LIC Loan Against Policy Calculator | LIC Loan Interest Rate | LIC Loan Against Policy Processing Time | LIC Loan Interest Payment Online

A loan is necessary to expand our business or meet our financial needs when we are in need. Banks and financial institutions give loans, and the banks charge interest based on market conditions. When a loan is taken out, the bank normally secures it against the borrower’s assets, such as a home, land, or other assets. If you have LIC insurance, you can take out a LIC Loan Against Policy, which would be supplied by the LIC of India. LIC is a company that offers a variety of services to its customers, such as investment programs with insurance, term insurance, and so on. Today we will share the details about LIC Loan Against Policy.

Table of Contents

LIC Loan Against Policy Interest Rate

The Life Insurance Corporation of India (LIC) isn’t the only lender who will provide you a loan against your LIC or other life insurance policy. In the case of certain top banks and NBFCs, the interest rates for this loan are as follows:

| Bank/NBFC/HFC | Interest Rate (%) |

| Life Insurance Corporation of India | As per individual applicant profile |

| LIC Housing Finance | 14.80 onwards |

| Axis Bank | 10.50 onwards |

| Bajaj Finserv | 12.99 onwards |

| Kotak Mahindra Bank | 10.99 onwards |

Note: While the majority of the above lenders accept life insurance plans issued by LIC, insurance policies issued by other private insurers are also acceptable in some situations, subject to applicable terms and conditions.

LIC Loan Against Policy Eligibility Criteria

Some significant eligibility conditions for persons seeking a loan against LIC insurance are as follows:

- The applicant must be an Indian citizen who is at least 18 years old.

- A valid LIC (or other life insurance) policy must be held by the applicant.

- The LIC policy which is used for attaining loan should have has guaranteed surrender value (term plans not eligible)

- A minimum of three years of LIC premiums must be paid in full.

- The policy must be assigned entirely in LIC’s favor.

- LIC term plans, which do not have a guaranteed surrender value, cannot currently be utilized as collateral for this secured personal loan. Some of the most common LIC policies that can be used as collateral for a loan against a LIC insurance include:

- Jeevan Pragati

- Jeevan Labh

- Single Premium Endowment Plan

- New Endowment Plan

- New JeevanAnand

- Jeevan Rakshak

- Limited Premium Endowment Plan

- Jeevan Lakshya

LIC Loan Against Policy Online Apply

Currently, you have the option of applying for applying for loan against LIC either offline or online:

Using an Offline Method

The offline option requires you to go to the nearest LIC office and fill out loan application forms, as well as any necessary KYC papers, before submitting them with the actual policy document. Following verification of the application’s facts, a loan of up to 90% of the policy’s surrender value is given out.

Using Online Method

If you’ve signed up for LIC e-Services, you can check if your insurance policy qualifies for a loan against it by logging into your online account. If it is, you will be able to view the loan’s terms and conditions, interest rates, and other features online. In order for your loan application to be approved, you may be needed to upload KYC documents or mail them to a nearby LIC office after submitting them.

Documents Required for LIC Loan Against Policy

A list of important personal loan documents that must be given in order to apply for this secured loan is as follows:

- Documentation of the original policy

- Aadhaar Card, Voter ID Card, Passport as a proof of identity

- Aadhaar Card, Voter ID Card, Driver’s License, Utility Bills as a proof of residence.

- Salary slips and bank account statements as a proof of income.

- The assignment deed

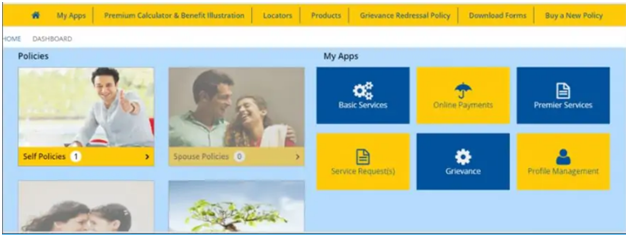

Registration & Login for LIC Loan Against Policy

There is no separate loan portal provided by the Life Insurance Corporation of India. To access online services relating to your LIC policy loan, you must first register and log into the LICeServices portal.

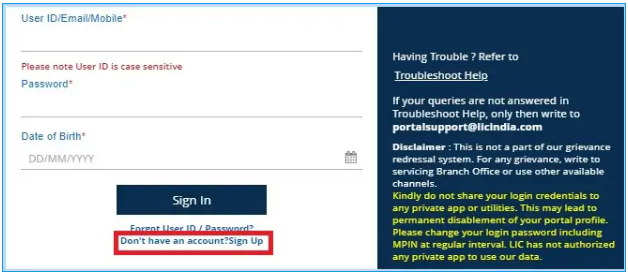

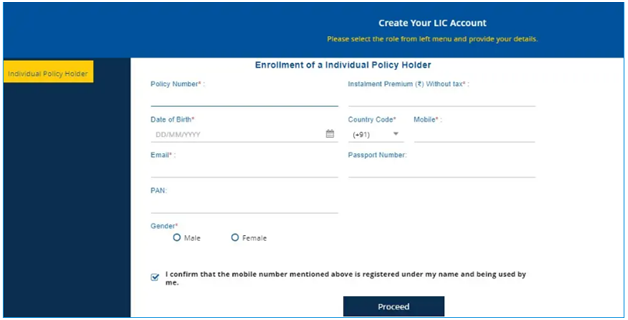

LIC eServices Registration Process

Step-by-step instruction to registration on the LICeServices Portal is provided below:

- Go to the LIC e-Services Portal and select “Don’t Have an Account?” Option to “Sign Up”:

- To sign up for LIC eServices online, fill out the requited information:

- After you’ve hit “Proceed,” you’ll be able to finish the registration process by creating a password. To log into your account, you may either create a User ID or use your email/mobile number.

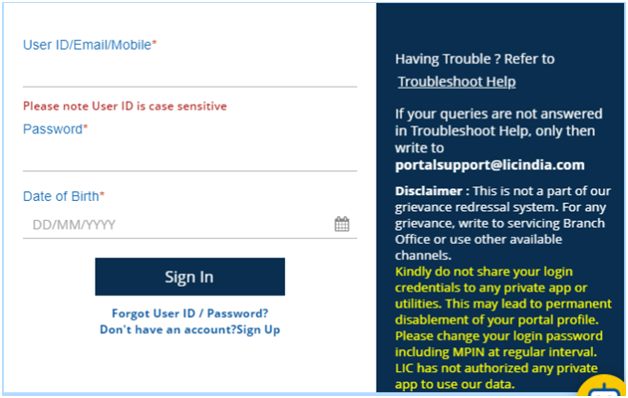

Login Instructions

The procedure for logging into the LICeServices Portal is as follows:

- To log into your account, go to the LIC e-Services Portal and enter your User ID/Email or Phone number and password.

- After successfully logging in, you will have access to your policy information as well as the full range of LICeServices.

Process to Pay Back Your Loan?

You must first enter into the e-Services portal and then select the loan details option to pay your loan EMI online. Following that, you’ll get current information about your outstanding loans, including the EMI due, loan repayment plan, outstanding loan principal, and more. You can pay your loan EMI online with a credit card, debit card, or Internet banking account with one of India’s main banks.

Change Name, DOB, Address, Email ID, Mobile Number in LIC Policy

Repayment Schedule for Loans

A loan against a LIC policy is issued for a minimum of six months. Even if a longer-term loan is prepaid, there is a 6-month minimum period after which prepayment can be made. The whole loan repayment schedule is sent to the borrower when the loan is approved, and it can also be accessed online through the LICeServices portal.

If the policy matures or the borrower dies before the 6 month period is over, the policy profits will be used to pay off the loan, with interest levied only for the time the loan was outstanding.

To repay the loan, you can follow the steps below:

- Pay interest in addition to the principal.

- Pay the interest for a few years and then repay the principal when you have enough money.

- Pay solely the interest, and the principal can be settled at maturity with the claim amount.

Maximum Loan Amounts

The maximum loan amount that can be sanctioned in the case of a loan against a LIC policy is up to 90% of the surrender value at the time of the application, according to current laws. This ceiling is lower for paid-up plans, at 85 percent of the surrender value. This includes any cash bonus that may be relevant to the life insurance policy used as collateral in both circumstances.

Rules and Regulations

The following are some of the most important terms and conditions associated with LIC’s loan against life insurance policy:

LIC Loan Against Policy Characteristics

The following are some of the important elements of this secured loan:

- Only LIC endowment policyholders are eligible for the loan.

- The loan amount is an advance on the plan’s surrender value.

- The LIC holds the insurance policy as collateral. As a result, if the applicant defaults on his or her loan payments, the insurance provider may refuse to renew the policy.

- This function is not available on all LIC insurance contracts. As a result, it is critical to select the appropriate policy so that the applicant can obtain the loan without delay.

- The loan’s interest rate is normally between 9 and 11 percent.

- The maximum loan amount is determined by the surrender value of the LIC policy. The loan amount is usually up to 90% of the policy’s value. This figure is 85 percent for fully paid-up insurance.

- If the loan debt exceeds the policy’s surrender value, LIC reserves the right to cancel the insurance.

- If the insurance policy matures before the loan is fully returned, LIC reserves the right to withhold the appropriate amount from the proceeds of the plan before handing them over to the policyholder.

LIC Loan Against Policy Benefits

- The following are the main advantages of taking out a loan with a LIC policy as collateral:

- Lower interest rate: When compared to other banks, the interest rate offered by LIC on LIC policies is lower. LIC has a low interest rate, which varies based on the insurance and the applicant’s profile. Furthermore, the loan’s interest must be paid semi-annually, or twice a year.

- Maximum Loan Amount: The maximum loan amount is determined by the surrender value of the policy.

- There is no requirement for a credit score: You can still get this loan against LIC policy even if you have a bad credit score or no credit score because it is a secured loan that uses the LIC policy as collateral.

- Quick processing: Because there are little procedures required, the loan application is handled swiftly, and the funds are paid to the applicant’s account without delay.

- Low processing fees and prepayment penalties: LIC charges minimum or no processing fees on loans, unlike banks and NBFCs. Furthermore, the loan’s prepayment penalties are small (if any). An applicant can save money on the loan’s varied costs this way.

- Flexible repayment: The majority of loans are repayable in EMIs. Because a loan secured by a LIC insurance allows for flexible repayment, an applicant can choose to pay interest only, both principal and interest, or pay the loan entirely in uneven instalments.

FAQ’s

No, it isn’t included in every insurance policy. Only endowment plans with at least three years of premium payments are eligible for borrowing against a LIC policy.

The applicant’s LIC policy is used as collateral for the loan. If the applicant is unable to repay his debt, LIC has the discretion to refuse to issue the policy.

If the policyholder dies during the loan’s term, LIC deducts the interest rate and outstanding loan principal from the claim settlement amount and pays the remainder to the policy’s beneficiaries.