Income Tax Helpline Number | Income Tax e Filing | Income Tax Refund Customer Care Toll Free Number | Income Tax Helpline Email IDs List

When it comes to aiding customers with their questions or finding solutions, the Income Tax department’s customer care section is extremely effective. Individuals can contact any of the below-mentioned numbers for assistance at any time. In an effort to make it easier for taxpayers to find answers to their questions, the Income Tax Department provides call center services. Taxpayers can call Income Tax Helpline Number for questions about e-filing their returns, income tax / TAN / PAN data, seek solutions about login troubles on the e-filing website, seek information regarding Form 16 and Form 26AS, and so on. Here are the customer service numbers you can call for help:

- For general queries associated with income tax, TAN and PAN feel free to call Aaykar Sampark Kendra, 1800-180-1961 (Toll free). This facility is available from Monday to Saturday between 8 AM and 8 Pm.

- For queries associated with TAN and PAN application for update/issuance via NSDL feel free to call at 020-27218080 (Helpline). This facility is available on all days of the week between 7 AM and 11 PM.

- For queries associated with the e-filing of returns and login problems on the e-filing website feel free to call at 1800-103-0025 (Toll free) and 080-46122000 (Helpdesk). This facility is available from Monday to Saturday between 9 AM and 8 PM.

- For queries associated with TRACES (TDS Centralized Processing Centre), Form 16, Form 15CA, Form 26AS and TDS statement feel free to call at 120-4814600 (Helpline) and 1800-103-0344 (Toll free). This facility is available from Monday to Saturday between 10 AM and 6 PM.

- For queries related to the refund, notification, processing and rectification of your Income Tax Returns feel free to call at080-46605200 (Helpline) and 1800-103-4455 (Toll free). This facility is available from Monday to Friday between 8 AM and 8 PM.

Table of Contents

Income Tax Helpline Email IDs List

The following is a list of official email addresses used by India’s tax authorities to connect with the public.

| Purpose | |

| www.nsdl.co.in | PAN card |

| www.utiitsl.com | PAN card |

| www.incometaxindiaefiling.gov.in/home | Departmental website |

| www.tdscpc.gov.in/app/login.xhtml | Information related to TDS |

| www.incometaxindiaefiling.gov.in/home | Filing income tax returns |

| www.insight.gov.in | Compliance and reporting |

The first and the second in the above list are the two agencies that are officially authorized to issue PAN cards.

Tax SMS Codes

The following is a list of the Income Tax Department’s official SMS codes. You can use these codes for official communications. The first three codes are used to send PAN card notifications while the last six codes are used to send tax reminder messages.

- PAN Card Codes

- NSDLTN

- NSDLDP

- UTIPAN

- Tax Reminder Message Codes

- ITDEPT

- ITDEFL

- TDSCPC

- CMCPCI

- INSIGHT

- SBICMP

Income Tax Helpline Number (Toll-Free), Email ID & Working Hours

Here’s a list of Income Tax Helpline Numbers, Working Hours for Income Tax Departments.

| Purpose | Working Hours | Helpdesk | Income Tax Helpline Number |

| General Queries related to Income Tax | 08:00 hrs – 22:00 hrs (Monday to Saturday) | AayakarSampark Kendra (ASK) | 1800 180 1961 (Toll free) (or) 1961 |

| e-Filing of Income Tax Return or Forms and other value-added services provided through e-Filing Portal | 09:00 hrs – 20:00 hrs (Monday to Saturday) | e-Filing | 1800 103 0025 (Toll free) (or) +91-80-46122000 +91-80-6500026 |

| Rectification, Refund, Intimation and other Income Tax Processing Related Queries | 08:00 hrs – 20:00 hrs (Monday to Friday) | Centralized Processing Center | 1800 103 4455 (Toll free) (or) +91-80-46605200 |

| Queries related to PAN & TAN application for Issuance/Update through NSDL | 07:00 Hrs – 23:00 Hrs (All Days) | Tax Information Network – NSDL | -27218009 |

| Form 16, Tax Credit (Form 26AS) and other queries related to TDS statement, Form 15CA processing | 10:00 hrs – 18:00 Hrs (Monday to Saturday) | TDS Reconciliation Analysis and Correction Enabling System (TRACES) | 1800 103 0344 (Toll free) (or) +91-120-4814600 |

Digital Fraud (Phishing)

Several taxpayers have recently reported to the Income-tax Department about attempts at digital fraud against them. Phishing is the term for such digital fraud efforts. These attempts are performed by SMS and email and are aimed at obtaining personal information from members of the general public. Messages like these are issued by people posing as tax collectors. Several taxpayers have recently reported to the Income-tax Department about attempts at digital fraud against them. Phishing is the term for such digital fraud efforts.

You should immediately report any phishing activities you come across right once. If you receive an email or SMS posing as an income tax official, for example, you should report it to the Income Tax Department. Send an email to webmanager@incometax.gov.in or incident@cert-in.org.in to do so.

Things to Remember

Here’s a rundown of things to keep in mind when it comes to tax communications.

- The Income Tax Department never asks for a PIN by email or SMS.

- They also don’t ask for passwords or other sensitive information by email or SMS.

- Do not give out any information about bank accounts, debit cards, or credit cards over the phone, email, or SMS.

- Do not respond to phishing emails or click on any of the links included in them.

- Any attachments that come with phishing emails should not be downloaded or opened.

- Because the Income Tax Department communicates with taxpayers via email, they have taken appropriate security precautions for their email domains.

Income Tax Helpline Grievance Cell

If you have any complaints, you can contact the income tax complaint cell if you have any complaints. You can get state-by-state contact information for the appropriate grievance office by visiting the official website of the Income Tax Department.

You must first choose your state, after which necessary email addresses and income tax Department complaint numbers will appear on the screen. For grievance redress, the necessary address is also provided.

What is Income Tax

As the name implies, income tax is a type of tax collected by the government on income received from various sources. It is a Direct Tax that is paid to the Indian government by the taxpayer. Income tax is one of the government’s key sources of revenue, which is then used to fund public services, pay government debts, and provide goods and services to residents. Individuals and businesses pay income tax, which is calculated based on their earnings or profits. Partnerships, on the other hand, are not taxed, but partners can be taxed on their share of the partnership’s profits. Income tax is one of the most important taxes that every earning individual and organization must pay in our country.

Income tax is computed by multiplying the tax rate by the taxpayer’s taxable income, with the Tax Rates rising as the taxable income rises. The tax rate varies depending on the taxpayer’s age and income. Paying taxes not only aids the government in collecting funds to meet the requirements of a country’s residents, but it also aids taxpayers in receiving a variety of benefits if they pay their taxes on time. It’s also crucial to understand why we, as taxpayers, must pay income tax.

Furthermore, because income tax is one of our country’s key taxes, it aids in the funding of most significant projects, such as meeting a nation’s defense demands and developing the country. The government, on the other hand, has several measures that provide credits to taxpayers in the form of a refund when they file their Income Tax Return in order to lessen the tax burden

What is the Purpose of Levying a Tax?

The following are the reasons for levying a tax: –

- To collect funds for government spending

- Redistribution of money among the population

- Social advancement

- Management of demand

- To address market flaws

India’s constitution empowers the government to collect taxes in order to provide services and goods to its population, to borrow money in times of need, and to prepare for war in the event that it becomes necessary. Any type of tax, whether it GST, Income Tax, or another type of tax, is critical nowadays for attaining global heights. India is still a developing country, and we can only make a difference as citizens and taxpayers by supporting the government on time and receiving the services and commodities that we require to thrive.

How Long Can We Go Without Filing an Income Tax Return?

Every year, as a law-abiding citizen, you meticulously File Your Income Tax Return. Every citizen is obliged to file their IT Return by the tax filing deadline, which is typically the 31st of July. If you have a tax burden, you must file your Income Tax Return; otherwise, you may receive a notice from the Income Tax Department.

Furthermore, if you do not owe any taxes, you are not required to file an ITR, but we recommend that you do so because the Income Tax Return is one of the most important proofs of your income in India. Here are some of the most significant advantages of submitting an income tax return.

- A taxpayer can Claim a Tax Refund for the extra tax paid to the government in the form of Advance Tax or Self-Assessment Tax by completing an Income Tax Return.

- Every year, as a law-abiding citizen, you meticulously file your Income Tax Return. Every citizen is obliged to file their IT Return by the tax filing deadline, which is typically the 31st of July. If you have a tax burden, you must file your Income Tax Return; otherwise, you may receive a notice from the Income Tax Department.There are occasions when you have losses in a financial year and you cannot avoid submitting a Revenue Tax Return; in such a circumstance, you should file an ITR so that you can carry forward the losses you have incurred and offset them against future years’ income.

- The authorities will ask for a copy of your previous year’s ITR when you apply for a home loan or a visa. So, if you want to apply for a loan or a visa, you must first file your income tax return.It is always a good practice to file an Income Tax Return for each of the relevant financial years, regardless of the source of income.

Types of GST Application Status

The following categories of Status may be seen on the GST Registration Application: –

- Form Allocated to the Assessing Officer: This status indicates that your registration application has been assigned to the assessing officer and is awaiting processing on the government’s side.

- Pending Clarification: This status indicates that the processing officer needs information about the GST registration application that was submitted. You should submit the required clarification as soon as possible on the GST Portal.

- Clarification NOT FILED — Pending for Order: This indicates that the applicant did not file the clarification within the time limit. The GST Officer would most likely issue an order denying the GST registration application.

- GST Registration Application Approved: This status indicates that the GST Officer has approved your GST registration application. The GSTIN and GST registration application will be sent to you shortly.

How to Get an ARN Number?

The ARN Number will be produced once you submit your GST registration application on the GST portal. Citizens can use the GST ARN Number to track the status of their GST application.

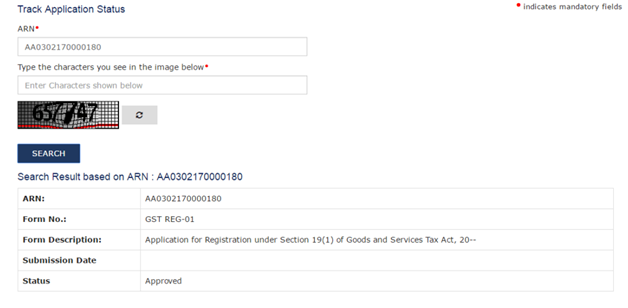

How to Check My GST Status

You can use the GST ARN Number to trace the status of your GST registration application until the Government of India issues you a GST Certificate and GSTIN.

You will get your ARN Number after submission of your GST registration application on the GST portal. Citizens can use the GST ARN Number to track the status of your GST application after you’ve generated it. To check the status of your GST application, follow the steps below: –

- Go to the GST Portal’s official website.

- Select the option “Track Application Status under Services” from the main menu.

- Then, in the space provided, enter the ARN and complete the CAPTCHA.

- Your GST Application Status will open on your screen after you submit the Form.

FAQ’s

Yes, you can notify the authorities if you get a phishing email. You must forward the email to incident@cert-in.org.in in order to do so. It’s a government agency for combating phishing.

For general inquiries, call the Aayakar Sampark Kendra at 1800 180 1961, which is the toll-free number for the Income Tax Department. On Sundays, this service is not helpful.

Phishing is an attempt to collect sensitive information about bank accounts with the intention of committing financial fraud. In the case of income tax, fraudsters impersonate as tax officials and collect sensitive information such as bank account numbers, debit, and credit card numbers, with the goal of stealing money from these accounts.

Check the domain from which the email or SMS is being sent. Phishing emails and SMS frequently contain misspelled email IDs or SMS codes that look identical to official email IDs and codes. Responding to these emails is not a good way to share sensitive information of any kind.