TaxCloud India is a cloud-based digital software for filing income tax returns online. Tax advisors and chartered accountants commonly utilize TaxCloud India for return filing and compliance with income tax returns. The Taxcloud Login performs sophisticated computations to calculate tax, authorized deductions, and file returns in accordance with the Income Tax Act, all while efficiently handling client information. Taxcloud Login is the simplest and fastest way to file IT returns.

Chartered accountants and CA firms in India utilize TaxCloud extensively. However, tax advisors, tax return preparers, lawyers, and other service professionals that provide ITR filing services can utilize this program.

Table of Contents

Features of Taxcloud Login India

The following are the primary characteristics of TaxCloud India.

- Auto-fill – The software can save your clients’ information, allowing you to fill up entries faster automatically.

- Multiple logins allow users to access their accounts from a variety of devices, making remote working a simple. From the same email address, many people can log in.

- Simplified Calculation – Maximize client-based reporting by properly computing the data of all your clients. When it’s time to update the reports, your employees can effortlessly edit the data.

- Upload reports – Data from uploaded reports such as Form 16 and Form 26AS will be auto-populated by the software. Furthermore, TaxCloud India allows users to submit capital gain data from ZERODHA, CAMs, and KARVY, making it simple to track capital gains and calculate taxes.

What Distinguishes Taxcloud Login India from other ITR and TDS Filing Software?

Under your login credentials, TaxCloud India software allows you to save your clients’ data such as name, PAN, bank account details, and other information on the cloud. This saves time because you won’t have to enter customer information every time you file a return. Also, because the TaxCloud India software allows for multiple logins, work can be delegated to employees and work on a single project by numerous persons at the same time.

Taxcloud Login Process

Following is the process to sign up for Taxcloud India. Simply provide your email address and confirm it as your login credentials to register with TaxCloud India. You can also use any domain’s email address to create a log in.

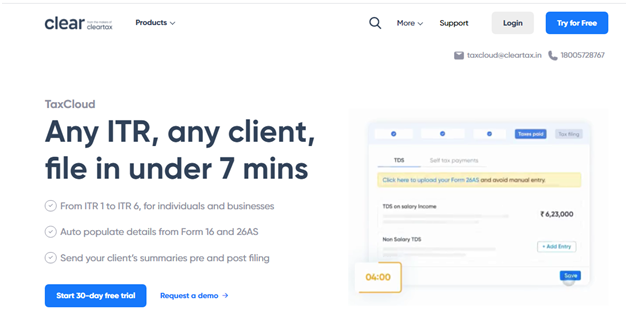

- First of all go to the clear tax website i.e. https://cleartax.in/taxcloud.

- On the home page, click on Login option.

- Fill up the required information, such as your name, email address, phone number, and your profession, such as tax return preparation, tax consultant, Chartered accountant, or other,

- Click on save option.

- A confirmation email will be sent to your your address. You may now use ClearTax’sTaxCloud service for your clients with ease.

Process to file ITR using Taxcloud Login India

The step by step process to file ITR using Tax Cloud India is shown below:

- First of all go to the clear tax website i.e. https://cleartax.in/taxcloud.

- Use your credentials to log in to TaxCloudindia.com. (You can log in using your gmail address). If you are a new user you need to sign up first for which the process is mentioned above.

- After logging in the software you need not select any ITR form based on the selected type of client and nature of income. ITR form will be automatically selected.

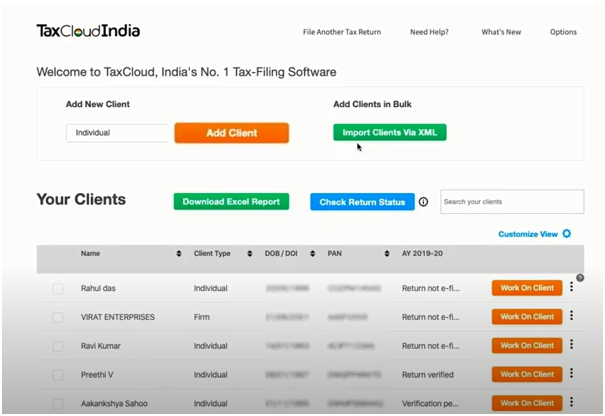

- Select type of the client you can import client’s data through XML including bulk import thus providing you a seamless switching experience or you can click on add the client from tax cloud directly.

- Once the data is imported client’s row will be created in the dashboard.

- Choose the assessment year and click on ‘work on client’ to start working on a client’s filing

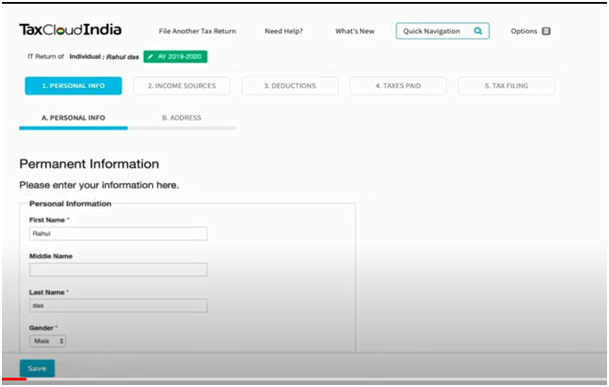

Personal Info

- Personal info: Now enter the personal information of the client including Name, gender and click on save option.

- Address: Now enter the Address details and click on save option.

Income Sources

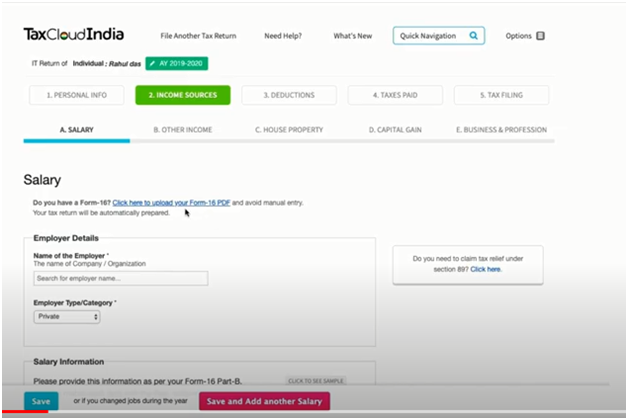

- Salary: Under the income sources tab click on the link to upload the Form 16 of the client. Form 16 is then automatically passed into tax cloud and all the details are fetched automatically into the tax cloud portal.

Note: Please note multiple Form 16 can also be uploaded for a client.

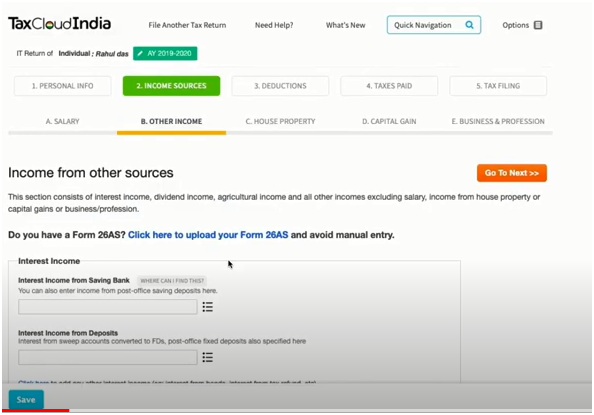

- Other Sources: Under the other income tab fill in the data manually or import client’s Form 26AS.

- House Property:Enter the house property details if any.

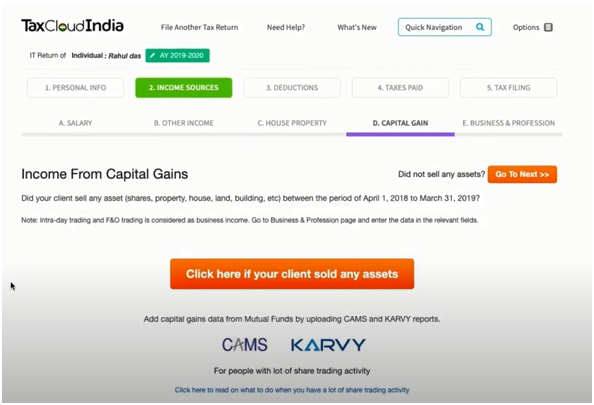

- Capital Gain: Next import capital gain statement from CAMS or KAEVY or you can seamlessly import the Excel template after filing in the details manually if any.

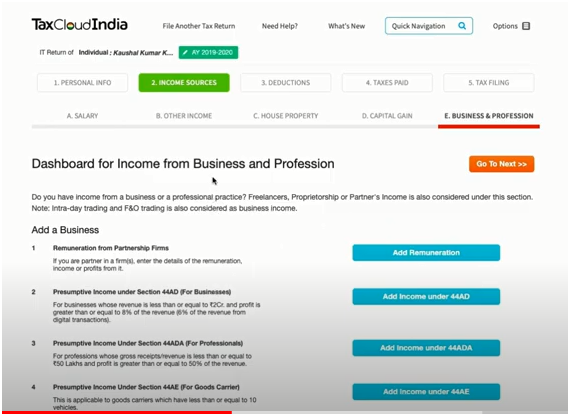

- Business and Profession:Now enter the business and profession details for your client.

Under the business and profession tab, you can also enter the audit information for the client. Here you can create tax audit report Form3CA/3CB and 3CD.

Deductions

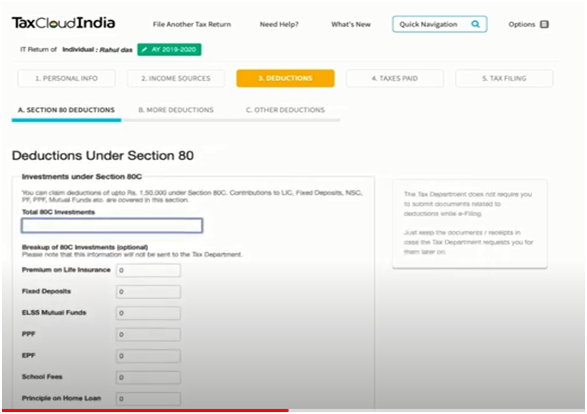

Section 80 Deductions: Next review the deduction details under the deductions tab.

More deductions: Make changes if required.

Taxes Paid

- Loss Summary:Also you can account previous year losses under the loss summary tab.

Tax Filing

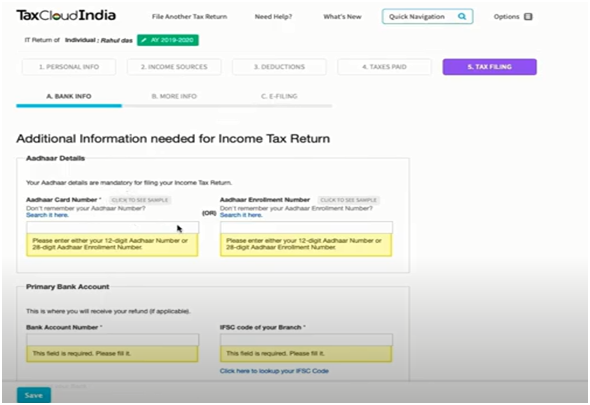

Bank Info: Now fill in the bank details under section tax filing if not already populated via prefill

More Info: Now fill in more information if required. i.eifany of these cases is applicable to you for example if you are a director in a company or you have foreign assets.

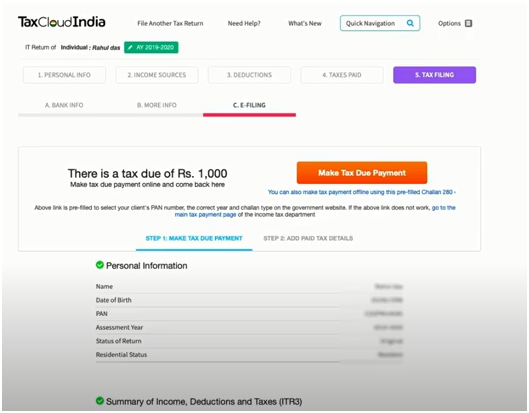

E- Filing: Go to the e-filing tab and check whether there is any tax due.

Verify the calculation and click on the ‘Make Tax Due Payment’ option

- Then you will be redirected to challan 280 with all the data pre-filled

- Once the payment is done go to Tax Filing’s e-filing tab and click on ‘Add Paid Tax details’ option.

- Fill in your tax payment details under the ‘Self-Tax Payments’tab.

Once the self-assessment tax entry has been made, go to the Tax Filing’se-filing tab and click on ‘Proceed to e-filing’

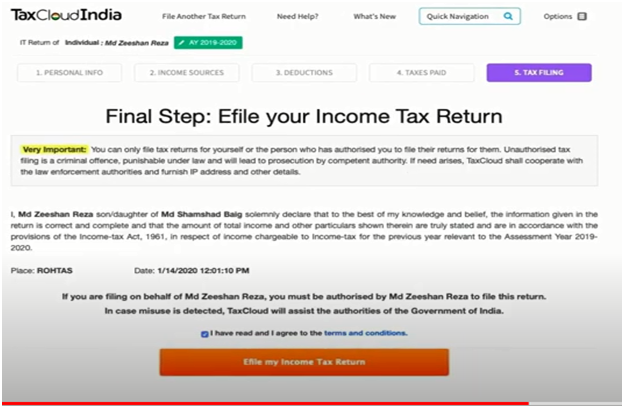

- Now, click on ‘E file my income Tax Return’ to proceed with e filing.

- An email confirming the submission will be sent to the registered email id.

- No need to wait for 6 minutes to finish your filing process. You can click on ‘File Another Return’ to simultaneously work on other clients

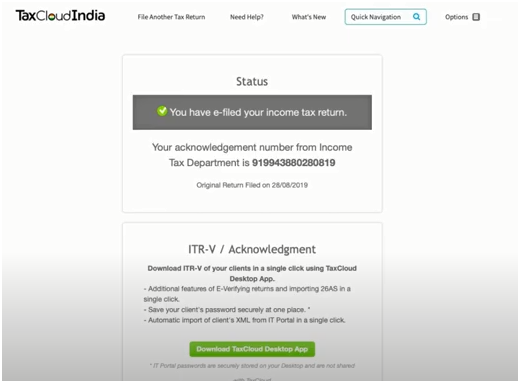

- Once the filing is acknowledged an email will also be sent to the registered email ID with the acknowledgment details. Once the IT return is successfully filed on the government server you will receive a confirmation message on the screen.

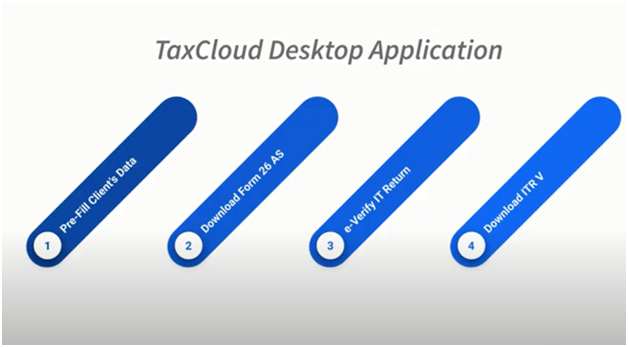

We also have a desktop application utility wherein one can perform the following tasks:

- Pre-fill data for clients from the government’s website.

- Download the form 26AS.

- E-Verify the IT returns for your client and

- Download ITR V

- Now go to the ‘Tax Cloud Desktop’app and E verify the client’s return

Now your IT return e filing is complete.

FAQ’s

The amount of returns that can be filed with TaxCloud India’s web-based ITR and TDS filming software has no restriction.

Following are the benefits of working with TaxCloud India

For ITR filing, TaxCLoud India provides web-based software. This means you won’t need to install any software on your laptop or PC, and you’ll be able to use the service from anywhere.

Because TaxCloud allows for multiple logins, CAs, and companies to work on the same project at the same time. By uploading Form 16 and Form 26AS to TaxCloud, you can easily populate your data and eliminate the need to manually enter your clients’ information.

CAMS capital gain reports can be uploaded to TaxCLoud. Karvy, as well as some of their partnered companies, such as zerodha. This tool allows you to upload an excel report from zerodha and the TaxCloud software will calculate the capital gains from the transactions automatically.

TaxCloud is a ClearTax product. We are a fintech company that provides online filing of ITR, TDS returns, GST software, e-way billing software, and investment services, among other things. The Income Tax India E-filing department has TaxCloud registered as an e-return intermediary. TaxCloud ensures data privacy because it is authorized by the Income Tax Department.