Income Tax Refund Status | Check Tax Refund Online | How Can I Check On My Income Tax Refund | Income Tax Refund Claim

You can use an online income tax calculator to figure out how much you owe in taxes. However, extra tax may be deducted at source from your pay or other sources of income. Alternatively, you could make a mistake and pay more advance tax than necessary. When you pay more income tax than you need to, the income tax department refunds the extra. This sum is referred to as an Income Tax Refund. Check further details to know more about Income Tax Refund Status.

Table of Contents

How to Get Income Tax Refund on Taxes

The ITR form can be used to seek an Income Tax Refund. The repayment from the IT department is subject to the IT department’s review and verification. The IT department will only process the ITR for a refund if the ITR is confirmed by delivering a signed copy of ITR V via any of the online or offline methods.

Income Tax Refund Period

An Income Tax Refund can be obtained in the following circumstances:

- Dual Taxation: When a person’s income is taxable in more than one country i.e., dual taxation, this circumstance can develop when he or she is a citizen of one country but earns income from another. However, under DTAA agreement, any excess tax payment can be claimed as a refund. DTAA i.e., Double Taxation Avoidance Agreement is an Agreement that the India has signed with a number of nations, allowing you to seek a tax refund if you are a non-resident Indian with income that is taxable in another country. Under this DTAA agreement, any excess tax payment can be claimed as a Income Tax Refund.

- Excess Advance Tax Paid-The advance tax paid through self-assessment was is greater than the actual tax liability for the given fiscal year. When ITR filing, you can claim this advance tax as a refund.

- Following certain changes to their income made during income tax proceedings, taxpayers may be asked to pay additional taxes by their income-tax officer. Appeal authority may remove such amendments. As a result, the taxpayer will receive a refund for the taxes he would have paid otherwise.

- Excess TDS deducted–

- The employer usually deducts taxes after considering various documented proofs presented by an employee, such as 80C investments, medical insurance premiums paid under 80D, and so on.However, there are times when an employee is unable to provide substantiation for a handful of these investments before the end of a fiscal year, and as a result, the employer makes a larger deduction. However, the employee can claim the advantage of such an investment when completing his tax return, resulting in a refund of the higher taxes paid.

- Certain persons may not be subject to taxation at all, as their income is less than Rs 2.5 lakhs. As a result, they would not be required to pay any taxes. Taxes, however, would have been withheld from their earnings. As a result, they are entitled to a refund of the excess tax deducted;

- On your interest income from bank FDs or bonds, excess TDS was deducted.

Claim Income Tax Refund

When a person files his or her Income Tax Refund for a given year, he or she can claim a refund of the excess tax paid or deducted during that year. To receive a refund under the Income Tax Act, a person must file his or her return for the applicable assessment year by July 31 (unless the deadline is extended). The applicable assessment year (AY) for a financial year is the one immediately following it. The ITR form can be used to claim an income tax refund. Also, the IT department will only process the ITR for a refund if it is validated by delivering a signed copy of ITR V via any of the online or offline methods.

Furthermore, the repayment from the IT department is subject to the IT department’s review and verification. When the refund claim is found to be valid and legitimate, the refund is allowed.

Amount of Taxpayer’s Income Tax Refund

When a taxpayer seeks a refund on his tax return, the tax department processes it, and the taxpayer receives an intimation from CPC under section 143(1) confirming the amount of refund that the taxpayer is entitled to. Based on the income tax department’s evaluation, the refund could either match or be more or lower than what is declared in the return of income. This is the amount of money that the taxpayer would like to get back from the IRS.

Income Tax Refund Status Check

To verify the status of the refund, you’ll need to know your PAN and assessment year. The tax department will process the refund once it has been determined. The income tax e-filing portal or the NSDL website can both be used to monitor the status of a refund.

Check Income Tax Refund Status using e-Filing Portal

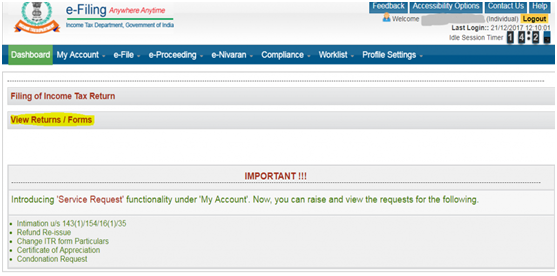

- Visit the official website of ‘e-Filing Income Tax Department, Government of India’.

- Log in to your account by providing your user id, password, and “captcha,” then clicking “login.”

- Now press “View Returns / Forms”

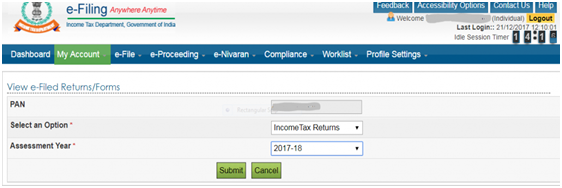

- On a new window, fill your PAN number, choose Income Tax Returns and Assessment Year. Later two options are mandatory. Click submit option.

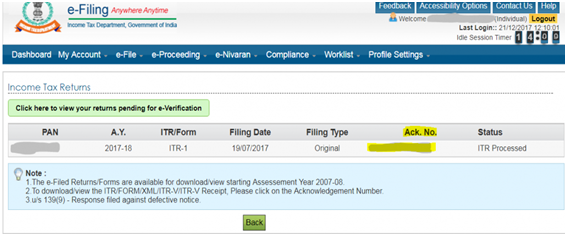

- Now, press acknowledgement number.

- The income tax refund status displays as seen in the screenshot below.

Check Refund Status using NSDL Portal

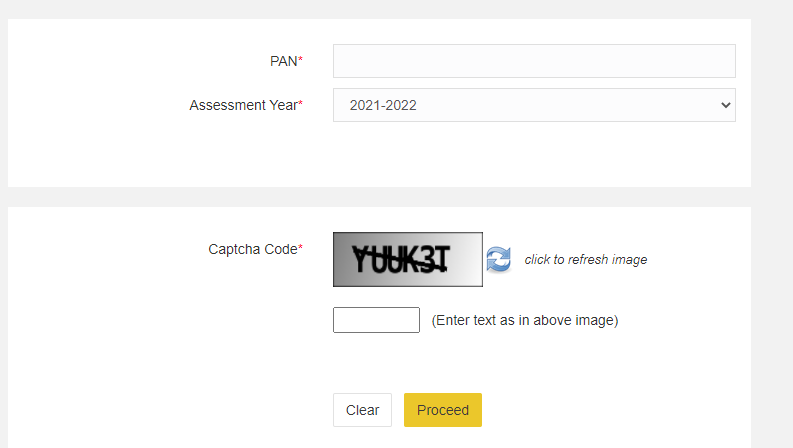

Follow the steps below to check the Income Tax Refund Status using NSDL Portal:

- Go to the official website of Tax Information Network.

- On the page, fill in the details of your PAN number, Assessment year, and the image that appears on the screen, then click “Submit.”

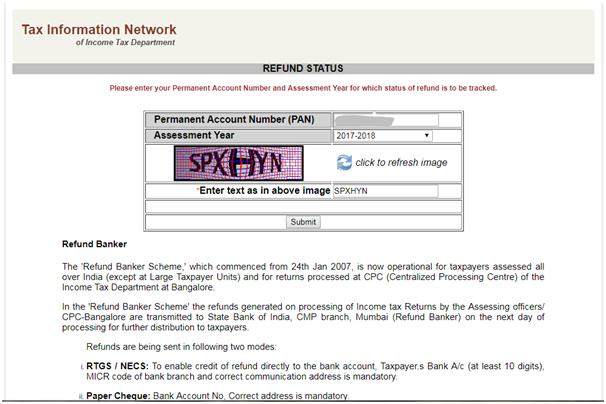

- After then, the screen below opens, which displays the status of your refund in the following manner.

Different Types of Income Tax Refund Status

| Refund status | Meaning | Action required |

| Refund paid | It means the ITR file is processed and the income tax refund has been transferred back to your bank account. | You can always contact the bank or the post office if you have not received any money. Contact your bank if you opted for direct debit from your bank account. If you choose “return by check,” you must trace the check using the post office tracking reference number. |

| Refund unpaid | Refund has been accepted by the IT department but was not paid due to an error in bank details or address details. | You must double-check your address and account number. Log in to the official website of the Income Tax department and make the necessary changes. You can also submit a request for a refund reissue. |

| No demand No refund | This indicates that the tax amount deducted is correct, and the income tax department is not required to refund any money to you. | You have the option to modify your tax return and include any deductions that you may have overlooked while submitting it. Make sure to double-check your tax calculations with a tax calculator. |

| Refund status not determined | Because the amount refundable has not been determined, the income tax authority has not processed your tax return. | Recheck the status after one week. |

| Demand determined | This status indicates that the income tax department has denied your refund request because their calculations reveal that you owe more tax. | To determine the mismatch/error, use the calculation described in 143(1). Make a payment to the IT Department within the stipulated timeframe if a mistake occurs. File a rectification together with all supporting information and documentation to justify your refund claim if there was no error. |

| Refund Determined and sent out to Refund Banker | Refund request was accepted by the IT department and the refund banker has been informed | Wait for your refund to be credited to your account or contact your refund banker to find out how your refund payment is progressing. |

| Rectification Processed and Demand Determined | Rectification returns have been accepted; nonetheless, there are unpaid tax dues (tax demands) that must be paid within a certain time frame. | Within the stated time limit, pay the outstanding tax/tax demand after cross-verifying all of the facts. |

| Rectification Processed, Refund Determined and Details sent to Refund Banker | Rectification returns have been accepted, as well as the refund amount, which has been adjusted and given to the bank for processing. | See your bank account to check the receipt of the refund. |

| Rectification Processed, No demand, and No Refund | The Income Tax Department has accepted the rectified return. Furthermore, you will not be obliged to pay any additional taxes and will not be entitled to a tax refund. | You are not required to pay any money to the Tax Authorities. The Income Tax Department is likewise not obligated to pay you any money. |

Important Points for Income Tax Refund Status

- Double-check the bank account information with the passbook to ensure that there are no mistakes.

- If you receive a return in the form of a check, double-check your address with the tax department.

- If you file your ITR before the deadline, your income tax refund will be processed quickly.

- Download your form 26AS and double-check that the amount of excess tax paid is indicated on the form.

Time Period for Claiming an Income Tax Refund

A taxpayer can only obtain an income tax refund if he or she has filed an income tax return. The time restriction for claiming an IT refund is the same because the process of claiming an income tax refund is dependent on ITR filing. The end of the assessment year is the latest time limit for filing returns and claiming a refund for any AY.

Income Tax Refund – on appeal

When a taxpayer is entitled to a refund as a result of an order issued in response to an appeal, there is no need to file a claim because the ITR department will credit the refund amount directly to the taxpayer’s account. Hence, the taxpayer is not required to submit any additional refund requests in circumstances involving an appeal.

Also, if the assessment of a taxpayer’s return of income was canceled owing to a decision to make a new assessment, the refund will not be received until the new assessment is completed.

Interest on Income Tax Refund

Section 244A specifies that if a taxpayer is granted a refund, interest must be paid to the taxpayer/assessee, subject to specified terms and conditions. If the following requirements and circumstances are met, interest on refund is payable to the assessee: – If the return is filed on or before the due date of the Assessment Year relevant to the FY for which the return is filed.

Set-off of a Refund of Income Tax

The assessing officer or commissioner can opt to set off the return amount against the liability if there is an income tax liability and a refund.

FAQ’s

Because it is the excess of tax liability paid over total taxable income evaluated for tax responsibility for a given year, an income tax refund is not taxable; nevertheless, interest on an income tax refund is taxable as income from other sources.

If you have any questions about your income tax refund, you can call the income tax department’s toll-free number 1800-180-1961 or send an email to refunds@incometaxindia.gov.in. Call the toll-free number 1800-425-2229 or 080-43456700 if you have any questions about any refund modification processed at CPC Bangalore.

Refunds may be delayed for a variety of reasons. We might cite a few reasons why the refund might be delayed:

In the event that the income tax return is not confirmed, the ITR filing is incomplete. As a result, verify your ITR within 120 days of filing your return. The later you verify, the later the reimbursement will be.

The income tax department has old bank account information.

Manual filing of income tax returns- Processing of refunds may take longer if income tax returns are filed physically rather than online.

Lastly, if the income tax department suspects underreporting of income, the return may be scrutinized, resulting in a refund delay.

If you’ve received notification from the Income-tax department or the Return Banker (SBI) that your refund has been delayed due to incorrect bank information, you should follow the steps below. You will need to log in to your Income-tax Department’s website and file a refund re-issue request, as well as alter your Correct or New bank account Number.

Login or create an account on the income tax portal.

Select My Account >> Service Request from the top menu.

In the Request type, choose “New request.”

Click submit after selecting “refund reissue.”

Select the assessment year, then input the CPC communication reference number found on the income tax department’s intimation u/s 143 (1).

Put the refund sequence number here.

Choose the refund issue option and provide the right account number.

Within the one-year deadline, the returns can be filed multiple times.

Yes, you must file an income tax return for the assessment year if you want to receive an income tax refund for any excess tax you paid during the financial year.