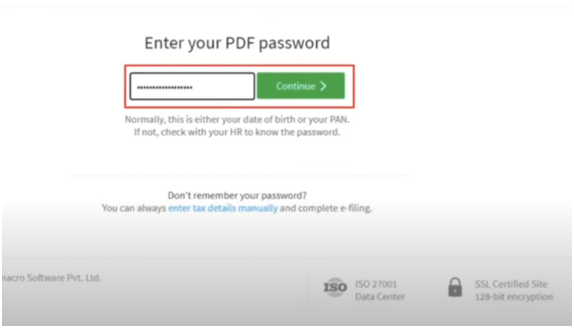

- On the next page, enter your PDF password as directed by your employer and click on continue option. Now it is successfully uploaded.

- Similarly you can import multiple Form 16 in you changed jobs in that year.

- Once uploaded click on Proceed to E- filing option.

Personal Information

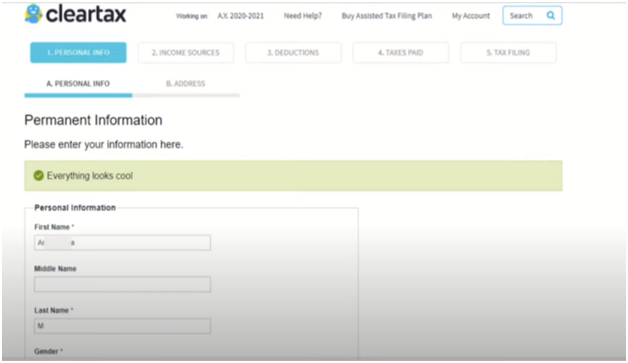

- Personal Info:

- Now another page will open. Here you need to enter personal information such as Name, Gender, d.o.b, PAN Number, Father’s Name, Martial status. Click on save option.

- Address

- Now next step is to enter your Address details and click on save option.

Income Sources

- Salary

- Now next step is to enter your salary details, TDS details and employer details auto filled from Form 16 including multiple employment (You can edit it if needed), verify and click on save button.

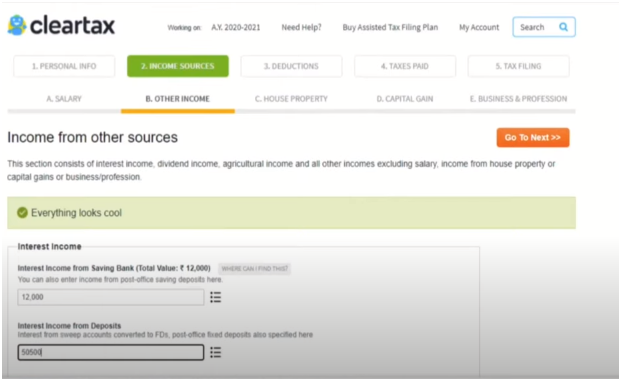

Other Income Details

- Here you need to enter the details of interest you earned, other income, exempt income, agriculture income (if any) and click on save option.

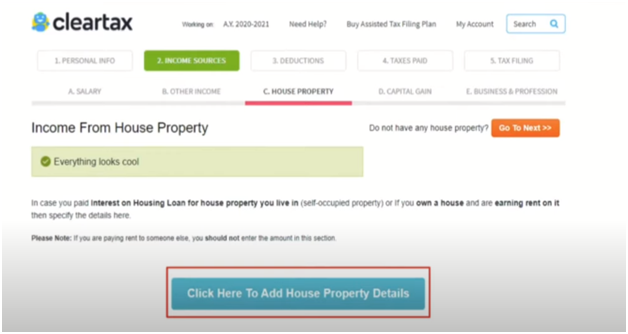

House Property

- If in case you paid interest on Housing Loan for the property that you own or you have earned rent on it click on the option ‘Click here to Add House Property Details’

- Foe self-occupied, select the type of house property as self-occupied.

- Enter the interest amount that you have paid on the loan.

- Enter the address details and the ownership details of the property and click on saveopt.

- Or if you selected self- occupied house property as Rented Property, then enter the rent amount, tax paid, Tenant details and the interest paid on the housing loan along with the property ownership details and click on save button.

Capital Gains

- Capital gains would apply in case you applyin case you sold any capital asset during that year making some loss or gain. Manually enter the details if there are few in number by clicking on the first button

- Or if you have invested to the platform such as ZERODHA, CAMS, KARVY click on the icons directly to import these details from their portal. Click on save and proceed.

Business and Profession

- Under Business and Profession, click on ‘Add Income from Business’ button as a businessman or freelancer to declare the profit or loss details, GST details, Speculation income etc

- Click on Go to Next option

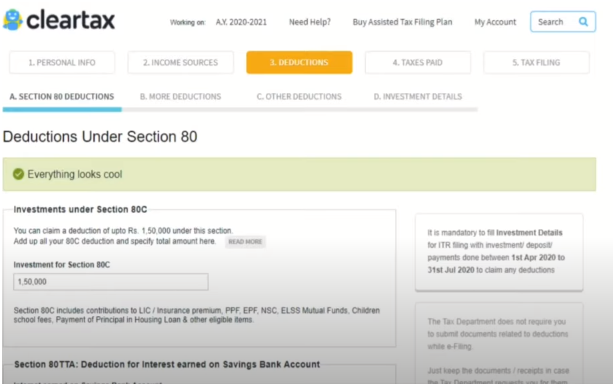

Deductions

Section 80 Deductions

Section 80 Deductions are already taken from Form 16 and are still editable.

- SB interest is auto filled under 80TTA.

- Enter 80G donations if any and click on save.

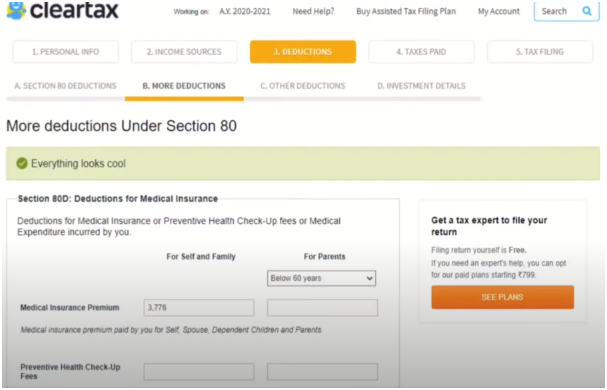

More Deductions

- It consists of Medical Insurance Premium, Education Loan Premium paid or any other additional contribution made.

- Enter the above amounts.

- Click on save option.

Other Deductions

- It consists of special deductions for disabilities if any.

Investment Details

- Investment Details window is newly provided for AY 2020-21 or FY 2019-20.

- For any other additional tax saving investments made between first April 2020- 31st July 2020, click on the button’ Click here if you have invested’

- Enter the amount and click on save to proceed

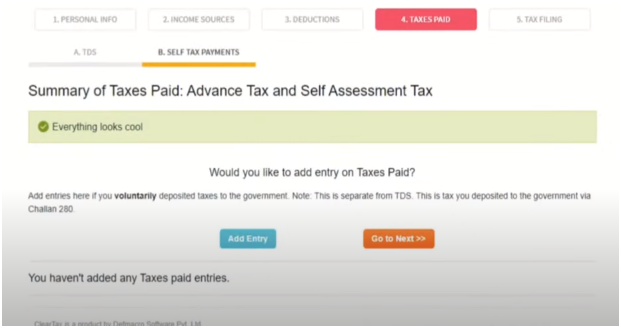

Taxes Paid

TDS

- It contains TDS details for that year.

- Also Form26 can be uploaded by clicking on the hyperlink. Select the file and click on open. Proceed to next.

Self-Tax Payment

- It contains self-assessment self-paid through challan including advance tax

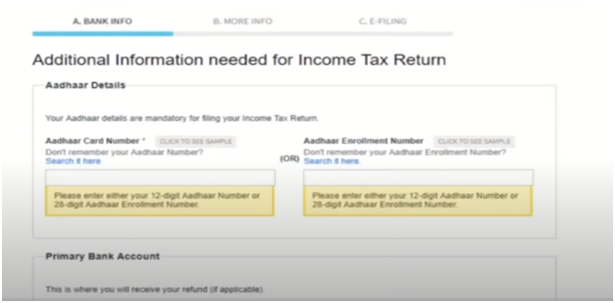

Tax Filing

Bank Info

- Here you need to enter your Aadhar Information i.e Aadhar number orAadhar enrollment number.

- Enter bank account details

More Info

It has more info reported in some cases as mentioned below:

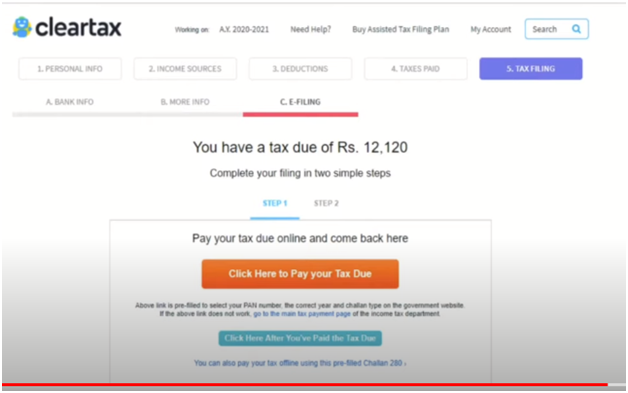

E- Filing

- Finally tax amount payable is calculated.

- Review the details given on the screen.

- You can also download the PDF or Word document.

- Make payment of tax dues (if any) and enter the challan details as per the previous step.

- You will find that there is no tax due.

- Click on Process to E-filing

- If takes few moments before you have successfully finished filing your Tax Return.

- You will get an acknowledgement number on the screen. This will be sent to your email address and mobile number

E- Verify ITR

- Once the return is filed, e- verify the income tax return using the net banking or through Aadhar link mobile number.

Cleartax Login FAQ’s

The previous year, also known as the financial year or your tax year, is a 12-month period that begins on April 1st and concludes on March 31st of the following year. Your tax year ends on March 31st, regardless of when you started your job, and a new tax year begins on April 1st. As a result, it is critical to plan your taxes for each fiscal year.

It’s a term you’ll hear a lot when it comes to tax preparation. It is the fiscal year after the prior year in which you will ‘assess’ and file your previous year return. For example, the assessment year for the prior year 2019-20 is 2020-21. The assessment year is the year in which you will file your prior year’s tax return.

You may generate money from a variety of sources besides your salary. Your total revenue is the sum of all of the income.

Deductions lower your taxable income. These are the sums that the Income Tax Department permits you to deduct from your income to lower your tax bill.

Sum of All Heads of Income = Gross Income – Deductions = Taxable Income

Electronic filing, often known as e-filing, is the process of submitting your tax returns online. You can file your income tax returns in one of two methods. The usual method is to go to the Income Tax Department’s office and physically file your returns. The other option is to e-file over the internet.

Yes, there is a distinction between deducting TDS and filing a tax return. Actually, you file a tax return to demonstrate that you’ve paid all of the taxes you owe. When applying for a loan or visa, the income tax return is also a very useful document.

For each type of tax scenario, there are seven forms: ITR 1, 2, 3, 4, 5, 6, and 7. If you e-file with ClearTax, we will automatically select the appropriate income tax return form for you.

You can still use ClearTax to file your tax return if you don’t have a Form 16. All you’ll need are your payslips. To e-file without Form 16, follow the instructions in this guide.

After e-filing your income tax return, you will receive an ITR-V, which is a one-page document. If you haven’t e-verified your tax return, you must print, sign, and submit the ITR-V to the Income Tax Department within 120 days of e-filing.

ITR return forms have no attachments, therefore the taxpayer does not have to include any documents (such as evidence of investment, TDS certificates, etc.) with the return of income (whether filed manually or filed electronically). These records, on the other hand, should be kept by the taxpayer and produced before the tax authorities when requested in situations such as assessment and inquiry.