CIBIL Score Benefits, Online CIBIL Score Check, CIBIL Score Range, CIBIL Score login

If you are looking for a housing loan, automobile loan, education loan, or aiding loan then the first thing that decides whether your loan will be sanctioned or not is your CIBIL score. A good CIBIL score not only helps you to get your loan sanctioned but also boosts up your process to get that loan. In this article, we are discussing various aspects of the CIBIL Score

Table of Contents

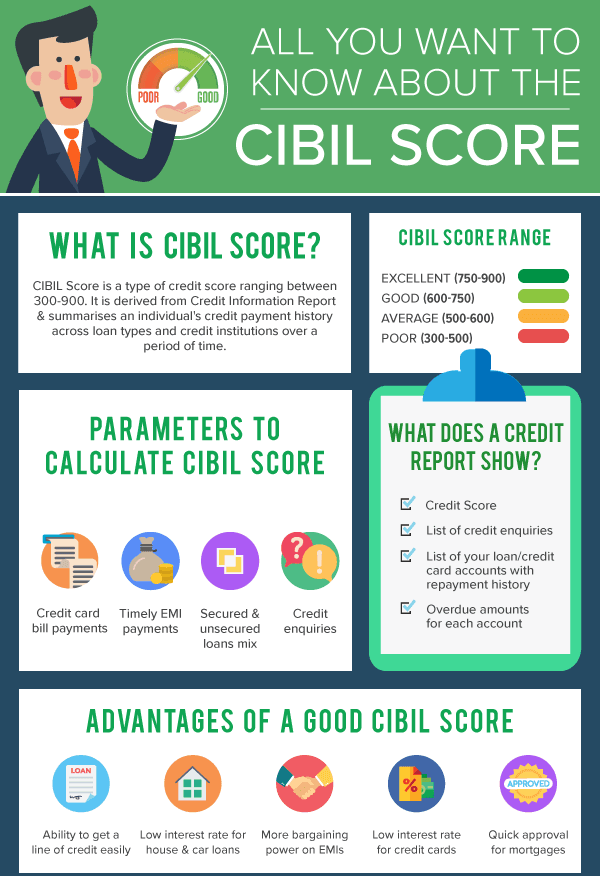

So what is CIBIL Score

A Credit Information Bureau of India Limited (CIBIL) is an institution that collects the credit data of individuals or groups of individuals from lenders on monthly basis. Credit Information Bureau of India Limited then made a credit report on the basis of this data, this credit report is known as the CIBIL score. CIBIL score is a three digits number ranging from 300 to 900 only, it is a user’s credit score that reflects the user’s credit history and consumer’s credit worthiness which is based on past credit behavior, such as borrowing and repayment habits as shared by banks and users or lenders with CIBIL on a regular basis.

WHAT IS A GOOD CIBIL SCORE

From the above article, you are now familiar with the term CIBIL score which is a three-digit number ranging from 300 to 900 and shows your credit history. A good CIBIL score close to 900 or a score above 700 is usually considered a good CIBIL score and 79% of loans are sanctioned to consumers with a CIBIL score greater than 750.

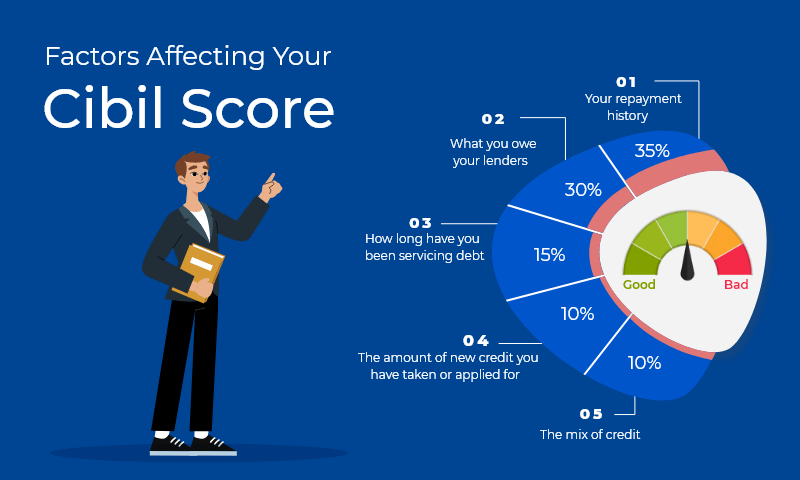

How CIBIL Score is Created

CIBIL score is made up of four factors but there are various factors that directly or indirectly affect your CIBIL score negatively:

- Good Payment History

Your past payment has the highest influence on your CIBIL or credit score. If you are paying all your EMIs and credit card bills on time then your CIBIL score will be good. Your CIBIL score can be declined if you don’t pay your credit card bills or EMIs on time every month.

- Overdue Debts and Loans

To maintain a good CIBIL report you should also take care of your past debts. You should always make sure to clear off your overdue debts. Unpaid due or EMIS can have a bad reflection on your CIBIL report and can also reduce your score.

- The High credit utilization ratio

The credit utilization ratio is the amount of available credit you are currently using or you can say the amount of credit used in proportion to the credit limit that is available to you. One should not exceed using 30% of your credit limit, as per experts. For example, if you have a limit of Rs. 1 lakh, you should spend around Rs. 30,000 but if you used over 50% of your credit limit, it can have a negative effect on your credit report, and have a high credit exposure will surely affect your CIBIL report and it indicates a higher risk of default.

- Closing old credit card accounts

When it is about creating a good credit history credit cards are a great tool. It is not advisable to close your old accounts as you end up losing a long credit history associated with them. Also if you have used credit cards for a long period of time, it is advised to keep them open as long as possible. There is no problem if you close your credit card that is all new.

Benefits of having a good CIBIL Score.

Having a good CIBIL report not only increases the chances of getting your loan to be approved quickly and fast but also affects your future action directly or indirectly. The benefits of a good credit score are as follows

- Discounts on processing fees and charges for loan applications will be provided if you have a good credit score.

- You will get loans at a cheaper rate of interest.

- Users can get a credit card with a higher credit limit, with Better deals.

- A person with a good Credit score can get a loan easily and quickly

- Having a good Credit score can introduce exciting and new offers on your loans as well as it can help to reduce your rate of interest on loans

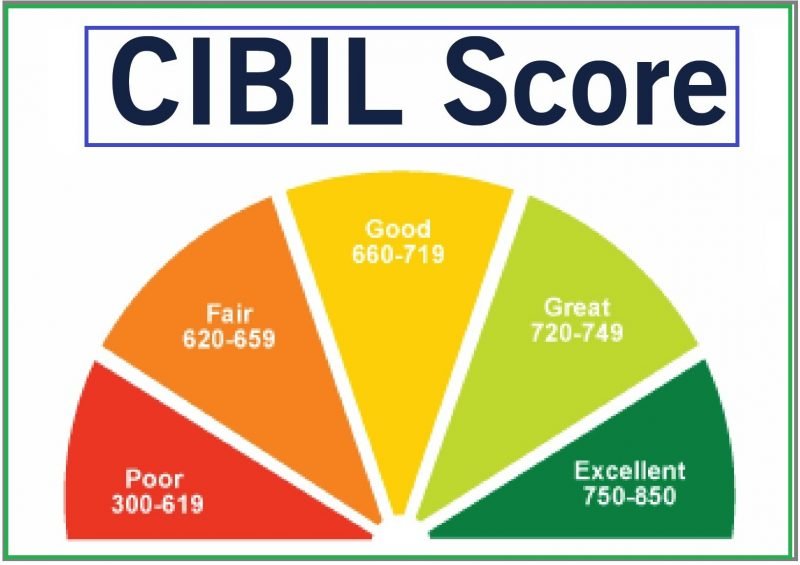

Different CIBIL Report Range

A CIBIL report ranging from 300-900, closer to 900 or above 750 is considered a good credit report A good Credit report always reflects a good impression on the executive here is a detail of various ranges. Here are the different credit report ranges

- NA/NH

This will be shown when you have no credit history or no history of the borrower, it means ‘NOT APPLICABLE’. Also, it will be shown if you have not used a credit card or have never taken a loan.

- Range Between 350 to 549

This Credit score is considered a bad credit report it reflects that you are not paying your credit card bills or EMIs on time. With this credit report, you would face difficulties to get a loan approval or getting a credit card as you are at a high risk of turning into a defaulter.

- Range Between 550 to 549

This credit score is considered as fair as compared to the scores listed above. With this credit report range, only a few lenders or banks would give you a loan. With this credit report, you might have to pay a high rate of interest on your loan. You must take measures to improve your credit report.

- Range Between 650 to 749

This CIBIL report reflects that you are on the right path to improving your credit report. At that point, you should continue to display good credit behavior and increase your score further. With this credit report lenders and banks will offer you loans but with strong questions and negotiation and with a high rate of interest.

- Range Between 750 to 900

If you are having your credit report in this range then congratulation, banks as well as lenders, will offer you loans with exciting offers and a minimal rate of interest would be applied as this credit report reflects that you have an impressive payment history.

How to Check CIBIL Score Online

We advise you to check your credit report from time to time and for that, there are numerous methods by which you can check your credit report. You can check your credit report online by following mentioned points

- Firstly visit the official website of CIBIL

- A homepage will appear on your screen

- On the homepage click on the Get Your Credit Score Tab

- After clicking on it, fill in all the required details like Email ID, PAN Card Number, Mobile Number, etc.

- Attach an ID proof.

- Click on ‘Accept and continue

- You will receive an OTP on your registered mobile number. Type the required OTP and continue.

- Select ‘GO dashboard’ and check your credit score.

- You will redirected to the website, mycscore.CIBIL.com

- Click on member login and once you log in you can see your credit report.

Conclusion

CIBIL score is a very important aspect when it comes to taking loans and credit cards. A good credit report will get you an easy loan at a low-interest rate. To get a good credit report you need to pay your credit card bills and EMIs on time.