What Is Citibank FD Rates | New Fixed Deposit Interest Rates | Citibank Tax Saver Fixed Deposit Rates | Citibank FD Rates Calculator

Fixed deposits are a great way through which you will be able to save a ton of money by making a small amount of your income each and every month. It is important to take into consideration a vc fixed deposit because it will help you to have a healthy retirement. You can check out other details related to the Citibank FD rates 2022 and we will also share with you all the details related to the new fixed deposits interest rates available from different banking organizations and for the different types of customers of Citibank.

Table of Contents

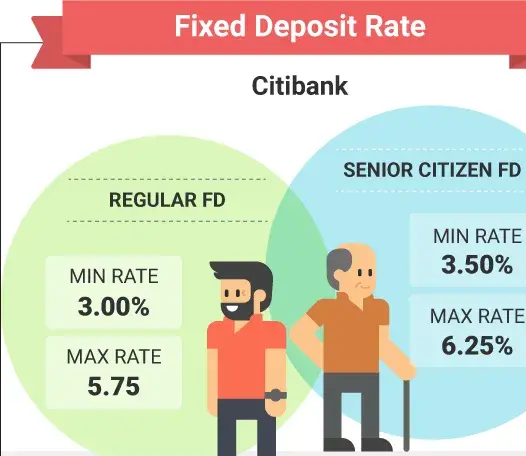

Citibank FD Rates 2022

Citibank fixed deposits will help you to set a site a portion of your income and true that Income you will be able to easily get proper opportunities for tax saving and also future investment opportunities. Citibank offers various ranges of fixed deposits for the customers and these fixed deposits are specially curated taking into consideration the saving schemes presented from all of the perspectives of a customer who is willing to take into consideration tax-saving opportunities. You can easily apply for the various fixed deposits available in this banking organisation from today and kick start your journey to save tax.

Benefits of Citibank Fixed Deposits

There are a lot of benefits of the various Citibank fixed deposits available by the banking organization and given below showing all of them:-

- The customers will be able to save a ton of money by using the fixed deposit schemes.

- You will be able to save tax on your investment.

- You will be able to have a healthy retirement.

- The interest rates in the fixed deposits for the Citi banks are very flexible.

- You will be able to save money without having to invest money each and every month.

- You can easily withdraw your money on occasion of any emergency.

Details of Fixed Deposits

The following fixed deposit schemes are available by the Citibank organization:-

| Type of Deposit | Minimum Deposit (Rs) | Minimum Tenure | Details |

| Fixed / Term | 1,000 | 7 days | Overdraft of up to 90% of the deposit value for Current Account customers Interest Options: Quarterly Compounded Interest / Simple Interest Quarterly Payout |

| Multi / Flexible | 1,000 | 7 days | High-interest rates Instant access to your funds when you need it Interest Options: Quarterly Compounded Interest / Simple Interest Quarterly Payout |

| Recurring | 1,000 | 12 months | Place a monthly standing instruction to automatically debit your account |

| Senior Citizen | 1,000 | 7 days | Higher interest rates |

| Tax Saver | 1,000 | 5 years | Tax benefits on deposits of up to Rs1,50,000 booked for five years Interest Options: Quarterly Compounded Interest / Simple Interest Quarterly Payout |

Eligibility Criteria

The applicant must follow the following eligibility criteria to apply for the Citibank fixed deposit schemes:-

- The applicant must be an Indian citizen

- Members of Hindu Undivided Family (HUFs) can also open a CitiBank FD account.

- Employees working for private organisations.

- Local governing bodies.

- Trust accounts.

- Business firms.

- Government departments.

Citibank IndianOil Credit Card

Documents Required

The applicant must submit the following documents to apply for the Citibank fixed deposit schemes:-

- Proof of identity such as PAN Card, Aadhaar, etc.

- Proof of address such as Aadhaar, utility bills, etc.

- Proof of age such as birth certificate, voter ID card, matriculation certificate, etc.

- Details of your bank account.

- Your passport size photographs.

FD Rates Under Rs.2 Crore – General Public

The table given below indicates the fixed deposit rates under 2 crore rupees for general public and senior citizens:-

| Tenure | For General Public (p.a.) | For Senior Citizen (p.a.) |

| 7 days to 14 days | 1.85% | 2.35% |

| 15 days to 35 days | 1.90% | 2.40% |

| 36 days to 180 days | 2.55% | 3.05% |

| 181 days to 270 days | 2.60% | 3.10% |

| 271 days to 540 days | 2.75% | 3.25% |

| 541 days to 731 days | 3.00% | 3.50% |

| 732 days to 1095 days | 3.50% | 4.00% |

| 1096 days and above | 3.50% | 4.00% |

FD Rates Above Rs. 2 Crore

The table given below indicates the fixed deposit rates for above 2 crore investment:-

| Tenure | Rs.2 crore to less than Rs.3 crore | Rs.3 crore to less than Rs.5 crore | Rs.5 crore to less than Rs.8 crore | Rs.8 crore to Rs.10 crore |

| 7 days to 14 Days | 2.00% p.a. | 2.85% p.a. | 2.00% p.a. | 2.95% p.a. |

| 15 days to 35 days | 2.00% p.a. | 2.00% p.a. | 2.00% p.a. | 2.00% p.a. |

| 36 days to 180 days | 2.00% p.a. | 2.00% p.a. | 2.00% p.a. | 2.00% p.a. |

| 181 days to 270 days | 2.00% p.a. | 2.00% p.a. | 2.00% p.a. | 2.00% p.a. |

| 271 days to 540 days | 2.00% p.a. | 2.00% p.a. | 2.00% p.a. | 2.00% p.a. |

| 541 days to 731 days | 2.00% p.a. | 2.00% p.a. | 2.00% p.a. | 2.00% p.a. |

| 732 days to 1095 days | 2.00% p.a. | 2.00% p.a. | 2.00% p.a. | 2.00% p.a. |

| 1096 days and above | 2.00% p.a. | 2.00% p.a. | 2.00% p.a. | 2.00% p.a. |

Citibank Tax Saver Fixed Deposit Rates

The table given below indicate the City Bank tax saver fixed deposit rates:-

| Tenure bracket | Regular FD rates (per annum) | Senior Citizens FD rates (per annum) |

| 5 years | 3.50% p.a. | 4.00% p.a. |

Best Cashback Credit Cards in India

Citibank NRE Deposit Rates

The table given below indicates the Citibank NRE deposits rate available for the customers:-

| Tenure | Below Rs.2 crore | Rs.2 crore to less than Rs.3 crore | Rs.3 crore to less than Rs.5 crore | Rs.5 crore to less than Rs.8 crore | Rs.8 crore to Rs.10 crore |

| 365 days to 400 Days | 2.75% p.a. | 2.00% p.a. | 2.00% p.a. | 2.00% p.a. | 2.00% p.a. |

| 401 days to 540 Days | 2.75% p.a. | 2.00% p.a. | 2.00% p.a. | 2.00% p.a. | 2.00% p.a. |

| 541 days to 731 Days | 3.00% p.a. | 2.00% p.a. | 2.00% p.a. | 2.00% p.a. | 2.00% p.a. |

| 732 days to 1095 Days | 3.50% p.a. | 2.00% p.a. | 2.00% p.a. | 2.00% p.a. | 2.00% p.a. |

| 1096 days and above | 3.50% p.a. | 2.00% p.a. | 2.00% p.a. | 2.00% p.a. | 2.00% p.a. |

Citibank NRO Deposit Rates

The table given below indicates the Citibank NRO deposits rate available for the customers:-

| Tenure | Below Rs.2 crore | Rs.2 crore to less than Rs.3 crore | Rs.3 crore to less than Rs.5 crore | Rs.5 crore to less than Rs.8 crore | Rs.8 crore to Rs.10 crore |

| 7 days to 14 Days | 1.85% p.a. | 2.00% p.a. | 2.85% p.a. | 2.00% p.a. | 2.95% p.a. |

| 15 days to 35 days | 1.90% p.a. | 2.00% p.a. | 2.00% p.a. | 2.00% p.a. | 2.00% p.a. |

| 36 days to 180 days | 2.55% p.a. | 2.00% p.a. | 2.00% p.a. | 2.00% p.a. | 2.00% p.a. |

| 181 days to 270 days | 2.60% p.a. | 2.00% p.a. | 2.00% p.a. | 2.00% p.a. | 2.00% p.a. |

| 271 days to 540 days | 2.75% p.a. | 2.00% p.a. | 2.00% p.a. | 2.00% p.a. | 2.00% p.a. |

| 541 days to 731 days | 3.00% p.a. | 2.00% p.a. | 2.00% p.a. | 2.00% p.a. | 2.00% p.a. |

| 732 days to 1095 days | 3.50% p.a. | 2.00% p.a. | 2.00% p.a. | 2.00% p.a. | 2.00% p.a. |

| 1096 days and above | 3.50% p.a. | 2.00% p.a. | 2.00% p.a. | 2.00% p.a. | 2.00% p.a. |

Citibank FCNR (B) Deposit Rates

The table given below indicates the Citibank FCNR (B) deposits rate available for the customers:-

| Maturity Period | GBP | EURO | USD | Jap Yen | Australian Dollar | Canadian Dollar |

| 1 year to 399 days | 0.01% | 0.01% | 0.01% | 0.01% | 0.01% | 0.01% |

| 400 days to 410 days | 0.01% | 0.01% | 0.01% | 0.01% | 0.01% | 0.01% |

| 411 days to 729 days | 0.01% | 0.01% | 0.01% | 0.01% | 0.01% | 0.01% |

| 730 days to 1825 days | 0.01% | 0.01% | 0.01% | 0.01% | 0.01% | 0.01% |

Customer Care

- 1860 210 2484 (Local call charges apply)

- Use +91 22 4955 2484 for calling us from outside of India.

FAQs For Citibank FD Rates 2022

You will first have to visit the official website of Citibank and then you can apply for the fixed deposit schemes.

You can get up to 90% off your fixed deposit as known in case of any financial requirement.

You just need your proof of Identity in order to get a Citibank fixed deposit account started.

The tenure for the Citi Bank tax saver deposit scheme is of 5 years.