How to Close Fixed Deposit (FD) in SBI Online Net Banking | Close SBI FD Online using YONO SBI App | Unable To Close SBI FD Online | SBI FD Premature Withdrawal

Fixed deposits are a safe way to save money while also earning higher interest rates than traditional savings accounts. Many people prefer to make a Fixed Deposit (FD) for a longer period of time in order to get the most out of it by earning a greater interest rate at maturity. However, you may want to break the FD and get the money into your account for some reason. In this article, we will learn more about How to Close SBI Fixed Deposit FD in SBI Online

There are distinct criteria in this scenario, and you may not get the projected interest rate; since you already know the disadvantages of dissolving an FD early, we’ll look at how to terminate SBI FD Online using your smartphone or computer.

Table of Contents

Things Needed for Closing FD in SBI Online

- Yono SBI App to be loaded on your smartphone in order to close SBI FD online.

- User ID for SBI net banking.

- Password for SBI net banking.

How to Close SBI Fixed Deposit Account

Closing a Fixed Deposit (FD) is a simple operation that may be completed both online and in-person at a bank location. An FD can be closed both before and after maturity. Most banks have the same procedure for closing an FD by visiting a branch. An FD can be closed in one of two ways:

- Online banking is used to close an FD.

- By visiting a bank branch, you can close your FD offline.

How to Close an FD Offline (Premature)

- Go to a bank branch and fill out a form for an early withdrawal.

- Complete the form with the required information, such as your name, bank account information, and FD number.

- Send the papers to the bank, and they’ll cover the rest.

- The funds will be credited to your savings account after the FD is closed.

How To Close FD in SBI Online Before It Matures

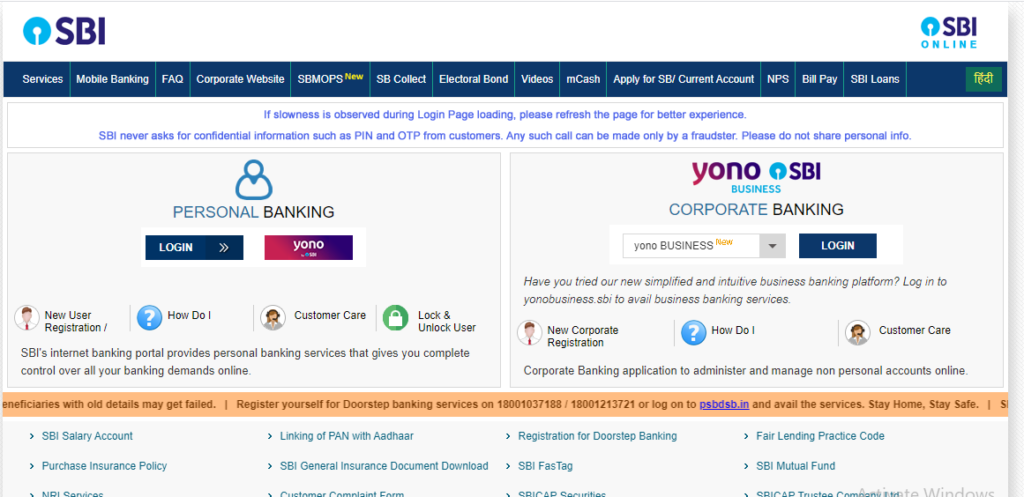

- Go to SBI’s website and select Fixed Deposit.

- Under the Fixed Deposit tab, select the ETDR/STDR (FD) tab.

- Select the ‘Close A/C Prematurely‘ tab

- In this area, you’ll find a list of your FDs.

- Click the Proceed button after selecting the FD you want to close.

- Check the details of your FD, such as the amount, maturity date, and so on.

- In the ‘Remarks’ area, explain why the FD is being closed, and then click the ‘confirm’ tab.

- This option is only available to Fixed Deposits with a “Sole Owner (SOW)” connection.

Close SBI FD Online using YONO SBI App

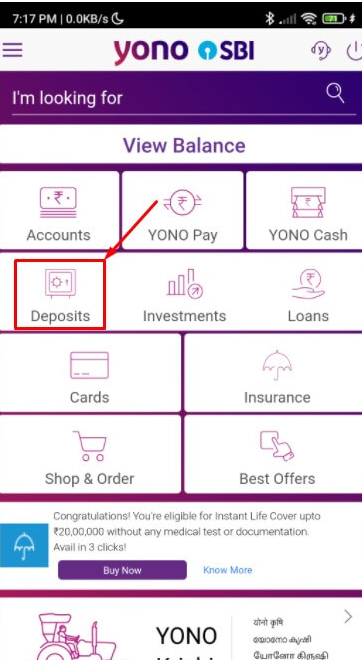

You can effortlessly close fd online using the Yono App on your smartphone.

- On your smartphone, download the YONOSBI App.

- Launch the app and grant the necessary permissions.

- Enter your User ID and password to log in.

- Once you’ve logged in to the app, go to the home page and select Deposits.

- Go to the Deposits area to see your Fixed Deposits, including the FD number and amount.

- Tap on the number to select the FD you wish to close.

- At the bottom of the screen, tap the Close Deposit option.

- An OTP will be sent to your registered phone number. On the screen, enter this OTP and press the CONFIRM button.

- Your Fixed Deposit has been successfully closed.

- Your savings account will be credited with the amount of the FD as well as the accumulated interest rate.

Close an ICICI Fixed Deposit (FD) Online Before It Matures

- Log in to your Net Banking account with your Customer ID and IPIN on the ICICI website (NetBanking Password).

- Then select the ‘My Accounts’ menu, then the ‘Deposits’ tab.

- Under the ‘Deposits’ tab, select the ‘Service Request‘ option.

- The ‘Closure/Renewal of Existing Fixed/Recurring Deposit’ option will appear. Select it by clicking on it.

- Select ‘Premature Withdrawal of FD’ under the ‘Request for‘ tab. To continue, select the ‘Continue’ tab.

- Review the FD information in the area and click the ‘Submit’ button.

- You’ll need to input digits from your debit card grid to authorize the transaction.

- On your registered mobile number, you will receive a one-time password (OTP).

- Click the ‘Submit’ tab after entering the OTP.

- A notice will appear on your screen stating that the FD has been closed.

Steps for Closing a Maturity FD

You must send the deposit certificate when you close an FD after it has reached maturity. A signed form indicating that the FD may be closed on the maturity date may also be required. On maturity, the fixed deposit amount, plus interest, will be transferred to your savings account. On the maturity date, you can renew or close the FD online.

Check SBI Debit Card EMI Eligibility

Closure of FD at Maturity

If your FD has reached its maturity time and you have not taken any action, the bank will have two options for dealing with your matured FD.

Auto-Renewal

On the due date, the bank may automatically renew the FD for one year or for the original duration.

Auto Liquidation

The FD will be liquidated on the due date, and the money will be sent to your savings account by the bank.

Note: To learn about how your Fixed Deposit will be treated when it matures, read the terms and conditions on the deposit certificate.

How Can You Minimize Deposit Closures That Aren’t Planned?

To reach our unexpected financial goals, the majority of us prematurely break our FDs. This will cost you a lot of money, and you won’t be able to get the most out of your term deposit. Though the penalty amount appears to be insignificant, when calculated, it results in a significant loss.

SBI Pension loan Interest Rate

Calculating Premature Closure Interest Rates

Rate of interest for premature withdrawal = interest rate on actual deposit term -1 percent. Many banks do not charge a penalty if you withdraw money too soon. Invest in a bank that provides this service. Instead of prematurely closing the deposit, take out a loan on it.

You can always take a loan/overdraft against your term deposit instead of breaking it. Customers can often borrow up to 90% of their deposit amount from most banks.

FAQs

Yes. Banks normally charge a penalty if you take money from your FD account too soon. The penalty amount varies depending on the bank and the type of deposit.

If you didn’t open your FD online, it might not show up in your net banking account. Even though the FD was not opened online, some banks allow you to close it online.

No. Premature withdrawal of any sort of tax-saving FD is prohibited.

Yes. NRIs who come home and lose their NRI status should close their FDs and invest elsewhere.

Yes. To close the FD, you’ll need the signature of the joint account holder.