SBI UPI Transaction Limit | SBI Yono App UPI Transfer Limit and Charges | SBI UPI Transaction Status | SBI UPI Transaction Limit Per Month

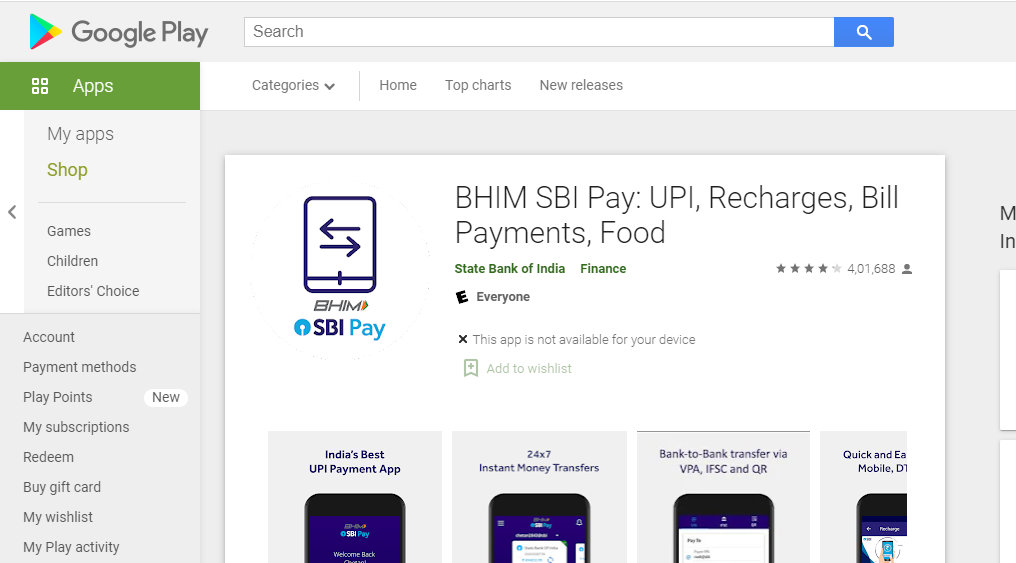

The State Bank of India has released the BHIM SBI Pay app, which is a mobile payment app. Customers having an account in SBI as well as those with accounts with other UPI-enabled banks shall be able to do it. The payments are transferred using a Virtual Payment Address (VPA). Within few seconds you can transfer money and make payments. You must use the same cellphone number that is linked to your bank account when you register, and you must also have a debit card. We will share with you here the details related to the SBI UPI Transaction Limit.

Table of Contents

How Do I Sign Up For SBI UPI?

You must complete the following steps to register with SBI UPI:

- Begin by installing the ‘BHIM SBI Pay’ app from your mobile’s app store.

- After that, type your mobile number, which is linked to your bank account.

- Enter your name when your cellphone number has been validated, and then go to the next stage.

- Select the bank with which you have an account, then the account number, and then click ‘Register.’ Then choose a six-digit password to go with it.

- After you’ve entered your debit card information and create an m-PIN, a registration message will be delivered to your phone number.

UPI Transaction without Internet

How to Receive/Collect Money via SBI Pay?

The steps to collect or receive money using SBI Pay are as follows:

- Open the BHIM SBI Pay app on your phone.

- Select ‘Collect/Receive‘.

- Enter the VPN of the person you want to receive money from, the amount you wish to receive, and then click ‘Request.’

SBI UPI Transaction Limit

The SBI UPI Transaction Limit (max) for a single day is Rs. 1 lakh. As a result, you can’t use BHIMSBI Pay to perform UPI transactions worth more than Rs 1 lakh in a single day.

Benefits of BHIMSBI Pay

- You can use BHIMSBI Pay to transfer payments using a variety of methods, including VPA, Aadhaar, scanning QR codes, account number + IFSC, and so on.

- BHIMSBI Pay transactions are free of charge.

- It is possible to take advantage of the available incentives and offers.

- Within the Rs.1 lakh limit, you can make a maximum of 20 transactions every day.

- You don’t have to register a beneficiary to transfer payments to them.

- SBI Pay Transactions can be scheduled at any time; there are no set hours for this service.

PayTm Per Day Transaction Limit

Fees for Using SBI Pay

Please note that there are currently no fees associated with using this app to conduct transactions.

Things Needed to Transfer Money Using YonoSBI App

To transfer money using Yono SBI App SBI Internet Banking, you’ll need the following items.

- Username and password of SBI Internet Banking are required.

- To get OTP through SMS, you must have your registered cellphone number with you and it must be active.

- The beneficiary account number, the IFSC code, and the mobile number are all required.

- Beneficiary MMID to transfer using Mobile+MMID method.

- Beneficiary UPI ID (for UPI transfer).

SBI Yono Money Transaction Limit

You can transfer money using the Yono App in a variety of ways. We’ll look at each method and the overall amount of data that can be transferred.

- Using NEFT – The NEFT option of the Yono App is limited to 10 lakh in 24 hours.

- IMPS – up to Rs. 2 lakh

- RTGS – Rs. 2 lakh to Rs. 10 lakh

- IMPS Quick Transfer – Maximum of 25, 000

- mCash – 1101 each transaction, 2202 per day, 5101 per month Charges per transaction: Rs. 2.5 plus taxes

- UPI (Unified Payments Interface) – 1 lakh per transaction per day

The table below shows each transaction mode, as well as its transfer limit and other aspects

What is the maximum amount of money we can send from YonoSBI?

| Mode | Transfer Limit | Beneficiary Need to Add? | Charges |

| NEFT | Rs. 10 Lakh | Yes | Nil |

| RTGS | Rs. 2 Lakh to Rs. 10 Lakh | Yes | Nil |

| IMPS | Rs. 2 Lakh | Yes | Nil |

| SBImCash | Rs. 1,101 per transaction, Rs. 2,202 in a day, and Rs. 5,101 in a month | No | Rs. 2.5 + tax per transaction |

| Quick Transfer | Rs. 25,000 per transaction | No | Nil |

| UPI | Rs. 1 Lakh per transaction per day | No | Nil |

FAQ’s

You can simply download the BHIMSBI Pay app. After downloading it enter your basic information in the UPI section, like your name, date of birth, etc. After that, you can link your bank account and acquire your SBI UPI ID by entering your preferred 6 number UPI PIN.

There are currently no fees associated with UPI transactions conducted through any bank or app.

SBI’sBHIMSBI Pay is a UPI mobile application. An individual with a bank account in any of the UPI-linked banks can use this app to create a UPI ID and conduct transactions.

The Unified Payment System, sometimes known as UPI, is a real-time payment system that allows money to be transferred from one bank account to another. The system was created by India’s National Payments Corporation (NCPI). UPI allows users to send money from their phone to their bank account.

The Virtual Payment Address created for each user when they register for UPI is referred to as the SBI UPI address. It is an address that is used in place of account numbers and IFSC codes to allow for the safe and seamless real-time transfer of funds via UPI.