HDFC UPI Transaction Limit | HDFC Mobile App UPI Transfer Limit | HDFC UPI Charges | HDFC UPI Customer Care

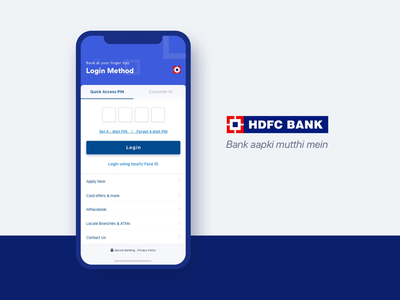

Through the mobile app, HDFC Bank MobileBanking, HDFC Bank enables the ability to make UPI transitions. This app is only available to HDFC Bank clients and includes a variety of other banking functions. As an HDFC Bank account user, you may conveniently and swiftly manage your account and send money to anyone at any time. This program makes money transfers and other transactions a breeze. Here are the details related to the HDFC UPI Transaction Limit.

Table of Contents

Sign Up for HDFC Bank’s UPI

You must complete the following steps to register for HDFC Bank UPI:

- From your app store, download the ‘HDFC Bank Mobile Banking‘ app.

- Your Customer ID and Password are required to use the app. Your Customer ID can be found in your net banking account.

- Navigate to the UPI option after logging in.

- Register your UPI or create a Virtual Payment Address as the next step (VPA). To create VPA, you can use your phone number or a username.

- After you’ve generated your VPA, you’ll need to create a 6-digit UPI PIN to finish your registration.

Add Beneficiary in HDFC Net Banking

Collect/Receive Money from HDFC Bank Pay

The steps to collect or receive money from HDFC Bank Pay are as follows:

- Open the HDFC Bank MobileBanking app on your smartphone.

- Go to the UPI section.

- Select ‘Collect/Receive‘ from the drop-down menu.

- Enter the VPN of the person you want to receive money from, the amount you wish to receive, and then click ‘Request.’

Advantages of BHIM HDFC Pay

The following are some of the most well-known advantages of HDFC Bank Mobile Banking Pay:

- You can make cashless payments to anyone on the go without needing to know their account number or IFSC code.

- You can make real-time payments to merchants with Quick scan.

- Paying bills, recharging mobile and DTH services, and other services are available through HDFC Bank Mobile Banking. Apart from conducting UPI payments, having such services on the app makes it a one-stop shop for a variety of other things.

- Your transactions and accounts are completely safe since the UPI network is completely secure. It is also backed by the RBI.

- You can also shop, book cinema tickets, and fly and train tickets.

- You can use a mobile application to do things like make NEFT transfers, add a beneficiary, and manage your credit card, loans, and investments.

Increase HDFC Credit Card Limit

HDFC Bank BHIM App’s Features

The HDFC Bank BHIM App has the following features.

- On its BHIM UPI app, HDFC Bank provides the following features:

- Face ID, touch ID, and password remembering are all available in the HDFC Bank app for quick and secure login.

- It offers a new all-in-one dashboard with real-time balances for all of your accounts, deposits, due invoices, and more.

- UPI, NEFT, IMPS, and other payment mechanisms can be used to send money quickly.

- You can also use the app to apply for a credit card of your choice.

- There are additional options for mobile phone recharge and DTH service.

- You can also manage your investments by opening or monitoring Fixed Deposit or Recurring Deposit accounts, as well as keeping track of your Demat account.

- You can save your favorite transactions and distribute receipts with a single touch after payment.

HDFC UPI Transaction Limit per Day

The HDFC UPI Transaction Limit for a single day is Rs. 1 lakh. As a result, you can’t use HDFC Bank Mobile Banking Pay to perform UPI transactions worth more than Rs. 1 lakh in a single day.

Other UPI Transaction Limits

We have told you about the HDFC UPI Transaction Limit per day. The other UPI Daily Transaction Limit are mentioned here:

PayTm Per Day Transaction Limit

HDFC Pay App’s Timing

UPI transactions through HDFC Bank Mobile Banking Pay are available 24 hours a day, 365 days a year, with real-time fund transfers. So, whether it’s a national holiday or a bank holiday, you may still use UPI to send and receive money.

Charges levied by HDFC Pay

UPI transactions performed using HDFC Bank Mobile Banking Pay are now free of charge.

FAQ’s

You can download the HDFC Bank Mobile Banking app and enter your basic information in the UPI section like name, date of birth etc. After that, you can link your bank account and acquire your HDFC Bank UPI ID by entering your desired 6 number UPI PIN.

There are currently no fees associated with UPI transactions conducted through any bank or app.

The Virtual Payment Address (VPA) created by HDFC is referred to as the HDFC UPI address.