How Many Types Of Cheque | List of Types Of Cheques | Advantages Of Cheque | Explanations For Cheques

A cheque is a great way through which you will be able to transfer funds from one place to another and you can easily take into consideration this payment method because it is a very old payment method and it is also a really easy payment method to undertake for all of the people who are not familiar with Internet Banking or mobile banking. You can check out the details related to the question of how many Types Of Cheques are available in the banking organisations of India. You can also take into consideration the advantages of cheques and also the explanation and the features of the various types of cheques.

Table of Contents

Different Types Of Cheque in India

There are a lot of different Types Of Cheques available in the various banking organisations across our country and you can take into consideration different types of cheques while you are going through the various procedures available in the banks. You must have proper knowledge regarding the types of cheques available and you must take into consideration the step-by-step procedure through which you will be easily able to write a working Cheque. Cheques are extremely easy to write and you just need minimal details in order to write a successful cheque. You can write cheques and they will be transferred easily.

Advantages Of Cheques

There are a lot of advantages of using a cheque and one of the main advantages is that the cheque is a negotiable instrument and it will guarantee the payment of a particular amount to the beneficiary taking into consideration the various details related to the beneficiary and the beneficiary’s bank account. You can easily write cheques without having to worry about the technical details related to the bank account and the amount that you want to pay to the beneficiary. The beneficiaries just require their name and the amount that they want to transfer while writing a Cheque and then the amount will be directly transferred without any problem.

How To Fill Cheque Step BY Step Guide

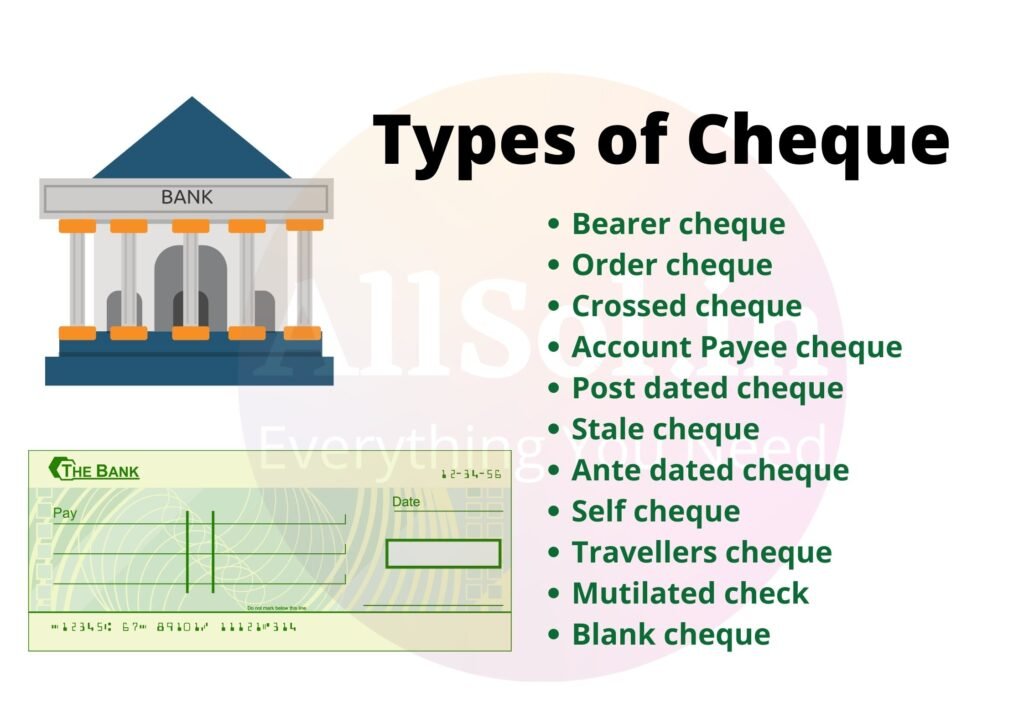

List of Types Of Cheque

There are various Types Of Cheques that can be issued. Given below is the list of the various cheque types:-

- Bearer Cheque

- Order Cheque

- Crossed Cheque

- Account Payee Cheque

- Stale Cheque

- Post Dated Cheque

- Ante Dated Cheque

- Self Cheque

- Traveller’s Cheque

- Mutilated Cheque

- Blank Cheque

Explanations For Cheques

You can check out the explanations for the different types of cheques given below:-

Bearer Cheque

The bearer cheque will be payable to the bearer of the Cheque or whose name the Cheque carries in the column meant for the first name of the drawing. This Cheque will have bearer printed at the end of the dotted lines and this line will have the name of the drawing. The Cheque can be presented over the counter and you will be able to cash the Cheque without any problem. You can also transfer the bearer Cheque and you can pass it to another beneficiary without any problem and there is no need to endorse this type of Cheque.

Order Cheque

If the printed word bearer is cancelled then it is called the order cheque. This Cheque is payable only to the person whose name is written in the place of the word. If you have cancelled the bearer then it is automatically understood that this is an order Cheque. The bank will be completing the transaction only after they have identified the details of the beneficiary in case of an order cheque.

Crossed Cheque

If it is crossed Cheque then there will be two parallel transverse lines at the top left corner of the cheque with or without writing AC payee. It doesn’t matter who presents the check to the bank. The transaction will be carried out to the person whose name is written in the Cheque. This Cheque is very popular because it reduces the risk of fraudulent practices.

Account Payee Cheque

This is also a cheque that requires no third-party involvement and this amount will be directly transferred to the bank account of the beneficiary. There are two lines made at the top left corner of the cheque and you will have to leave this cheque as AC payee.

Stale Cheque

A stale cheque is a cheque that has passed the validity period and you can no longer encash this Cheque. The validity period is six months from the date of the issuance of the cheque but now the validity period is only three months.

Post Dated Cheque

A check which will be issued at a later date is called a post-dated cheque. You can present this cheque to the bank at any time after its issuance but the money will not be transferred until the date mentioned on the cheque.

Ante Dated Cheque

If the date mentioned in the cheque is mentioned prior to the current date on the cheque then it is called ante dated cheque.

Self Cheque

A self-check is issued by the account holder themselves in order to withdraw the money from the bank by using the medium of Cheque. You can only cash this Cheque in your own bank account and you must be careful because if it is lost then another person can easily cash the amount in place of you.

Traveller’s Cheque

Traveller’s cheques are available almost everywhere and anywhere in various denominations and you can use this Cheque to make payments from one place to another. There is no expiry date in the traveller’s cheques and you can use this in your next travel as well.

Mutilated Cheque

If the cheque is in a very bad condition then it is called a mutilated cheque and if the relevant information is torn then the bank will be rejecting your cheque and will be declaring it invalid.

Blank Cheque

A blank check is issued by the authorities when they are not confirmed of the amount that they want to pay and you can fill the amount after you have got in the signature of the account holder and then you can cash the check without any problem.

FAQs For Types Of Cheque

There are around 11 types of cheques available from all around the banking organisation.

The beneficiaries need the details related to the bank account of the payee and also the amount that you want to transfer to the beneficiary in order to make a check.

When a bearer cheque is cancelled it automatically becomes an order cheque and you will need proper identification proof in order to cash this Cheque.

It will take around one day in order to successfully transfer your funds from one place to another using a bearer cheque.