Withdraw PF Amount Online with UAN, Withdraw PF Amount offline Procedure, How to withdraw PF amount online, How to withdraw PF online with UAN

In case of emergencies or unemployment, one thing that comes to our mind is money. Arranging money at that critical time becomes an instant headache. The Provident fund becomes a savior in those hard times, from our PF account we can withdraw amounts in those critical situations. In this article we are sharing the PF withdrawal process, read this article till the end for complete information.

Table of Contents

What is Provident Fund?

Provident fund is the scheme that was introduced with the motive to help salaried employees to do savings. The saving scheme is introduced by the government of India for the better future of employees. In this scheme, the amount is added on a monthly basis which will be helpful after retirement. The employer and the employee both contribute to this fund. Every employee has one universal account number (UAN). If any employee decides to change the company then the PF account will change but the UAN will remain the same.

Withdraw PF Amount Online

The individual can withdraw money from their PF account in case of emergencies like marriage, repayment of loans, medical treatment, etc. One can also withdraw the PF amount in case of unemployment for more than 3 months. The employee also has the option to withdraw money fully or partially.

Benefits of Provident Funds

- Future security– It provides future security to the employees.

- Flexibility – It helps employees to use their money at any time by allowing them to withdraw the amount in parts.

- Good investment– with the help of this scheme the employee can do a big investment for his future by just contributing on monthly basis.

- Retirement Benefits- After retirement, the employees receive a huge amount that helps in dealing with increasing market rates.

- Tax benefits- The amount which is added to the PF account is allowed for tax exemption.

Important Points to Remember PF Withdrawal Process

- Keep UAN ready.

- Aadhar number should be linked and verified with UAN.

- The bank account you are planning to receive should be linked with Aadhaar.

- If you want to make any changes then complete the EKYC process and make sure you update all your all details before submitting the claim.

Important Documents Required for Online and Offline PF Withdrawal

- Composite claim form

- Identity proof

- Address proof

- Bank account details

- Two revenue stamps

- One blank or canceled cheque

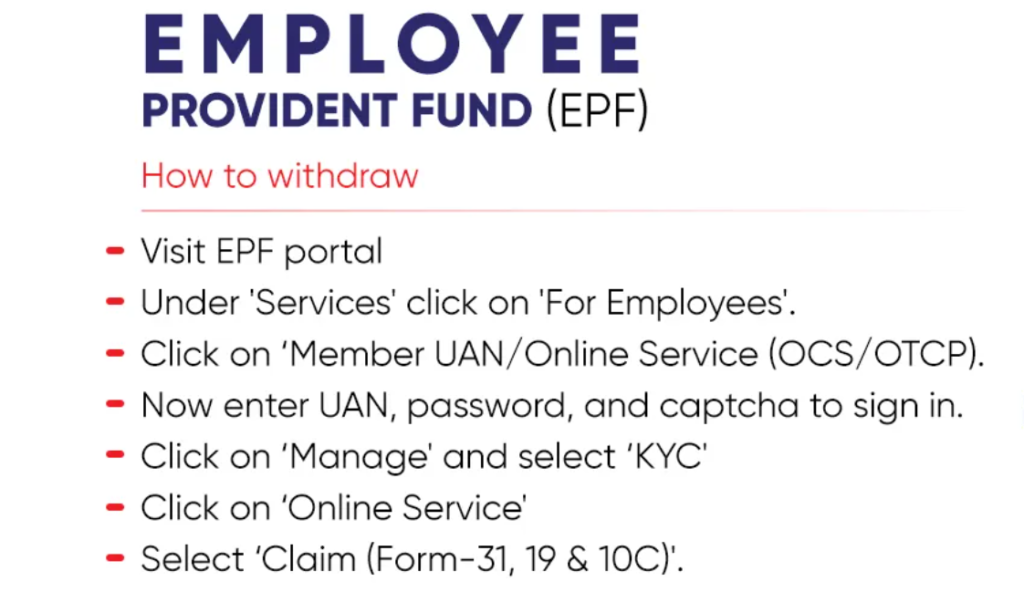

Withdraw PF Amount Online Procedure

It is very easy to withdraw money from a PF account with the help of UAN. Here we are sharing the online PF Withdrawal Process.

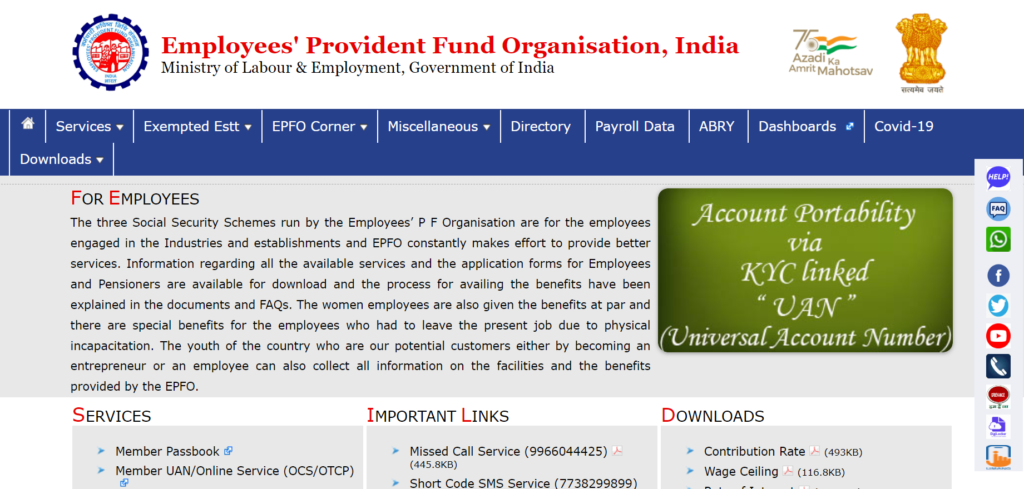

- First, visit the Official Website of EPF

- A homepage will appear on your screen

- On the homepage, Click on Service Tab and then click on Employees Tab

- A new section of Services will appear on the bottom left corner of the screen.

- Now click on Member UAN/Online Service (OCS/OTCP).

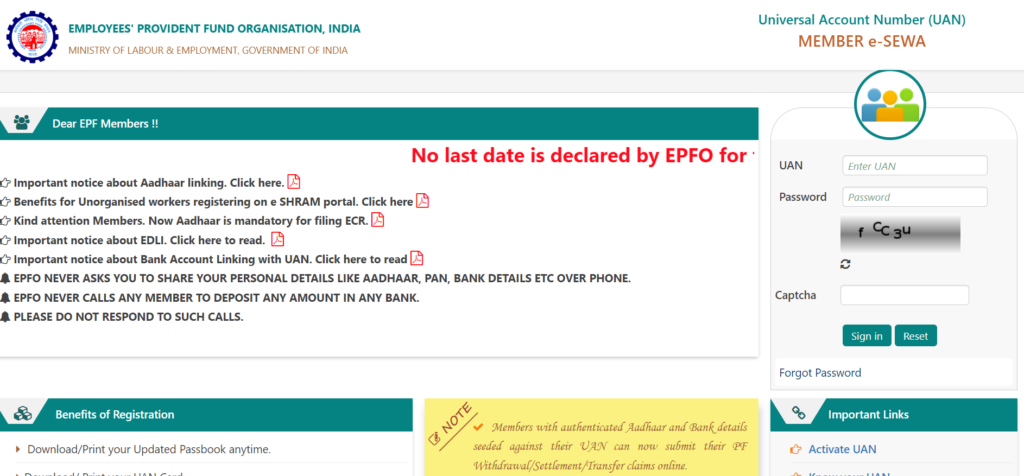

- Login with the help of a UAN number and password

- If anyone forgets the password then he can easily reset the password by receiving OTP in his registered mobile number.

- Click the online claims section.

- After opening the online claim section, enter the correct bank details as a part of the verification process.

- Confirm all terms and conditions.

- Click on proceed for the online claim option.

- In the drop menu, select the reason for withdrawing money. You have to enter your complete address.

- If you have selected the Advance claim option then you may be asked to upload your cheque or passbook details.

- Click on accept all terms and conditions then request a one-time password for verification. You will receive OTP at your registered mobile number with your Aadhaar.

- After entering the correct OTP, your claim will be submitted.

- After completing the process of submission, the employee can also track his claim by logging into the Member e-SEWA portal account. After verification of the documents, the claim will be processed and soon you will receive the amount in a bank account that is linked with your UAN.

Withdraw PF Amount Offline Procedure

- Visit the EPFO office to collect form composite form

- Fill out the composite form and submit it at the EPFO office.

- There will be two types of forms The Aadhaar form does not need any attestation. Another one is non-Aadhaar which needs attestation from the employer.

- Attach all the documents asked.

- Complete the procedure by submitting the form at the office.

Conclusion

The government of India has introduced the Provident Fund for the better future of employees. Employees can easily withdraw the amount from their provident fund in case of emergency. PF provides financial security to employees after their retirement or in old age. We hope you get the complete online and offline withdrawal process of the provident funds.