Table of Contents

Introduction

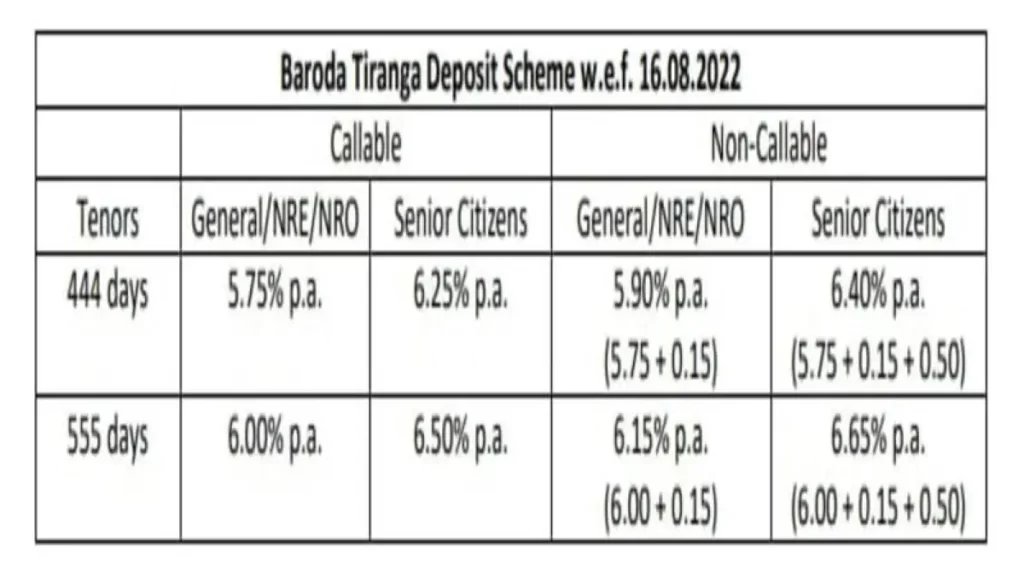

In Tuesday’s announcement, the Bank of Baroda (BoB) unveiled a special Tiranga fixed deposit scheme called the ‘Baroda Tiranga Deposit Scheme’, which offers higher interest rates and it is paperless. If you invest Rs 1 lakh for 555 days in non-callable deposit, they will days will grow to over Rs 1.26 lakh at maturity. In the case of senior citizens who make a non-callable deposit of 555 days, the maturity amount is over Rs 1.28 lakh.

What is Tiranga Fixed Deposit Scheme?

It offers a higher interest rate and the flexibility to choose between two tenures, all backed by one of India’s leading banks. Bank of Baroda divided this scheme into two different groups based on the age of the customer and the category of the customer. There are two types of this fixed deposit offered by Bank of Baroda under this scheme callable fixed deposit and non-callable fixed deposit

- Customers are allowed to withdraw money prematurely from callable fixed deposits.

- Customers are not allowed to withdraw money prematurely from Non-Callable Fixed Deposit. It also offers a high rate of interest compared to callable FD.

| Name of Scheme | Tiranga Fixed Deposit Scheme |

| Name of Bank | Bank of Baroda |

| Scheme announced on | 16th August 2022 |

| Last Date of Application | 31st August 2022 |

| Tenure | 444 Days and 555 Days |

| Rate of Interest | 5.5% p.a to 6.5 % p.a |

Benefits of BOB Tiranga Fixed Deposit Scheme

The benefits of BOB fixed deposit are as follows-

- Customers will get an assured rate of return with utmost safety.

- Tiranga Fix deposit will help you in saving tax.

- It is useful in an emergency.

- Easy loans are provided against the FD

How to Open Bank of Baroda Tiranga Fixed Deposit Scheme

Customers of BOB are able to avail the benefits of this scheme by downloading the BOB world app on their smartphones. Tiranga fixed deposit scheme will be easily operated from BOB World mobile as it is completely paperless. Senior citizens of India who are not able to walk through the bank branch will find this scheme very convenient.

Tiranga Fixed Deposit Scheme Interest Rate and Tenure

- Interest Rate for 444d Days Callable Fix Deposit– As per the statement of BOB, 440 days callable fixed deposit scheme will be available for a general account, non-residential external account (NRE), and non-resident ordinary account (NRO) and they will get an interest rate of 5.5% P.A. On the other hand, senior citizens will get a 6.25% p.a rate of interest under this category of fixed deposit

- Interest Rate for 444 Days Non-Callable Fix Deposit- Bank of Baroda said that in this category general account, non-residential external account (NRE), and nonresident ordinary account (NRO) will get an interest rate of 5.9% p.a whereas senior citizens will get an interest rate of 6.4% p.a

- Interest Rate for 555 Days Non-Callable Fix Deposit- Customers will get a higher rate of interest in the 555 days non-callable fix deposit. As per the BOB, general account, non-residential external account (NRE), and nonresident ordinary account (NRO) will get an interest rate of 6 percent p.a, while senior citizens will get an interest rate of 6.5 percent p.a.

We Hope you got the complete information about the Bank of Baroda Tiranga Fix Deposit scheme. We will update our page on regular basis, if your want to learn more about banking, and finance information then visit our website regularly