How to File ITR Online | Income Tax Return Filling Process for Beginner | Income Tax Return Last Date | Calculating Income Tax for Beginner

Table of Contents

File ITR Online

An income tax return is a form that a person uses to declare his or her earnings, spending, tax deductions, investments, and taxes, among other things. The Income Tax Act of 1961 makes it essential for a taxpayer to file an income tax return in a variety of situations. An income tax return is a form used to report a taxpayer’s annual earnings. Even if there is no income, there are a variety of reasons to File an ITR income tax return.

A taxpayer may need to file an income tax return to declare his earnings for the year, carry forward losses, claim an income tax refund, or claim tax deductions, among other things. The Income Tax Department offers the option of filing an income tax return online (e-filing).

Calculating Income Tax for Beginner

The taxpayer will be obliged to compute his or her income in accordance with the rules of the income tax law that apply to him or her. The computation should include all sources of income, including salary, freelancing, and interest income. Tax-saving investments, for example, can be claimed as deductions under section 80C. Before going over the stages required in e-filing an income tax return, it’s critical for a taxpayer to preserve all of the documents related to ITR calculation and reporting. A taxpayer should also consider any credit for TDS, TCS, or any advance tax paid.

ITR Filing Process for Beginner

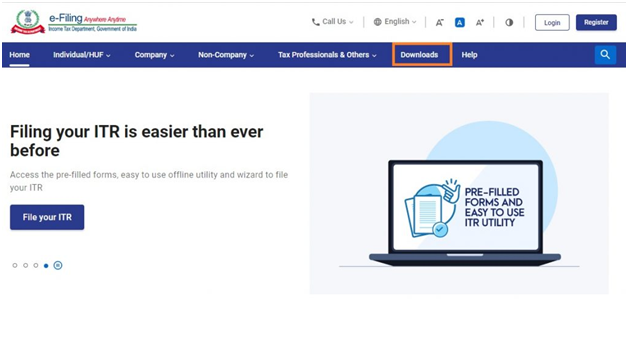

In order to download the ITR utility from Income Tax Portal follows the steps mentioned below:

- First, if go to www.incometax.gov.in and select “Downloads” from the top menu bar.

- Select the assessment year and download the offline utility program, such as Microsoft Excel, Java, or JSON, depending on your preference. From AY 2020-21, the income tax department will stop using excel and java utilities.

- Fill in all the required details in the Downloaded File

Fill in the required details of your income after downloading the offline utility, and check the tax payable or refund recoverable based on the utility’s calculations. The downloaded form can be filled up with the details of an income tax challan.

- Validate the Entered Information

On the right-hand side of the downloaded form, there are a few buttons. To check that all of the needed information is filled in, click the ‘Validate’ button.

- Convert the file to XML Format

After confirming the file, click the ‘Generate XML’ button on the right-hand side of the file to convert it to XML format.

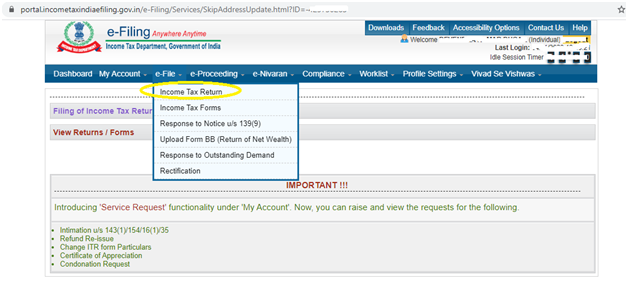

- Upload the XML file on the Income Tax Portal

Log in to the income tax e-filing portal and select the ‘Income Tax Return’ option under the ‘e-File’ menu.

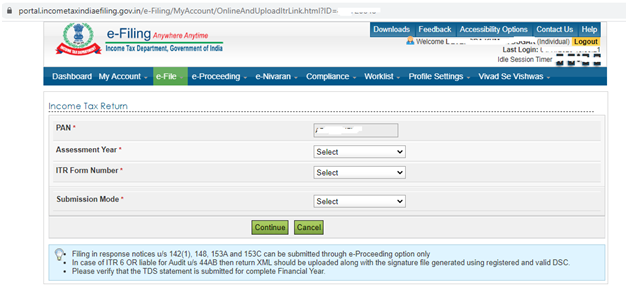

Provide the required information, including your PAN, assessment year, ITR form number, and submission mode. Remember to select ‘Upload XML’ from the drop-down menu next to the field name ‘Submission Mode,’ as seen in the figure below.

Attach the XML file from your computer and click the ‘Submit’ button to complete the process.

Choose between Aadhaar OTP, electronic verification code (EVC), and mailing a physically signed copy of ITR-V to CPC, Bengaluru.

TDS Certificates & Form 26AS

The taxpayer must determine which income tax form/ITR Form he should use to file his income tax return. The taxpayer should sum up his TDS amount based on the TDS certificates he has received for each of the four quarters of the fiscal year. Form 26AS provides a summary of TDS and tax paid during the fiscal year to the taxpayer. The taxpayer can proceed with the filing of the income tax return after determining the income tax form. Filing can be done in two ways: online or offline.