HDFC Bank Net Banking Registration | HDFC Bank Net Banking Login | HDFC Bank Net Banking App Download | Reset HDFC Bank Net Banking Password

HDFC Bank which is a leading Bank in India provides the HDFC Bank Net Banking facility to its users. The bank often updates the app with new features and security measures to ensure that customers have a pleasant and secure experience. The following is a list of information about HDFC Bank Net Banking that you can read in the article.

Table of Contents

HDFC Bank Net Banking Login

Account-holders must follow the steps outlined below to access the HDFC Bank Net Banking portal:

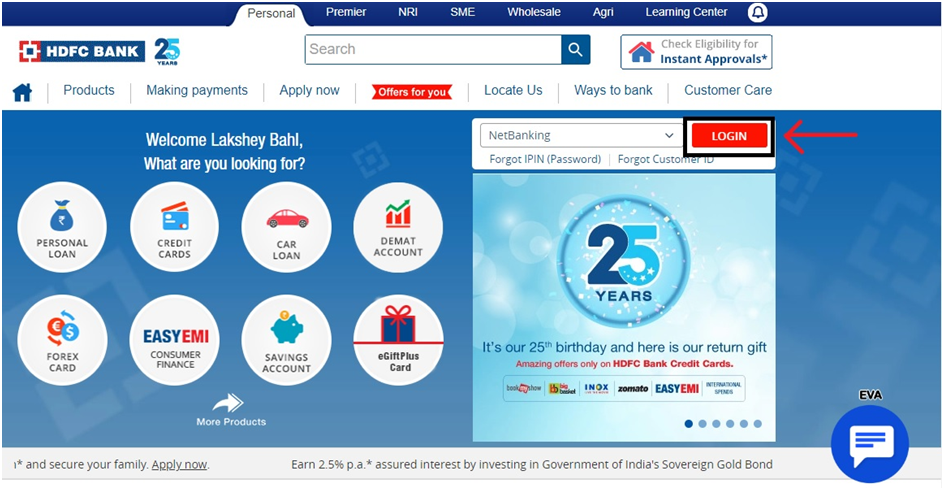

- Go to the official website of HDFC Bank.

- Select “Login” option.

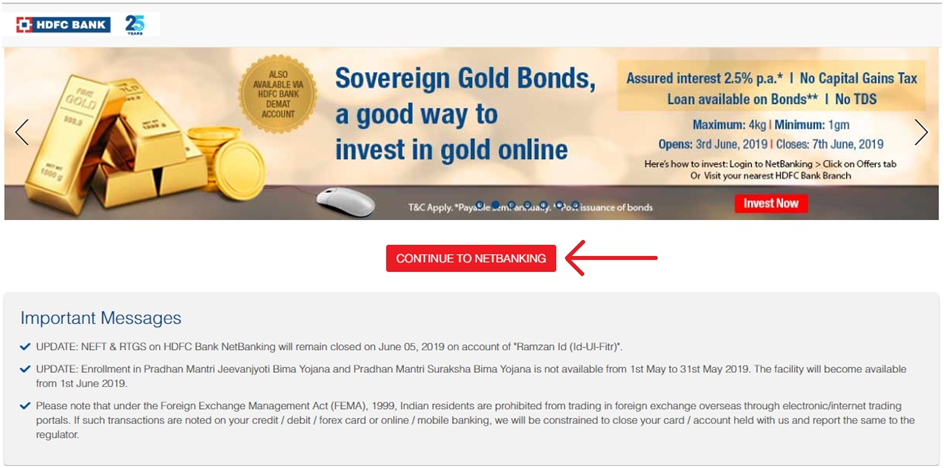

- Go to the HDFC Bank Net Banking Login page by clicking the “Continue to Netbanking” button on the next page.

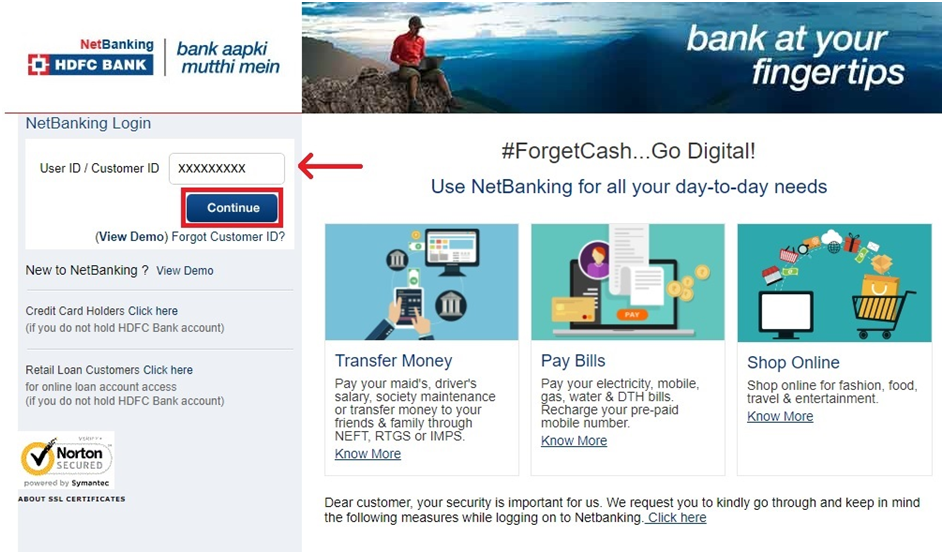

- Click “Continue” after entering your User ID or Customer ID.

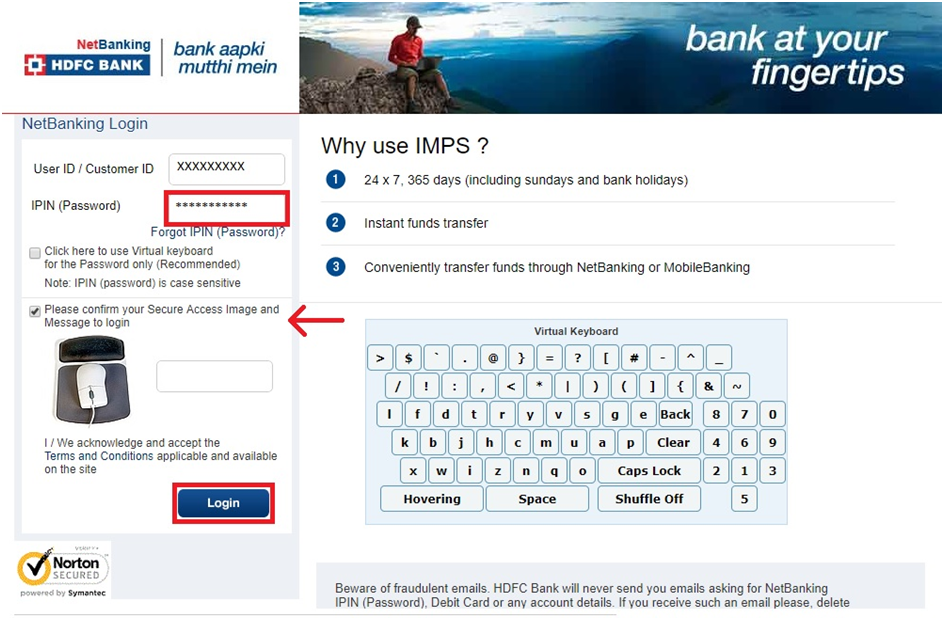

- To login successfully, enter your IPIN or HDFC Netbanking password and confirm the secure access image and message.

Reset HDFC Bank Net Banking Password

If an account holder forgets his or her HDFC Netbanking login, the forgot password option might assist him or her in recovering it. Following the instructions below, account holders can instantly reset or regenerate their HDFC Net banking password or IPIN:

- Go to the HDFC Bank netbanking portal, type in your HDFC Bank Customer ID, and then click “Continue.”

- Select “Forgot IPIN (Password)” from the drop-down menu.

- On the following page, type in your “Customer ID” and click “Go.”

- Authenticate using one of the ways listed below –

- Using the HDFC Bank Debit Card details and an OTP sent to the registered mobile number (HDFC Bank Debit Card PIN and expiry date)

- Using a one-time password (OTP) issued to the registered mobile number and email address (not applicable for Resident senior citizen customers).

- Provide the needed information.

- Type in your HDFC Net Banking IPIN.

- 4- Change your HDFC Netbanking Password

- Log in to HDFC Net Banking with your new IPIN or password.

What is an HDFC Bank User ID or Customer ID?

When you create a bank account with HDFC Bank, you will be given a customer/user ID that you may use to access the bank’s numerous financial services. It’s also listed on the first page of the bank’s checkbook.

You can use HDFC Bank Netbanking to send money to another HDFC Bank account or to a different bank via NEFT/IMPS/RTGS. Log in to your HDFC Bank Net Banking account and select the type of fund transfer you’d like to make. Select beneficiary account from the list of beneficiaries in your net banking account, transfer amount, transfer method, beneficiary Mobile no./Email ID, tick terms & conditions, then hit the continue button. Your funds will be transferred after you authenticate your transaction with an OTP.

Add Beneficiary to your HDFC Bank Net Banking Account

To Add Beneficiary to your HDFC Bank Net Banking AccountFirst, log in to your HDFC Bank Netbanking account using your user ID and IPIN. Select transaction type, add Beneficiary Account No./Credit Card No., re-enter same credentials, select Beneficiary account type, IFSC Code, Beneficiary Name, and Email ID, and then click Add. Use OTP to verify your transaction. After being added/modified, the HDFC Bank beneficiary activation may take up to 30 minutes.

Pay Bills and Recharge using HDFC Bank Net Banking

Through HDFC Bank Netbanking services, you can pay bills or recharge Electricity, Telephone, and Mobile Bills, Prepaid DTH/ Mobile Connection/ Data Card Recharge, Gas Bills, and Mutual Funds, Insurance Premiums, Subscriptions, and Charitable Contributions, among other things. To do so, log in with your user ID and IPIN. Continue to the BillDesk page by clicking on BillPay & Recharge. To pay your bills, go to the Pay link. If your biller isn’t already on the list, you can add them online.

Pay HDFC Credit Card Bill Online using HDFC Bank Net Banking

Click on Cards after logging into the HDFC Bank Netbanking portal. On the page, you’ll see all of your current cards, along with the pending bill. Complete the transaction by clicking the Make Payment option.

Increase HDFC Credit Card Limit

How do I Register with HDFC Mobile Banking?

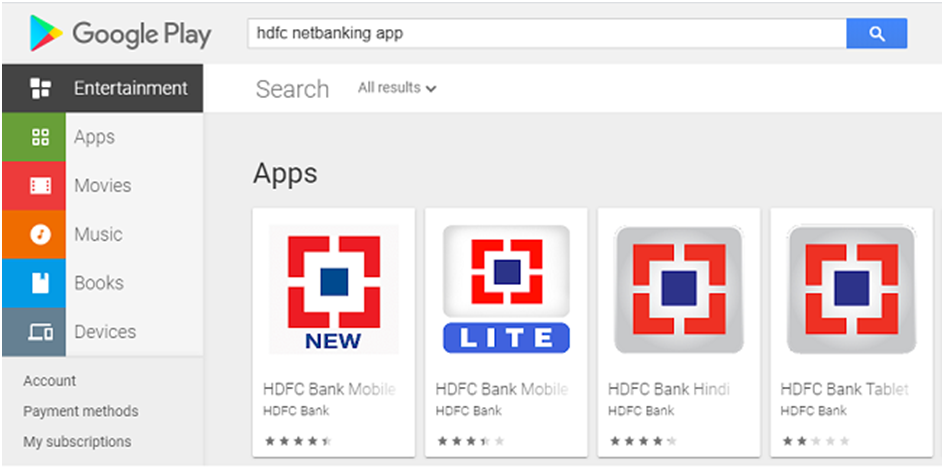

- Download the HDFC Mobile Banking App from the Google Play Store or App Store.

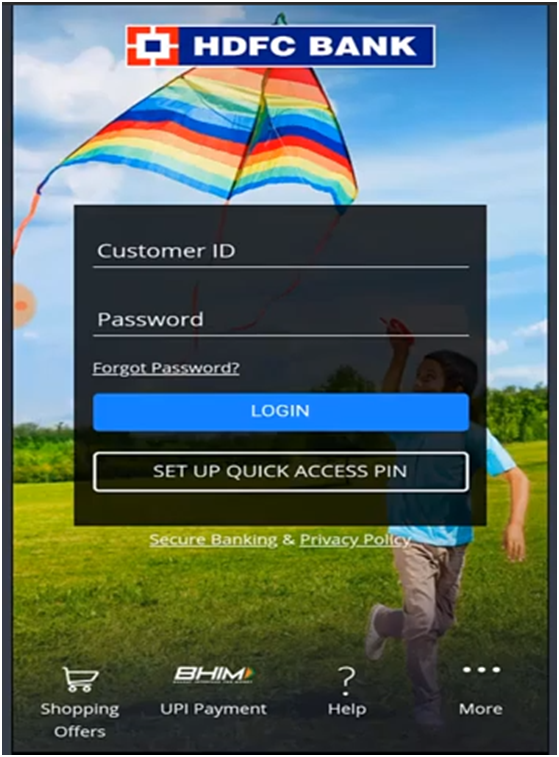

- To see the login screen, open the app.

- To use mobile banking services, you do not need to register individually. You can log in using the same login and same IPIN that you use for online banking purposes.

- Alternatively, you can create a fast access PIN on the app by pressing the button on the app’s home screen.

- Under the ‘Enter Your Details’ page, you need to enter your customer ID and registered mobile number and then continue by clicking the ‘Continue’ button.

- On the registered mobile number, you shall receive an OTP immediately. Within 30 seconds, enter the OTP under the ‘Enter OTP’ tab and click ‘Continue.’

- You must input your ATM PIN, debit card expiration month, and year on the next tab. Then press the ‘Continue’ button.

- By typing it twice, you can create a four-digit Quick Access PIN. You can also select to use fingerprints for authentication. When you’re finished, click ‘Continue.’

How do I Access HDFC Mobile Banking?

- On your smartphone, launch the HDFC Bank app.

- To access mobile banking services, replace customer ID and password with your online banking username and IPIN. Alternatively, you can also log in with the help of 4-digit Quick Access PIN. If fingerprint authorization has been activated, then you can log in just by placing your finger on the sensor.

Add and Remove Nominee in HDFC Bank Account

Services Available through HDFC Mobile Banking

On the app, the following services are available:

- You can make UPI payments, do credit card registrations and transfer money.

- You can pay your bills online.

- Check the card’s domestic and foreign limits.

- Stop the payment of a check that has been issued.

- Recharge your phone, data card, and DTH.

- Invest in mutual funds by opening a Demat account.

- Inquire about getting a new chequebook.

- Access all of the information about your accounts and deposits.

- Get a home loan, a personal loan, a car loan, a gold loan, a two-wheeler loan, or a digital loan secured by mutual funds.

- You can pay your income tax online.

Send Money through Mobile App

- On your smartphone, open the HDFC app.

- As seen in the image below, you will see a screen with details of all the accounts you have with the bank:

- From the home screen’s top-left corner, select the ‘Menu’ option.

- The following screen will show you all of the different types of services that you can use with the app.

- Select ‘Money Transfer’ under the ‘PAY’ option.

- Select ‘Transfer Money to Anyone, anywhere’ on the next screen.

- Choose the account from which you want to send funds. Select the payee bank details from the available payee list by entering the payee’s name. You can use the ‘Add Payee’ button to transfer to a new payee. You can also transfer funds by inputting the payee’s MMID and mobile phone number.

- After selecting the payee name from the list, you will be required to input the amount to be sent, the transfer date (schedule if necessary), the transfer mechanism (NEFT or IMPS), add remarks, and then click ‘Continue.’

- If the information supplied is correct, check the box indicating that you agree the terms and conditions. Select ‘Confirm’.

- Along with the transaction reference number, a success message will be displayed.