How To Fill Cheque | Fill Cheque For NEFT | How To Fill Cheque Step BY Step Guide | Components of a Cheque

Checks are a cashless banking method that is both safe and simple to use and are currently employed by elderly people who are unfamiliar with online banking. In today’s digital environment, checks are still commonly utilized, but they are less popular than they previously were. Paper checks are a cost-effective and efficient way to move money, but you probably don’t write checks every day. Remember that writing a check is simple, even simpler than using e-banking after you’ve mastered it. Read below to check the detailed information related to How To Fill Cheque Step BY Step Guides like Components of a Cheque, Requirements to Fill a Check, Steps to Fill a Cheque, and much more.

Table of Contents

How To Fill Cheque Step BY Step Guide – Comprehensive Details

Even in today’s digital environment, a large number of people still utilize paper checks for financial purposes. Though the use of checks as a primary means of banking has decreased significantly in popularity and regularity, however, the paper check is a low-cost and simple method of transferring money or withdrawing funds. Because of the widespread use of online banking and money transfers, using checks for banking reasons would be a novel and unfamiliar activity for today’s youth.

How to Find Bank Account Number

Cheque Components

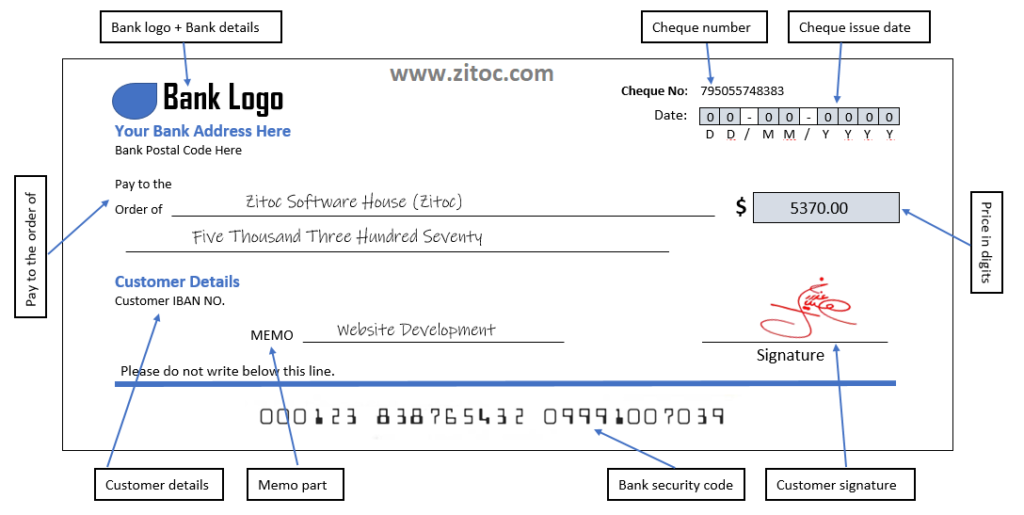

The cheque consists of various components which are as follows:

- Current date

- Payee

- Amount in numeric form

- Amount in words

- Signature

- Memo (or “For”) line

- Current date: In this section, you write the current date near the top right-hand corner. In most circumstances, the user uses today’s date, which makes it easier for both user and the receiver to keep track of things. Users can also postdate the check, however, this does not always operate as expected.

- Payee: In this section, you write the name of the person or organization you’re paying

- Amount in numeric form: In this section user needs to write the amount of their payment in numeric form in the little box on the right-hand side.

- Amount in words: To minimize fraud and misinterpretation, write out the amount in words. This will be your payment’s official amount. If the amount you typed in words differs from the amount you provided in numeric form in the previous step, the amount you put in words will be the lawful amount of your check. Use all capital letters because they are more difficult to change.

- Signature: Make a legible signature on the bottom-right corner of the cheque. Your signature is the most important factor in a successful money withdrawal because it serves as proof of your agreement to the withdrawal. Use the same name and signature that your bank has on file. A check will not be valid if it does not include a signature. You must carefully sign the check-in in the blank space provided.

Axis Bank Cheque Book Request By SMS

Requirements to Fill a Check

To write a successful cheque, you’ll need to fill in some gaps and blanks. Although different banks have varied spaces, the requirements are very similar. Some essential items to have on hand while writing a check are:

- Checkbook that the bank has issued in your name

- Writing pen

Steps to Fill a Cheque

To fill a cheque, the user needs to follow the below-given steps:

- First of all, enter the correct date near the top-right corner of the cheque leaf. It is recommended to use that day’s date, but you can use future dates in some cases.

- Then write the name of the payee i.e., the name of the person or organization that will receive the funds.

- Now, write the amount you want to withdraw in numeric form

- After that write the amount in words after you’ve written it in numeric form

- Finally, carefully sign the check to approve the check

Make a Note of the Payment in Your Checkbook

In a check register, keep track of every check you write. As a result, you will be able to:

- Keep track of your spending to avoid bounced checks

- Your checking account can be used to detect fraud and identity theft.

- You should be aware of where your money gets spent. You may just see a check number and amount on your bank statement, with no indication of who you wrote the check to.

Making a Copy of all the Important Information on Your Check

The following are some of the details that you much keep the recorded for future reference:

- The number of the check

- An explanation of the transaction or the name of the person to whom you wrote the check

- The date on which you wrote the check

- The total amount of the payment

Things to Remember while Filling a Cheque

Implement the right practices to reduce the risks of your account being hacked.

- Make it permanent: anytime you write a check, use a pen. Anyone with an eraser can change the amount of your check and the name of the payee if you use a pencil.

- Don’t Issue Blank checks: You must not sign a cheque until the payee’s name and the amount have been completed. If you’re not sure who to write a check payable to or how much something costs, bring a pen instead of giving someone unlimited access to your bank account. Keep checks from increasing: When filling in the amount, ensure the value is printed in such a way that scammers can’t add to it. Drawing a line from the far left border of the area to the last digit is a good way to start.

- Consistent signature: Many people don’t have a legible signature, and some even sign cheques and credit card slip with funny images on them. However, using the same signature regularly aids you and your bank in detecting fraud. If a signature does not match, it will be easier for you to prove that you are not liable for the charges.

- Carbon copies: Get checkbooks with carbon copies if you want a paper record of every check you write. A small sheet in those checkbooks contains a copy of every check you write. As a result, you’ll be able to easily see where your money went and what you wrote on each check.

FAQ’s

You can deposit a check written to yourself in an ATM, a bank branch, or using your mobile banking app. Follow the same steps as before, but write your name in the “Pay to the Order of” section of the cheque. When you deposit the check, you must endorse the back of it.

Do not sign a check until the “Pay to the Order of” portion, as well as the numeric and written amount, have been completed. If you sign a blank check and lose it or it is stolen, your bank account is vulnerable.