Bank of India Mobile Number Registration | Bank of India Mobile Number Application Form | Bank of India Mobile Number Change

We’ve compiled some vital information for all of our readers. As we all know, practically everyone has a bank account, but our cell phone is not linked to the account, which causes a slew of issues. A mobile phone number can be registered for a variety of reasons. It assists us with transaction updates, internet banking, and other tasks. It’s critical to keep your cell number up to date so that you’re alerted if your account is accessed without your permission. As a result, read the entire article to learn more: What is the procedure for Bank of India Mobile Number Registration?

Note that only the consumer can register a mobile number. It is possible to do so through your home branch; please visit your branch for further information.

Table of Contents

Bank of India Mobile Number Registration Procedure?

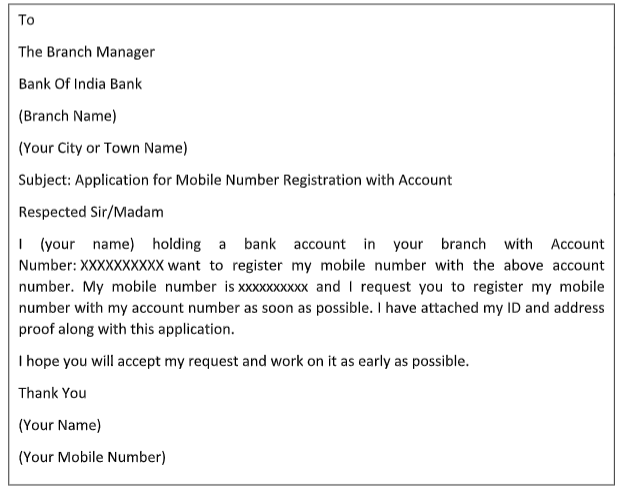

Method 1: Compose an Application

First and foremost, you must submit an application to the branch manager of your home bank for Bank of India Mobile Number Registration. The procedure for writing an application to the branch manager for adding a mobile number to a Bank of India account is discussed below.

- Take a sheet of plain A4 paper and fold it in half.

- You can use a blue or a black pen.

- Prepare an application in the format outlined below.

- Now, submit a photocopy of a self-attested (with your signature at the bottom) document with this application letter.

- You can submit a photocopy of your AADHAR Card or any other pertinent document. (PAN Card, Local Certificate, Voter ID, Driver’s License, Passport, and so on.)

- Now that you have all of the necessary documents, simply go to your nearest branch and present this application letter, along with a photocopy of your AADHAR card, to the branch manager or any other bank official.

- As a result, please bring your genuine AADHAR Card with you, as bank officials may ask to see it for verification purposes.

- Finally, after 3-5 days, your mobile number will be linked to your bank account.

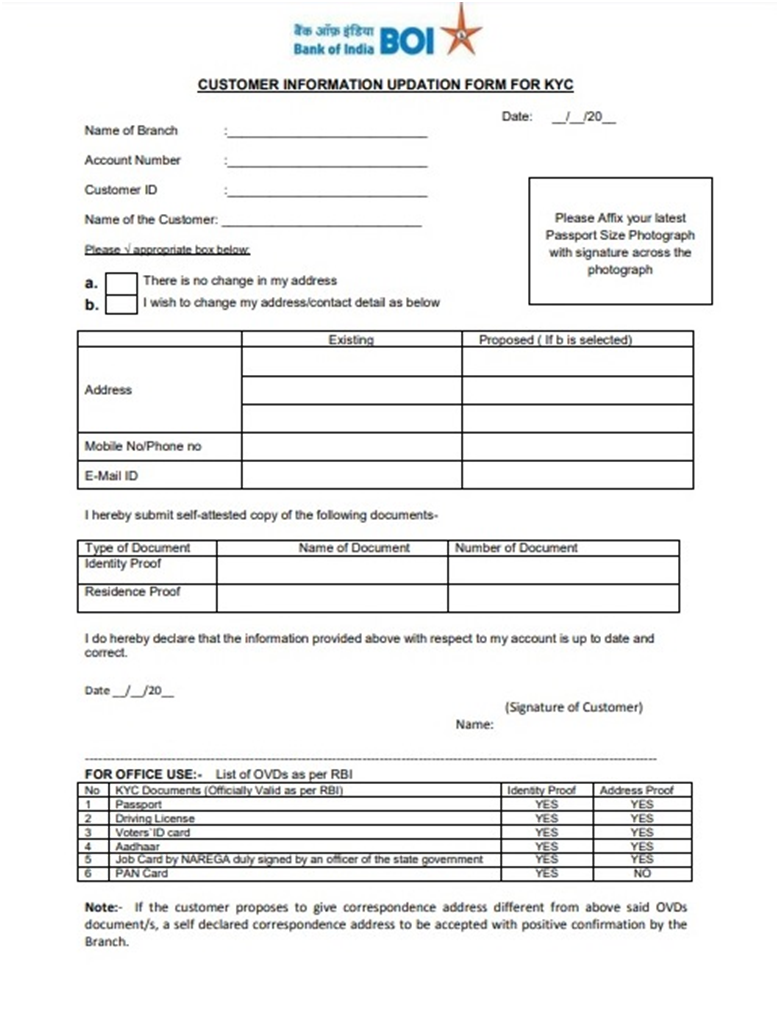

Method 2: Obtaining a Mobile Number Registration Form or Know Your Customer (KYC)

You can get a mobile number registration form or a KYC form from the branch, which you can pick up or download. Complete the form and submit it. In 3-5 days, it will be registered.

Change Bank of India Mobile Number Online

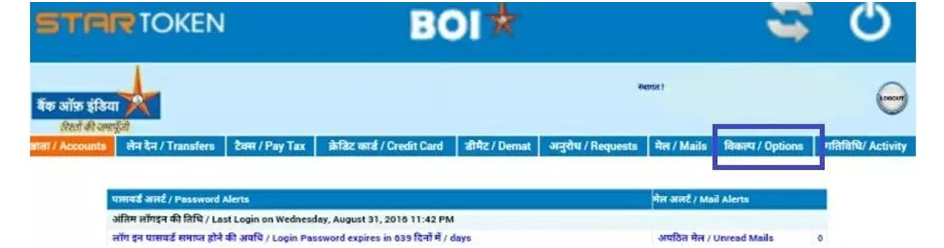

First Method is BOI Net Banking for Bank of India Mobile Number Registration

Update/Change Mobile Number in Bank of India Net Banking

It is important to note that registration is not available. Net banking is the only way to modify or update an existing mobile number. Follow the instructions below:

- To begin, go to Bank of India’s internet banking website

- Log in using your User ID and Password.

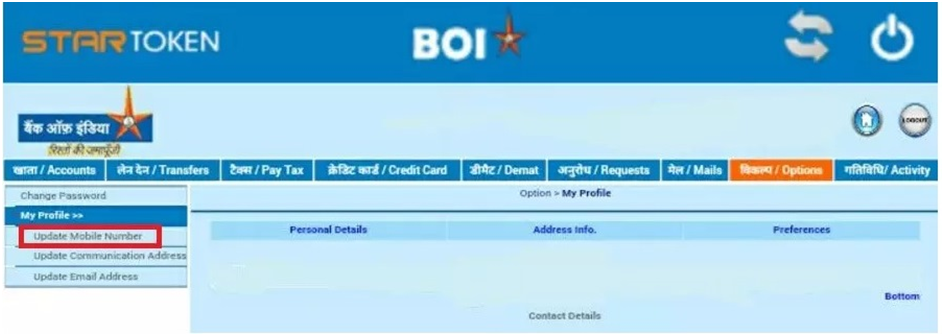

- At the top of the menu, select Options.

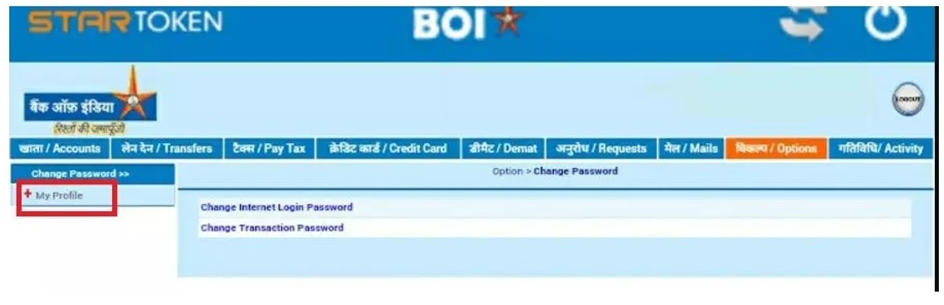

- Go to the left side of the screen and select Profile.

- Press Update Mobile Number.

- Enter the phone number you’d like to update.

- After that, input the OTP that was sent to your phone number.

- Finally, your old phone number will be changed to your new one.

- With Bank of India’s net banking, you can change your cellphone number. To update your mobile number, the only need is that your account has complete KYC. How to Create an Internet Banking Password for the Central Bank of India?

The Second Method is BOI ATM.

Change Bank of India Mobile Number using an ATM

With an active ATM card, you can change your mobile number by yourself by following the instructions below:

- To begin, go to any Bank of India ATM in the area.

- Put your ATM card in the slot.

- After that, choose a language.

- Select Mobile Update from the Other Request menu.

- Finally, proceed to the next step.