SBI PPF Account Interest Rate | SBI PPF Account Opening Form | SBI PPF Account Online Payment | SBI PPF Login Portal

The Public Provident Fund is one of the working class’s favored retirement savings funds (PPF). The long-term investment horizon and the magic of compounding, as well as the income tax exemption available on it, may be the main reasons for its success. You may be unsure how to open a PPF account with one of your preferred institutions, such as the State Bank of India (SBI). We’ve included some valuable information about the Public Provident Fund SBI PPF Account and the step-by-step procedure for opening one with SBI in this article.

Table of Contents

PPF’s Product Features

Features of PPF Products are mentioned below

- Attractive interest rate of 7.1 percent p.a., which is totally tax-free under Section 80C of the Income Tax Act.

- For the next 15 years, this is a good long-term investment.

- The minimum deposit amount is Rs.500, with a maximum deposit amount of Rs.1, 50,000 every financial year.

- A financial year’s worth of deposits can be made in up to 12 transactions.

- The loan is available from the third to the sixth fiscal year.

- From the sixth financial year onwards, a partial withdrawal facility is provided.

- After the account matures, it can be extended in five-year increments.

About Public Provident Fund (PPF)

In India, the Public Provident Fund (PPF) is a popular small savings scheme. It’s commonly referred to as PPF. The scheme was launched by the Indian government in 1968 to encourage people to save tiny amounts of money.

The PPF interest rate is set by the Indian government every quarter. The scheme provides an appealing investment opportunity with income tax advantages.

How To Add Nominee in SBI Bank Account

Eligibility Criteria for Opening a SBI PPF Account

In order to open a PPF account with SBI, you must be eligible.

- Residents of India, as well as those acting on behalf of minors, can open and manage a Public Provident Fund account.

- The account can also be formed on behalf of a minor child by either the mother or father.

- Grandparents are not permitted to open accounts on behalf of minor grandchildren.

Grandparents, on the other hand, can open an account as guardians of the grandchild if both parents die.

Required Documents to start a SBI PPF Account

To open a PPF plan with SBI, you’ll need the following documents.

1. Application for a Public Provident Fund account (Form A).

2. Form of Nomination

3. A passport-sized photo

4. A copy of your PAN card or a completed form 60-61

5. Identification and proof of residence in accordance with the bank’s KYC requirements

SBI Debit Card Types and Annual Charges

Prerequisites for establishing an SBI PPF account

To open it online, you’ll need the following requirements.

1. A SBI savings account that is open and operational.

2. Access to your account using net banking or mobile banking.

3. Your account should be connected to your Aadhaar number.

4. Your Aadhaar-linked phone number must be in good functioning order.

How to Open an SBI PPF Account Online

Customers of SBI can now open a PPF account in SBI at any time and from anywhere using SBI internet banking and mobile banking. The entire procedure of opening an SBI PPF account is fairly simple and can be accomplished in just a few minutes. Fill out the online Public Provident Fund application and submit it. To open an SBI PPF Account Online, print the form and bring it to the branch with your KYC credentials and a photograph. To open an account with the State Bank of India online, follow these simple steps.

The procedure for opening an SBI PPF account online is as follows:

To apply for SBI PPF online, follow the steps outlined below.

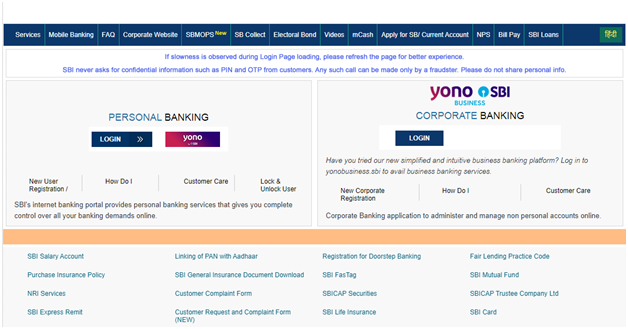

- First of all go to the SBI website i.e https://www.onlinesbi.com/

2. Use your SBI net banking credentials to log in.

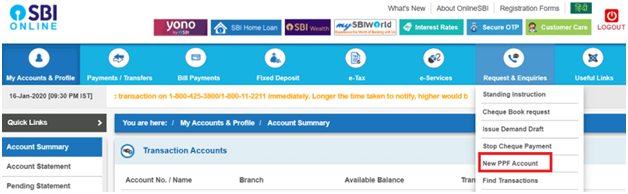

3. Now, on the main menu, go to the “Request & Enquiries” option in the upper right corner. From the drop-down menu, select the “New PPF Account” option.

4. A new page will open after you click it. Your savings account’s details are visible.

If it’s for a minor

5. If you’re starting a PPF in the name of a minor (under the age of 18), select the option and enter the minor’s name, date of birth, and relationship to the applicant.

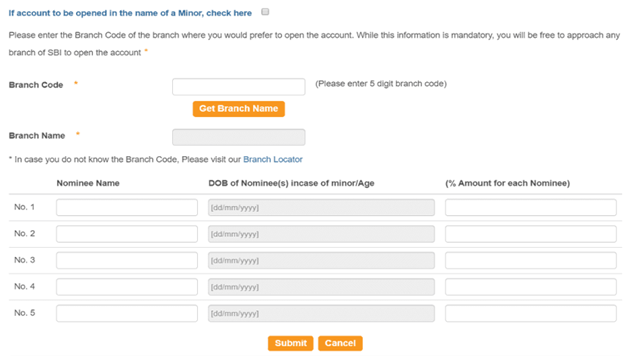

If it weren’t for a Minor,

6. If the Public Provident Fund is not to be formed in the minor’s name, provide the five-digit code of your home branch or the SBI branch where you want to open your Public Provident Fund scheme. If you don’t know the branch code, you can look it up using the branch locator.

7. Finally, type in the branch code. After clicking “Get Branch Name,” the name of the branch will appear here.

8. Next, fill in the nominees’ names. A Public Provident Fund account can have up to 5 nominees. Put the nominee’s date of birth here if he or she is a minor. You can also specify a percentage of the total sum for each nominee.

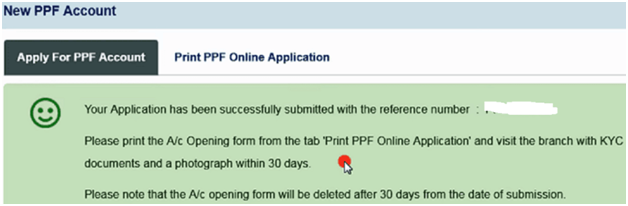

11. Select the tab “Print PPF Online Application Form” to print the PPF application form. Please note that after 30 days from the date of submission, the SBI PPF account opening form will be removed.

12. Within 30 days, return to the branch with KYC documentation and a photograph. On the form, paste a photo and the money you want to deposit.

Provision for Standing Instructions for Periodic Credits to the PPF program

For crediting the PPF plan, you can give Standing Instructions on your Savings or Current account.

Standing Instructions can also be sent online using State Bank of India online banking for crediting on a regular basis.

If you want to join the Public Provident Fund system, you can use the ECS mandate.

Before Creating an SBI PPF Account, Few Things to Keep In Mind

1. At any given time, an individual can only have one PPF account. Except for accounts opened in a minor child’s name.

2. PPF Investment Limits: The minimum deposit amount is Rs. 500 per year, with a maximum limit of Rs. 150000 per year.

3. This strategy has a 15-year duration. It matures once 15 years have passed from the end of the year in which it was first opened. After the maturity period, you can extend the tenure for one or more blocks of five years each.

5. The interest rate set by the Indian government on a quarterly basis.

6. Between the third and sixth fiscal years, a loan facility is offered.

7. Starting in your seventh year, you can make one partial withdrawal per year, subject to specific criteria.

8. Income tax benefits are available under Section 80C of the Income Tax Act.

9. There is a nomination system in place.

10. You can move your PPF account to different branches, banks, or Post Offices.

Interest Rate on SBI PPF The rate of interest set by the Government of India on a quarterly basis. The current SBI PPF interest rate is 7.9% per year. On the minimum balance, interest is calculated between the 5th and the end of the month. Every year on March 31st, the interest amount is paid.

SBI PPF Account Access through Internet Banking

The State Bank of India allows you to check your account balance at any time. You can transfer money from your linked SBI savings account to your SBI checking account online.

Your SBI PPF account statement is also available online through your Net Banking account.

FAQ’s

In India, the Public Provident Fund (PPF) is one of the most popular tax-efficient savings products for building a retirement fund. PPF deposits of up to Rs1, 50,000 (per financial year) are tax-deductible, and the amount received at maturity is tax-free. The interest you earn is tax-free as well. As a result, it is a single investment vehicle that is EEE (exempt-exempt-exempt). In addition, the profits are assured and risk-free.

No, opening a joint PPF account is not available. A person can only have one account.

When opening a PPF account, you do not need to provide your PAN number.

Yes, a minor’s parents or legal guardians can open a PPF account on his or her behalf. Relevant documentation must, however, be submitted at the time of account opening.

No, you cannot close your PPF account before it matures. If the account holder dies before the account matures, however, the account can be closed. If the account holder is unable to make payments for a period of five years owing to illness or financial difficulties, the account will be closed prematurely.

Yes, a PPF account can be used to change nominations. For a change of nomination, you’ll need to fill out and submit Form F.

If the account holder dies, the nominee will not be allowed to run the account.

No, NRIs are not eligible to open a PPF account.

After opening an account, individuals will be able to take out a loan between the third and sixth financial years.

If the account user does to make a minimum contribution of Rs.500 per financial year, a punishment of Rs.50 is imposed.

There are a number of reasons why your PPF account balance may be low, the reasons include the following:

Interest is only calculated at the end of the year, on March 31.

Every quarter, the interest rate fluctuates.

A deduction for a loan taken against your PPF balance could be possible.

If you make a deposit after the 5th of the month, you won’t get interested until the following month.

Regularly invest in your PPF account to improve your balance. You can use the auto-debit feature to send monies from your savings account to your PPF account on a regular basis.