HDFC Bank Mobile Banking | HDFC Bank Mobile Banking App Download | HDFC Bank Mobile Banking Online Registration | HDFC Bank Mobile Banking App Login

To meet the needs of its consumers, HDFC Bank provides mobile banking services. The bank has been regularly updating the app with new features and security measures to ensure that customers have a pleasant and secure experience. The following is a list of information about HDFC Mobile Banking that you can discover in the article.

Table of Contents

How do I Register with HDFC Mobile Banking?

- Install the HDFC Mobile Banking app from the Google Play Store or App Store.

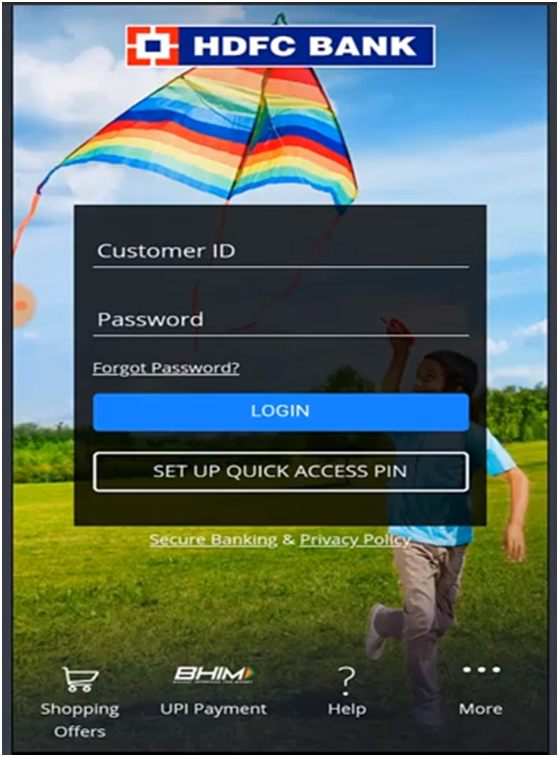

- To see the login screen, open the app.

- You do not require to register for mobile banking services individually. You can log in using the same login and IPIN that you use for online banking.

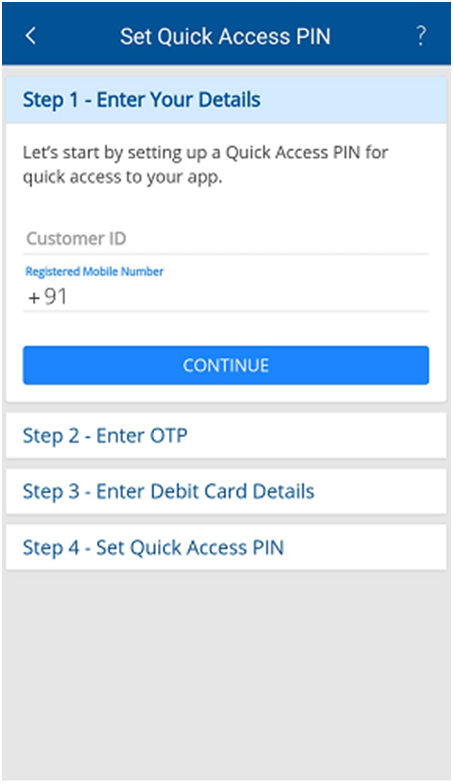

- Alternatively, you can create a fast access PIN on the app by pressing the button on the app’s home screen.

- Under the ‘Enter Your Details‘ page, enter your customer ID and registered mobile number. Click the ‘Continue’ button.

- On the registered mobile number, you will receive an OTP. Within 30 seconds, enter the OTP under the ‘Enter OTP’ tab and then click ‘Continue.’

- In the following tab, you must input your ATM PIN, as well as the month and year that your debit card will expire. Then press the ‘Continue’ button.

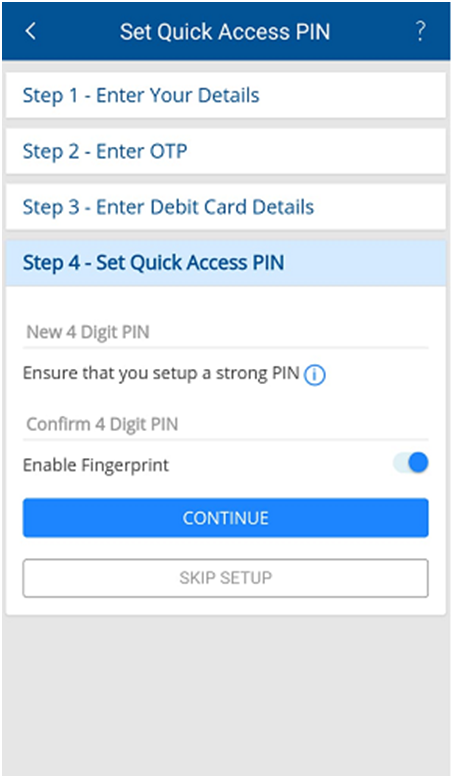

- By entering it twice, you can create a four-digit Quick Access PIN. You can also choose to use fingerprints to authenticate yourself. When you’re finished, click ‘Continue.’

Benefits of using HDFC Mobile Banking

- Face ID is used to unlock the phone.

- Face ID can be used to unlock your account, just like it can be used to unlock your smartphone. This method of unlocking offers great security while being simple and pleasant to use.

- You may use the app to make payments and money transfers while on the go. Additionally, the app provides mobile recharge notifications as well as auto-bill payment options.

- Everything you need to know about the latest updates is all in one place.

- Simply log into your HDFC account on the app to receive notifications about all of your HDFC accounts, including savings, fixed deposits, credit cards, and loan accounts.

- Receipts from money transfers can now be shared on social media and even downloaded for future use.

- Make a banking to-do list in the same way you would any other to-do list. With this new function, you won’t miss any financial activities you need to complete.

How do I Access HDFC Mobile Banking?

- On your smartphone, launch the HDFC Bank app.

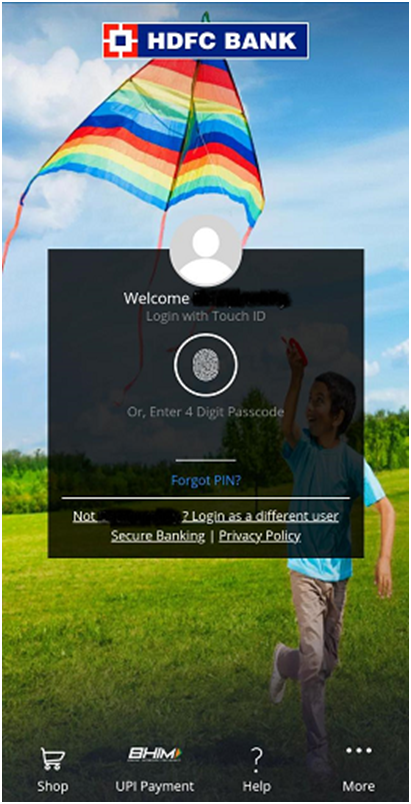

- To access mobile banking services, use your internet banking username and IPIN instead of your customer ID and password. Alternatively, you can log in using the 4-digit Quick Access PIN. If fingerprint authorization has been activated, you can log in by placing your finger on the sensor.

What Services are Available through the App?

On the app, you can access the following services:

- Make UPI payments, money transfers, and credit card registrations.

- Check the card’s domestic and foreign limits.

- Invest in mutual funds by opening a Demat account.

- Recharge your phone, data card, and DTH.

- Access all of the information about your accounts and deposits.

- You can pay your bills online.

- Inquire about getting a new chequebook.

- You can pay your income tax online.

- Stop the payment of a check that has been issued.

- Get a personal loan, a gold loan, a car loan, a two-wheeler loan, a home loan, or a digital loan secured by mutual funds.