How To Open State Bank of India Account | State Bank of India Account Opening Form | SBI Minimum Balance | State Bank of India Account Opening Process

Customers can open a State Bank of India Savings Account to save for the future and earn interest on deposits (Check Savings account Interest Rate). Customers can choose from over 9,000 branches around the country to open a savings account and enjoy the ease that comes with a savings account. The article will tell you more details about the State Bank of India Account Opening Process and other details related to it.

Table of Contents

What is the State Bank of India Account Opening Process

Customers must follow the steps outlined below to open SBI savings account at any SBI Bank branch.

- Pay a visit to the SBI branch that is closest to you.

- Request an account opening form from the bank executive.

- Both portions of the account opening form must be completed by applicants.

- Form 1 – Name, address, signature,various other details and assets.

- Form 2 – If the customer does not have a PAN card, they must fill out this section.

- Make sure that all of the fields have been filled out correctly. The information on the application form should agree to the information on the KYC documents.

- The customer will now need to provide a Rs.1,000 initial deposit.

- Once the bank has completed the verification process, the account holder will receive a complimentary passbook and cheque book.

- Apart from it, customers can also submit the internet banking form at the same time.

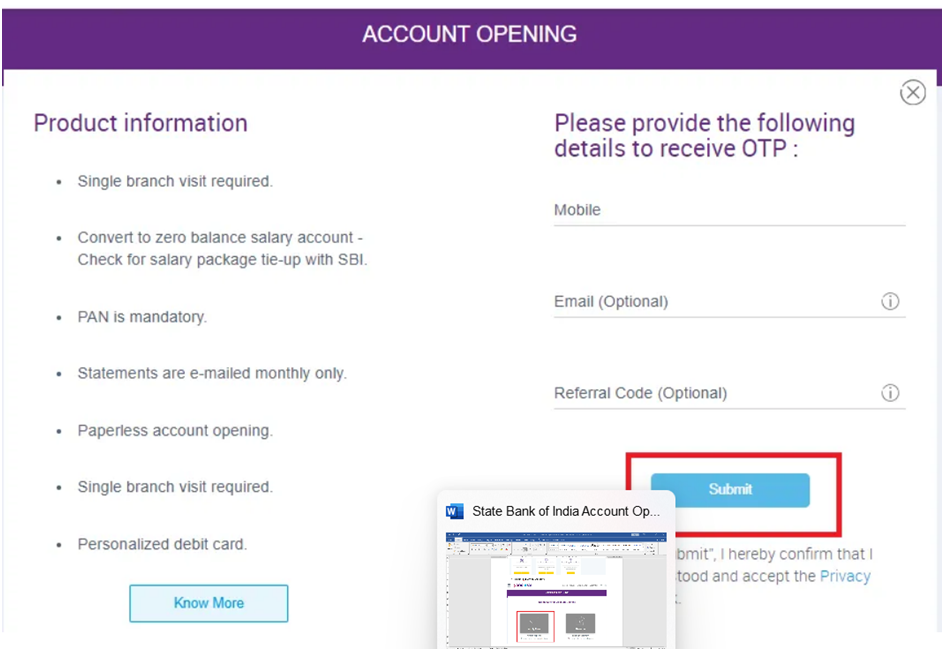

State Bank of India Account Opening Online Process

- First of all, visit the State Bank of India’s website

- Select “Apply Now” option.

- Select “Sbi Savings Accounts”.

- Fill out the application form, including your name, residence, date of birth, and other pertinent information, and submit it.

- The bank will notify the applicant to visit the branch with the required KYC documents – proof of identity and address – once the information has been submitted.

- The bank will begin the verification procedure after receiving the documents.

- After approval, the account will be activated within 3-5 bank working days.

SBI Fixed Deposit Interest Rate

State Bank of India Account Opening Eligibility

Customers must meet certain requirements in order to create a savings account with the State Bank of India.

- Should be an Indian national.

- In order to be eligible, the person must be at least 18 years old.

- In the event of children, the account can be opened on their behalf by their parents or legal guardians.

- The applicant must present government-issued identification and evidence of address.

- Following bank approval, the applicant must make an initial deposit, which will be determined by the minimum balance requirement of the savings account he or she has chosen.

Required Documents to Open an SBI Savings Account

Customers must submit the following papers together with the account opening form to be eligible for the SBI Savings Account.

| Proof of identity | Passport, Driving license, Voter’s ID card, etc. |

| Proof of address | Passport, Driving license, Voter’s ID card, etc. |

| Other important documents | PAN card Form 16 (only if PAN card is not available) 2 latest passport size photographs |

SBI New ATM Online Application

SBI Savings Accounts Nomination Service

All savings account customers are obliged by the Government of India to name a beneficiary who can run the account on their behalf. Customers will be requested to select a candidate while filling out the application form. If the nominee is under the age of 18, he or she will be able to run the account after they reach the age of 18. After the account holder’s death, the nominee can manage the account on his or her behalf.

State Bank of India Account Opening Welcome Kit

The consumer will receive a savings account welcome packet once the bank has given its permission. The kit shall include the following things:

- ATM debit card from SBI

- The PIN will be sent separately through mail.

- SBI cheque book (with 10 leaves)

- Pay-in slips

- On arrival, one must verify that the welcome kit is sealed.

Change Address in SBI Account Online

Helpline for SBI Savings Accounts

Customers can call the SBI savings account helpline at (1800) 112 211 for any assistance, grievances, or requests.