What Is Blank Cheque | What Is The Meaning Of Blank Cheque | Uses of Blank Cheque Explained | Why is it called blank cheque

There are various different types of cheques available in the banking organisations of India and you must have proper information related to each and every type of cheque so that you can take into consideration banking procedure without having to worry about the conclusions that this transaction method provides to all of the other users. You can check out the details related to the cheque given below and we will also share with you all the specifications of the Meaning, Definition & Uses of the Blank Cheque Explained.

Table of Contents

What is Cheque

Cheques are a great way through which you will be able to transfer your funds from one place to another without having to worry about the cash payments which can be a tough task to complete. You can exchange your cheque from one place to another and also you can transfer your cheque from one person to another which is a very easy method of payment of various types of things. You can easily write your cheque or take into consideration various procedures related to the cheques settlement. Writing a cheque can be a tough task but once you have got enough practice you will be able to write a cheque without any problem. The cheque needs to be filled with certain details related to the beneficiary and also the amount that you want to give.

Axis Bank Cheque Book Request By SMS

What is a Blank Cheque?

Sometimes it happens that you are writing a cheque for a future event that is still unknown so the concerned authorities will sign the check and will not write mandatory details inside the cheque and this check will be called a blank cheque. Often the field of the payment that is to be made by the cheque is left blank and here comes the name of the Blank Cheque. This practice is often taken into consideration when a cheque is made for the future uncertain event and the amount is written only when the event has taken place. The cheque already has a signature so it is important to take into concentration proper care of the cheque in order to avoid any type of misuse.

How To Fill Cheque Step BY Step Guide

Uses

Blank Cheques are used on the occasion of events that are uncertain and often the Blank Cheque are signed by the concerned authorities when they are not sure of the amount that they will have to give to the particular person unless and until a future event takes place. You can take into consideration Cheques when you are in a situation where you do not have any particular idea regarding the amount that you will have to pay or also you can take into concentration the blank Cheques when you are not sure about the name of the person that you are paying your money after you have signed the cheque and written the amount.

Details Required

The following details are required while you are writing a cheque:-

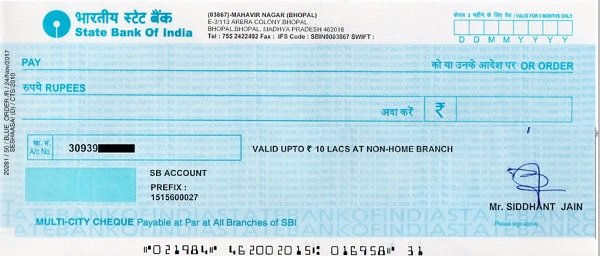

- Date: It is the date on which the cheque is issued. Remember that a cheque is valid only up to a period of three months from this date.

- Pay: The name of the person or the entity, to whom a payment is being made.

- Or bearer: If the cheque is not to be paid to a specific person but simply to anyone holding the cheque, these words can be left non-stricken at the end.

- Rupees: The amount of money that is being paid to the party.

- Amount in numbers: The amount which is being paid, should be written in numbers.

- Account number: This is pre-printed on the cheque beforehand.

- Authorised Signatory: This is the place where the issuer of the cheque makes his signature to authorise the cheque.

- Cheque number and MICR code: These are printed on the lower side of the cheque.

FAQs

You just need to sign the cheque while you are writing a blank cheque.

There must be the proper amount of money that you need to fill in the blank cheque taking into consideration the account balance of the account holder.

You must take care of the blank cheque because it can be easily misused if lost.