Sharekhan Login | Sharekhan Brokerage Charges | Sharekhan Desktop Login Portal | Sharekhan Customer Care

Sharekhan is one of India’s most well-known stock dealers. Shripal Morakhia, a Mumbai-based entrepreneur, founded the company in the year 2000. It was purchased by BNP Paribas, a French financial corporation, in 2016. As a result, it was renamed “Sharekhan by BNP Paribas. Sharekhan is a premium and promising full-service brokerage in India. It has a sizable and engaged consumer base. In this article, we’ll go over the Sharekhan Login process and its features. It also covers the login process for all trading platforms as well as their usability.

Sharekhan Demat Account, Sharekhan Brokerage Charges, Sharekhan Trading Platforms, Sharekhan Customer Service, and Sharekhan Account Opening are all covered in this article.

Table of Contents

About Sharekhan Login Broker

ShareKhan is one of India’s oldest and most reputable stock dealers. It’s a full-service broker with a variety of trading platforms, portfolio management, and mutual fund investments. It currently has over 3000 shops in over 540 cities across India. It was created with the goal of assisting you with all elements of the Sharekhan Login service. Sharekhan Desktop Login, Sharekhan Web-based Login, Sharekhan Mobile Trade Login, Sharekhan Mini Login, and Sharekhan Back-office Login are all included.

Sharekhan’s Products and Services

Sharekhan offers a variety of products and services which are listed below:

1. Equities

2. Currency

3. Mutual Funds

4. Commodities

5. Futures and Options (F&O)

6. ETFs (exchange-traded funds)

7. IPOs

Trading Platforms by Sharekhan

1. Web portal

Even for beginner traders and investors, the Sharekhan web interface is sophisticated and simple to use. It has a variety of features, which are stated below: –

1. Keeping track of your portfolio’s investments and purchases is a simple way.

2. Use their free courses to learn the fundamentals of the stock market.

3. With just three keywords, you can get all the information you need.

4. Go to the Stocks Page to learn more about the stocks.

5. You can use CDR’s Live Chat to address your problem.

6. NSECURR, MCXCURR, and MCX are all easy to trade.

7. Make a Mutual Fund investment

2. Sharekhan Mini

ShareKhan Mini is a mobile trading app for people who want to trade on the go or have a slow Internet connection. The following are some of the characteristics of Sherkhan Mini:

1. It works flawlessly on 2G Internet.

2. MCXCURR, MCX, and NSECURR trade in Mutual Funds and invest in them.

3. Use SharekhanMini to keep track of your portfolio.

4. Use a multi-exchange watch list to keep track of your preferred stocks.

5. Get real-time updates on the most recent market occurrences and research calls.

6. Use the tools and calculator area to learn everything there is to know about their futures and options.

7. Transfer funds securely from your bank account to your trading account and vice versa.

3. ShareKhan App

You can trade, invest in stocks, and mutual funds with the Sharekhan App. The following are some of the characteristics of the ShareKhan App:

1. Works flawlessly on a 2G internet connection.

2. NSE, BSE, and NSEFO trading facilities.

3. You may trade, invest, create alerts, and more using the advanced search bar.

4. Keep track of your portfolio.

5. You can trade on the NSECURR, MCXCURR, and MCX exchanges, as well as invest in mutual funds.

6. Maintain a record of all option contracts.

7. Access all market research, including advanced charts and studies.

8. Get up-to-date market information from around the world.

9. Deposit monies into your Sharekhan trading account from your bank account.

Sharekhan Trade Tiger

Sharekha Trade Tiger is a sophisticated online desktop trading platform. Even if you are a novice, you will find it simple to use. The following are some of the characteristics of ShareKhan Trade Tiger:

1. Using advanced tools, you can trade with a single click.

2. Use their superior charts and analysis to improve your trading.

3. To trade efficiently, you can place an order in advance, such as huge trades, build orders, bracket orders, and so on.

4. Access to online sessions is free.

5. Get instant access to breaking news and expert research.

6. You may personalize Sharekhan Trade Tiger by adding shortcuts, conversations, multiple windows, and other features.

5. Dial and Trade

The Dial and Trade service is completely free. You can use this to place trade orders over the phone. The following are some of the characteristics of Dial and Trade:

1. Get experts to provide guidance on all market segments.

2. Seek advice and learn about market trends.

3. ShareKhan offices are easily accessible.

4. It is secure because all calls are recorded for security purposes.

Dialing and Trade Timings

1. From 8:30 a.m. until 4:30 p.m., equity, and derivatives

2. From 9:00 a.m. to 5:00 p.m., the currency is accepted.

3. Commodity from 9:00 a.m. until the close of the market

Contact Information for Dial and Trade

For further queries contact the below-mentioned phone numbers

1. 022-25752300 / 022-25752900

2. Local number – 022-33054900

Requirements for Dial and Trade

1. Phone ID (IVRcode)

2. TPIN

Eligibility for a Sharekhan Account

Before applying for the Sharekhan Account, applicants must meet the following eligibility criteria.

1. The applicant must be at least 18 years old.

2. The applicant must possess Indian citizenship.

3. Both paid and self-employed individuals are eligible to apply.

Documentation Required by the Applicants

1. Provide proof of address

2. Id verification

3. The information about your bank account.

4. Information on the most recent year’s income tax returns.

5. Signatures of the applicants

Required Id Proof documents

1. Aadhar card

2. Pan card

3. Passport

A canceled check can be used to obtain bank account information.

Note: Your signature on the account opening form must match your signature on your bank records.

How to Create a Sharekhan Account

To open a Sharekhan account, simply follow the steps mentioned below:

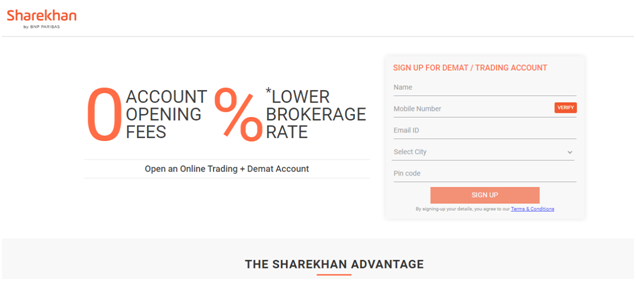

1. Go to the official ShareKhan website and click on the Create New Account option.

2. Enter your Name, Mobile Number, Email, City, and Pin Code.

3. To verify your information, you will receive an OPT (one-time-password) on the cellphone number associated with both Aadhaar cards.

4. After that, you will be contacted via video call for document verification.

5. After you’ve completed the verification, click the e-sign button. An OTP will be sent to your registered number. After you’ve entered it, your e-KYC is complete.

6. Upon completion, you will obtain your unique client code, which you may use to begin trading and investing.

How to Do Sharekhan Login

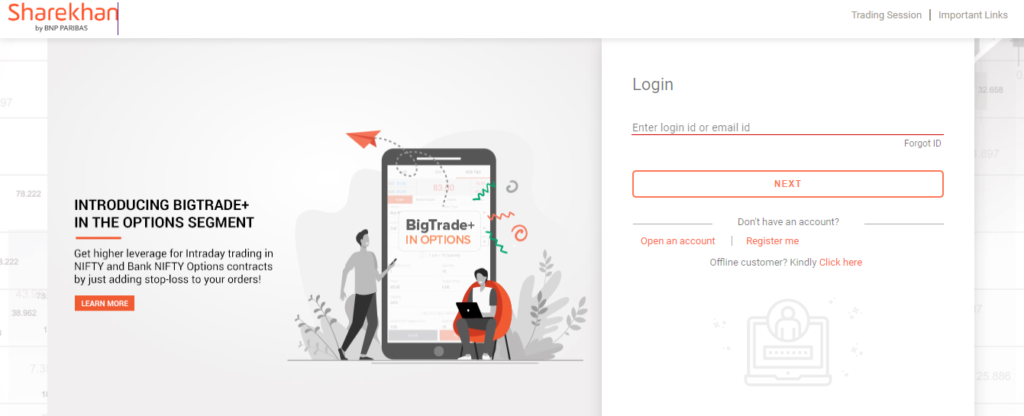

1. Go to the official ShareKhan website and click on the Login option.

2. Enter the login/Email ID and click on the next option.

3. After that, enter the password

4. Now click on the Login option.

Sharekhan Charges for the Year 2021

Currently, the broker offers trading and Demat accounts for the following fees:

1. There are no fees to open a Sharekhan Trading Account.

2. AMC for Trading Account: Nil

3. No costs for creating a Sharekhan Demat Account.

4. Annual Maintenance Charge (AMC) for SharekhanDemat Account: Rs.400 (Free for 1st year with trading account)

What are the Sharekhan Brokerage Fees?

The following is the current Sharekhan brokerage rate:

1. Brokerage Fees at Sharekhan in 2021

2. Intraday Stock Trading: 0.10 percent every transaction – purchase or sell (Sharekhan brokerage intraday).

3. Stock Delivery Trading: 0.50 percent each purchase or sell transaction.

Sharekhan Customer Care Number

Sharekhan has a large client base in India, with over 677 thousand users. Its excellent communication network is the reason for this. In terms of customer service, users have high expectations of the broker. You may reach Sharekhan Customer Service through a variety of means, including:

1. Email Id: – myaccount@sharekhan.com

2. Phone Numbers: –

- 022-25753200/500,

- 022-330546000,

- 022-61151111,

- 1800-22-7500

3. Whatsapp Number: – 7506651112/3/4/5

4. Offline Address: -There are approximately more than 3000 branches across India where you can pay a visit.

Advantages of Sharekhan login

1. The platform for making calls and trading is free.

2. There are no fees for transferring money from a bank account to a trading account and vice versa.

3. Participate in free online classroom sessions.

4. Extensive coverage in over 540 cities across India.

5. You will receive research calls from experts.

6. You can stroll into any of the company’s branches to speak with someone throughout

Disadvantages of Sharekhan Login

- Minimum brokerage fees of 10 paise per share make trading in equities below Rs.20 unprofitable.

2. It does not provide a three-in-one Demat account.

3. After trading hours, there is no way to place orders.

FAQ’s

Yes, the iOS Trading app is available with a Sharekhan login.

No, there are no additional fees associated with utilizing Sharekhan’s trading platforms.

Yes, you can access all trading platforms with a single credential.

Yes, Sharekhan allows you to log in to your BackOffice.

Yes, Sharekhan provides trading applications for all mobile platforms.