Yes Bank Credit Card Online Apply | Yes Bank Credit Card payment | Yes Bank Credit Card Customer Care | Yes Bank Credit Card Annual Fee

There are a lot of different types of reward points available for the customers of Yes Bank through the different types of credit cards available by the concerned authorities and you will be able to take into consideration these reward points if you want to earn more while shopping. Given below we are sharing some of the most important specifications related to the Yes Bank Credit Card Online Apply procedure. We will also share with you all the step-by-step procedures through which you will be able to check your account balance and also the specifications of the Eligibility, Charges & Annual Fee.

Table of Contents

Yes Bank Credit Card

There are 8 different types of credit cards available by the YES bank and you will be able to take into consideration these credit cards from the official website of the organization. There are different types of benefits available by the Yes bank and you will be able to check out the various benefits available by the organization by going to the official website created by the authorities. The different types of eligibility criteria that you need to fulfill before successfully applying for the various credit cards available by the organization of Yes Bank. You can fill out the application form available on the official website in order to get most of the information related to credit cards.

YES Bank Net Banking Registration

Benefits of Yes Bank Credit Card

Given below, we are sharing the benefits of the Yes bank credit cards:-

FinBooster Credit Card

- Grow your credit score – Credit Strong subscription for customers with a real-time dashboard

- Lifetime free Credit Card – Enjoy nil first year and renewal membership fee

- E-shopping companion – With accelerated rewards on online Dining, online Grocery, and Online Apparel

- 5X reward points on online Dining spends

- 3X reward points on online Grocery and online Apparel spends

- 2 reward points per INR 200 (1X) on all other retail spends (except fuel spends)4

- No capping & Never expiring reward points

- Exclusive reward point sharing with friends and family

- Redeem reward point against statement outstanding

- Redeem reward points from an exclusive catalogue of products to choose from

- Credit Shield cover of INR 2.5 lacs in case of accidental death of Primary Cardmember

- 1% Fuel surcharge waiver at all fuel stations across India for transactions between INR 400 to INR 5,0005

- Avail great offers across travel, dining, shopping, wellness, and more, in select cities

- Secure Password for Online Transactions (for cards issued under VISA network)

- Secure your online transactions with Verified by VISA (VBV)

Wellness Credit Card

- Complimentary annual preventive Health Check-up (25 parameters)

- Complimentary annual Eye & Dental Check-up

- Unlimited consultation with General practitioners, Specialist & Nutritionists through App

- 6 Complimentary Fitness sessions (Gym, Yoga, Zumba, etc.) per month

- All these benefits can be availed through Aditya Birla Multiply App.

- 20 Reward Points per INR 200 spent on Chemist/ Pharmaceutical stores

- 4 Reward Points per INR 200 spent on all other categories

- 5X Reward Points on first 3 transactions of the biller registered on YES PayNow (valid only on first 5 billers registered)

- Dedicated Website for Flight/Hotel/Movie ticket booking on Reward Points redemption

- Redemption of Reward Points against Air Miles (10 Reward Points = 1 InterMile / 1 Club Vistara Point)

- Credit Shield cover in case of accidental death of Primary Cardmember

- Interest Rate of 3.5% per month (42% annually) on Revolving Credit, Cash Advances, and Overdue Amount

- 1% Fuel surcharge waiver at all fuel stations across India for transactions between INR 400 to INR 5,000

- Avail great offers across travel, shopping, wellness, and more, in select cities

Wellness Plus Credit Card

- Complimentary annual preventive Health Check-up (up to 31 parameters)

- Complimentary annual Eye & Dental Check-up

- Unlimited consultation with General practitioners, Specialist & Nutritionists through App

- 12 Complimentary Fitness sessions (Gym, Yoga, Zumba, etc.) per month

- All these benefits can be availed through Aditya Birla Multiply App.

- 30 Reward Points per INR 200 spent on to Chemist/ Pharmaceutical stores

- 6 Reward Points per INR 200 spent on all other categories

- 5X Reward Points on the first 3 transactions of the biller registered on YES PayNow (valid only on the first 5 billers registered)

- Please visit YES Rewardz to know more or redeem Reward Points

- Dedicated Website for Flight/Hotel/Movie ticket booking on Reward Points redemption

- Exclusive Catalogue of Products

- Redemption of Reward Points against Air Miles (10 Reward Points = 1 InterMile / 1 Club Vistara Point)

- Enjoy Domestic Lounge access (limited to 2 visits per quarter) for Primary Cardmembers across 30 + Lounges in India

- Life Insurance Cover of INR 1 Cr for death due to Flight Accidents

- Medical Insurance cover of INR 25 Lakhs for emergency hospitalization when traveling overseas

- Credit Shield cover in case of accidental death of Primary Cardmember

- Interest Rate of 3.5% per month (42% annually) on Revolving Credit, Cash Advances, and Overdue Amount

- 1% Fuel surcharge waiver at all fuel stations across India for transactions between INR 400 to INR 5,000

- Avail great offers across travel, shopping, wellness, and more, in select cities

- Contactless transactions on the Card enabled with NFC Technology

- Wellness Plus Credit Card is enabled with contactless technology, facilitating fast, convenient and secure payments at retail outlets. You can use your card to make quick transactions at merchant locations accepting contactless cards

Block/Unblock Yes Bank Debit Card

YES Prosperity Edge Credit Card

- Earn 15,000 Bonus Reward Points on achieving spending of INR 6 Lakhs or more in each anniversary year

- Accelerated rewards points will continue to be offered on select transactions on YESCART

- 4 Reward Points for every INR 200 on all categories other than ‘Select categories’

- 2 Reward Points for every INR 200 on Select categories

- 5X Reward Points on first 3 transactions of the biller registered on YES PayNow (valid only on first 5 billers registered)

- Dedicated Website for Flight/Hotel/Movie ticket booking on Reward Points redemption

- Redemption of Reward Points against Air Miles (10 Reward Points = 1 InterMile / 1 Club Vistara Point)

- Redemption is available for Flights, Hotels and Movies only (Catalogue redemption not available)

- Enjoy 4 complimentary rounds of green fees per calendar year at select Golf courses in India

- Enjoy one complimentary Golf Lesson every calendar month at select golf courses in India

- Domestic Lounge Program – 1 complimentary Domestic Airport Lounge visit in India per calendar quarter for Primary Cardmember. Please click here to know more

- Life Insurance Cover of INR 50 Lakhs for death due to air accident

- Medical Insurance cover of INR 15 Lakhs for emergency hospitalization when travelling overseas

- Credit Shield cover in case of accidental death of Primary Cardmember

- Interest Rate of 3.5% per month (42% annually) on Revolving Credit, Cash Advances and Overdue Amount

- Preferential Foreign Currency Markup of 3% only

- 1% Fuel surcharge waiver at all fuel stations across India for transactions between INR 400 to INR 5,000h

- Avail great offers across travel, dining, shopping, wellness and more, in select cities

- YES, Prosperity Edge Credit Card is enabled with contactless technology, facilitating fast, convenient and secure payments at retail outlets. You can use your card to make quick transactions at merchant locations accepting contactless cards

- Secure your online transactions with MasterCard SecureCode or Verified by VISA

YES Prosperity Rewards Plus Credit Card

- Earn 12,000 Bonus Reward Points on achieving spending of INR 3.6 Lakhs or more in each anniversary year

- Accelerated rewards points will continue to be offered on select transactions on YESCART

- 4 Reward Points for every INR 200 on all categories other than ‘Select categories’

- 2 Reward Points for every INR 200 on Select categories

- 5X Reward Points on first 3 transactions of the biller registered on YES PayNow (valid only on first 5 billers registered)

- Redemption of Reward Points against Air Miles (10 Reward Points = 1 InterMile / 1 Club Vistara Point)

- Credit Shield cover in case of accidental death of Primary Cardmember

- Interest Rate of 3.5% per month (42% annually) on Revolving Credit, Cash Advances and Overdue Amount

- The interest rate of 2.49% (29.88% annually) on Revolving Credit, Cash Advances & Overdue Amount for Credit Cards issued against Fixed Deposit

- Preferential Foreign Currency Markup of 3.40% only

- 1% Fuel surcharge waiver at all fuel stations across India for transactions between INR 400 to INR 5,000e

- Avail great offers across travel, dining, shopping, wellness and more, in select cities

- Secure your online transactions with MasterCard SecureCode or Verified by VISA

YES Prosperity Rewards Credit Card

- Earn 10,000 Bonus Reward Points on achieving spending of INR 1.8 Lakhs or more in each anniversary yeara

- Accelerated rewards points will continue to be offered on select transactions on YESCART

- 2 Reward Points for every INR 200 on all categories other than ‘Select categories’

- 1 Reward Point for every INR 200 on Select categories

- 5X Reward Points on first 3 transactions of the biller registered on YES PayNow (valid only on first 5 billers registered)

- Redemption of Reward Points against Air Miles (10 Reward Points = 1 InterMile / 1 Club Vistara Point)

- Interest Rate of 3.5% per month (42% annually) on Revolving Credit, Cash Advances and Overdue Amount

- Preferential Foreign Currency Markup of 3.40% only

- 1% Fuel surcharge waiver at all fuel stations across India for transactions between INR 400 to INR 5,000e

- Avail great offers across travel, dining, shopping, wellness and more, in select cities

YES Prosperity Cashback Plus Credit Card

- Earn 15,000 Bonus Reward Points on achieving spending of INR 6 Lakhs or more in each anniversary yeara

- Accelerated rewards points will continue to be offered on select transactions on YESCART

- 4 Reward Points for every INR 200 on all categories other than ‘Select categories’

- 2 Reward Points for every INR 200 on Select categories

- 5X Reward Points on first 3 transactions of the biller registered on YES PayNow (valid only on first 5 billers registered)

- Dedicated Website for Flight/Hotel/Movie ticket booking on Reward Points redemption

- Redemption of Reward Points against Air Miles (10 Reward Points = 1 InterMile / 1 Club Vistara Point)

- Enjoy 4 complimentary rounds of green fees per calendar year at select Golf courses in India

- Enjoy one complimentary Golf Lesson every calendar month at select golf courses in India

- Domestic Lounge Program – 1 complimentary Domestic Airport Lounge visit in India per calendar quarter for Primary Cardmember. Please click here to know more

- Life Insurance Cover of INR 50 Lakhs for death due to air accident

- Medical Insurance cover of INR 15 Lakhs for emergency hospitalization when travelling overseas

- Credit Shield cover in case of accidental death of Primary Cardmember

- Interest Rate of 3.5% per month (42% annually) on Revolving Credit, Cash Advances and Overdue Amount

- Preferential Foreign Currency Markup of 3% only

- 1% Fuel surcharge waiver at all fuel stations across India for transactions between INR 400 to INR 5,000h

- Avail great offers across travel, dining, shopping, wellness and more, in select cities

YES Prosperity Cashback Credit Card

- Earn 15,000 Bonus Reward Points on achieving spending of INR 6 Lakhs or more in each anniversary yeara

- Accelerated rewards points will continue to be offered on select transactions on YESCART

- 4 Reward Points for every INR 200 on all categoriesc other than ‘Select categories

- 2 Reward Points for every INR 200 on Select categories

- 5X Reward Points on first 3 transactions of the biller registered on YES PayNow (valid only on first 5 billers registered)

- Dedicated Website for Flight/Hotel/Movie ticket booking on Reward Points redemption

- Redemption of Reward Points against Air Miles (10 Reward Points = 1 InterMile / 1 Club Vistara Point)

- Enjoy 4 complimentary rounds of green fees per calendar year at select Golf courses in India

- Enjoy one complimentary Golf Lesson every calendar month at select golf courses in India

- Domestic Lounge Program – 1 complimentary Domestic Airport Lounge visit in India per calendar quarter for Primary Cardmember. Please click here to know more

- Life Insurance Cover of INR 50 Lakhs for death due to air accident

- Medical Insurance cover of INR 15 Lakhs for emergency hospitalization when travelling overseas

- Credit Shield cover in case of accidental death of Primary Cardmember

- Interest Rate of 3.5% per month (42% annually) on Revolving Credit, Cash Advances and Overdue Amount

- Preferential Foreign Currency Markup of 3% only

- 1% Fuel surcharge waiver at all fuel stations across India for transactions between INR 400 to INR 5,000h

- Avail great offers across travel, dining, shopping, wellness and more, in select cities

Eligibility Criteria

Given below, we are sharing the details of the eligibility criteria for the various credit cards:-

- FinBooster Credit Card

- Age Criteria: Minimum 21 years to maximum 60 years

- Salaried or Self Employed

- Minimum Net Salary of INR 25,000 per month or Income Tax Return of INR 5 Lakhs and above

- Wellness Credit Card

- Age Criteria: Minimum 21 years to maximum 60 years

- Salaried or Self Employed

- Minimum Net Salary of INR 25,000 per month or Income Tax Return of INR 5 Lacs and above

- Cities Covered: Ahmedabad, Bangalore, Chandigarh, Chennai, Delhi & NCR, Hyderabad, Jaipur, Kolkata, Mumbai, Pune, Thane and Navi Mumbai.

- Wellness Plus Credit Card

- Age Criteria: Minimum 21 years to maximum 60 years

- Salaried or Self Employed

- Minimum Net Salary of INR 25,000 per month or Income Tax Return of INR 5 Lacs and above

- Cities Covered: Ahmedabad, Bangalore, Chandigarh, Chennai, Delhi & NCR, Hyderabad, Jaipur, Kolkata, Mumbai, Pune, Thane and Navi Mumbai.

- YES Prosperity Edge Credit Card

- Age Criteria: Minimum 21 years to maximum 60 years

- Salaried or Self Employed

- Minimum Net Salary of INR 60,000 per month or Income Tax Return of INR 7.2 Lakhs and above.

- YES Prosperity Rewards Plus Credit Card

- Age Criteria: Minimum 21 years to maximum 60 years

- Salaried or Self Employed

- Minimum Net Salary of INR 35,000 per month or Income Tax Return of INR 5 Lakhs and above

- YES Prosperity Rewards Credit Card

- Age Criteria: Minimum 21 years to maximum 60 years

- Salaried or Self Employed

- Minimum Net Salary of INR 25,000 per month or Income Tax Return of INR 5 Lakhs and above

- YES Prosperity Cashback Plus Credit Card

- Age Criteria: Minimum 21 years to maximum 60 years

- Salaried or Self Employed

- Minimum Net Salary of INR 35,000 per month or Income Tax Return of INR 5 Lakhs and above

- YES Prosperity Cashback Credit Card

- Age Criteria: Minimum 21 years to maximum 60 years

- Salaried or Self Employed

- Minimum Net Salary of INR 25,000 per month or Income Tax Return of INR 5 Lakhs and above

Fees And Charges

Given below, we are sharing the fees and the charges that will be applicable for various credit cards:-

- Wellness Credit Card

- First-Year Membership Fee of Rs. 1,999 + Applicable Taxes

- Renewal Membership Fee of Rs. 1,999 + Applicable Taxes

- Wellness Plus Credit Card

- First-Year Membership Fee of Rs. 2,999 + Applicable Taxes

- Renewal Membership Fee of Rs. 2,999 + Applicable Taxes

- YES Prosperity Edge Credit Card

- First-Year Membership Fee of INR 399 + Applicable Taxes, waived on total retail spends of INR 15,000 within 90 days of card set up a date

- Renewal Membership Fee of INR 399 + Applicable Taxes, waived on total retail spends of INR 75,000 within 12 months prior to the card renewal date

- YES Prosperity Rewards Plus Credit Card

- First-Year Membership Fee of Rs 399, reversed on spends of Rs 10,000 within 90 days of card Set up.

- Renewal Membership Fee of Rs 399, reversed on spends of Rs 50,000 within 12 months prior to the renewal.

- YES Prosperity Rewards Credit Card

- First-Year Membership Fee of INR 399 + Applicable Taxes, waived on total retail spends of INR 5,000 within 90 days of card set up a date

- Renewal Membership Fee of INR 399 + Applicable Taxes, waived on total retail spends of INR 25,000 within 12 months prior to the card renewal date

- YES Prosperity Cashback Plus Credit Card

- First-Year Membership Fee of INR 399 + Applicable Taxes, waived on total retail spends of INR 15,000 within 90 days of card set up a date

- Renewal Membership Fee of INR 399 + Applicable Taxes, waived on total retail spends of INR 75,000 within 12 months prior to the card renewal date

- YES Prosperity Cashback Credit Card

- First-Year Membership Fee of INR 399 + Applicable Taxes, waived on total retail spends of INR 15,000 within 90 days of card set up a date

- Renewal Membership Fee of INR 399 + Applicable Taxes, waived on total retail spends of INR 75,000 within 12 months prior to the card renewal date

How To Apply For Yes Bank Credit Card?

To apply for the Yes Bank credit card, you will have to follow the simple procedure given below:-

- First, you have to visit the official credit card page for Yes Bank by clicking on the link given here and the home page will open on the screen.

- Now you have to click on the option called Apply Online and a new page will open on your screen.

- The various types of credit cards will be displayed on your scene and you will have to click on the apply online button present to the credit card of your choice.

- The application form will be displayed on your screen in which you will have to enter all of the details and successfully apply for the credit card by uploading all of the documents.

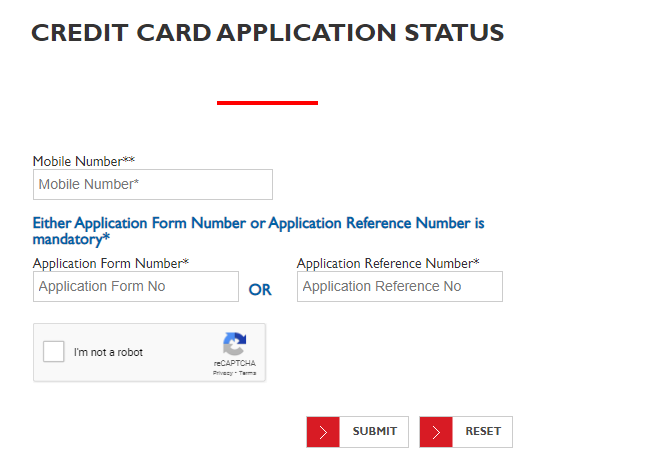

Application Status

To check the application status you will have to follow the simple procedure given below:-

- First, you have to visit the official credit card page for Yes Bank by clicking on the link given here and the home page will open on the screen.

- Now you have to click on the option called Application Status and a new page will open on your screen.

- You will have to enter your mobile number and application form number.

- You have to enter your application reference number and captcha code.

- Click on submit and the application status will be displayed on the screen.

How To Pay Yes Bank Credit Card bill?

You can pay the YES BANK Credit Card Bill through the following convenient channels:-

For YES BANK Account Holders

- NetBanking

- You will have to register yourself for the YES BANK Net Banking and make Credit Card payments online.

- Standing Instruction

- You can submit a written instruction to automatically debit a pre-determined portion of your monthly outstanding from your Savings/Current Account to your Credit Card Account.

For All Customers

- NEFT/IMPS/RTGS

- You can make your payment through NEFT/IMPS/RTGS fund transfer mode from other bank accounts. Please add your YES BANK Credit Card as a beneficiary. Use IFSC code: YESB0CMSNOC”

- Billdesk

- Click on the given link to make the payment using the Billdesk facility https://netbanking.yesbank.co.in/netbanking/DISCLAIMER.html

- Cheque Payment

- You can make your Credit Card payment by cheque, quoting your 16 digit Credit Card Number, and drop the cheque at any of our drop boxes in your city. Please mention your name and mobile number on the back of the cheque.

- Cash Payment

- You can also make payments through Cash at YES BANK Branches. Please refer to the schedule of Charges in the Most Important Terms & Conditions for charges applicable for cash payments.

Customer Care

- For YES FIRST Credit Cards

- 1800 103 6000 (Toll-Free for Mobile & Landlines in India)

- +91 22 4935 0000 (When Calling from Outside India)

- Email us at yesfirstcc@yesbank.in

- Foe YES Prosperity Credit Card

- 1800 103 1212 (Toll-Free for Mobile & Landlines in India)

- +91 22 4935 0000 (When Calling from Outside India)

- Email us at yestouchcc@yesbank.in

FAQs For Yes Bank Credit Card

You can use a mobile application or Yes Bank Pay application. You can also take into consideration the UPI application present on your mobile to pay the credit card bill.

You will have to visit the official website of Yes Bank credit card and click on the option called reward redemption in order to redeem all of your rewards.

The cashback will be directly credited to the bank account associated with your credit card as soon as you will need the transaction.