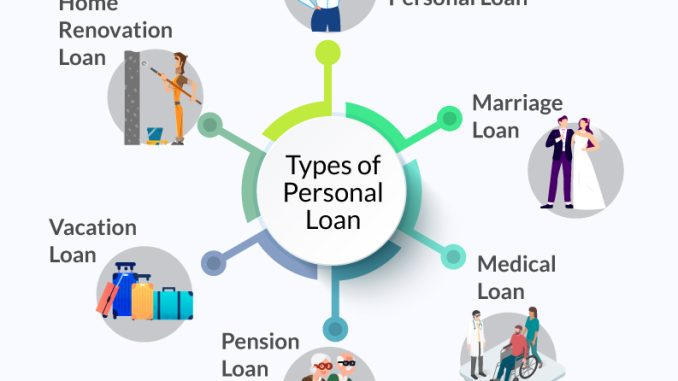

To access finances for a variety of purposes, you can take out loans from financial organizations such as banks and NBFCs (non-banking financial companies). A car loan, for example, is used to purchase a car, a home loan is used to purchase a house, and an education loan is used to support your education. Personal loans are available for a variety of purposes, including weddings, trips, shopping, and more. There are different Types of Personal Loan available in the market. Today we are going to provide you with details of Types of Personal Loan with their eligibility and other details.

Table of Contents

Various Types of Personal Loan 2022

Personal loans are unsecured loans in which a bank lends you money based on your creditworthiness and no collateral is required. Personal loans, on the other hand, have higher interest rates than any other loan, such as a home loan or an education loan, due to the level of risk involved in providing the money. Personal loans are available from most banks in the range of Rs.50,000 to Rs.15 lakh.

Different Types of Personal Loan Available in India

There are many different types of loan available for the customers so that they can avail of the benefit. Some of the common lawn types are discussed below, have a look.

Wedding Loan

In India, weddings are major and expensive events. Most people want their wedding day to be unforgettable, and they go to great lengths to make that happen. Banks provide wedding loans to help you make your special day even more unforgettable. The would-be bride, groom, or any family member can take out a loan.

Important Points

- Loan amounts range from Rs.1,000 to Rs.25 lakh.

- Loan payback periods range from three to 72 months.

- Process with minimal documentation.

Travel Loan

Holiday loans are specifically designed for vacationers who want to tour the world and pay their bills later. Holiday loans frequently include travel insurance, ensuring that you are covered on all fronts.

Important Points

- Process of documentation is simple and quick.

- A loan of up to Rs.40 lakh is possible.

- Loan repayment terms are flexible and can be extended up to 72 months.

Home Renovation Loan

Home loans are used to purchase new properties. But what if your old house is in desperate need of repair? People rarely modify their homes because the costs are prohibitive. Home renovation loans assist you in meeting your repair costs while also enhancing the economic value of your home on the real estate market.

Important Points

- Amounts ranging from Rs.2 lakh to Rs.40 lakh are available as loans.

- Loan payback terms of up to 30 years are possible.

- Interest rates start as low as 6.85 percent per annum.

Most Trusted Loan App in India

Pension Loan

Pension loans are only available to retirees, thus the regular eligibility conditions do not apply in this particular programme. Some banks provide 7 to 10 times the amount of pension the pensioner received the month before the loan application was submitted.

Important Points

- The loan amount ranges between Rs.25,000 to Rs.14 lakh.

- Loan repayment terms of up to 60 months are possible.

- A discounted rate of interest as low as 11.70 percent per annum is available.

Education Loan

A variety of lenders provide personal loans that can be utilised for educational purposes. You can utilise the education loan to pay for anything from your child’s tuition fees to any other academic obligation.

Important Points

- Up to 15 years to repay the loan.

- The interest rate starts at 6.35 percent per annum.

- Amount of loan: up to Rs.20 lakh

Personal Loan Eligibility Criteria

Individuals with a Salary:

- The applicant must be at least 21 years old.

- Applicant’s maximum age upon loan maturity is 60 years.

- Minimum Employment Period: 2 years total, 1 year at current employer.

- Minimum monthly income ranges from Rs. 7,500 to Rs. 15,000 per month.

- For businessmen and self-employed professionals:

The applicant must be at least 25 years old

- Applicant’s maximum age upon loan maturity is 65 years.

- Minimum Time in Current Profession/Business – Minimum 2 to 3 years in current profession/business.

- A minimum annual income of Rs.1 lakh is required.

- Please keep in mind that eligibility requirements vary by bank.

Interest Rates for Different Types of Personal Loan in 2022

| Bank | Interest Rate |

| ICICI | 11.25% p.a. – 21% p.a. |

| HDFC Bank | 10.5% p.a. – 21.00% p.a. |

| SBI | 9.60% p.a. – 15.65% p.a. |

| Mahindra Box | 10.25% and above |

| Axis Bank | 12% p.a. – 21% p.a. |

| Fullerton India | 11.99% p.a. – 36% p.a |

| IndusInd Bank | 11.00% p.a. – 31.50% p.a. |

Documents Required for Personal loan

- Two passport size photographs

- Income proof: Bank Statement for the last 3 months (if salaried)

- Income Tax Returns for the last 2 years (if professional/self-employed)

- Proof of Continuity in Current Job – Form 16/Company Appointment Letter (if salaried)

- Proof of Identity (Passport/PAN Card/Driving License/Voters ID/Aadhar Card)

- Proof of Residence (Passport/Ration Card/Aadhar Card/Utility Bill/Voter ID/LIC Policy Receipt)

- Credit (CIBIL) score

Some banks may offer personal loans in addition to the ones listed above. Women frequently receive unique offers on personal loans, with terms that differ from those offered to men, but the type being the same. A wedding loan taken by a woman and a man from the same bank, for example, may have different loan details, but both will be getting wedding loans.

Finally, the type of loan you choose is determined by your needs. Compare personal loans and choose the one that best suits your needs.

FAQ’s

The Types of Personal Loan accessible in the country are listed below:

Wedding loan

Vacation loan

Festival loan

Home renovation loan

Consumer durables loan

Top-up loan

Bridge loan

Agricultural loan

Pension loan

Personal computer loan

When you don’t have enough money to cover your wedding expenses, you can get a wedding loan. During peak wedding season, interest rates on these loans are higher.

A vacation loan, sometimes known as a travel loan, is used to fund a planned vacation. The amount of the loan is determined by your income and credit score.

A festival loan is used to pay for the costs of celebrating a festival. On these loans, banks normally set a borrowing limit of Rs.50,000.

This loan provides you with the finances you require to renovate your property. Home improvement loans can help you boost the market value of your home.

Consumer durables loans are used to purchase consumer items. Refrigerators, televisions, washing machines, and other appliances fall under this category. This loan allows you to borrow up to Rs.5 lakh.