HDFC Debit Card Online |How to Disable International Transaction on HDFC Credit | HDFC Debit Card Online Transaction Limit

Using your credit card while traveling outside India might be unsafe than using it within India. There have been multiple cases of fraud where the cardholder was not abroad but was nonetheless charged for foreign transactions. Read below to know how it happens and how you may avoid it by simply turning off foreign transactions on your credit card. The article will provide you with details related to how to Disable International Transaction on HDFC Credit & Debit Card

Table of Contents

Disable International Transaction on HDFC

If you have an international credit card, you should be aware that international usage is enabled by default. You can completely stop foreign transactions to be on the safe side, especially if you have no plans to travel abroad anytime soon.

By contacting the card issuer’s customer service or visiting their website, you can disable international transactions. “When not traveling abroad, deactivating international usage helps protect against fraudulent unsecured Card Not Present transactions,” says Prasad.

In the case of an HDFC credit card, here’s how to Disable International Transaction on HDFC

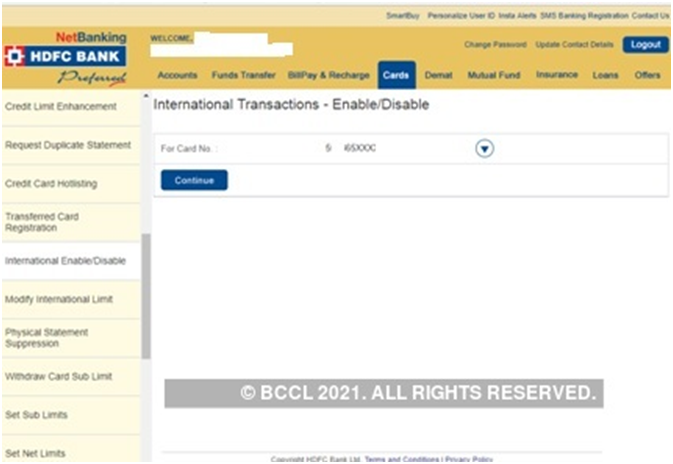

Step1:

Step2:

Step3:

Step 4:

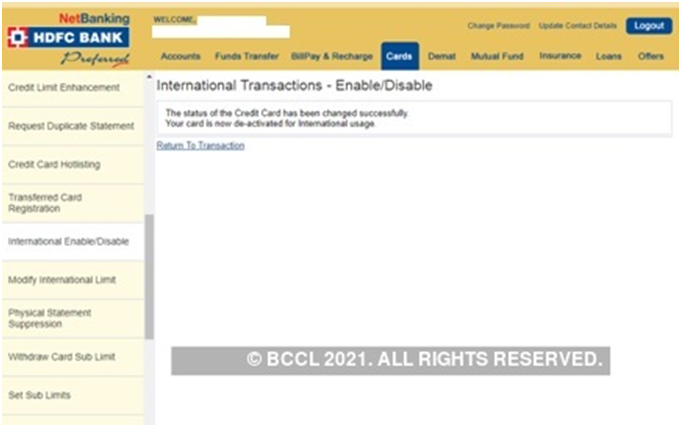

When the feature is turned off, the following message appears: ” “The Credit Card’s status has been successfully changed. For international use, your card has been deactivated.”

Add Beneficiary in HDFC Net Banking

Why is the Risk of International Transactions Higher?

For domestic credit card transactions, the Reserve Bank of India (RBI) has made 2-factor authentication (2FA) compulsory; however, foreign transactions do not have this added layer of security.

The PIN serves as 2FA for domestic transactions at the point-of-sale (PoS), while the OTP serves as the second security layer for online purchases.

International transactions, on the other hand, are governed by the country’s merchant acquiring rules. 2nd-factor authentication in the form of an OTP is not required for international transactions (on websites) across nations. As a result, only the card number, CVV, and expiration date are required to complete such transactions. This data is itself embossed on the card,” says Hardayal Prasad who is MD & CEO, SBI Card.

So, if someone gets your card number, CVV, and credit card expiry date (whether it’s a merchant or someone you’ve handed your card to), they can easily give these details to someone in another country. As a result, you should always ask for the card to be swiped in front of you.

HDFC Debit Card EMI Eligibility Check

Credit Cards: How Safe Are They?

The RBI has already instructed card-providing banks in India to replace magnetic stripe cards with EMV Chip and Pin cards by December 31, 2018, regardless of the card’s validity length. EMV cards, often known as chip cards, use integrated circuits rather than magnetic stripes to store data. Every time you complete a transaction, this generates dynamic data, making it nearly impossible for fraudsters to copy or clone your card.

Card issuers are taking proactive initiatives to improve the security of card transactions. “Using intelligent algorithms, robust real-time transaction monitoring technologies enable us to authenticate the legality of card transactions. When an odd transaction is detected on a card, our staff contacts the consumer ahead of time to check the transaction’s validity. The card is banned in circumstances where fraud is suspected ” said by Prasad.

Card-not-Present Fraud

Despite the adoption of EMV chip cards, card-not-present (CNP) fraud, which includes phone, Internet, and mail-order transactions in which the cardholder does not physically present the card to the merchant, continues to be a problem. The majority of CNP fraud entails the use of card information obtained through skimming, hacking, email phishing campaigns, phone solicitations, or other means. The card information is then utilized to enable fraud.

Because the 2FA is just for web firms in India, not outside the country, the possibilities of a fake attack are higher on foreign websites. As a result, making online transactions on foreign websites, which is a CNP transaction, is more vulnerable to this type of fraud.

The fraudulent transaction should be reported right away. “If a consumer claims fraud involving an international transaction, the card is immediately banned, and temporary credit is immediately supplied so that the customer is not impacted and does not have to incur any interest burden while the inquiry is being conducted,” says Prasad.

Precautionary Measure

When a credit card’s credit limit is high, there is always a risk. Check with the issuer to see if you can manage it as a cardholder. According to Prasad, “each card issuer has its own special policy that permits cardholders to divide credit limitations between international and local usage.” Although there may be an upper limit on foreign transactions, you can establish your own without deactivating it.