Pan Card Correction | Pan Card Address Online | Pan Card Download Form | Pan Card Name Change Online

Your PAN (Permanent Account Number) is a vital document. This number is necessary not just for filing taxes and remitting big sums of money, but also for proving your identification. As a result, inaccurate information on your PAN card could cause future issues. Making the appropriate changes to your PAN card will help you avoid these issues. Changing your PAN card is easy and maybe done both online and offline. Read below to check the detailed information related to Pan Card Correction like PAN Card Name Correction Reasons, Required Documents, apply for PAN Card Correction Online & Offline, Change Name, and much more.

Table of Contents

Pan Card Correction – Comprehensive Details

In India, the Permanent Account Number (PAN) is extremely important, not just for tax purposes but also as a confirmation of identity To file Income Tax Returns, you’ll need a PAN Card, and it’s critical that all of the information on the card is up to date and accurate. . Any inaccuracies on your PAN could cause complications in the future. As a result, it is recommended that you address any errors or discrepancies in your PAN as soon as feasible.

PAN Card Name Correction Reasons

People alter their names on PAN cards for a variety of reasons. The following are some of the reasons:

- Incorrectly spelled name on PAN card

- After marriage, the surname on the PAN card is changed.

- Legally, the name was altered.

Required Documents for PAN Card Correction

For Pan Card Correction, some important documents will be needed by the user, make sure to keep them handy. The documents required for Pan Card Correction are as follows:

Indian Citizens and Hindu Undivided Family (HUF)

The following documents are required by the Indian Citizens and Hindu Undivided Family (HUF)

| S. No. | Type | Documents |

| Identity Proof | Aadhaar cardDriving licenseRation card with the applicant’s photoVoter IDPassportArm’s licenseAny photo identity card issued by the central government, state government, or a public sector undertakingCentral government health service scheme card/ex-servicemen contributory health scheme card (with photo)Bank certificate on the bank’s official letterhead with the name and stamp of the issuing officer (must also contain an attested photograph and bank account details)Pensioner’s card which has a photo of the applicantCertificate of identity signed by an MP, MLA, MLC, or a gazetted officer | |

| Date of Birth Proof | Aadhaar cardPassportVoter IDDriving licenseAny photo identity card issued by the central government, state government, or a public sector undertakingMark sheet or m articulation certificate from a recognized boardBirth certificateThe central government issued a domicile certificatePension payment orderThe affidavit is sworn before a magistrateCentral government health service scheme card/ex-servicemen contributory health scheme card (with photo)Marriage certificate issued by Registrar of Marriages | |

| Address Proof | Domicile certificateProperty registration Voter IDAadhaar cardDriving licensePost office passbook with the applicant’s addressLatest property tax assessment orderPassport or spouse’s passportGas connection card (not more than 3 months old) Allotment letter of accommodation not more than three years old (issued by the state or central government)The central government-issued documentElectricity bill, landline bill, broadband connection, water bill, piped gas bill (not more than 3 months old)Bank account statement, credit card statement (not more than 3 months old)Certificates of address signed by an MP, MLA, MLC, or a gazetted officerEmployer certificate |

For Foreign Citizens

The following documents are required by the Foreign Citizens

| S. No. | Type | Documents |

| Identity Proof | PassportPerson of Indian Origin (PIO) cardOverseas Citizen of India (OCI) cardCitizenship identification number of the applicant (if they are a citizen of another country)Certificate of Residence in IndiaBank account statement (in the country of residence)NRE bank account statement in IndiaTaxpayer identification number attested by Apostille, the Indian Embassy, the Indian High Commission, the Indian Consulate, or authorized officials of scheduled banks registered in India which have branches overseasVisa, appointment letter from an Indian company, and original certificate of Indian address issued by the employerRegistration certificate issued by the Foreigner’s Registration Office (must show an Indian address) | |

| Address Proof | PassportPerson of Indian Origin (PIO) cardCitizenship identification number of the applicant (if they are a citizen of another country)Overseas Citizen of India (OCI) cardTaxpayer identification number attested by Apostille, the Indian Embassy, the Indian High Commission, the Indian Consulate, or authorized officials of scheduled banks registered in India which have branches overseas |

Indian Companies

The following documents are required by the Indian companies:

| Type of Company | Documents Required |

| Company | Certificate of registration |

| Partnership | Certificate of registration or partnership deed |

| Limited Liability Partnership | Certificate of registration issued by the Registrar of LLPs |

| Artificial Juridical Person, Body of Individuals, Local Authority, or Association of Persons | Agreement copy, certificate of registration number issued by Charity Commissioner registration of the cooperative society, or any other document provided by a central or state government department |

| Association of Persons (Trust) | Trust deed, certificate of registration number issued by Charity Commissioner |

Companies with a Registered Office Outside India

The following documents are required by the Companies with a Registered Office outside India

| S. No. | Type | Documents |

| Identity Proof | Apostille, the Indian Embassy, the Indian High Commission, the Indian Consulate, or authorized staff of scheduled banks registered in India with offices abroad attests to the taxpayer identification number.Indian authorities may provide a registration certificate or grant authority to open an office in India. | |

| Address Proof | Apostille, the Indian Embassy, the Indian High Commission, the Indian Consulate, or authorized staff of scheduled banks registered in India with offices abroad attests to the taxpayer identification number.Indian authorities may provide a registration certificate or grant authority to open an office in India. |

Steps to Apply for PAN Card Correction Online

Applicants need to follow the below-given steps to apply for the PAN Card Correction Online

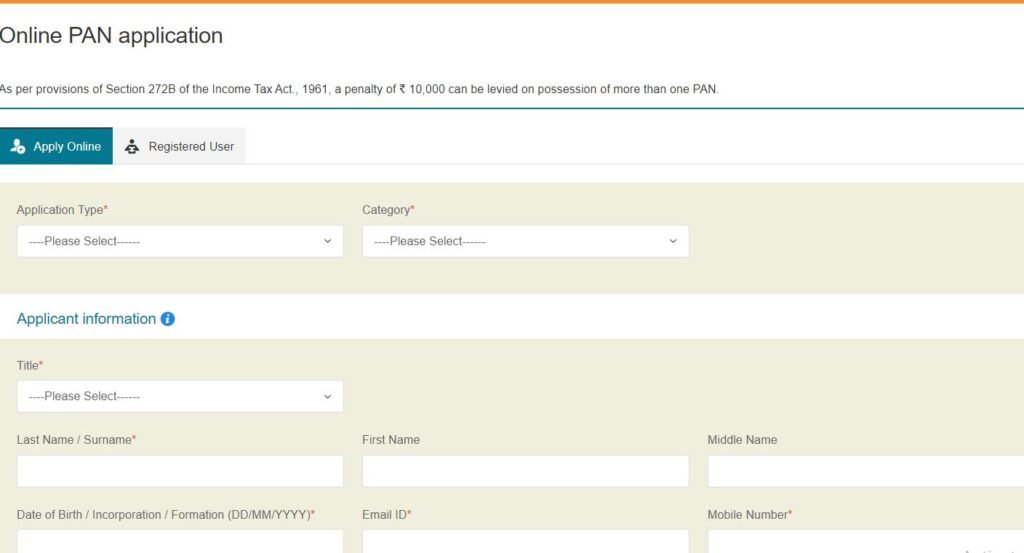

- First of all, visit the Protean eGov Technologies Limited portal

- Online PAN application form will open on the screen

- Now, fill in the form with all the required details like

- Application Type

- Category

- Title

- Name

- Date of Birth

- Email ID

- Mobile Number

- PAN Number, etc

- Carefully enter your PAN number, as a wrong number will cause your modification request to be delayed.

- Make sure the checkboxes next to the parameters you want to edit are checked.

- The modification will not be made if the checkbox is not selected.

- Now, review and recheck all the details and click on the submit button

- A 15-digit acknowledgment number will appear once your modifications have been confirmed. Keep this number handy in case you need to communicate with someone else or follow the status of your application.

- Make the payment, print the acknowledgment, attach the appropriate documents, and post it to the address below:

- Income Tax PAN Services Unit (Managed by Protean eGov Technologies Limited)

- 5th Floor, Mantri Sterling, Plot No. 341

- Survey No. 997/8, Model Colony

- Near Deep Bungalow Chowk

- Pune 411 016

Steps to Apply for a Name Change in a PAN Card

To apply for a Name Change in a PAN Card, the user needs to follow the below-given steps:

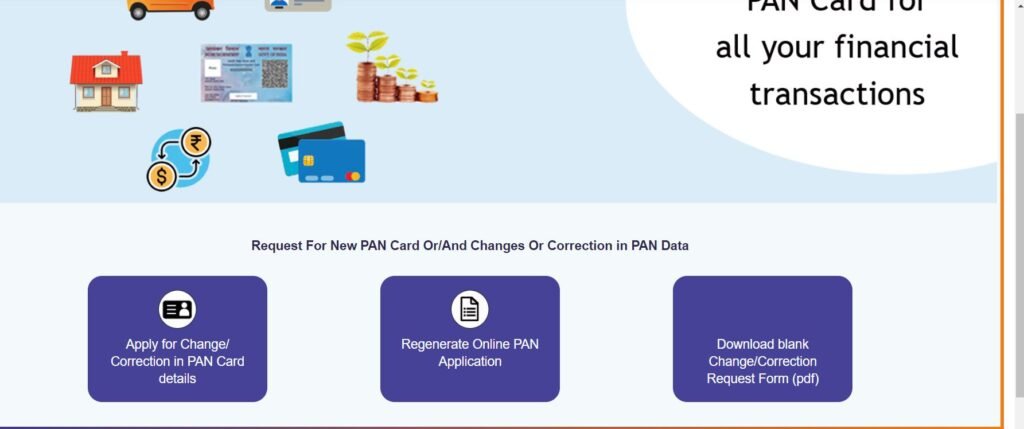

- First of all, go to the official website of UTI

- The home page of the website will open on the screen

- Click on the Change/Correction in the PAN Card tab

- A new page will open on the screen

- Click on Apply for Change/Correction in PAN Card Details

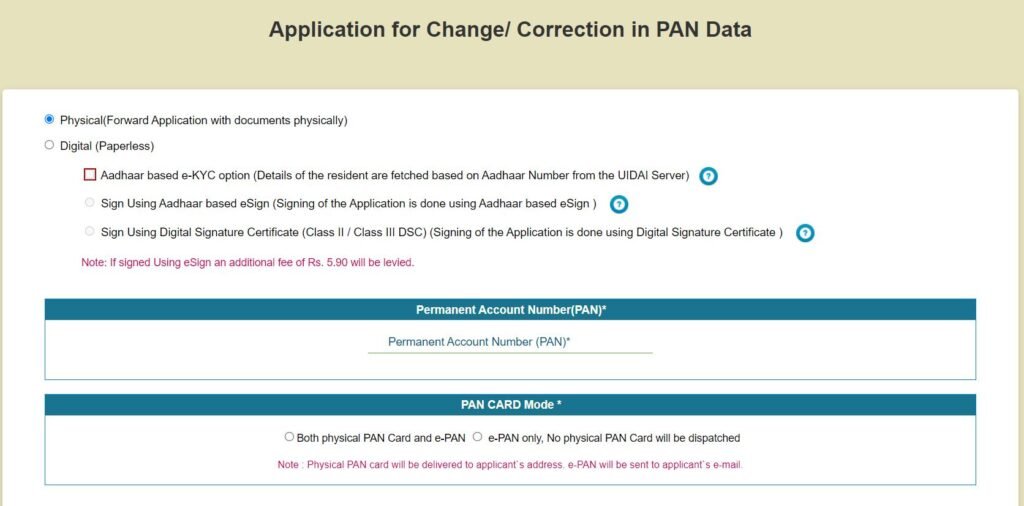

- A new page will open on the screen

- Now fill in all the required details

- After that upload all the required documents

- Finally, click on the Submit button

- In a few days, your changes will be applied.

Charges for Correction or Update of PAN Existing Card

- If Physical PAN Card is Required:

| S. No. | Particulars | Fee (Inclusive of applicable taxes) | |

| Application Type | Dispatch of physical PAN Card in India (Communication address is Indian address) | Dispatch of physical PAN Card outside India (Communication address is foreign address) | |

| PAN applications submitted at PAN Centres or TIN Facilitation Centres/online using * physical mode (physical documents forwarded to NSDL e-Gov.)/ | Rs. 107 | Rs. 1,017 | |

| Request for Reprint of PAN card submitted through the separate online link (No Updates) | Rs. 50 | Rs. 959 | |

| PAN applications submitted Online through paperless modes (**e-KYC & e-Sign / **e-Sign scanned based /DSC scanned based) | Rs. 101 | Rs. 1,011 |

- If Physical PAN Card is Not Required:

e-PAN Card will be sent at the email id mentioned in the PAN application form

| S. No. | Particulars | Fee (Inclusive of applicable taxes) |

| 1. | PAN applications submitted at PAN Centres or TIN Facilitation Centres/Online using * physical mode (physical documents forwarded to NSDL e-Gov.) | Rs. 72 |

| 2. | PAN applications submitted Online through paperless modes (**e-KYC & e-Sign / **e-Sign scanned based / DSC scan based) | Rs. 66 |

Steps to check the PAN Card Correction Status

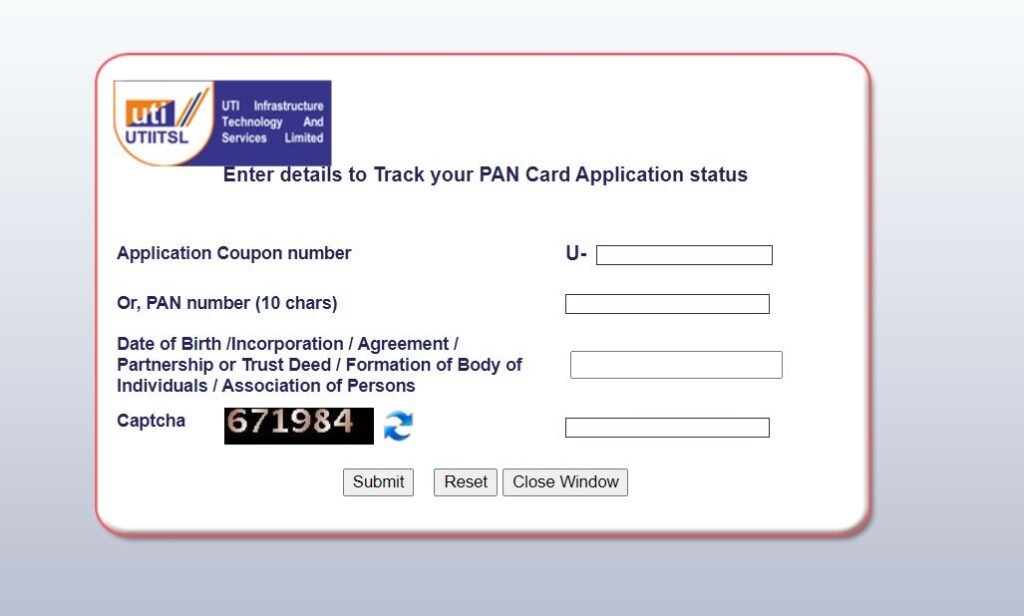

You can check the post with the acknowledgment number to see if the adjustment has been submitted. This number is received after the form has been successfully submitted. User needs to follow the below-given steps to check the PAN Card Correction Status:

- First of all, go to the official website of UTI

- The home page of the website will open on the screen

- Click on the Track PAN Card tab

- A new page will open on the screen

- Now, enter the required details like:

- Application Coupon number or, PAN number (10 chars)

- Date of Birth /Incorporation / Agreement / Partnership or Trust Deed / Formation of Body of Individuals / Association of Persons

- After that, enter the captcha code

- Finally, click on the Submit button

Steps to Apply for PAN Card Correction Offline

Applicants need to follow the below-given steps to apply for the PAN Card Correction Offline

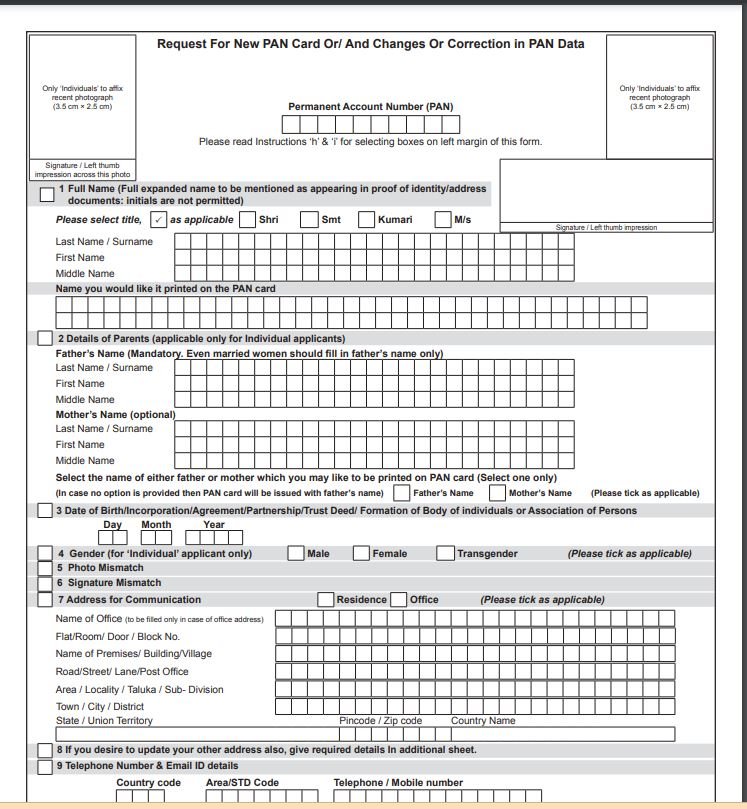

- First of all, open the link for the Request for New PAN Card Or / and Changes or Correction in PAN Data Form

- A PDF of the form will open on the screen

- Now, download the form and take out its printout

- Now, fill in the form with all the required details

- After that, attach all the required documents like passport size photographs, identity proof, address proof, etc.

- Review and recheck the filled details to avoid any mistakes

- Now, submit the form at the nearest NSDL collection center

- You must pay the necessary fees for updating or correcting your PAN card offline.

- After that, you will be given a 15-digit acknowledgment number with which you may track the status of your PAN Card application.

- You will have to pay the applicable charges for PAN card update/correction offline. Following this, you will get a 15-digit acknowledgment number to track the status of the PAN Card application

FAQ’s

Yes, along with other documents, you will be required to submit evidence of PAN. This might be a copy of your PAL allotment letter or a copy of your PAN card.

You can either use the NSDL portal or the UTIITSL portal to fill out the form and submit a request for changes to your PAN details.

If you have sufficient proof to back up your allegations, you can apply to have the PAN data changed.