IDFC Credit Card Apply Online | IDFC Credit Card Application Form | IDFC Credit Card Customer Care | IDFC Credit Card Application Status

Credit cards are a great way through which you will be able to buy your favorite product without having to worry about the amount of money that you currently have in your bank account and the credit cards also offer a wide range of discounts plus cash back offers to the customers. Given below we are sharing some of the most important specifications related to the IDFC Credit Card and we will also share with you all the step-by-step procedures through which you will be able to Apply Online, Offer, Eligibility & Customer Care.

Table of Contents

IDFC Credit Card

IDFC Bank offers a wide range of credit cards to customers and these credit cards are available at a lower interest rate to all of the customers. You can get these credit cards online or you can visit your nearest bank branch in order to get your preferred credit card. There are four types of credit cards available by the authorities of the IDFC bank and all of these credit cards can be checked out on the official website of the IDFC bank. You can apply for the credit card in which you are interested in taking into consideration the benefits and the discounts available by each of the credit cards presented by the authorities of the IDFC bank. You can fill out the application form available at the official website.

Types of IDFC Credit Card

There are four credit cards available by the IDFC Bank and given below we are specified each one of them:-

- Millennia card

- Classic credit card

- Select credit card

- International lounge access card

IDFC FIRST Bank Net Banking Registration

Eligibility Criteria

The applicant must follow the following eligibility criteria to apply for the credit card:-

- Applicant must be aged 21 yrs. or above in order to apply for an IDFC FIRST Bank Credit Card

- Applicant must qualify as an Indian resident and have a current and permanent residential address within India

- IDFC FIRST Banks maintains a set of cities that are allowed for sourcing

- The applicant is expected to have a good credit bureau score and no evidence/history of defaulting on loans or missing payments on loans or credit cards

- The applicant must have a Minimum Net Monthly Income = ₹25,000 (subject to change)

- Bank runs certain internal policy criteria to select a customer for issuing credit cards

- Internal Policy criteria are based on bureau history, any existing Bank relationship, customer demographics, and credit exposure

- The Bank reserves the right to issue a Credit Card to the applicant based on an assessment of his / her credentials. The final decision is at the Bank’s sole discretion, in line with the mentioned internal policies, and notwithstanding the applicant meeting the criteria

Application Fee

The applicant will have to pay the following application fees to apply for the various credit cards:-

Millennia Card

- No annual fee. Lifetime Free Credit Card

- Low Interest Rates (APR), from 0.75% to 3.0% per month (9% to 36% per annum)

- Interest-free cash withdrawals on Domestic and International ATMs for up to 48 days (Cash Advance Fee of only ₹ 250 per transaction)

- No over-limit fee

- No reward redemption fee

- Late Payment Fee: 15% of the total amount due (subject to Min ₹100 and Max up to ₹1,000)

- Forex Markup at 3.5% for all international transactions

Classic Credit Card

- No annual fee. Lifetime Free Credit Card

- Low Interest Rates (APR), from 0.75% to 3.0% per month (9% to 36% per annum)

- Interest-free cash withdrawals on Domestic and International ATMs for up to 48 days (Cash Advance Fee of only ₹ 250 per transaction)

- No over-limit fee

- No reward-redemption fee

- Late Payment Fee: 15% of the total amount due (subject to Min ₹100 and Max up to ₹1,000)

- Forex Markup at 3.5% for all international transactions

Select Credit Card

- Over limit Fee – NIL

- FIRST Select Credit Card Interest Rate – from 0.75% to 2.99% per month

- Reward Redemption Fees – NIL

- FX Markup – 1.99%

- Late Payment Fee – 15% of Total Amount Due (subject to Min ₹100 and Max up to ₹1,000)

- International & Domestic Cash Advance Fee – ₹250

- International lounge access card

- No annual fee.

- No over-limit fee

- Interest-free cash withdrawals on Domestic and International ATMs for up to 48 days (Cash Advance Fee of only ₹ 250 per transaction)

- No reward-redemption fee

- Low Interest Rates (APR), from 0.75% to 3.0% per month (9% to 36% per annum)

- Forex Markup at 1.5% for all international transactions

- Late Payment Fee: 15% of the total amount due (subject to Min ₹100 and Max up to ₹1,000)

IDBI Bank Net Banking Registration

Benefits of IDFC Credit Card

Given below, we are sharing the benefits and the privileges available for the various types of credit cards:-

Millennia Card

- Welcome voucher worth ₹ 500 on spending ₹ 15,000 or more within 90 days of card issuance

- 5% cashback on the transaction value for your first EMI transaction within the first 90 days of card issuance (no upper cap on cashback amount)

- 25% discount on movie tickets up to ₹ 100 (valid once per month)

- 4 complimentary Railway lounge visits per quarter

- Complimentary Roadside Assistance worth ₹ 1,399

- Fuel surcharge waiver of 1%, at all fuel stations across India, up to ₹ 200/month

- 50+ in-App discount offers | Up to 20% discount at 1500+ restaurants |

- Up to 15% discount at 3000+ Health & Wellness outlets

- Personal Accident Cover of ₹ 2,00,000* and Lost Card Liability Cover of ₹ 25,000

- Convert all transactions above ₹ 2,500 into easy & convenient EMIs from your mobile app

- Instant EMI conversion for all online transactions above ₹ 2,500 on the bank’s OTP page

- Enjoy convenient transfer of balances from your other bank credit cards with our balance transfer privilege

Classic credit card

- Welcome voucher worth ₹ 500 on spending ₹ 15,000 or more within 90 days of card issuance

- 5% cashback on the transaction value for your first EMI transaction within the first 90 days of card issuance (no upper cap on cashback amount)

- 25% discount on movie tickets up to ₹ 100 (valid once per month)

- 4 complimentary Railway lounge visits per quarter

- Complimentary Roadside Assistance worth ₹ 1,399

- Fuel surcharge waiver of 1%, at all fuel stations across India, up to ₹ 200/month

- 50+ in-App discount offers | Up to 20% discount at 1500+ restaurants |

- Up to 15% discount at 3000+ Health & Wellness outlets

- Personal Accident Cover of ₹ 2,00,000* and Lost Card Liability Cover of ₹ 25,000

- Convert all transactions above ₹ 2,500 into easy & convenient EMIs from your mobile app

- Instant EMI conversion for all online transactions above ₹ 2,500 on the bank’s OTP page

- Enjoy convenient transfer of balances from your other bank credit cards with our balance transfer privilege

Select Credit Card

- Welcome voucher worth ₹ 500 on spending ₹ 1 5,000 or more within 90 days of card issuance

- 5% cashback on the transaction value for your first EMI transaction within the first 90 days of card issuance (no upper cap on cashback amount)

- ‘Buy one, get one offer on movie tickets up to ₹ 250 on Paytm mobile app (valid twice per month)

- 50+ in-App discount offers | Up to 20% discount at 1500+ restaurants |

- Up to 15% discount at 3000+ Health & Wellness outlets

- 4 complimentary domestic airport lounge visits per quarter

- 4 complimentary Railway lounge visits per quarter

- Complimentary Roadside Assistance worth ₹ 1,399

- Fuel surcharge waiver of 1%, at all fuel stations across India, up to ₹ 300/month

- Air Accident Cover of ₹ 1 crore

- Personal Accident Cover of ₹ 5,00,000 and Lost Card Liability Cover of ₹ 50,00

- Comprehensive Travel Insurance Cover of ₹ 22,500

- Convert all transactions above ₹ 2,500 into easy & convenient EMIs from your mobile app

- Instant EMI conversion for all online transactions* above ₹ 2,500 on the bank’s OTP page

- Enjoy convenient transfer of balances from your other bank credit cards with our balance transfer privilege

International Lounge Access Card

- Welcome voucher worth ₹ 500 on spending ₹ 15,000 or more within 90 days of card issuance

- 5% cashback on the transaction value for your first EMI transaction within the first 90 days of card issuance (no upper cap on cashback amount)

- Movie, Online and Dining Discounts

- ‘Buy one, get one offer on movie tickets up to ₹ 500 on Paytm mobile app (valid twice per month)

- 50+ in-App discount offers | Up to 20% discount at 1500+ restaurants |

- Up to 15% discount at 3000+ Health & Wellness outlets

- Premium Benefits

- 4 complimentary Domestic & International airport lounge, spa visits per quarter

- 2 complimentary golf rounds per month

- Insurance and Road Assistance

- Complimentary Roadside Assistance worth ₹ 1,399

- Fuel surcharge waiver of 1%, at all fuel stations across India, up to ₹ 400/month

- Air Accident Cover of ₹ 1 cr

- Personal Accident Cover of ₹ 10,00,000* and Lost Card Liability Cover of ₹50,000

- Comprehensive Travel Insurance Cover of ₹ 22,500

Rewards Points

Given below, we are sharing the details related to the reward points that will be available to the people who are applying for the IDFC credit cards:-

- 10X Reward Points on incremental spends above ₹20,000 per month and spends done on your birthday

- 6X & 3X Reward Points on online & in-store spends respectively on spending up to ₹20,000 per month

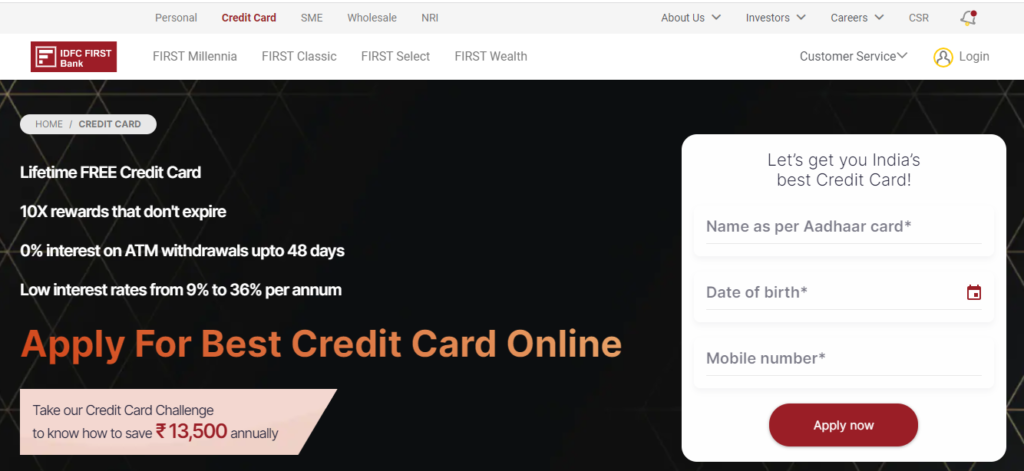

How To Apply For IDFC Credit Card?

You can easily apply for the IDFC credit card by following the step-by-step procedure given below:-

- You will first have to visit the official website of IDFC bank by clicking on the link given here

- The details related to the credit card will be displayed on your screen.

- You need to enter your name as per the Aadhar Card and then you need to enter your date of birth.

- Enter your mobile number and click on apply now.

- Select your credit card and you will be successfully able to get the credit card without any problem.

Customer Care

- 1860 500 1111

FAQ

IDFC Bank does not impose any type of annual charges or joining fees on all of the people who are getting this credit card.

The interest rate for the credit cards of this bank will range from 9% to 36% per annum.

You can easily apply for the credit cards available in the IDFC bank by going to the official website and filling out the application form or you can also visit your nearest bank branch in order to get most of the information related to the credit cards.

IDFC credit cards offer low-interest rates ranging between 9% to 36% while the other credit cards charge high-interest rates of up to 42 % per annum.

You can give your family a card with their name and you can share your line of credit with them.