SBI Pension loan Interest Rate | SBI Pension loan Scheme Apply Online | SBI Pension loan Scheme Application Form

The State Bank of India (SBI), India’s largest lender, is giving lucrative interest rates on pension loans to retirees. Pensioners include those employed by the federal and state governments, as well as those employed by the military and those receiving a regular pension from a bank. You will learn about SBI Pension Loan Scheme: Features, Eligibility, and Interest Rate in this post.

Table of Contents

SBI Pension Loan for Pensioners

Pension loans are available from the State Bank of India to older persons and family pensioners who get a regular pension from the central or state government. This loan can be used to purchase your dream home, support your child’s wedding, arrange a vacation, or obtain medical assistance.

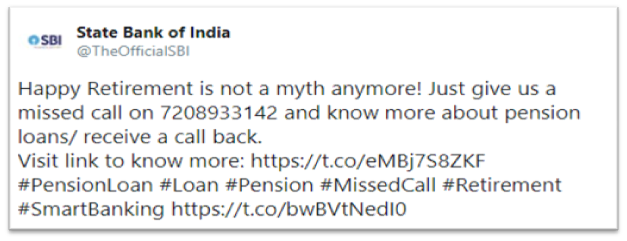

The retirement has just gotten a whole lot better with this loan. For more information or to apply for an SBI Pension Loan, call 1800-11-2211 or visit the contact center. To get a call back from the SBI contact center, leave a missed call on 7208933142 or text SMS “PERSONAL” to 7208933145.

SBI Pension Loan Highlights

| Rate of Interest | 9.75 percent |

| Loan Amount | Rs.2.50 lakh to Rs.14 lakh |

| Loan Tenure | 24 Months to 84 Months |

| Prepayment Charges | 3% on Prepaid Amount |

The SBI pension loan interest rate is 9.75 percent, according to a tweet from SBI Bank’s Twitter handle @TheOfficalSBI.

SBI Pension Loan Benefits

- There is a low processing cost.

- The loan application is processed fast.

- There are no additional fees or administrative expenditures.

- SI offers simple EMIs (Equated Monthly Instalments).

- The amount of paperwork required to process a loan is minimal.

- This loan is available at all State Bank of India branches.

- Amounts ranging from Rs.2.5 lakh to Rs.14 lakh for a loan.

- The loan term can be anywhere from 24 to 84 months.

Eligibility Criteria

The following are the loan qualifying requirements that must be considered while applying for this loan:

Pensioners from the Central and State Governments

- The applicant must be under the age of 76.

- The State Bank of India maintains a pension payment order.

- He/She should give the Treasury an irreversible assurance not to change his or her mandate during the loan’s term.

- The Treasury must agree in writing that no request from a pensioner to transfer his or her pension payment to another bank will be accepted until a NOC is provided.

- All of the scheme’s normal terms and conditions will apply, including a guarantee from the spouse (who is eligible for a family pension) or an appropriate third party.

Pensioners from the Defence

- The candidate must be a member of the Indian armed forces, including the Army, Air Force, Navy, paramilitary forces (CISF, CRPF, ITBP, BSF, and others), Rashtriya Rifles, Assam Rifles, and Coast Guards.

- The State Bank of India maintains a pension payment order.

- At the time of loan processing, the maximum age should be less than 76 years.

- The scheme has no minimum age requirement.

Pensioners with a Family

- Family pensioners are members of the pensioner’s family who have been permitted to receive a pension following the pensioner’s death.

- The applicant must be no older than 76 years old.

Repayments and Maximum Eligible Loan Amount

The age restriction for SBI pension loans is also listed in the table below:

Pensioners from the Central and State Government

| Age at the Time of Loan Sanction | Maximum Loan Amount | Repayment Period | Age at the Time of Full Repayment |

| Below 72 years | 18 months Pension or Rs.14.00 lakh | 60 months | Up to 77 years |

| 72 – 74 years | 18 months Pension or Rs.12.00 lakh | 48 months | Up to 78 years |

| 74 – 76 years | 18 months Pension or Rs.7.50 lakh | 24 months | Up to 78 years |

Pensioners from Defence

| Age at the Time of Loan Sanction | Maximum Loan Amount | Repayment Period | Age at the Time of Full Repayment |

| Below 56 years | 36 months Pension or Rs.14.00 lakh | 84 months | Up to 63 years |

| 56 – 72 years | 36 months Pension or Rs.14.00 lakh | 60 months | Up to 77 years |

| 72 – 74 years | 36 months Pension or Rs.12.00 lakh | 48 months | Up to 77 years |

| 74 – 76 years | 36 months Pension or Rs.7.50 lakh | 24 months | Up to 78 years |

Pensioners with Family (including Defence Pensioners)

| Age at the Time of Loan Sanction | Maximum Loan Amount | Repayment Period | Age at the Time of Full Repayment |

| Below 72 years | 18 months Pension or Rs.5.00 lakh | 60 months | Up to 77 years |

| 72 – 74 years | 18 months Pension or Rs.4.50 lakh | 48 months | Up to 78 years |

| 74 – 76 years | 18 months Pension or Rs.2.50 lakh | 24 months | Up to 78 years |

Documents for SBI Pension Loans

Depending on the group to which you belong, the SBI Pension Loan documentation may differ. The following is a list of basic documents:

- Identification proof such as a Pan Card, a Voter ID Card, a Passport, a Driver’s License, or an Aadhaar Card

- 2. Identification proof such as a passport, ration card, driver’s license, bank account statement, Aadhaar card, telephone bill, electric bill, and property purchase agreement (for owned properties).

- 3. A pension payment order can be used as proof of income.

- Interest Rates for SBI Pension Loans in 2021

- According to a tweet from the State Bank of India, the interest rate for SBI pension loans is 9.75 percent. “Get Pension Loans at 9.75 percent and have a happy retirement,” SBI tweeted. All you have to do is send an SMS to 7208933145.”

SBI Pension Loan Calculator 2022

Using the SBI pension loan EMI calculator 2021, you can figure out how much your pension loan will cost you in EMIs.

How to Obtain an SBI Pension Loan

This loan can be applied for in the following ways.

- To apply for an SBI pension loan online, go to SBI website

- To apply through the contact center, dial 1800-11-2211.

- Request a callback from the SBI support center by leaving a missed call on 7208933142.

- Request a callback from the State Bank of India contact line by texting “PERSONAL” to 7208933145.

Check the Status of Your SBl Pension Loan Application

As of now, you can check the status of your SBI pension loan on the official SBI website only. Follow the steps below to check on the progress of your SBI pension loan application:

- First of all visit the SBI personal loan application status website to check on the status of your application.

- Enter your loan application reference number, as well as your phone number and ISD code.

- To find out the progress of your loan application, go to ‘track.’

Statement of SBI Pension Loans

By logging into your online banking account, you can get your pension loan statement.

Alternatively, you can acquire a hard copy of your pension loan statement by visiting your nearest SBI bank.

Rules and Regulations

- For family pensioners, the EMI/NMP ratio must not exceed 33% in all situations.

- In all other types of pensioners, the EMI/NMP ratio must not exceed 50%.

- The prepayment fee will be 3% of the total amount prepaid.

- If the account is closed with the funds of a new loan account under the same scheme, there are no prepayment/foreclosure charges.

- The loan repayment mode is specified by Standing Instructions, which debit the pension account for EMI recovery.

- The TPG of a spouse qualifying for a family pension, or any other family member or third party eligible for a pension loan, secures the loan.

FAQ’s

SBI’s pension loan interest rate is currently 9.75 percent.

SBI would provide you with a loan sum ranging from Rs.2.5 lakh to Rs.14 lakh, depending on your category.

Yes. Pension loans are available from the State Bank of India to state or central government retirees, defense pensioners, or family pensioners who receive their pension through the SBI bank.

No, you are not eligible for this financing program. You must be under the age of 76 to be eligible for this loan.

You have the option of repaying your loan through EMI payments over a period of 2 to 7 years. You can repay it by setting up automatic debit instructions to deduct the due amount from your bank account on the due date.