Tax Rebate Under Section 87A For FY | How Is Section 87a Rebate Calculated | Tax Rebate Under Section 87A For FY Complete Process

The Section 87A rebate assists taxpayers in lowering their income tax liability. If your total income, after Chapter VIA deductions, does not exceed Rs 5 lakh in a financial year, you can request the rebate. After claiming the Section 87A rebate, your income tax burden is zero. Section 87A was first established in the Finance Act of 2003, and it has since been amended several times. If your income does not exceed Rs. 5 lakh, an individual taxpayer who is a resident of India for income tax purposes is currently eligible for a tax rebate of up to Rs. 12,500 against his tax burden.

However, once your income exceeds this threshold, your right to claim the Section 87A rebate is lost forever. Read below to check the detailed information related to Tax Rebate Under Section 87A For FY 2022-23 like Highlights, Eligibility Criteria, Calculating the rebate under Section 87A, and much more.

Table of Contents

Tax Rebate under Section 87A for FY 2022-23– Comprehensive Details

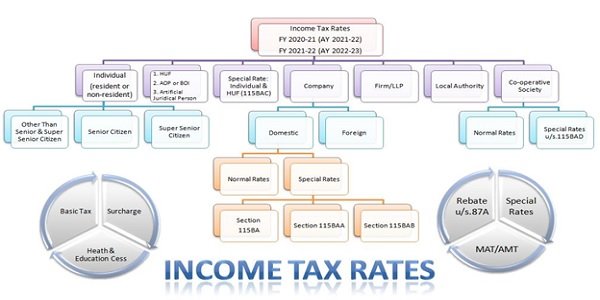

The government hasn’t modified the basic exemption level of 2.50 lakh in a long time since it doesn’t want people to go outside the tax net and avoid filing ITRs. At the same time, the successive administrations have suggested a tax rebate for taxpayers with incomes up to a particular level. Those with an annual income of less than 5 lakh rupees are currently eligible for a tax rebate. This reimbursement is provided under Section 87A of the Internal Revenue Code. The discount is not available to everyone. Although the fundamental exemption amount of Rs. 2.50 lakh applies to all individuals and HUFs, whether resident or non-resident, the Section 87A refund is only payable to individuals, and only if they are residents for income tax purposes. As a result, this reimbursement is not available to HUFs or non-resident persons.

Objectives of Tax Rebate under Section 87A for FY 2022-23

Any government’s first job is to protect its citizens, and the Indian government is continually attempting to attain this goal. To assist the government in achieving this goal, citizens of India are obligated to pay taxes based on their income. Taxes assist the government in developing the nation’s infrastructure. However, Indian tax law includes several provisions for reducing tax responsibilities, one of which is Section 87a of the Online Income Tax, 1961.

Income Tax Rebate u/s 87A Eligibility Criteria for FY 2022-23

The following are the requirements for claiming the rebate under Section 87A of the Income Tax Act 1961:

- The 87A rebate is only available on the gross total tax liability before the 4% health and education cess is applied.

- Senior persons (those between the ages of 60 and 80) can also claim the rebate under section 87A.

- However, the 87A rebate is not available to super senior citizens (those over the age of 80).

- Only residents of the United States will be eligible for reimbursement under Section 87A.

- Both the previous and new income tax regimes will be eligible for the Section 87A rebate. As a result, you can claim the rebate under section 87A

- The maximum amount you can claim as an 87A refund is the lower of the limit outlined in section 87A (12,500) or your entire tax liability before cess.

Working of Rebate

People hold the misconception that if their income does not surpass the magic figure of 5 lakh, they do not have to pay any tax. This is because the tax rate for ordinary income is 5% between 2.50 lakhs and 5 lakhs, and the tax due at 5% on 2.50 lakhs is exactly 12,500. If your income includes items that are taxed at a greater rate of 15% (short-term capital gains) or 20% (other long-term capital gains), you will still have to pay some tax, even if your total income does not reach 5 lakhs. Your 5-lakh earnings are made up of one lakh in short-term capital gains on listed shares and the rest is your monthly income.

Your tax liability would be Rs. 22,500, which would be made up of Rs. 7,500 (5 percent on 1.50 lakh) plus Rs. 15,000 in interest (15 percent on 1 lakhs of Short term capital gain). Even if your income does not surpass the limit of five lakhs, you would have to pay Rs. 10,000/- and cess after the rebate of 12500/-.

Steps to calculate Tax Rebate under Section 87A

The steps involved in calculating the rebate under Section 87A are as follows:

- Calculate your total gross income (GTI)

- Deductions under sections 80C and 80U are reduced

- Calculate your taxable income based on the income tax slabs

- Subtract the amount of the rebate

- Calculate the amount of Health and Education Cess payable at 4% on your balance tax payable (if any)

The amount of the rebate under Section 87A will be determined by the taxes you owe.

| Tax Payable | Rebate u/s 87A |

| Less than Rs. 12,500 | Equal to the tax amount payable |

| Exactly Rs. 12,500 | Rs. 12,500 |

| More than Rs. 12,500 | NIL |

Example:

Let’s look at an example to help you grasp the computations. Say Mr. Rahul’s total taxable income is:

Rs. 4 Lakhs

Rs. 5 Lakhs

Rs. 6 Lakhs

| Particulars | Amount | Amount | Amount |

| Total Taxable Income | 4,00,000 | 5,00,000 | 6,00,000 |

| Less: Basic Exemption Limit | 2,50,000 | 2,50,000 | 2,50,000 |

| Taxable Income after Basic exemption limit | 1,50,000 | 2,50,000 | 3,50,000 |

| Tax Payable | 7,500 | 12,500 | 32,500 |

| Less: Rebate under section 87A Lower of 1) Tax Payable or 2) Rs 12,500 | 7,500 | 12,500 | NIL* |

| Balance Tax Payable | NIL | NIL | 32,500 |

| Add : Health & Education Cess @ 4% | – | – | 1,300 |

| Final Tax payable | – | – | 33,800 |

Points to remember to take advantage of the Section 87A rebate

- For the benefit, Section 87a has been added to the Income Tax Act, 1961, and it takes effect on April 1st of each financial year. This statute governs a tax assessment year as well as following tax assessment years

- Before adding a 4% health and education cess, the rebate can be applied to the total tax.

- Residents are the only ones who are eligible for a rebate under this clause.

- The advantages of this tax rebate do not apply to non-Indians.

- This tax rebate is available to both female and male taxpayers.

- Section 87A provides a rebate to senior individuals over the age of 60 but not over the age of 80.

- Section 87A rebates are not available to super senior people beyond the age of 80.

- The amount of the rebate will be less than the Section 87A limit or the total amount of income tax due (before cess)

- The Section 87A rebate is accessible in both the old and new tax regimes.

- If the total tax due is less than Rs.2, 000, Section 87a of the Income Tax Act limits the tax rebate to the total tax due.

Rebate on a variety of tax liabilities

The Section 87A refund can be used for the following tax liabilities:

- Ordinary income, taxed at the slab rate

- Section 112 of the Income Tax Act applies to long-term capital gains. (Long-term capital gains on the sale of any capital asset other than listed equity shares and equity-oriented mutual funds are subject to Section 112).

- Under Section 111A of the Act, short-term capital gains on listed equity shares and equity-oriented mutual fund schemes are taxed at a fixed rate of 15%.

- Note that the Section 87A rebate cannot be used to offset taxes on long-term capital gains on stock and equity-oriented mutual funds (Section 112A).

Rebate limit under Section 87A for all the financial years

The Rebate limit under Section 87A for all the financial years is given in the table below:

| Financial Year | Limit on total taxable Income | Amount of rebate allowed u/s 87A |

| 2021-22 | Rs. 5,00,000 | Rs. 12,500 |

| 2020-21 | Rs. 5,00,000 | Rs. 12,500 |

| 2019-20 | Rs. 5,00,000 | Rs. 12,500 |

| 2018-19 | Rs. 3,50,000 | Rs. 2,500 |

| 2017-18 | Rs. 3,50,000 | Rs. 2,500 |

| 2016-17 | Rs. 5,00,000 | Rs. 5,000 |

| 2015-16 | Rs. 5,00,000 | Rs. 2,000 |

| 2014-15 | Rs. 5,00,000 | Rs. 2,000 |

| 2013-14 | Rs. 5,00,000 | Rs. 2,000 |

FAQ’s

No, this rebate is only available to citizens. As a result, taxpayers who are identified as non-residents are not eligible for an 87A rebate.

There are no specific adjustments needed to calculate the rebate under Section 87A. As a result, taxable income will be calculated as usual, with exempt income such as PPF interest not being added back.

Only members of a HUF can claim the 87A rebate in their respective capacities as Indian residents. HUF, on the other hand, will not be eligible for a rebate.

The income tax exemption limit is the same as the basic exemption limit to calculate Sec 87A. This limit is currently set at Rs. 2, 50,000. If your total income is up to Rs. 5, 00,000, you are eligible for a tax rebate of Rs. 12,500 or 100 percent of the tax amount, whichever is lesser, under section 87A.