What is Direct Tax | Types of Direct Taxes | Features of Direct Tax | Direct Tax PDF | Tax Rates for Various Types of Direct Taxes

A tax is a necessary fee or monetary charge imposed by a government on an individual or an organization in order to raise funds for public works projects that provide the greatest services and infrastructure. The funds raised are then used to fund other government activities. Failure to pay taxes or refuse to contribute will result in harsh consequences under the pre-determined law. The article contains details about Direct Tax, types, and many other features.

Taxes can be collected in a variety of ways, central taxes, including state taxes, direct taxes, indirect taxes, etc. Taxes can be categorized as Direct Tax and Indirect tax. This division is based on the manner in which the tax is paid to the government. In this article, you will get to know about Direct Tax in detail.

Table of Contents

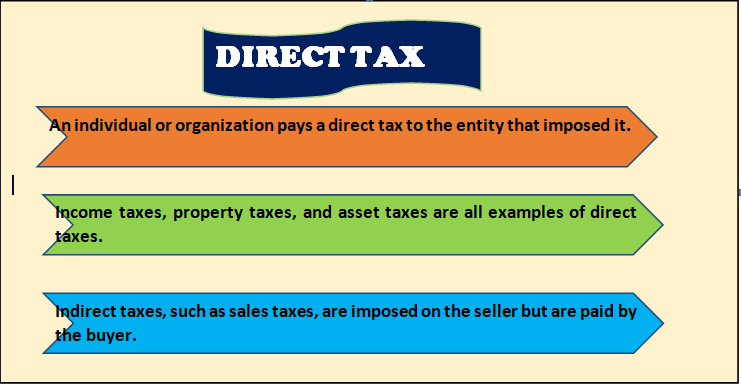

About Direct Tax

A Direct Tax is one that is paid directly to the institution that imposed it. The impact and incidence in Direct Tax are both included in the same category. The tax is paid directly to the entity that imposed the payment by the organization or an individual. The tax must be paid to the government directly and not to anyone else.

As an example, Individual taxpayers pay direct taxes to the government for a variety of reasons, such as income tax, personal property tax, real estate tax, and asset taxes.

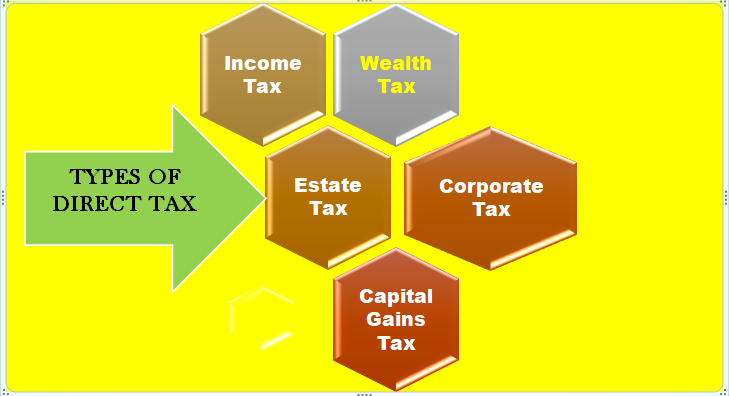

Types of Direct Taxes

The following are the many forms of direct taxes imposed in India:

Income Tax

The Government of India has various tax slabs that govern the amount of income tax that must be paid. Income Tax must be paid based on an individual’s age and income. Every year, the taxpayer must file an Income Tax Return (ITR). Depending on their ITR, individuals may be eligible for a refund or may be required to pay a tax. Individuals who do not file ITR are subject to severe penalties.

Income Tax is the most prevalent sort of tax imposed by the government on qualified residents. Every year, a portion of your income is paid to the government, which utilizes this money to promote growth and development efforts around the country.

Corporate Tax

Apart from shareholders, domestic companies will have to pay corporate tax. In India, income obtained through asset sales, technical service fees, dividends, royalties, or interest is taxed. A corporate is a legal body that is separate and distinct from its shareholders.

Under the Income-tax Act, both domestic and international corporations must pay corporate tax. A domestic corporation is taxed on its total income, whereas a foreign firm is only taxed on income earned in India, that is, money that is accumulated or received in India. Under Corporate Tax, the following taxes are also included:

- Securities Transaction Tax (STT):Any taxable income obtained through securities transactions requires payment of the tax.

- Fringe Benefit Tax:Fringe Benefits Tax is imposed on companies that give fringe benefits to employees such as cleaners, drivers, and others.

- Dividend Distribution Tax (DDT):This Tax is imposed on domestic firms that declare, distribute, or receive dividends from their shareholders. DDT, on the other hand, is not imposed on foreign companies.

- Minimum Alternate Tax (MAT):MAT is imposed on zero-tax corporations that have accounts prepared in accordance with the Companies Act.

Wealth Tax

The tax is due on an annual basis and is calculated based on the property’s ownership and market value. If a person possesses a property, he or she must pay a wealth tax, which is imposed regardless of whether the property provides income. Depending on their residency status, corporations, Hindu Undivided Families (HUFs), and individuals must pay wealth tax. Assets such as gold deposit bonds, stock holdings, home property, and commercial property rented for more than 300 days, and house property owned for business and professional usage are excluded from wealth tax.

The Wealth Tax Act of 1957 required an individual, a Hindu Undivided Family, or a corporation to pay a 1% wealth tax on annual profits of more than Rs. 30 lakh. This tax was a levy on exceptionally rich individuals, corporations, or HUFs’ net worth (the aggregate value of assets less the aggregate value of debts or liabilities as of the valuation date) at the conclusion of a fiscal year.

The goal of the wealth tax was to raise the amount of direct taxes collected from the wealthy in order to minimize wealth inequality in India and ensure that these individuals contributed more to the country’s revenue.

Estate Tax or Inheritance Tax

Inheritance Tax is calculated based on the value of an individual’s estate or the money left after his or her death. In other words, Inheritance tax is a sort of tax placed on an individual’s income derived from his or her ancestral property. The tax is levied equally on the inheritors in the case of holdings that are equally distributed among all siblings.

Capital Gains Tax

It is a type of direct tax that’s levied on revenue derived from the sale of assets or investments. Capital assets include investments in farms, shares, art, bonds, businesses, and own house. Tax can be defined as long-term or short-term depending on how long it is held.

Short-term gains apply to any assets, other than securities, that are sold within 36 months of their acquisition. If any income is earned through the sale of properties that have been held for longer than 36 months, long-term assets are levied.

Tax Rates for Various Types of Direct Taxes

Income Tax: A person’s age and salary will determine which tax bracket he or she falls into. The following are the three distinct tax brackets:

For Individuals & Hindu Undivided Families HUFs of Age Below 60

| Tax slab | Income tax |

| Income of above Rs.10 lakh | 30% of the total income that is more than Rs.10 lakh + Rs.1,12,500 + 4% cess |

| From Rs.5,00,001 to Rs.10,00,000 | 20% of the total income that is more than Rs.5 lakh + Rs.12,500 + 4% cess |

| From Rs.2,50,001 to Rs.5,00,000 | 5% of the total income that is more than Rs.2.5 lakh + 4% cess |

For Indians Above Age 80 i.e Super Senior Citizen

| Tax slab | Income tax |

| Above Rs.10 lakh | 30% of the total income that is more than Rs.10 lakh + Rs.1,00,000 + 4% cess |

| From Rs.5,00,001 to Rs.10,00,000 | 20% of the total income that is more than Rs.5 lakh + 4% cess |

| Up to Rs.5 lakh | Nil |

For Citizens of Age >60 and <80 i.e. Senior Citizens

| Tax slab | Income tax |

| Income of above Rs.10 lakh | 30% of the total income that is more than Rs.10 lakh + Rs.1,10,000 + 4% cess |

| From Rs.5,00,001 to Rs.10,00,000 | 20% of the total income that is more than Rs.5 lakh + Rs.10,500 + 4% cess |

| From Rs.3,00,001 to Rs.5,00,000 | 5% of the total income that is more than Rs.3 lakh + 4% cess |

| Up to Rs.3 lakh | Nil |

New Income Tax Slab for Individuals

| Income Tax Slab | Tax Rate |

| Up to Rs.2.5 lakh | Nil |

| From Rs.2,50,001 to Rs.5,00,000 | 5% of the total income that is more than Rs.2.5 lakh + 4% cess |

| From Rs.5,00,001 to Rs.7,50,000 | 10% of the total income that is more than Rs.5 lakh + 4% cess |

| From Rs.7,50,001 to Rs.10,00,000 | 15% of the total income that is more than Rs.7.5 lakh + 4% cess |

| From Rs.10,00,001 to Rs.12,50,000 | 20% of the total income that is more than Rs.10 lakh + 4% cess |

| From Rs.12,50,001 to Rs.15,00,000 | 25% of the total income that is more than Rs.12.5 lakh + 4% cess |

| Income above Rs.15,00,001 | 30% of the total income that is more than Rs.15 lakh + 4% cess |

Note: The above-mentioned income tax rates are optional.

- Corporate Tax:The following are the tax rates for domestic and international businesses:

- Domestic companies:

- The corporate tax rate is 25% if the company’s sales is less than Rs.250 crore. However, if the company’s turnover exceeds Rs.250 crore, the corporation tax rate is 30 percent.

- If the company’s taxable income exceeds Rs.10 crore, a surcharge of 12% is applied.

- If your taxable income is between Rs.1 crore and Rs.10 crore, you would be charged a surcharge of 10% of your taxable income.

- A cess of 4% of the corporate tax is collected.

- International companies:

- A corporate tax of 41.2 percent is imposed on enterprises generating less than Rs.1 crore. The business tax consists of a 40% base tax and a 3% education cess.

- A corporate tax of 42.024 percent is imposed on enterprises earning more over Rs.1 crore. The business tax consists of a 40% basic tax, a 2% surcharge, and a 3% education cess.

- If a company earns more than Rs.10 crore, it is subject to a 5% surcharge in addition to the base tax.

- Wealth Tax:

- Wealth Tax is imposed based on one’s net worth. The sum of all taxable assets minus the total debt outstanding that is owed can be used to calculate net wealth.

- The formula for calculating net worth is: Net Wealth = (Sum of All Assets) – (Sum of All Debt).

- Every year, on March 31 of the year immediately preceding the assessment year, the value of net wealth is calculated.

- Wealth Tax has been eliminated with effect from 1 April 2016 for wealth held as of 31 March 2016.

- Capital Gains Tax:

- Short-term capital gains are leveid according to regular tax rates.

- Long-term capital gains are taxed at a rate of 20% if the Capital Gains Tax is calculated with the indexation benefit in mind.

- Long-term capital gains are taxed at 10% if the Capital Gains Tax is calculated without taking into account the indexation benefit.

What is Direct Tax Code

The Direct Tax Code, sometimes known as the DTC, was created to replace the Income Tax Act of 1961. DTC’s major goal is to make direct taxation more equitable, effective, and efficient. The DTC was also written to amend and stabilize all direct tax laws so that the tax-to-GDP ratio rises and voluntary compliance becomes easier. Efforts to establish a DTC began in 2009.

The most compelling argument for repealing the Income Tax Act is because it is outdated and complicated. It is divided into roughly 700 sections. Since 1961, the economic and corporate climate has altered dramatically. In September 2017, the government formed a Direct Tax Code Task Force to “draft new income tax legislation for India in “consonance with the country’s economic demands.”

Features of Direct Tax

The following are the important characteristics of the Direct Tax Code:

- All direct taxes are subject to the same code: By combining all direct taxes into a single code, a single, unified taxpayer system can be implemented. All compliance features can be grouped together under a single code.

- Stability: Taxes are currently formed based on the Finance Act of the relevant year. The tax rates are set between the DTC’s First and Fourth schedules, under the Direct Tax Code. Any changes to the schedule must be made through the passing of an Amendment Bill in the Parliament.

- Regulatory functions are terminated: All regulatory functions must be handled by other regulatory authorities.

- Constant litigation issueshave been eliminated: special effort has been taken to ensure that the code is not misunderstood or exploited in order to avoid ambiguity and contradiction.

- Political contributions: Political contributions will be made with 5% of the gross total income that can be deducted.

- Flexibility: A legislation has been enacted to allow for changes and the need to grow the economy to be addressed without the need for frequent modifications.

- Fringe benefits tax: Employees, not employers, are subject to the fringe benefits tax.

Benefits of Direct Tax

The following are the key benefits of direct taxes in India:

- Economic and social equilibrium: The Indian government has implemented well-balanced tax slabs based on an individual’s earnings and age. The tax slabs are also dictated by the country’s economic position. Exemptions are also implemented in order to balance out all income disparities.

- Productivity: As the number of people working and living in the community grows, so do the returns from direct taxes. As a result, direct taxes are thought to be particularly productive.

- Inflation is stifled: During periods of high inflation, the government raises taxes. Increased taxes diminish the demand for goods and services, causing inflation to fall.

- Certainty:There is a sense of certainty from both the government and the taxpayer due to the presence of direct taxes. The taxpayer and the government both know how much money they need to pay and how much money they need to collect.

- Equal Distribution of Wealth:The government imposes higher taxes on those persons or organizations who can afford them, ensuring that money is distributed equally. This extra money is utilized to assist India’s impoverished and lower socioeconomic groups.

Despite a few drawbacks, direct taxes play a critical part in India’s economy. If these taxes are implemented correctly, they have the potential to play a significant role in maintaining price levels and preventing inflation.

FAQ’s

By investing a portion of your income in tax-deductible funds, investments, and policies, you can have a portion of your income treated as or declared non-taxable.

Some tax-saving fixed deposits, investments in National Savings Certificates (NSCs), insurance policies, EPF and PPF schemes, and other investments are directly excluded from taxation under Section 80C, 80CCC, and 80D.

TDS stands for Tax Deduction at Source. A specific amount is deducted as tax before you receive your salary using the TDS system.

Wealth Tax is a Direct Tax.

An assessment year is a 12-month period that begins on April 1st and ends on March 31st of the following year.

No, receipts are divided into two categories: revenue receipts and capital receipts. Unless specifically exempted, all revenue receipts are taxable, and all capital receipts are exempt unless specifically taxed.

Direct taxes have the drawback that the procedure of filing an income tax return takes longer.

Direct taxes are levied on profits and income, whereas indirect taxes are levied on products and services.

GST (Goods and Services Tax) is an indirect tax levied on goods and services.