What is Salary Slip | Salary Slip Check Out Meaning | Components of Salary Slip | Salary Slip Download

A salary slip, also known as a pay stub, is a document that contains a full description of the major components of your paycheck as well as personal employment information. An employer issues it once a month in the form of a printed hard copy or an electronic copy. A payslip should ideally include a firm logo, as well as the name and address of the company. Read below to check the detailed information related to Salary Slips like Eligibility Criteria, Format, Components, Importance, and much more.

Table of Contents

Salary Slip – Comprehensive Details

A pay stub is a precise account of an employee’s pay and deductions for a specific period. Employees might receive a tangible copy of this document or it can be mailed to them. Employees can view and print salary slips in pdf format. A corporation is also required by law to give a payslip to its employees regularly as documentation of wage payments and deductions. A salary slip is a piece of paper that an employer gives to an employee. It includes a full summary of the employee’s compensation components, such as HRA, LTA, and bonus payments, as well as deductions, for a given period, usually a month. It might be printed or mailed to the employee. Employers are required by law to provide Salary Slips to their employees regularly as confirmation of salary payments and deductions.

Who Receives a Salary Slip?

Only paid employees have access to a salary slip, and your employer can present you with a copy of your payslip each month. Some smaller businesses may not offer a salary slip regularly, in which case you might request a Salary Certificate from your employer. While most companies provide digital payslips, some may also send paper copies.

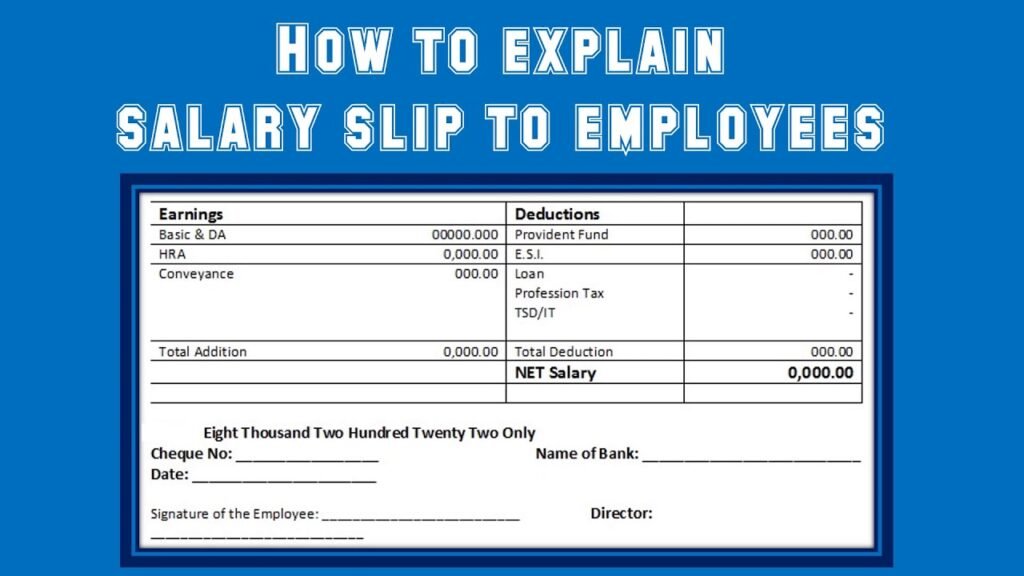

Salary Slip Format

Salary slips are formatted differently in different workplaces. Following Eyes A Salary Slip Basic Template Contains the following:

- Company name, logo and address, Salary Slip month and year

- Employee Name, Employee Code, Designation, Department

- Employee PAN / Aadhaar, Bank Account Number

- EPF Account Number, UAN (Universal Account Number)

- Total Work Days, Effective Work Days, Number of Leaves

- Itemized list of Earnings and Deductions

- Gross Pay and Net Pay in numbers as well as words

Components of Salary Slip

Basic information on a salary slip or payslip includes the firm name, employee name, designation, and employee code, among other things. The Salary Slip’s Components Can Be divided into two parts i.e.,

- Income / Earnings

- Deductions

Income / Earnings

The Income / Earnings component consists of the following sections:

- Basic Salary: This is the most essential component of your salary, accounting for 35 percent to 40 percent of your total pay. It also serves as a foundation for determining the salary’s other components.

- Dearness Allowance (DA): Dearness Allowance is a percentage of your basic salary that is granted to help offset the effects of inflation. It is fully taxable and must be declared when submitting an ITR. This section of the payslip is usually only seen in the case of government personnel.

- Performance and Special Allowance: Employees are offered performance and special allowances to motivate them to perform better. This portion is entirely taxed.

- HRA (House Rent Allowance): This is a stipend to assist people in paying their rent. The amount of HRA varies by location and ranges from 40 percent to 50 percent of base pay. If you reside in a leased house, you can claim a portion of the HRA as a tax deduction under Section 10 of the Income Tax Act, 1961.

- Conveyance Allowance: This is a stipend that covers the expense of transportation from home to work and back again.

- Leave Travel Allowance: Employees and their close family members receive a Leave Travel Allowance to cover the expense of travel while being on leave.

- Medical Allowance: This is a stipend to cover the employee’s medical expenses while on the job.

- Other Allowances: This category includes all of an employer’s additional allowances, regardless of the reason. Such allowances may be classified by an employer as “Other Allowances” under a specific heading or range of headings.

Deductions

The Deductions component consists of the following sections:

EPF (Employees Provident Fund):

It is the employee’s contribution to the provident fund. This is eligible for the Income Tax Act’s section 80C deduction. The collection of assets for an employee’s retirement period is known as a provident fund. It is governed by the Employees’ Provident Fund Organisation. The EPF receives 12% of the employee’s base income. On behalf of the employees, the company makes a similar payment for their retirement. However, not all donations to the Employee Provident Fund are used to fund the fund. The Employees’ Pension Scheme receives 8.33 percent of employee contributions.

The contribution is INR 1,250 if their wage is more than INR 15,000 per month. Employees having a salary of less than INR 15,000 contribute 8.33 percent to the Employees’ Pension Scheme. The remaining funds are deposited into the EPF account. Employees can, however, opt-out of the EPF plan (up to a certain level) and invest in higher-yielding securities such as equity funds (ELSS). Employee Provident Fund appears on the salary slip’s deductions side.

Tax Deductible at Source (TDS):

It relates to the amount of tax deducted by your employer on behalf of the Internal Revenue Service (IRS). This cost can be reduced by participating in tax-free investments such as equity mutual funds (ELSS), PPF, NPS, and tax-saving FDs. It shows on the salary slip’s deductions side. As a result, investing in Income Tax Act section 80C instruments enhances your take-home pay. Investments in mutual funds (ELSS) can be made, investment evidence was shown to the company, and TDS returns claimed.

Professional Tax:

This component of the pay stub is imposed on all individuals with an income, including salaried workers, professionals, and traders. It is only imposed in a few states like West Bengal, Kerala, Meghalaya, Orissa, Tamil Nadu, Gujarat, Karnataka, Andhra Pradesh, Chhattisgarh, Tripura, Telangana, Maharashtra, Assam, Jharkhand, Bihar, Madhya Pradesh, etc and is determined according to a person’s tax bracket. This sum is taken out of your taxable income. It also frequently only amounts to a few hundred rupees each month and is taxed at the highest rate. It shows on the salary slip’s deductions side.

Importance of a Salary Slip

Salary slips are just as essential as job certificates in terms of keeping them safe. Employees can use the wage slip to apply for loans, future employment, income tax planning, and government subsidies, and it also serves as a legal document of work.

Evidence of employment:

- A pay stub is a legal document that acts as a verification of employment. Applicants must produce a copy of their most recent income slip as legal verification of their last drawn salary and designation when applying for travel visas or institutions and schools.

- In addition, one of the most important documents for background checks is the pay stub. The paper serves as legal evidence in support of the wage claim.

- The current designation is also listed on the salary slip. All previous slips can be used to highlight the employee’s career progression at the company.

Planning for Income Taxes:

- The monthly earnings and deductions are listed on a salary slip. There are also tax-deductible components in it. Basic salary, HRA, medical allowance, and travel allowance are all part of the earnings breakdown. Deductions, such as professional tax, EPF, and TDS, are also available.

- TDS allows employees to plan ahead of time for their tax obligations. As a result of these deductions, the take-home pay is greater. The tax is then determined based on income tax slabs on the take-home pay.

- Tax outflow can be managed with adequate income tax planning. Tax planning is an important aspect of financial management. As a result, it assists in obtaining the greatest benefits of tax deductions, rebates, allowances, and concessions while staying within the guidelines established by the Income Tax Act of 1961. Salary slips are useful for computing TDS returns and income tax refunds, as well as measuring the tax outflow. To stay on top of Income Tax, it’s crucial to maintain track of your pay breakdown.

Avail loans and credit card

- A salary slip contains all of the wage and classification information. It acts as legal verification of an employee’s credit-paying abilities.

- Furthermore, the salary slip is used to apply for loans, credit cards, mortgages, and other forms of borrowing. As a result, while applying for a loan, credit card, or mortgage, this document is necessary. Lending institutions and banks ensure that a copy of the pay stub is kept on file. The salary statements are used to assess the borrower’s creditworthiness.

- The wage slip aids in the establishment of a credit limit. It also serves as a qualification requirement for obtaining a loan or credit card. The salary slip also affects your taxes for the entire fiscal year.

Looking for a future job:

- A wage slip serves as a legal confirmation of current employment as well as the employee’s current pay scale. This document aids in bargaining with potential employers on an aggregate level, i.e., the total cost to company CTC, as well as at the component level, i.e., basic salary, allowances. Almost every company requires previous paystubs as proof of work and earnings.

- Employees can also compare offers from new employers based on previous salary slips. It is very important in judging the experience. As a result, the wage slip is crucial in the job search. It also aids in determining the type of hike to take.

- Furthermore, in a compensation discussion with a new company, the salary slip is a deal-breaker. Previous pay stubs can also be utilized to demonstrate a professional path.

Get government subsidies

- Certain free services can be obtained via the payslip. They can be utilized to obtain heavily subsidized services. Medical treatment, food grains, and other services fall within this category.

- The income tax calculator on Scripbox can be used to calculate taxable income, which will aid in the filing of income tax forms. For tax savings, the calculator also suggests investing in mutual funds (ELSS). Save money by using the calculator.

FAQ’s

The wage slip is significant since it aids employees in obtaining loans, future employment, income tax planning, and government subsidy eligibility, as well as serving as a legal document of employment. Salary slips are just as crucial as job certificates in terms of keeping them safe.

Your salary slip is provided by your company every month. The company will either print or email you a wage slip. You can also look up your employee’s salary slip on their internal portal. Your salary and deductions will be detailed on your payslip.

Every month, the employee’s employer sends salary slips to him or her by email. Each month’s wage slip is available to download or print. You can get your payslip through your company’s payroll software or the employee’s internal portal.

Yes. Salary slips can be printed or handwritten, depending on whether they are issued electronically or on paper. Handwritten salary slips have the same value as those that are provided electronically. When applying for bank loans, as proof of work, and so on, a copy of handwritten salary slips can be produced.

The majority of banks will request your last two or three months’ pay stubs. The wage slips serve as documentation of your earnings, which is used to approve your loan. It is also required to be submitted to banks when applying for a mortgage or other types of loans.