Axis Bank Privilege Credit Card Apply Online | Axis Bank Privilege Credit Card Annual Charges | Axis Bank Privilege Credit Card Benefits

Credit cards are especially available for people who love shopping and also want to take into consideration special rewards while they are shopping by using credit cards. Axis Bank provides a lot of different types of reward points on activation and milestone to all of the customers who have got the Axis Bank Privilege Credit Card and you will be easily able to achieve these benefits by applying for the Axis Bank privilege credit. We will also share with all of our readers this specification related to the Benefits, Annual Charges, And Apply Online.

Table of Contents

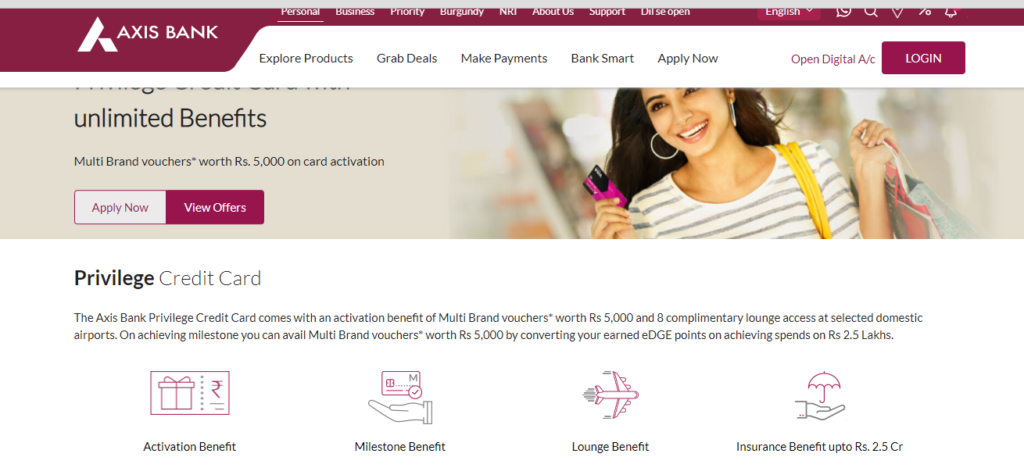

Axis Bank Privilege Credit Card

Axis Bank Privilege Credit Card is for the people who are looking for a credit card with a lot of awards and rewards you can earn up to 10 reward points on every shopping that you have done of more than 200 rupees by using this credit card and you will be able to double your benefit once you will reach the milestone of Rupees 2.5 lakh. This credit card will be special for the people who are spending more than 20,000 Rupees per month on shopping. You can check out the various reward points available inside this Axis Bank credit card by visiting the official website of the Axis Bank organization.

Benefits of Axis Bank Privilege Credit Card

There are a lot of benefits available by the Axis bank through their privileged credit card and given below we are specifying each one of them:-

- Multi-brand Vouchers on the Activation

- Axis Bank Privilege Credit Card gives 12,500 EDGE reward points that can be redeemed against multi-brand vouchers worth Rs. 5,000. This is applicable on the payment of the joining fee and on the completion of 3 transactions of minimum Rs. 200 each within 60 days.

- However, priority banking customers can earn 6,250 EDGE reward points, redeemable against multi-brand vouchers worth Rs. 2,500 on the completion of 3 transactions of minimum Rs. 200 each within 90 days.

- On the payment of joining fee of Rs. 1,500, you will get multi-brand vouchers worth double its value, which is quite impressive. These vouchers can be redeemed at multiple brands, such as Myntra, Lifestyle, Levi’s, Pizza Hut, The Body Shop and many more. This benefit of Axis Bank Privilege Credit Card is very beneficial for people who shop online.

- Spending Milestone Benefits

- You can spend Rs. 2.5 lakh in a year and convert your EDGE reward points into multi-brand vouchers worth twice the value. The denomination of multi-brand vouchers available under this benefit is Rs. 2,500. Also, spends done on both primary as well as add-on cards are eligible for this benefit.

- Annual fee reversal on spending Rs. 2.5 lakh in a year

- 3,000 EDGE reward points on renewal of your card

- Applicable on achieving annual spend of Rs. 2.5 lakh in an anniversary year of the credit card.

- Applicable on the payment of the annual fee levied on your credit card statement in the month of card setup.

- The spending milestone of this credit card is Rs. 2.5 lakh, which sums up to approximately Rs. 20,000 per month, which is quite high. For a cardholder, achieving the monthly spending limit of approximately Rs. 20,000 is not easily achievable. This would be a great option if you can easily achieve the spending milestone and maximize your benefits. Otherwise, you can look for similar credit cards that come with a low spending milestone.

- Exceptional Rewards Program

- You can earn Axis EDGE reward points for transactions and 500+ rewards and offers to redeem points. 10 reward points for every Rs. 200 spent through this credit card are offered for domestic as well as international transactions.

- The rewards rate offered with this annual fee is quite exemplary. If we talk about SBI Card Prime, it offers 20 reward points on every Rs. 100 spent only on utility bill payments and charges an annual fee of Rs. 2,999, whereas with Axis Bank Privilege Credit Card, you can avail of 10 reward points for every Rs. 200 spent with half of SBI Card Prime’s annual fees.

- Complimentary Lounge Access on Domestic Lounges

- You can avail of 2 complimentary airport lounge access per calendar quarter to selected domestic lounges with Axis Bank Privilege Credit Card. Here, domestic lounge access can be a drawback of this card as compared to other ones. For example, with SBI Card prime, you can avail of 8 and 4 complimentary lounge visits to domestic and international lounges, respectively. On the other hand, with this card, you can avail of 2 lounge access every quarter but only on domestic lounges. However, the benefit provided with respect to the annual fee is reasonable as SBI Card Prime charges Rs. 2,999 annually for its benefits.

- Fuel Benefit on Axis Bank Privilege Credit Card

- Axis Bank Privilege Credit Card also offers a fuel surcharge waiver of 1% (up to Rs. 400 per month) on transactions between Rs. 400 to Rs. 4,000. This waiver can be availed at all petrol pumps in India. However, no reward points are earned on fuel transactions.

- Other Benefits of Axis Bank Privilege Credit Card

- You can also avail of the common benefits, such as the EMI option, travel insurance coverage and more. Some of the other benefits offered by Axis Bank Privilege Credit Card include-

- Dining Benefits: You can save up to 20% at 4,000+ partner restaurants under the Dining Delights Program

- Convert purchases into EMIs: If you frequently swap your credit card and make purchases above Rs. 2,500, then you can easily convert them into EMIs

- Avail pre-planned experiences courtesy of ‘Extraordinary Weekends’ by Axis Bank

- In case of any fraud or unknown transaction, this card provides a purchase protection plan of up to Rs. 1 lakh

- You can also avail of the common benefits, such as the EMI option, travel insurance coverage and more. Some of the other benefits offered by Axis Bank Privilege Credit Card include-

- Air accident cover worth Rs. 2.5 crore

- Credit shield of Rs. 1 lakh

- Loss travel document cover of up to $300

- Delay of check-in baggage cover of up to $300

- Loss of check-in baggage cover of up to $300

Eligibility Criteria

The applicant must follow the following eligibility criteria to apply for the Axis Bank Privilege Credit Card:-

- The age of the primary cardholder should be 18 to 70 years.

- The age of the add-on cardholder should be over 18 years.

- The minimum income of the applicant must be Rs.6 lakhs per annum.

- The applicant must be an Indian resident.

Axis Bank Mobile Number Registration

Annual Charges

The detailed fee structure of Axis Bank Privilege Credit Card is provided below:-

| Privilege Credit Card | Charges |

| Standard Joining Fee | Rs. 1500 (Nil for Priority Customers only) |

| Standard Annual Fee (2nd year onwards) | Rs. 1500 |

| Standard Add-on Card Joining Fee | Nil |

| Standard Add-on Card Annual Fee | Nil |

| Finance Charges (Retail Purchases & Cash) | 3.40% per month (49.36% per annum) |

| Cash Withdrawal Fees | 2.5% (Min. Rs. 500) of the Cash Amount |

| Fee for Cash Payment | Rs. 100 |

| Card Replacement | Rs. 100 |

| Duplicate Statement Fee | Waived |

| Overdue Penalty or Late Payment Fee | Nil if Total Payment Due is up to Rs. 300 Rs. 100 if the total payment due is between Rs. 301 – Rs. 500 Rs. 500 if the total payment due is between Rs. 501 – Rs. 1,000 Rs. 500if the total payment due is between Rs. 1,001 – Rs. 10,000 Rs. 750 if the total payment due is between Rs. 10,001 – Rs. 25,000 Rs. 1000 if the total payment due is between Rs. 25,001 and 50,000 Rs. 1000 if the total payment due is greater than Rs.50,000 |

| Over Limit Penalty | 2.5% of the over-limit amount (Min. Rs. 500) |

| Charge Slip Retrieval Fee or Copy Request Fee | Waived |

| Outstation Cheque Fee | Waived |

| Cheque return or dishonour fee or auto-debit reversal | 2% of the payment amount subject to min. Rs. 450 |

| Surcharge on purchase or cancellation of Railway Tickets | As prescribed by IRCTC/Indian Railways |

| Fuel Transaction Surcharge | 1% of transaction amount (Refunded for fuel transactions between Rs. 400 and Rs. 4000) |

| Foreign Currency Transaction Fee | 3.50% of the transaction value |

| Mobile Alerts for Transactions | Waived |

| Hotlisting Charges | Waived |

| Balance Enquiry Charges | Waived |

Documents Required

Applicants must also submit KYC Documents, which include Proof of Identity, income and Address. The table below shows some documents that are generally accepted by the bank:-

| Proof of Identity | PAN Card, Aadhaar card, Driver’s License, Passport, Voter’s ID, Overseas Citizen of India Card, Person of Indian Origin Card, Job card issued by NREGA, Letters issued by the UIDAI |

| Proof of Address | Aadhaar card, Driver’s License, Passport, Utility Bill not more than 3 month’s old, Ration Card, Property Registration Document, Person of Indian Origin Card, Job card issued by NREGA, Bank Account Statement |

| Proof of Income | Latest one or 2 salary slip (not more than 3 months old), Latest Form 16, Last 3 months’ bank statement |

How To Apply For an Axis Bank Privilege Credit Card?

There is a very easy procedure that you will have to follow in order to apply for a credit card:-

- You will first have to visit the official website of Axis bank and then you will have to click on the option called Retail

- You will now have to click on the option called cards and then click on the option called Credit Card.

- Click on the option called Axis Bank privilege credit card and a new page will be displayed on your screen with all of the benefits related to this card.

- Read the details related to the benefits available inside this card and you have to click on the option called Apply Now.

- Enter the questions displayed on the screen and enter all of the information asked by the concerned authorities to successfully submit the application for your card.

Customer Care

- Dial 1-860-419-5555 or 1-860-500-5555 to contact the Axis bank credit card customer care.

FAQs For Axis Bank Privilege Credit Card

You will have to visit the official website of Axis bank and you will have to check out the various details related to the Axis Bank privilege credit card.

There are different types of charges that you will have to give in order to get the Axis Bank privilege card delivered to you online.

Yes, all of the customers will have to pay the annual charges even if they are not using the card which is one of the limitations of this card.

It will take around 15 to 20 days for the credit card to show up at your doorstep after you have applied for it online.