Business funding plays a key role in business start-ups as well as business expansion. Every business needs an investment of funds, whether at the start-up level or at the operational level. It helps to grow and expand business in an upward direction. Finding the right funding for a business is not an easy task, it takes lots of effort and labor to get business funding. In this article, we are talking about businesses and business funding.

Table of Contents

What is Business?

Business is an activity where people work professionally with the motive to earn money. It is not easy to start a new business it has many risks and difficulties. In today’s world, there are many opportunities in the market to start short and long-term businesses. In the starting phase, every business has to face new market conditions. Every business should have good planning to survive in the market.

Types of Business

There are two types of Business, Short Term Business, and Long Term Business

- Short-Term Business- Short-term business is the organizations that focus on a short period of time. This business shows results within a year. Their aim is also focused on short-term needs like improving cash flow or introducing a new product.

- Long-Term Business- Long-term businesses are organizations that aim to work for a long period of time in the market. They work to stay long in the market by earning maximum profits. These organizations have fixed and clear long-term objectives. The long-term business needs finance for big projects and also for the expansion of the business.

Business Funding

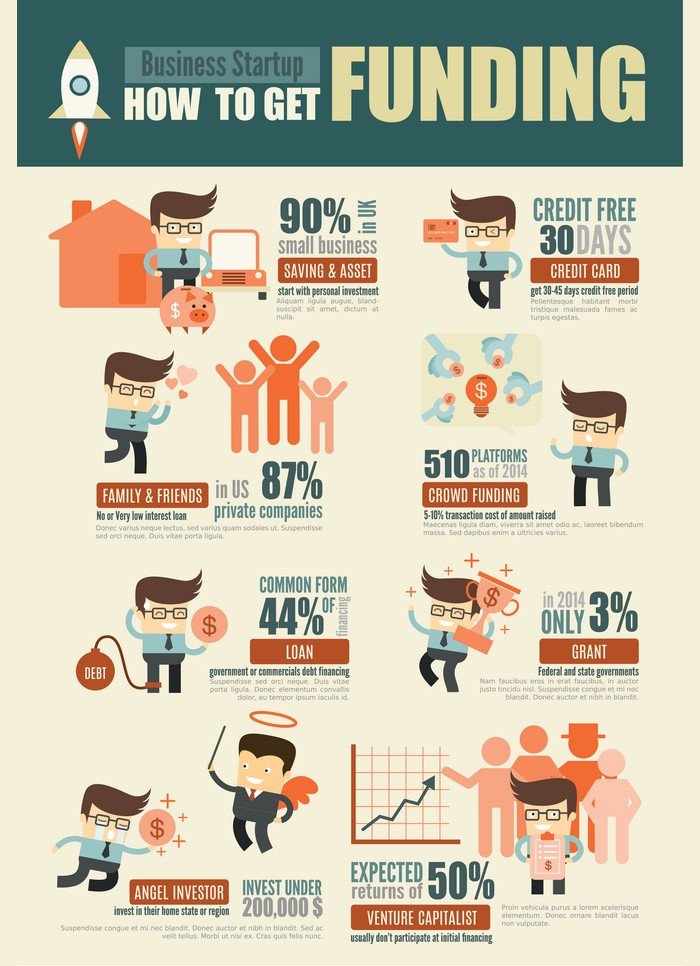

In the initial years of the business whether it is short-term business or long-term business there is a need for finance. Finance is considered the main part of every business. There are many ways to arrange finance for business it can be in form of a loan from the bank or it can be funding also. Taking a loan for a business is very normal but the financing options totally depend on what type of business you are going to start. Type of business, market conditions team ad place is the essential components of the business. Now, we will discuss how the business gets funding to run successfully.

Why There is a Need for Business Funding?

Business is the sales and purchase of goods and services. Financial support is needed to run the business properly, so the company looks for funding options. Here we are sharing a few business scenarios, where one can need financial funding.

- Establishment of New Company

- To meet the objectives of the company.

- Expansion of Business.

- To buy new machinery, office renovation, factory set-up, etc

- For recruiting new employees.

Important Points to Remember for Business Funding

Funding also depends upon specific details like planning, growth stage, and other factors. Make sure you have all these ready.

- Establish a business plan.

- You need to show investors that your business is capable of succeeding in order for them to invest in you.

- Maintain a detailed understanding of every detail like business strategy, business plan, future plans, etc

- You must inform your investors of their return on investment, or how much money they can expect to make as a result of the risks they take.

- The investors could ask you about your business planning and process of business establishment, so be ready and keep even minor details of your business on your tips.

Funding Option for Short-Term Business

- Angel investors– Angel investors are the group of people who wants to do investment in a business that has the potential to give maximum profits in the future. Angel investors also help small-term businesses by guiding them.

- Cloud funding– Cloud funding is also known as an online small business funding resource. It is the process to provide finance business through the internet. It is the platform where a number of investors are ready to invest by analyzing the ideas and plans of the business.

- Partners and Venture Capital (VC) – This is the easy way to help the business. Partners also help to raise capital. They can also become an employee of the business. Venture Capital gives helps the business by investing in the initial years. VC also invests with the motive to take the major share of a small business firm in order to make bigger investments.

- Government Schemes and Bank Loans– There are many benefits that are provided by the government to help in financing a small business. Pradhan Mantri Mudra Yojana is one of the many government schemes to support small businesses. Financial support will be provided by the government in the form of easy and low-interest loans to support Micro, Small, and Medium enterprises. Cooperative banks, MFIs, NBFCs, RRBs, etc. are the banks that provide loans to small businesses.

- The Small Business Administration (SBA) – The SBA is who promises to help in providing loans to small businesses. The best part of this is that it also promises loans for startups also. The SBA follows a proper channel, it doesn’t have a direct connection in providing loans it only guarantees loans so commercial banks can safely make them. The local bank will be responsible for looking at all processes of providing loans.

Funding Option for Short-Term Business

- Long-term bank loan– This is one of the options for the long-term business to arrange finance. The long-term bank loan includes many terms and conditions that the business has to agree to before taking the loan.

- Equipment loans– Banks provide these loans to businesses that are in manufacturing. The main aim of this loan is to help business to purchase new equipment and plant. In this loan, the bank gives a loan in crores.

- Alternative loans- This is the form of loan that businessmen generally takes. Private lenders, commercial lenders, and fintech lenders are those who work as investors and provide loans. In comparison to other methods, the rates are more but these loans are easy to take.

- Business Line of Credit– A business line of credit is a business loan. In the Business line of credit, the borrower will be provided with the desired amount in form of a loan. The borrower can choose to use a small amount of the sanctioned amount instead of using the entire amount, and the bank will charge interest only on the amount actually used rather than the whole sanctioned amount. In simple words, a business line of credit works on the principle of the credit card.

- Personal Saving- Many people use their personal savings to start their businesses. Personal saving is the best way to start your business, as you don’t need to pay any interest on the amount unlike loans, Business Line of Credit, etc

Conclusion

The management of the business should be very attentive at the time of asking for funds. They should choose appropriate sources of funds as many of them may not result in good benefits. In today’s time, getting funds is not a difficult task.