HDFC Fastag Login | HDFC Fastag Balance Check | HDFC Bank Fastag Recharge | HDFC Fastag Online Apply

Giving toll tax when you are traveling to somewhere outside your state can be quite hassling because of the procedure of finding the exact change in your pocket. You can take into consideration the various Fastag available for the consumers nowadays and given below we are sharing the specifications of the HDFC Fastag. We will also share with you all the step-by-step procedures through which you will be able to check the Login, Balance Check & HDFC Bank Fastag Recharge. You can also recharge your card by using various methods available online and specified below.

Table of Contents

HDFC Fastag

HDFC Fastag was released recently so that there is contactless toll collection and you will be able to install the card in your car window and through that, you will be able to enable automatic toll deduction from your bank account. You will have to link your bank account to your Fastag installed in your car window and then you will facilitate cashless transactions. You can also check your balance online and you will be able to drive right past through the toll plaza without having to pause your car each and every time. HDFC bank offers online Fastag to all of our customers and you can also recharge this Fastag by using the official website.

Working of HDFC Fastag

HDFC Fastag is a rectangular card that will be attached to your vehicle’s windscreen and it will be linked to your prepaid account. This code will be working with all of the device readers present at the toll plaza and they will use the radio frequency identification technology to capture the unique Fastag number present on your card. The amount from your prepaid account will be directly deducted as soon as you drive past the toll plazas available in India and it will make the process of giving the toll tax really easy without having to struggle to find the exact change. The reader’s present at the toll plaza will directly deduct the amount from the wallet or the balance of the customers and then you can recharge your wallet again.

Benefits of HDFC Fastag

- HDFC Bank Fastag will be able to help you with cashless transactions at each and every toll plaza in the country.

- This method will save a ton of time and all of your transactions will be auto-debited with the precise toll amount.

- You can recharge your Fastag by using your HDFC bank account online through a credit card, debit card, wallet or internet banking.

- SMS alerts will be sent to you if you are doing transactions or if you are on a low balance.

- The customers will be able to check out all of the details related to this Fastag by using the online portal.

- This method will also reduce air pollution and paper use.

- You can save a ton of time by using this option available by the HDFC bank and this method is also economically stable.

Application Fee

The charges applicable on FASTag have been given below:-

| Particulars | Amount |

| Joining Fee | Rs.100 including taxes |

| Re-issuance Fees | Rs.100 including taxes |

One Time Deposit

The customers will also have to give a one-time deposit fee according to the vehicle that they are driving and given below we have shared the specification of each one time deposit:-

| Vehicle Class | Description | Threshold Amount | Tag Colour | Tag Deposit |

| 4 | Jeep/Van/Car | Rs.200 | Violet | Rs.200 |

| 4 | Tata Ace and similar mini light commercial vehicle | Rs.100 | Violet | Rs.200 |

| 5 | Minibus/light commercial vehicle | Rs.140 | Orange | Rs.300 |

| 6 | Bus 3 Axle | Rs.300 | Yellow | Rs.400 |

| 6 | Truck 3 Axle | Rs.300 | Yellow | Rs.500 |

| 7 | Truck 2 Axle/Bus 2 Axle | Rs.300 | Green | Rs.400 |

| 12 | Truck 4,5,6 Axle/Tractor/Tractor with trailer | Rs.300 | Pink | Rs.500 |

| 15 | Truck 7 Axle and above | Rs.300 | Blue | Rs.500 |

| 16 | Earth Moving/Heavy Construction Machinery | Rs.300 | Black | Rs.500 |

Documents Required

The following documents need to be submitted to the bank while applying for the FASTag:-

- Duly filled and signed FASTag application form

- Passport-size photograph of the vehicle owner

- Scanned copy of the Registration Certificate (RC) of the vehicle

- Know Your Customer (KYC) documents as per your category:

- For Individuals:

- ID proof and Address proof in the form of the following: PAN Card (mandatory), Driving License, valid Passport (first and last page), Voter ID Card, Aadhar Card.

- For Corporates:

- For Public Limited, Private Limited, Partnership, and Proprietorship:

- Certificate of Incorporation/ Partnership Deed/ Registration certificate of the firm/ PAN Card of the Proprietor

- PAN Card (mandatory) as the address proof of the Proprietor’s firm.

- Photo ID of signing authority

- List of Directors along with partners’ names and addresses.

Balance Check

To get the enquiry regarding your balance you will have to follow the simple procedure given below:-

- Give a Miss-Call to 720-805-3999 to know your Balance

How To Apply For HDFC Fastag?

Given below, we are sharing the detailed procedure through which you will be able to apply for the Fastag:-

- You will first have to visit the official website of Fastag and the homepage will open on your screen.

- You have to now visit the HDFC FASTag customer webpage.

- Go to the ‘Enter Details’ section.

- You will be asked if you already have an HDFC saving bank account.

- Choose Yes/No as applicable.

- If you choose ‘Yes’-

- Enter your Customer ID.

- A verification code will be sent to your registered mobile number.

- On verification, the bank will use the existing KYC information to auto-fill into your application form.

- If you choose ‘No’-

- Enter all the details including KYC documents.

- Under the ‘Vehicle registration’ section, select the vehicle type (commercial/private) and vehicle number for which you want FASTag.

- Upload the documents

- After reviewing your completed application, click on ‘Submit’.

- The bank will verify your application and mail the RFID sticker to your registered address.

How To Apply For HDFC Fastag Offline?

If you don’t want to apply for the Fastag online then you can follow the offline method and apply for it by visiting the nearest HDFC Bank and following the steps given below:-

- You can buy HDFC FASTag offline by visiting the bank’s authorized agent sales offices or POS locations at the National Highway toll plazas.

- The list of toll plazas and HDFC sales branches for FASTag purchases is available on the bank’s website.

- You will have to visit the POS or bank branch with-

- A duly filled and signed HDFC bank FASTag application form

- Vehicle owner’s passport-size photograph

- Original and scanned copy of the Registration Certificate (RC) of the vehicle

- A valid driving license/Adhaar card/PAN Card for address and identity proof

- Original and scanned copies of other KYC documents as applicable to the individual or corporate FASTag user

- You will then be eligible to get the tag as soon as possible.

Login Process

To log in you will have to follow the simple procedure given below:-

- You will first have to visit the official website of HDFC Fastag and the homepage will open on your screen.

- You need to enter your user ID or wallet ID or phone number or vehicle registration number.

- And You can also log in by using your user ID and password.

- Enter your captcha code and click on get OTP.

- Enter the OTP to successfully log in.

HDFC Bank Fastag Recharge

There are different methods through which you will be able to recharge your fastag and given below we are specifying each and every one of the methods:-

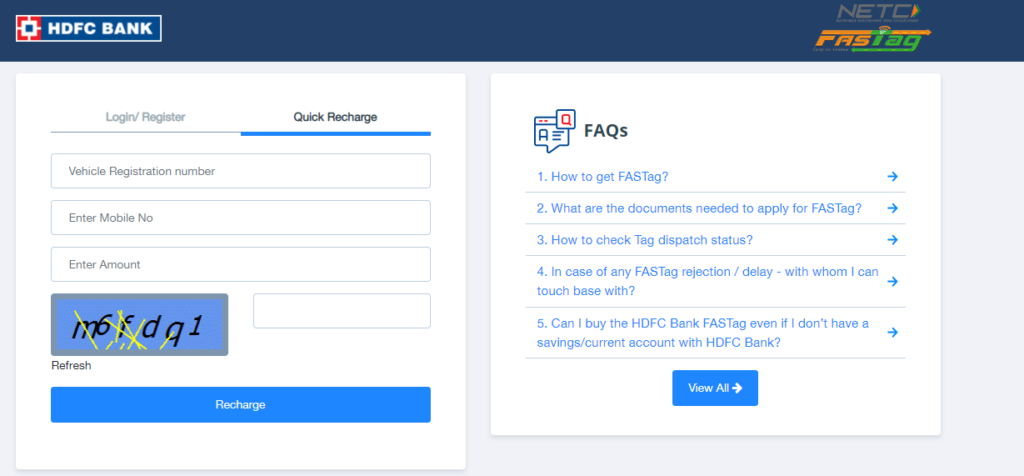

Through the FASTag portal

- You will first have to visit the official website of HDFC Fastag and the homepage will open on your screen.

- You need to click on the option called Quick Recharge

- Enter your vehicle registration number, mobile number and amount.

- Enter the captcha code.

- Click on recharge and your card will be successfully charged.

Through any UPI Application

- You need to open your UPI application and the homepage will open on your screen.

- Select the ‘Pay by UPI ID’ option and enter the VPA.

- Enter the pre-defined VPA for HDFC Bank FASTag Recharge

Customer Services

- 1800 120 1243

FAQ

You can visit the official HDFC Fastag customer webpage and you will be eligible to apply for the Fastag by entering all of the details.

You can use any of the UPI applications available on your mobile phone to recharge your HDFC Fastag or you can also use internet banking to recharge your Fastag.

The tag is automatically activated once you have created your account for the HDFC Fastag recharge online by providing your credentials.

The joining fees and the re-issuance fees are Rupees hundred. The one time deposit will vary from vehicle to vehicle.

You can buy the HDFC Fastag even if you don’t have any current or savings account by visiting the official webpage.