IDBI Bank Net Banking Online Registration |IDBI Bank Net Banking Generate Online Password |IDBI Bank Net Banking Login | Activate IDBI Bank Net Banking

IDBI Bank offers its consumers a wide range of banking services. Customers can access their account information on the go with the IDBI Bank Net Banking service. Customers can very effortlessly activate their mobile banking services. It is necessary to be registered with the bank or to use net banking to use this service. Customers can make use of the net banking app even when the bank is closed.

Table of Contents

Requirements for IDBI Bank Net Banking Registration Online

- IDBI net banking registration online requires the following items.

- Client ID – You must know your account’s customer ID.

- IDBI Account Number – The full account number is required.

- IDBI Debit Card Number and ATM PIN — The IDBI debit card number is required. Before registering for internet banking, you must first generate a PIN for your IDBI debit card.

- Registered Mobile Number – You must have your bank’s registered mobile number with you, and it must be active in order to receive OTP by SMS.

How to Register for IDBI Bank Net Banking Online – A Step-by-Step Guide

This technique can be completed in 5 minutes while sitting at home. Here are the easy actions you need to take –

- Open the IDBI Bank Net Banking website on your PC or smartphone.

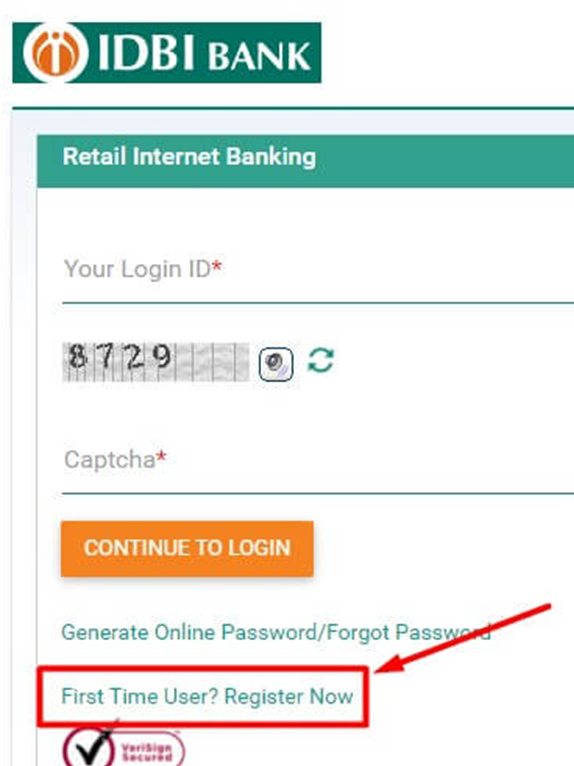

- Click the “First Time User?” link on the login screen. Choose the “Register Now” option.

- Click on register now option in netbnking login page

- The registration form will now appear in a new window.

- Correctly enter the Customer ID and bank account number. After that, click the Continue button.

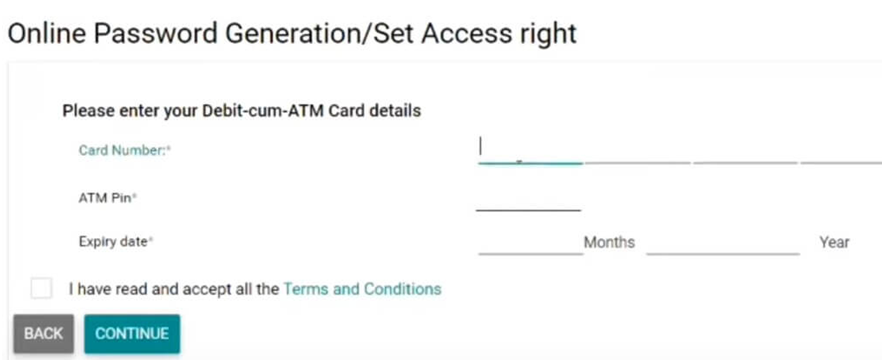

- Enter the IDBI debit card number, ATM PIN, and expiration date in MM/YYYY format.

- By clicking the box in front of the terms and conditions, you agree to them, and then click the CONTINUE button.

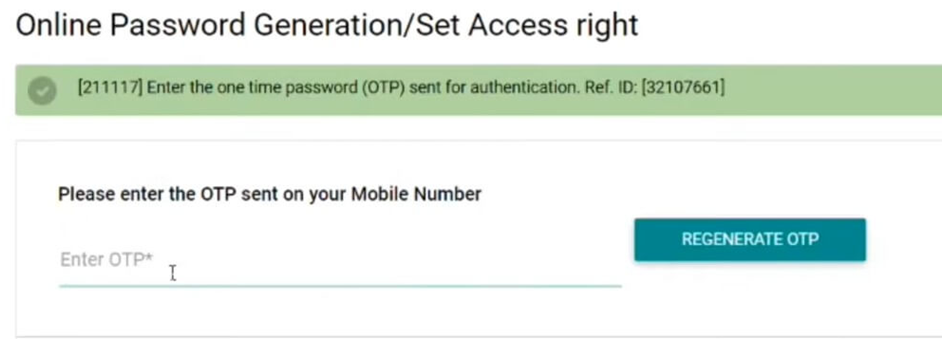

- Your registered mobile number will now receive an OTP. On the screen, enter the OTP and then click the CONTINUE button. If you haven’t gotten an OTP yet, click on regenerate OTP to receive one.

- After the OTP has been verified, you will be able to see your IDBI net banking password.

- You must create two separate passwords: a Logon Password and a Transaction Password.

- You must also choose between a view-only or transaction-only access permission.

- After you’ve set both passwords and access permissions, click the SUBMIT button.

- You will now get a notification stating that your password has been set. To log in to your account for the first time, click LOGIN.

Activate IDBI Bank Net Banking

After you’ve created a password for your IDBI Net Banking account, you’ll need to log in and establish the security phrase and image combination.

- Your login ID (customer ID) and password must be entered.

- Click the CONTINUE TO LOGIN button after entering the CAPTCHA code properly.

- You must configure the security phrase and image now that you have logged in for the first time.

- Type whatever phrase you want and choose an image from the selection that appears.

- To avoid logging into bogus websites, this security phrase-image combination is used. You must double-check the phrase-image combination every time you log in to your account.

- You can now log in to your account by entering your login ID and password after submitting the phrase-image security combination.

Registration for IDBI Mobile Banking

Customers can register for IDBI Bank’s mobile banking services through any one of the following ways:

Net Banking: Customers who already have an IDBI Bank Net Banking account, can use it to sign up for mobile banking services.

For mobile banking registration, go to the IDBI net banking portal and select the appropriate option.

Visiting an IDBI branch: Customers can also fill out the ‘Channel Registration Form’ at the nearby IDBI branch. Just pick up the form at the bank’s branch or download it from their website. After that submit your registration request after filling out all of the necessary details.

Now, you will receive a mobile banking activation SMS on your registered mobile number once your registration has been approved. After that Double-check if your current phone number has been updated with the bank and is associated with your account.

After you’ve received the confirmation SMS, you’ll need to set your password by following these steps:

- Go to IDBI Bank’s official website and choose ‘Set Password Online.’

- Choose your favourite mobile banking channel.

- Choose your desired access rights from the options below:

- View-only access

- Full transaction access rights

- Restricted transaction mode

- After you’ve chosen your access rights, you’ll need to create a mobile banking password.

- Now access IDBI Bank’s mobile banking services with this password.

Login to IDBI Mobile Banking

The steps to log in to IDBI Bank’s mobile banking app are mentioned below:

- First of all, visit the app store to get the app.

- For first-time users, open the app and select ‘Activate App.’

- You will be prompted to input your customer ID after selecting the ‘Activate App’ option.

- For verification purpose, an SMS shall be issued to your registered telephone number.

- The mobile app will be launched on your phone after verification.

- To proceed, enter your customer ID and MPIN if your mobile banking services have already been activated.

How do you change your IDBI mPIN?

The MPIN is a four-digit security code that needs to be entered to access the app. If you’ve forgotten your MPIN or wish to change it, then read the following steps:

- Download and install the IDBI mobile banking app.

- On the login page, select ‘Reset MPIN’.

- After that you’ll need to enter your customer ID.

- Once you’ve entered your customer ID, you’ll receive a verification SMS to your registered phone number.

- Once the phone number has been validated, you can reset the MPIN.

IDBI Bank Mobile Apps

| App Name | Features |

| IDBI Bank GO Mobile+ | Personalize the app Financial calculators User-friendly interfaceManage debit and credit cards Transfer funds Access account detailsBill payments Mobile/DTH recharge |

| IDBI Bank mPassbook | E-PassbookExpense manager View all transactionsInterest rate updates View transactions in online or offline mode |

| Abhay | Instant, anywhere control of debit cardsHot-list cardActivate/deactivate cardsView transactionsView loyalty points |

| Bharat QR | Payment solution for merchants Create dynamic QR codeBharat QRScan and pay Accept payment through Visa/Master, UPI, or RuPay cards |

| IDBI AppKart | Single platform to manage all IDBI apps Download and update apps Quick and easy |

Options for IDBI Bank Fund Transfer

IDBI Bank offers three types of fund transfers: NEFT, RTGS, and IMPS.

National Electronic Funds Transfer (NEFT) is one of India’s most popular fund transactions. It is a one-to-one electronic financial transfer that allows a consumer to send money to another person. This differs from RTGS transfers in that it is cleared batch by batch. Customers can transfer funds from any bank branch in the country to any individual or entity in any other bank branch. IDBI Bank provides outstanding NEFT transfer services for a low fee.

Real-time Gross Settlement (RTGS) is a cash transfer system that allows funds to be transferred from one bank to another in “real-time.” It does not have a waiting period for clearance, unlike NEFT. In emergency situations or for high-value transactions that require immediate clearance, the RTGS system is employed. RTGS, which is regulated by the Reserve Bank of India, is a secure way to transfer payments within India. IDBI Bank provides RTGS fund transfer as a service to its customers.

IMPS- If consumers need an immediate fund transfer, this is the method to use. Immediate Payment Service is a mobile-based electronic fund transfer service. It allows you to send money instantly. There is no waiting period with IMPS because funds are transmitted quickly. IDBI Bank’s Go Mobile app includes an IMPS option for money transfers.

IDBI Bank Fund Transfer Charges and Timings

NEFT

| Transfer Amount | Charges (exclusive of taxes) for Indus comfort regular, Indus Comfort and Indus Comfort Premium users |

| Up to Rs.10,000 | NIL |

| Rs.10,001 – Rs.1 lakh | Rs.5 per transaction |

| Rs.1 lakh – Rs.2 lakh | Rs.15 per transaction |

| Above Rs.2 lakh | Rs.25 per transaction |

| Cut-off timing for processing on the same day | |

| BRANCH TIMING | NETBANKING TIMING |

| Monday to Friday | 9 am to 7 pm |

| Saturday (excluding 2nd and 4th) – During branch working hours | 9 am to 1 pm |

RTGS

| Transfer Amount | Charges (exclusive of taxes) |

| Rs. 2 lakh to Rs. 5 lakh | Rs.30 per transaction |

| Above Rs. 5 lakhs | Rs.55 per transaction |

| Cut-off timing for processing on the same day | |

| Monday to Friday | 9 AM to 4:15 PM |

| Saturday (excluding 2nd and 4th) | 9 AM to 1 PM |

Customer Care Numbers of IDBI Bank

| IDBI | Customer care number |

| Toll-free numbers | 1800-200-1947/1800-22-1070 |

| Chargeable numbers | 022- 66937000/0091-22-66937000 |

Advantages of IDBI Mobile Banking

The following are some of the advantages of IDBI mobile banking:

- Using IDBI Bank mobile banking saves a lot of time as clients don’t have to visit the bank to receive the information they are looking for.

- Customers who use mobile banking are constantly notified on the status of their accounts.

- Mobile banking aids in the battle against fraud by notifying customers of every transaction done on their account. Any unauthorised transactions will be reported to the bank by the customer.

- Customers may pay their bills on time using IDBI Bank’s mobile banking app, which offers a particular function to pay bills online via the bank’s portal.

- Customers can use mobile banking to move money from one account to another, which is very useful these days.

- Mobile banking is cost-effective because it is free.

Mobile Banking Security at IDBI Bank

- IDBI Bank mobile banking services are accessed through a browser that is comparable to that used for internet banking.

- IDBI Bank mobile banking is exceptionally safe since it uses 128-bit SSL from the VeriSign gateway.

- To make it even more secure, it includes https:// access.

- It also uses an intrusion detection system, which ensures that transactions are secure.

- Customers are also given an OTP (One-Time Password) to approve each transaction.