E Verify ITR | Online Verification of ITR without Login e-filing portal |E Verify ITR Without Login | E Verify Income Tax Return

The Income Tax Department has taken a number of steps to make submitting an Income Tax Return, or ITR, easier for individuals. In addition to these precautions, the Income Tax Department has added an E Verify ITR facility to its home page.

This function allows you to e-verify your income tax return or E Verify ITR without having to log into the e-filing portal. Previously, taxpayers had to sign up for an e-filing account and then e-verify their ITR. Taxpayers can now verify without logging into the e-filing site due to the implementation of the ‘E-Verify facility.

Table of Contents

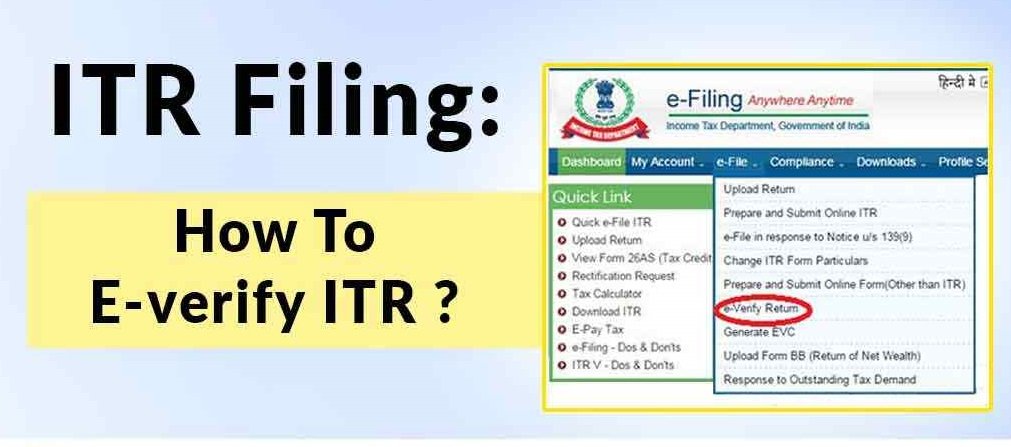

Process to E Verify ITR

The next step is to validate your tax return after it has been correctly filled. Once your return has been verified, the Internal Revenue Service begins processing it. Returns that have been submitted and verified are afterward processed for refunds if in case any.

Net banking is recommended for verifying your return. It’s the simplest and quickest way to double-check your tax return.

You do not need to deliver the physical ITR-V after properly e-verifying your ITR via net banking. If you do not want to use e-verification, you must deliver the physical ITR-V. The steps for sending the physical ITR-V are as follows. Any of the following methods can be used to verify your return electronically:

- Using internet banking

- Through Aadhaar OTP

- EVC on the website of Income Tax Department

Process to E Verify Verify Your Tax Return

Following is the process to E-Verify Verify Your Tax Return

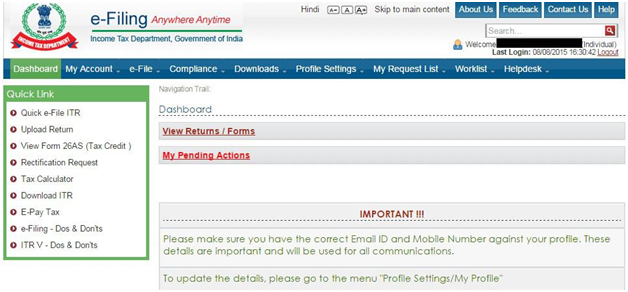

- Use your credentials to log in to incometaxindiaefiling.gov.in.

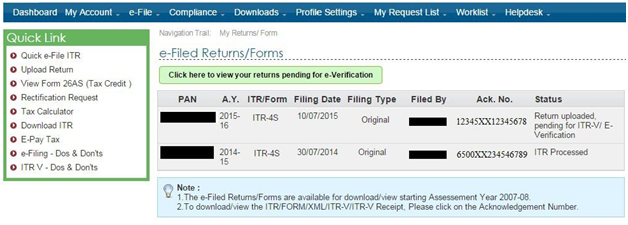

- To see e-filed tax returns, go to the ‘View Returns/Forms‘ option.

- Choose the option ‘Click here to view your pending e-verification returns.‘

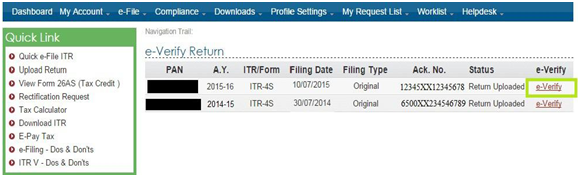

- Choose the e-verify option.

- When you click on e-verify, you’ll get a choice of options for generating an EVC.

- Enter the EVC and submit after successfully creating it in the appropriate mode.

- A confirmation message with the transaction ID and EVC code will be shown. To download the attachment, click the green icon. This is strictly for your records. There is no need to take any further action.

Process to ‘E Verify ITR’ without logging into the e-filing portal

Following is the process to ‘E Verify ITR’ without logging into the e-filing portal:

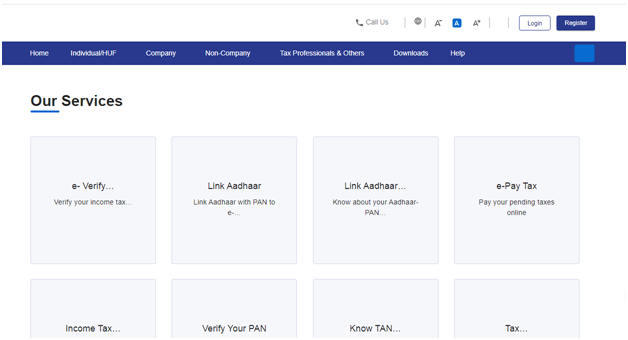

- First of all go to ‘e-Filling’ website of Income Tax Department

- Scroll down and click on the ‘e-verify’ under Our Service tab.

- On clicking on e-service option, another page will open. Here you need to fill following details:

- PAN

- Assessment Year

- Acknowledgement Number

- Mobile Number

- Click continue option.

- Submit the six-digit OTP number obtained on your mobile phone.

- Select the return you want to e-verify after you’ve successfully verified your OTP.

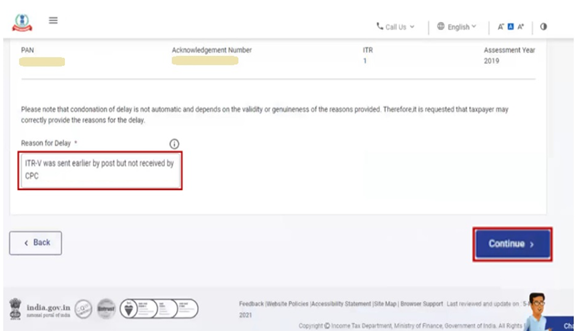

- If you’re verifying your return after 120 days, click ‘OK’ to submit your condonation request. Continue by selecting the cause for the delay from the menu and submitting the condonation delay request.

- If you’re e-verifying within 120 days after submitting your return, you can choose from any of the modes listed below and e-verify:

- Generate Aadhaar OTP

- Existing EVC

- Existing Aadhaar OTP

- Generate EVC through Demat Account, Bank Account, and Bank ATM option (offline method)

Which years can I use the e-verification service for?

The ‘verify service has been available since the current assessment year. The ‘E-Verify function can be used to e-verify ITRs filed from AY 2019-20 onwards.

ITR E-Verification Requirements

- The ITR for the AY 2019-20 should have been filed and an acknowledgment created in ITR-V.

- An acknowledgment number would be printed on the ITR-V, as required by the ‘e-verify’ facility.

- The ITR should be submitted by a taxpayer who is not required to sign the ITR using a DSC (Digital Signature Certificate).

- An authorized signatory or representative assessee should not file the ITR.

How can I e-verify my ITR for the 2018-19 fiscal year?

Only from the AY 2019-20 onwards is the ‘E-Verify option on the income tax department’s home page available. A taxpayer must log onto the e-filing system and e-verify ITRs filed prior to the 2018-19 fiscal year.

How can I e-verify my ITR for the 2019-20 fiscal year?

A taxpayer can e-verify the ITR using one of the two options below for the AY 2019-20:

- Selecting the ITR submitted for AY 2019-20 for e-verification after logging into the e-filing site.

- E-verification using the ‘e-verify’ option on the e-filing portal’s home page under ‘Our Services.’

A taxpayer must input their PAN (Permanent Account Number), choose AY 2019-20, type in the acknowledgment number from the AY 2019-20 ITR-V, and provide their mobile number under the ‘E-Verify option. Once the taxpayer types the above into the ‘E-Verify tool, the following options will be available:

- Generate Aadhaar OTP, Bank Account, and Demat Account

- Existing Aadhaar OTP

- Existing EVC

- Generate EVC through Bank ATM option (offline method)

The final step in the ITR filing process is e-verification. Following the submission or uploading of an ITR, a taxpayer has 120 days to e-verify it. Any of the options listed above can be used to e-verify a taxpayer. Any of the following methods can be used to generate an EVC for a taxpayer (during pre-login)

- EVC through Net banking facility, bank account number, Demat account number, and your bank ATM

FAQ’s

The procedure of filing a tax return does not end with the uploading of a return of income. You must verify your return in order to complete the return filing procedure.

E-verification is required for online returns. E-verification can be carried out using an Aadhaar OTP, net banking, or a bank or Demat account. If you are unable to e-verify your return, you may download the return filing acknowledgment (ITR V), print it, sign it, and send it to CPC, Bangalore for processing your returns.

Furthermore, if you are filing a paper return (and are not required to do so online), you may sign your return of income to authenticate it and submit it to the jurisdictional income tax office.

The individual or any person authorized under Section 140(a) can verify and sign the return. The following are examples of situations where someone other than the individual can sign:

a. Any person whom the individual permits to sign on his behalf if he is not in India.

b. His guardian or any other person competent to act on his behalf if he is mentally disabled.

c. If the individual is unable to sign for any other reason, any person whom he permits to sign on his place.

Before making a payment, everyone who is responsible for paying their salary must subtract TDS. According to the Income Tax Act, everyone who deducts TDS from a payment must provide a certificate detailing the number of TDS deducted and submitted. An employer, in particular, is needed to provide a certificate in the form of a Form.

E-verification with an Electronic Verification Code (EVC) or an Aadhaarotp, if applicable, is advantageous in that it eliminates the need to sign and provide a printed copy of the return filing acknowledgment. Furthermore, when compared to other modes of verification, e-verification speeds up the processing of your return.

An Aadhaar OTP can also be used to e-verify a tax return. To do so, you must link your Aadhaar with your PAN as well as your registered mobile number.

After that, you must e-verify by completing the steps below:

a. Select e-verify return from the e-file menu.

b. Select Option 3 – “I would like to generate Aadhaar OTP to e-verify my return” from the e-verify link.

c. The taxpayer will receive an OTP on his or her mobile phone.

d. After entering the OTP, click the “Submit Aadhaarotp” option.

You may send your ITR V to CPC once more. As long as you can provide sufficient proof of having sent the ITR V to CPC for the first time, you will not be viewed as a taxpayer who has not filed his return.

The Income Tax Return (ITR) is a form that must be submitted to the Income Tax Department of India. It comprises information on a person’s earnings and the taxes that must be paid on those earnings throughout the year. The information in an ITR must be for a certain financial year, which begins on April 1st and ends on March 31st of the following year.