Post Office Atal Pension Yojana Online Registration | Post Office Atal Pension Yojana Form | Post Office Atal Pension Yojana Statement | Atal Pension Chart

The Atal Pension Yojana (APY) is a government-run pension system that is available to all Indian citizens, with a concentration on the unorganised sector. The Pension Fund Regulatory and Development Authority (PFRDA) administers APY on behalf of the National Pension System (NPS).

Beneficiaries are given a minimum monthly pension of Rs.1000 to Rs.5000 under this scheme. Subscribers can choose a monthly pension of 1000, 2000, 3000, 4000, or 5000 rupees, which will begin after they reach the age of 60. The amount of pension a person receives is directly proportional to their age when they first joined APY and the monthly amount they contribute.

Table of Contents

Post Office Atal Pension Yojana Details

Some of the primary characteristics of the Atal Pension Yojana are as follows:

- All Indians between the ages of 18 and 40 can subscribe.

- After the subscriber reaches the age of 60, the pension will begin.

- Monthly pension amounts of Rs. 1000, Rs. 2000, Rs. 3000, Rs. 4000, and Rs. 5000 are available. Amounts of contributions will be computed accordingly.

- The system requires a bank account, and the deposit amount is automatically deducted from the account on a regular basis.

- Contributions to the Atal Pension Yojana are deductible under Section 80CCD of the Income Tax Act.

APY Objectives

The Atal Pension Yojana aims to achieve the following important goals:

- Housekeepers, gardeners, and delivery boys as unorganised sector.

- Assure citizens’ safety and safeguard them from illnesses, accidents, and diseases.

Atal Pension Yojana Eligibility Criteria

- The APY allows any Indian nationals between the ages of 18 and 40 to apply for a pension after reaching the age of 60.

- The person applying for the scheme’s benefits must have contributed for at least 20 years.

- Individuals participating in the Swavalamban Yojana will be automatically moved to the Atal Pension Scheme.

How to Open Atal Pension Yojana Account

- Fill out the APY registration form and submit it to your local bank branch.

- Give your bank account number, Aadhar number, and cell phone number.

- At the time of account opening, your first contribution will be deducted from your associated bank account.

- You will receive an acknowledgment number/PRAN number from your bank.

- Subsequent contributions will be taken from your bank account automatically.

How to Get the APY Form

The account opening form for the Atal Pension Yojana can be simply accessed offline at a participating bank branch near you. However, other websites, such as the Pension Fund Regulatory and Development Authority (PFRDA) Official Website, offer free downloads of the APY application form.

Alternatively, the Atal Pension Yojana subscription form is available online via a variety of banking websites, including those of most major Indian banks (both private and public-sector).

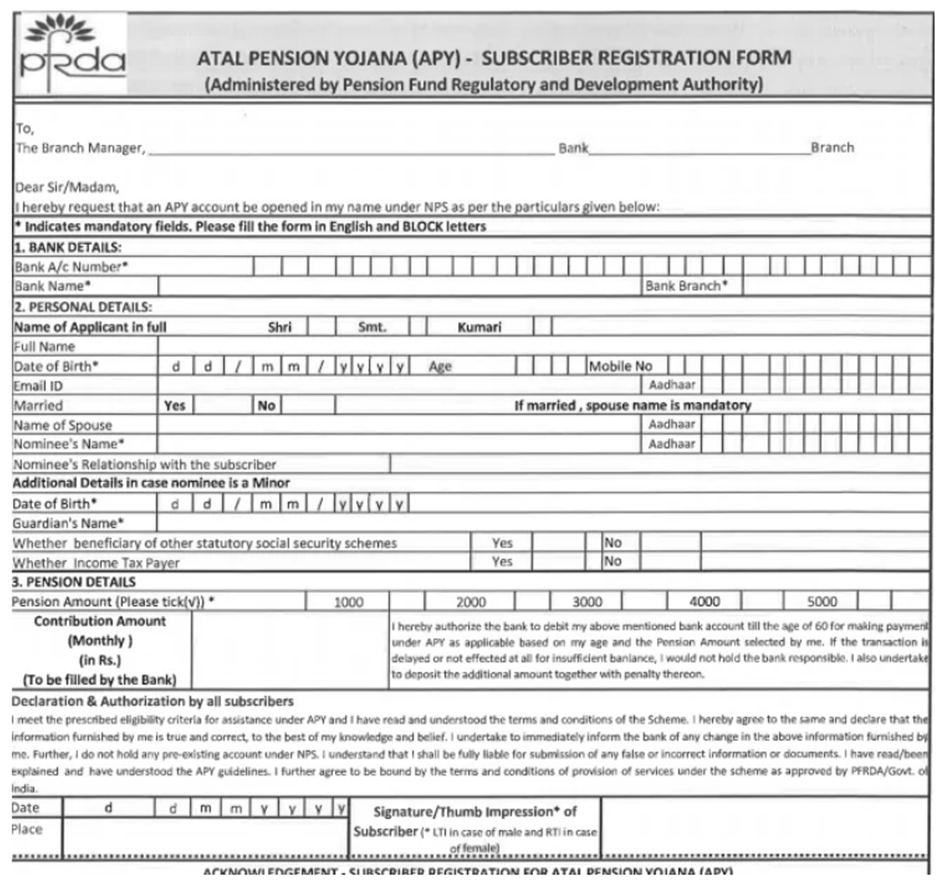

Atal Pension Yojana Sample Form

The Atal Pension Yojana Form, which may be downloaded for free from the PFRDA website, looks like this:

How to Complete the Application Form

The following crucial fields on the Atal Pension Yojana application form must be filled out accurately before the application can be submitted:

- Section 1: Bank information such as account numbers, bank names, and bank branches.

- Section 2: Personal information such as the

- Applicant’s name,

- Date of birth,

- Email address,

- Marital status,

- Spouse’s name,

- Nominee’s name,

- Nominee’s relationship with the subscriber,

- Subscriber’s age, and

- Subscriber’s mobile number.

- Details from the spouse’s and nominee’s Aadhar cards.

If the APY applicant does not have an account with the bank through which they are applying, they must open one with a scheduled bank that uses the core banking infrastructure. The remaining stages are the same for existing Bank Account holders once the bank account is up and running.

The application form must be signed by the subscriber and delivered to the bank once it has been entirely filled out. “Acknowledgement – Subscriber Registration for Atal Pension Yojana (APY)” is written on the Acknowledgement section of the APY form. Once the application has been processed, a Bank Official will fill out this form and sign/stamp it.

Open Post Office Savings Account

Atal Pension Yojana Contribution

- You must supply your savings bank account information, your cell phone number, and an authorization letter authorising the bank to deduct your contribution automatically every month. This is referred to as an auto-debit method.

- Contributions can be made on a monthly, quarterly, or half-yearly basis, with the appropriate auto debit instruction.

- The account must be sufficiently filled to carry out the standing instruction to transfer money to the APY scheme on a regular basis.

- The first date of contribution determines the due date for monthly contributions. This date will be used for all subsequent submissions. If you make your initial contribution on January 14th, your next due date will be February 14th, and so on.

- Also required is the submission of an Aadhaar card, which is used as the primary document for KYC to identify the subscriber, spouse, and nominee. To minimise future disputes over pension and corpus rights and entitlements, an identification document is required.

Is It Possible to Modify Your APY Pension Payout?

- The amount of the pension can be changed by the subscriber at any time during the contributing term. Once a year, in the month of April, this can be done.

- In the event of a pension downgrade, the difference will be repaid to the donor via direct credit to an APY-registered bank account.

- The APY account can be upgraded or downgraded for a fee. The bank would impose a one-time fee of Rs. 25.

- Because the subscription will be for at least 20 years, the subscriber must be committed for the long term (in case subscriber enters scheme at age of 40 years).

How to Make a Contribution To The Atal Pension Yojana

Set up an auto-debit instruction with your bank to contribute to the Atal Pension Yojana. This is the only way to contribute. If you do not have enough money in your account to cover the auto-debit, you will be charged the following penalty:

- If your monthly contribution is less than Rs. 100, you will be fined a penalty of Rs. 1.

- If your monthly payment is between Rs. 101 and Rs. 500, the charge will be Rs. 2 each month.

- If your monthly payment is between Rs. 501 and Rs. 1000, you will be charged Rs. 5 as a penalty.

- If the monthly contribution exceeds Rs. 1,001, a penalty of Rs. 10 will be imposed.

What Happens If You Don’t Make an APY Contribution?

If you sign up for APY but don’t contribute to the pension system on a regular basis due to a failed auto-debit instruction, the following happens:

- After six months of non-payment, the Atal Pension Yojana account gets frozen.

- After 12 months of non-payment, the APY account will be deactivated.

- After 24 months of non-payment, the APY account will be automatically closed.

- The Bank has until the last day of the month to collect the outstanding balance. Funds can be withdrawn whenever funds are available in the APY-linked bank account and at any time during the month.

Note: Banks provide monthly mobile alerts to APY customers to prevent late payments.

Fees and Charges for Maintaining an APY Account

| Intermediary | Activity | Relevant Charges |

| Point of Presence | Registration of APY Subscriber | Rs.120 to 150, which depends on the number of subscribers |

| Recurring Charges Per Annum | Rs. 100 per subscriber | |

| Central Recordkeeping Agencies | APY Account opening charges | Rs. 15 per account |

| Account maintenance charges | Rs. 40 per account per annum | |

| Custodian | Investment maintenance Fee (per annum) | 0.0075% for electronic & 0.05% for physical segment of AUM* |

| Pension Fund Managers | Investment maintenance Fee (per annum) | 0.0102% of AUM* |

*AUM – Assets under Management

How to invest APY Money?

Because you earn a guaranteed pension with the APY, the investing details are less important than they are with the NPS. Only if the investment return exceeds the guaranteed pension amount does it matter. On the death of the subscriber, a higher pension amount or higher corpus return will be available for nominees.

- Government securities – a minimum of 45 percent and a maximum of 50 percent are required.

- Bank term deposits and debt securities have a minimum of 35 percent and a maximum of 45 percent.

- Minimum of 5% and maximum of 15% in equity and associated instruments

- Asset-Backed Securities, etc. – a maximum of 5%

- Money Market Instruments – a maximum of 5%.

NPS Swavalamban Scheme

The Swavalamban Yojana was a government-sponsored pension system. The initiative was designed for India’s unorganised sector. The Atal Pension Yojana has taken the place of this scheme. Existing Swavalamban scheme subscribers were automatically migrated to APY, with the option to opt-out. Subscribers were also allowed to go to their nearest authorised bank and convert their Swavalamban account into APY with PRAN data if there was no transfer. Those who choose not to participate received government assistance only up to 2016/2017, assuming they were found to be eligible. They were allowed to stay in the Swavalamban scheme until they were 60 years old. Subscribers to the Swavalamban plan who were above the age of 40 and did not want to continue might opt out by withdrawing their whole contribution in one lump sum.

Atal Pension Yojana Advantages

Subscribers to the Atal Pension Yojana can take advantage of a variety of perks. The following is a summary of the major advantages of this government-sponsored pension plan:

- Government of India guarantees payouts, therefore it’s a low-risk retirement alternative.

- Depending on the subscriber’s contributions, a guaranteed pension of Rs. 1,000, Rs. 2000, Rs. 3000, Rs. 4000, or Rs. 5,000 is available.

- Contributions to APY are tax deductible under Section 80CCD (1) of the Income Tax Department Act of 1961.

- It is simple for Indian residents, whether self-employed or salaried, to sign up.

- Even people who contribute to other private/government-sponsored pension plans can join APY.

- In the event of the APY subscriber’s death, the spouse/nominee/next of kin is guaranteed benefits according to the applicable rules.

- Flexible subscriptions are available, as the pension amount can be enhanced or lowered at the discretion of the subscriber.

- Subscribers have the choice of paying on a monthly, quarterly, or half-yearly basis, giving them a lot of flexibility.

- Workers in both the organised and unorganised sectors are eligible to join APY.

Tax Benefits for APY Subscribers

Because the Atal Pension Yojana is a government-approved pension plan, it provides tax benefits up to the yearly maximum of Rs. 1.5 lakh under Section 80C of the Income Tax Act, 1961. In addition, under the comparatively newer Section 80CCD (1) of the Income Tax Act, 1961, APY is eligible for an extra benefit of up to Rs. 50,000 per year. This additional advantage of up to Rs. 50,000 per year applies to National Pension System contributions and is in addition to the Rs. 1.5 lakh yearly tax exemption benefit provided under section 80C.

Rajasthan Social Security Pension Scheme

APY Account Closure and Exit

Closure of an APY account and exit from the scheme are only permitted in the event of terminal sickness or death. Upon the subscriber’s death, the full APY corpus is paid to the nominee, according to the information specified on the APY account opening form.

The government would contribute to this initiative in order to increase the popularity of APY among unorganised workers. The government would add 50 per cent of the amount contributed by the beneficiary per year or Rs. 1000 per year, whichever is lesser, as a co-contribution. This co-contribution will be made by the government for five years, from Financial Year 2015-16 to Financial Year 2019-20. Subscribers who benefit from the co-contribution cannot be members of any statutory social security programme and are not required to pay income tax (meaning their income should be below the income tax threshold).

Calculation of the Atal Pension Yojana

The Atal Pension Yojana is calculated using the following formula:

- The amount of retirement income that the applicant wishes to receive

- The applicant’s age when he or she gets enrolled in the programme.

The factors stated above have a direct impact on one another-

- Early membership in the scheme results in lower monthly contributions. For example, if you join the scheme when you’re 18, you’ll have 42 years to meet your retirement target.

- Similarly, if you join the plan at the age of 40, you will have 20 years to reach your end objective, but your monthly payment amount would be larger.

At the age of 18, the minimum contribution to get Rs.1000 as a pension is Rs.42. At the age of 40, the maximum payment of Rs.1454 will be given in exchange for a pension of Rs.5000.

The Atal Pension Yojana computation currently provides varying needed contribution amounts depending on whether you contribute to the plan monthly, quarterly, or half-yearly, as well as your intended monthly pension amount.

The tabular representations of monthly, quarterly, and half-yearly contributions required to attain a specific target established by the candidate are shown below:

Bihar Student Credit Card Scheme

Indicative APY Monthly Contribution Chart

The following chart displays the monthly contribution amount based on the age of entry into the scheme and the target monthly pension amount wanted after retirement if you were to invest in an APY program every month. This Atal Pension Yojana computation is indicative, and the real amount you’ll need to contribute could vary at any time. The chart below summarises your monthly contribution requirements for this pension plan:

| Entry Age (years) | Total Years of Contribution | Monthly Contribution Amount Required | ||||

| Monthly Pension of Rs. 1000 | Monthly Pension of Rs. 2000 | Monthly Pension of Rs. 3000 | Monthly Pension of Rs. 4000 | Monthly Pension of Rs. 5000 | ||

| 18 | 42 | 42 | 84 | 126 | 168 | 210 |

| 19 | 41 | 46 | 92 | 138 | 183 | 228 |

| 29 | 40 | 50 | 100 | 150 | 198 | 248 |

| 21 | 39 | 54 | 108 | 162 | 215 | 269 |

| 22 | 38 | 59 | 117 | 177 | 234 | 292 |

| 23 | 37 | 64 | 127 | 192 | 254 | 318 |

| 24 | 36 | 70 | 139 | 208 | 277 | 346 |

| 25 | 35 | 76 | 151 | 226 | 301 | 376 |

| 26 | 34 | 82 | 164 | 246 | 327 | 409 |

| 27 | 33 | 90 | 178 | 268 | 356 | 446 |

| 28 | 32 | 97 | 194 | 292 | 388 | 485 |

| 29 | 31 | 106 | 212 | 318 | 423 | 529 |

| 30 | 30 | 116 | 231 | 347 | 462 | 577 |

| 31 | 29 | 126 | 252 | 379 | 504 | 630 |

| 32 | 28 | 138 | 276 | 414 | 551 | 689 |

| 33 | 27 | 151 | 302 | 453 | 602 | 752 |

| 34 | 26 | 165 | 330 | 495 | 659 | 824 |

| 35 | 26 | 181 | 362 | 543 | 722 | 902 |

| 36 | 24 | 198 | 396 | 594 | 792 | 990 |

| 37 | 23 | 218 | 436 | 654 | 870 | 1087 |

| 38 | 22 | 240 | 480 | 720 | 957 | 1196 |

| 39 | 21 | 264 | 528 | 792 | 1054 | 1318 |

| 40 | 20 | 291 | 582 | 873 | 1164 | 1454 |

Indicative APY Quarterly Contribution Chart

It is possible to calculate the quarterly payment that you are needed to make to the pension scheme based on your age of admission as well as your desired monthly pension amount using the Atal Pension Yojana calculating methodology. The quarterly contribution chart below shows indicative figures that may change at a later date:

| Entry Age (years) | Total Years of Contribution | Quarterly Contribution Amount Required | ||||

| Monthly Pension of Rs. 1000 | Monthly Pension of Rs. 2000 | Monthly Pension of Rs. 3000 | Monthly Pension of Rs. 4000 | Monthly Pension of Rs. 5000 | ||

| 18 | 42 | 125 | 250 | 376 | 501 | 626 |

| 19 | 41 | 137 | 274 | 411 | 545 | 679 |

| 29 | 40 | 149 | 298 | 447 | 590 | 739 |

| 21 | 39 | 161 | 322 | 483 | 641 | 802 |

| 22 | 38 | 176 | 349 | 527 | 697 | 870 |

| 23 | 37 | 191 | 378 | 572 | 757 | 948 |

| 24 | 36 | 209 | 414 | 620 | 826 | 1031 |

| 25 | 35 | 226 | 450 | 674 | 897 | 1121 |

| 26 | 34 | 244 | 489 | 733 | 975 | 1219 |

| 27 | 33 | 268 | 530 | 799 | 1061 | 1329 |

| 28 | 32 | 289 | 578 | 870 | 1156 | 1445 |

| 29 | 31 | 316 | 632 | 948 | 1261 | 1577 |

| 30 | 30 | 346 | 688 | 1034 | 1377 | 1720 |

| 31 | 29 | 376 | 751 | 1129 | 1502 | 1878 |

| 32 | 28 | 411 | 823 | 1234 | 1642 | 2053 |

| 33 | 27 | 450 | 900 | 1350 | 1794 | 2241 |

| 34 | 26 | 492 | 983 | 1475 | 1964 | 2456 |

| 35 | 26 | 539 | 1079 | 1618 | 2152 | 2688 |

| 36 | 24 | 590 | 1180 | 1770 | 2360 | 2950 |

| 37 | 23 | 650 | 1299 | 1949 | 2593 | 3239 |

| 38 | 22 | 715 | 1430 | 2146 | 2852 | 3564 |

| 39 | 21 | 787 | 1574 | 2360 | 3141 | 3928 |

| 40 | 20 | 867 | 1734 | 2602 | 3469 | 4333 |

Indicative APY Half-Yearly Contribution Chart

The chart below was created using current APY calculation criteria in the event that half-yearly contributions were made over a set length of time in order to get the desired pension amount after reaching the age of 60. The values provided in the following table as half-yearly contribution amounts are indicative and may change at a later period.

| Entry Age (years) | Total Years of Contribution | Half-Yearly Contribution Amount Required | ||||

| Monthly Pension of Rs. 1000 | Monthly Pension of Rs. 2000 | Monthly Pension of Rs. 3000 | Monthly Pension of Rs. 4000 | Monthly Pension of Rs. 5000 | ||

| 18 | 42 | 248 | 496 | 744 | 991 | 1239 |

| 19 | 41 | 271 | 543 | 814 | 1080 | 1346 |

| 29 | 40 | 295 | 590 | 885 | 1169 | 1464 |

| 21 | 39 | 319 | 637 | 956 | 1269 | 1588 |

| 22 | 38 | 348 | 690 | 1045 | 1381 | 1723 |

| 23 | 37 | 378 | 749 | 1133 | 1499 | 1877 |

| 24 | 36 | 413 | 820 | 1228 | 1635 | 2042 |

| 25 | 35 | 449 | 891 | 1334 | 1776 | 2219 |

| 26 | 34 | 484 | 968 | 1452 | 1930 | 2414 |

| 27 | 33 | 531 | 1050 | 1582 | 2101 | 2632 |

| 28 | 32 | 572 | 1145 | 1723 | 2290 | 2862 |

| 29 | 31 | 626 | 1251 | 1877 | 2496 | 3122 |

| 30 | 30 | 685 | 1363 | 2048 | 2727 | 3405 |

| 31 | 29 | 744 | 1487 | 2237 | 2974 | 3718 |

| 32 | 28 | 814 | 1629 | 2443 | 3252 | 4066 |

| 33 | 27 | 891 | 1782 | 2673 | 3553 | 4438 |

| 34 | 26 | 974 | 1948 | 2921 | 3889 | 4863 |

| 35 | 26 | 1068 | 2136 | 3205 | 4261 | 5323 |

| 36 | 24 | 1169 | 2337 | 3506 | 4674 | 5843 |

| 37 | 23 | 1287 | 2573 | 3860 | 5134 | 6415 |

| 38 | 22 | 1416 | 2833 | 4249 | 5648 | 7058 |

| 39 | 21 | 1558 | 3116 | 4674 | 6220 | 7778 |

| 40 | 20 | 1717 | 3435 | 5152 | 6869 | 8581 |

Return of Corpus to the Nominees and Beneficiaries of APY

In the event that an Atal Pension Yojana subscriber dies, the subscriber’s nominee or beneficiary will receive the following compensation based on the monthly pension amount chosen by the subscriber:

| Monthly Pension Amount (in Rupees) | Return of Corpus to the nominee of the subscriber (in Rupees) |

| 1000 | 170,000 |

| 2000 | 340,000 |

| 3000 | 510,000 |

| 4000 | 680,000 |

| 5000 | 850,000 |

FAQ’s

Yes, Atal Pension Yojana investments qualify for a tax deduction under section 80CCD of the Income Tax Act of 1961.

Yes, it is correct. The Atal Pension Yojana allows any Indian resident between the ages of 18 and 40 to apply for a pension, regardless of whether they are salaried or self-employed.

Yes, it is correct. If you want to participate in the Atal Pension Yojana, you must have a bank account.