Punjab National Bank Account Opening Online | Punjab National Bank Account Opening Form | PNB Minimum Balance | How Can I Open A Bank Account In PNB

Customers all throughout the country can open a Punjab National Bank Savings Account to save for the future. PNB’s savings accounts come with the convenience of online banking as well as free phone and mobile banking services. Customers can open a savings account in person at a Punjab National Bank branch near them or online through the bank’s website. The article will tell you details about the Punjab National Bank Account Opening and many other details.

Table of Contents

Eligibility Criteria for Punjab National Bank Account Opening

Customers must meet certain requirements in order to create a savings account with Punjab National Bank.

- Should be an Indian national.

- To be eligible, the applicant must be at least 18 years old. In case of children, the account can be opened on behalf of their parents or legal guardians.

- The applicant must present government-issued identification and evidence of address.

- After the bank has confirmed the application, the applicant will be required to make an initial deposit, which will be determined by the minimum balance requirement of the savings account he or she has chosen.

What is Punjab National Bank Account Opening Process

In three easy steps, you can open a Punjab National Bank Savings Account:

- For the account opening process, go to your nearest Punjab National Bank with the required documents.

- Fill out the application form at the bank’s new account department and inform the executive that you want to start a new savings account.

- Ensure that the information provided on the application form and the information on your KYC documents are identical. Fill out the application form and hand it in at the counter.

- After the bank verifies the paperwork, the savings account will be opened within 3-5 bank working days if accepted.

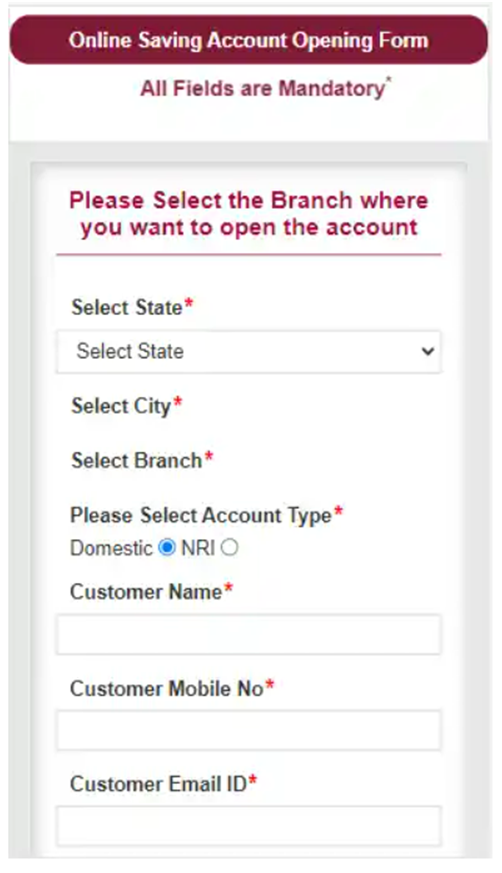

How to Open an Online Punjab National Bank Savings Account

- First of all, go to the PNB Link https://www.pnbnet.org.in/OOSA/.

- To open an Online Savings Account without the use of E-Sign, go to “Click Here to open the Online Savings Account without E-Sign facility” link.

- Select the branch, Account Type, Customer Name, Mobile Number, and Customer Email ID, and tick the checkboxes and declaration boxes on the PNB Savings Account application form.

- Please input the Security Code and then press the Submit button.

- A TCRN (Temporary Customer Reference Number) will be generated upon submission of the application form.

- The applicant’s mobile number and email address will receive the number.

- The consumer must next submit the TCRN, application form, and required KYC papers for verification after getting the TCRN.

- The bank will activate the account within 3-5 working days after receiving permission.

Check PNB Account Balance By Missed Call, SMS

Documents Required for Punjab National Bank Account Opening

When applying for a new savings account with PNB, customers will be needed to submit the following documents:

- Proof of identity – Passport, Driving license, Voter’s ID card, etc.

- Proof of address – Passport, Driving license, Voter’s ID card, etc.

- PAN card

- Form 16 (only if PAN card is not available)

- 2 latest passport size photographs.

Points to Consider Before Punjab National Bank Account Opening

Individuals should investigate some elements of the Punjab National Bank savings account before deciding if it is right for them. They are as follows:

- They’d have to first evaluate the savings account’s minimum balance criteria to see whether it fits their budget.

- It’s also a good idea to look into the penalties for not keeping a minimum balance.

- Check the interest rate on those deposits for that specific savings account. The interest rate determines your return on deposits, therefore knowing it before selecting a savings account is critical.

- He or she should double-check the account’s daily transaction and withdrawal limits.

- Extra fees may apply if cash is withdrawn using checks, and the applicant should be aware of the monthly withdrawal limit at ATMs other than Punjab National Bank.

Safety Tips for Savings Account Holders at Punjab National Bank

- You should never send your account password or PIN to anybody via email, SMS, or social media.

- If you suspect a transaction has been performed without your knowledge, contact your bank right once.

- Check your bank statements on a regular basis to see if there have been any incidences of fraud and to keep track of your finances – both in and out of your account.

- If your debit card is lost or stolen, you should immediately block it through your net banking account or call Punjab National Bank customer service to have it done for you.

- Never save your bank account information on an online merchant website for security reasons. Additionally, make sure you close the page as soon as you’ve made an online transaction.

- Always do your shopping on secure websites.

Customer Service Number for Punjab National Bank

Customers can call the PNB customer service toll-free number – 1800 180 2222 – if they have requested, issues, require support, or have problems with their savings account.