What Is IFSC Code | IFSC Code Definition | Search IFSC Code All Bank Branches | Benefits of International Financial Services Code

The Indian Financial System Identifier (IFSC) is an 11-digit alphanumeric code that is used to identify your account’s bank branch and facilitates online money transfers. This 11-character code aids in the identification of bank branches where individuals have bank accounts that engage in various online money transfer options such as National Electronic Funds Transfer (NEFT), Real-time Gross Settlements (RTGS), Immediate Payment Services (IMPS), and Unified Payment Interfaces (UPI). Read below to check the detailed information related to IFSC Code like Highlights, Objectives, Features, Benefits, Format, search Indian Financial System Identifier Code, and much more.

Table of Contents

IFSC Code – Comprehensive Details

Every bank branch in the country has its own unique Indian Financial System Identifier code. The Reserve Bank of India assigns the code. It is required for any transfer system that is controlled by the RBI. The first four characters of an Indian Financial System Identifier Code reflect the bank’s name, the fifth character is 0 and the last six numbers represent the bank’s branch code. They’re frequently seen on your bank’s checkbook as well as other financial documents like bank passbooks.

When you log in to your respective internet banking account, you can also find them on your bank’s Internet banking website. When it comes to internet money transfers, the this code is vital. However, you can only use this code to receive or send money within India. However, instead of the IFSC code, a SWIFT (Society for Worldwide Interbank Financial Telecommunication) number is required to transfer or receive money abroad, such as Wire Transfers.

How to Update Bank Details in EPFO/EPF Portal Online

Objectives of IFSC Code

The Reserve Bank of India (RBI) assigns the Indian Financial System Identifier Code to each bank branch to track internet money transfers. Without a valid IFSC Code, electronic or online transactions like NEFT (National Electronic Fund Transfer), RTGS (Real Time Gross Settlement), and IMPS (Immediate Payment System) cannot be initiated. The use of an Indian Financial System Identifier code decreases the risk of error during a transaction. The code makes it simple to identify the bank and its branch, ensuring that the money transfer process runs smoothly. The code also facilitates and speeds up the money transfer process.

Features of Indian Financial System Identifier Code

Some of the key features of the IFSC Code are as follows:

- An IFSC code allows you to move money from one bank account to another quickly and easily. The usage of the Indian Financial System Identifier Code is required for all electronic or online financial transfers using NEFT, RTGS, or IMPS.

- It aids in the identification of all banks and their branches, allowing consumers to avoid any potential mistakes.

- The RBI uses the Indian Financial System Identifier code to keep a record of all financial transactions, reducing the possibility of any discrepancies in the money transfers process.

- The Indian Financial System Identifier code assists customers in securely completing the fund transfer process, hence reducing the risk of fraudulent behavior in the online fund’s transfer process.

IFSC Code Format

The IFSC Code is written in a specific format. The 11-character Indian Financial System Identifier code is made up of three key elements:

- The bank code is represented by the first four characters

- A ‘0’ is the fifth character

- The last six characters represent a specific branch code

Example: IFSC Code for the State Bank of India’s Delhi branch

| State Bank of India Code | Zero | State Bank of India Branch Code | ||||||||

| S | B | I | N | 0 | 0 | 0 | 1 | 7 | 0 | 7 |

- The first 4 characters ‘SBIN’ represent the bank code of SBI,

- The 5th character is a ‘0’ and

- The last 6 characters ‘001707’ represent the branch code of Azadpur, Delhi.

What is MMID Meaning in Banking

Benefits of International Financial Services Code (IFSC)

The following are the importance and benefits of the Indian Financial System Code (IFSC):

- The code is used to identify a specific bank branch, allowing consumers to avoid making mistakes when transferring funds online using NEFT, RTGS, or IMPS.

- With the help of the IFSC code, all online operations, including bill payment, may be completed quickly.

- The RBI uses the code to track all of an individual’s online transactions, ensuring that there are no inconsistencies in the fund transfer procedure.

- The customer does not need to visit the branch for any financial transactions and can instead use the IFSC Code to make an online money transfer. As a result, it is a very practical and environmentally responsible solution.

Best options to Check for an IFSC Code

You can look for a bank’s IFSC Code in a variety of ways:

- The IFSC code can be found on the bank’s issued cheque and passbook

- On the RBI’s website, you can look up the Indian Financial System Identifier code

- By going to the relevant bank’s website

Several ways to Transfer Money online using the IFSC code

In India, the this code is used to transfer funds online via the three main rapid payment systems: IMPS, NEFT, and RTGS. These three methods of financial transfer can be utilized with either online banking or mobile banking.

- NEFT (National Electronics and Telecommunications Commission): National Electronic Financial Transfer, or NEFT, is an electronic payment system used in India for rapid interbank fund transfers. Fund transfers using NEFT might take anywhere from one to two hours. The main advantages of NEFT are that there are no minimum or maximum transaction amounts, and it is available from all Indian banks. From 8 a.m. to 6:30 p.m. Monday through Friday, and from 8 a.m. to 1 p.m. on working Saturdays. There are fees associated with NEFT fund transfers, which vary per bank. Based on the transaction value, the fees vary from Rs. 2.5 to Rs. 25 + GST.

- RTGS: Real-Time Gross Settlement, or RTGS, is one of India’s fastest interbank money transfer systems. It enables real-time money transfers in under an hour. According to the RBI, the minimum transaction limit is Rs. 2 lakh. This support is open at bank branches that support RTGS. The money can be transferred between the hours of 8 a.m. and 4 p.m. on bank working days, Monday through Friday, and on working Saturdays. Based on the transaction amount, a fee of up to Rs. 60 + GST is applied on fund transfers.

- IMPS: Immediate Payment System (IMPS) is an online money transfer system that allows money to be transferred to a beneficiary’s account in a matter of seconds. The IMPS fund transfer system is safe and secure, and transactions are completed via a two-step verification method. Although there is no minimum limit on financial transfers, the maximum limit varies by bank. This service is offered to customers who have access to mobile banking or internet banking. Even on bank holidays, the funds can be moved without difficulty 24 hours a day, 7 days a week. The fees for this service range from Rs. 15 to Rs. 15 plus GST, depending on the amount of money being transferred.

Steps to Search IFSC Code

Users can look for the Indian Financial System Identifier Code of a specific bank branch both online and offline. The many methods for obtaining the IFSC code are as follows:

Online Methods

- Reserve Bank of India

Users can also seek up the IFSC codes on the RBI’s official website (Reserve Bank of India). Users need to follow the below-given steps to search the IFSC code:

- First of all, go to the official website of the Reserve Bank of India

- The homepage of the website will open on the screen

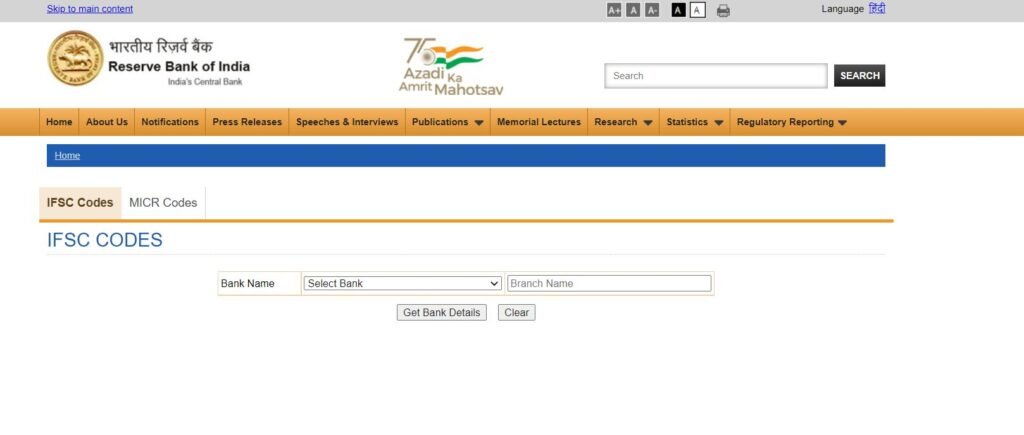

- Click on the IFSC codes

- A new page will open on the screen

- Now, select the bank name and the bank branch

- After that click on the Get Bank Details button to check the Indian Financial System Identifier code

- Mobile Banking / Internet Banking

- The IFSC code can be obtained through the account holders’ specific bank’s net banking page or mobile banking application

- To find the Indian Financial System Identifier Code of a certain bank branch via online banking, the user must first log into the bank’s net banking portal with their User ID and password.

- The IFSC Code of a user’s specific branch can be found in the “Accounts” section of the menu.

- It should be noted, however, that each bank’s internet banking platform operates differently.

Online Methods

- Cheque Book

The IFSC code is printed at the top of the cheque leaf issued by the bank

- Passbook

The IFSC codes can be found on the first page of the bank’s passbook.

FAQ’s

The Reserve Bank of India issues the IFSC, which is an 11-digit alphanumeric number used to transfer money in India.

All accounts in the same branch of the bank have the same IFSC code. It is an 11-digit alphanumeric code in which the first four characters reflect the bank’s name, the fifth character is 0, and the final six numbers define the bank’s branch code. The IFSC Code can be found on the bank’s cheque and passbook, or you can look for it on the relevant bank’s website or the RBI’s website.

Each bank branch’s IFSC code is unique, and it is necessary for online fund transfers in India. The security of the transfer is ensured by the unique code issued to each bank. The IFSC code, on the other hand, cannot be used for fraud or theft.