PPF Account Scheme Apply Online | PPF Account Scheme Interest Rates | PPF Account Opening Online | PPF Account Scheme Tax Benefits

In India, the Public Provident Fund i.e., PPF was established in 1968 to mobilize small savings in the form of investment with a return. It’s also known as a savings-cumulative-tax savings investment vehicle since it allows you to create a retirement fund while lowering your annual taxes. Anyone looking for a risk-free way to save money on taxes while earning guaranteed profits can open a Public Provident Fund i.e., PPF account.

Table of Contents

PPF Account Scheme

The Public Provident Fund (PPF) program is a long-term investment option with a competitive rate of interest and returns on investment. The interest and returns earned are not taxable under the Income Tax Act. Under this system, one must create a PPF account, and the amount contributed during the year will be claimed as a deduction under section 80C.

PPF Account & it’s Advantages

The Government of India’s Public Provident Fund (PPF) is a retirement savings scheme that aims to provide everyone with a secure post-retirement existence. The account requires a minimum deposit of Rs.500 every financial year, with a maximum deposit of Rs.1.5 lakh. You can claim income tax benefits on the amount you invest in the account, in addition to providing retirement savings.

Some of the advantages of the PPF Account Scheme are as follows:

- The minimum investment is Rs.500.

- Returns are risk-free because they are not affected by market volatility.

- The interest rate is compounded.

- For a period of 15 years, this is a long-term investment.

- On maturity, the PPF account has an unlimited extension facility in five-year blocks.

- Section 80C of the Income Tax Act of 1961 allows for a tax deduction.

- Advances and loans against your PPF balance.

- From the seventh financial year onwards, a partial withdrawal facility is available.

Who is Eligible to Open a PPF Account?

A PPF account can be opened by any adult Indian resident. A legal guardian can open an account on behalf of a minor or a person with a mental disability.

How Can I Open a PPF Account?

A PPF account can be opened at any Post Office or any nationalized bank, such as the State Bank of India or the Punjab National Bank, among others. Even private banks such as ICICI, HDFC, and Axis Bank, among others, are now authorized to provide this service.

Top Rated Banks for Current Account

Best Place to Start a PPF Account?

Depending on your preference, you can open a PPF account at the nearest Post Office branch or a participating bank branch. The list of banks that provide a PPF account is provided below.

| S.No. | Bank Name |

| 1 | Bank of Baroda |

| 2 | HDFC Bank |

| 3 | ICICI Bank |

| 4 | Axis Bank |

| 5 | Kotak Mahindra Bank |

| 6 | State Bank of India |

| 7 | Bank of India |

| 8 | Union Bank of India |

| 9 | Oriental Bank of Commerce |

| 10 | IDBI Bank |

| 11 | Punjab National Bank |

| 12 | Central Bank of India |

| 13 | Bank of Maharashtra |

| 14 | Dena Bank |

Best Bank to Open a PPF Account with?

PPF accounts are offered by the Indian government and are not tied to any particular bank. When you open a PPF account, all banks offer the same set of options and benefits. The government sets the interest rate, which remains the same regardless of where the PPF account is stored. As a result, there is no optimum bank for a PPF account.

Opening a PPF Account Online

Follow the below-given steps to open a PPF account online:

- Use the online banking or mobile banking platform to access your bank account.

- Choose the option to “Open a PPF Account.“

- Select the ‘Self Account’ option if the account is for personal use. Select the ‘Minor Account‘ option if you are opening the account on behalf of a minor.

- Fill out the application form with the necessary information.

- Enter the total amount you’d like to put in the account for the financial year.

- Submit the filled application form.

- Submit the filled application form. The registered mobile number will receive an OTP. Put it in the appropriate field.

- Your PPF account will be set up in a matter of seconds. The number of your PPF account will be displayed on the screen.

- An email with all the details confirming the same will be sent to your registered email address.

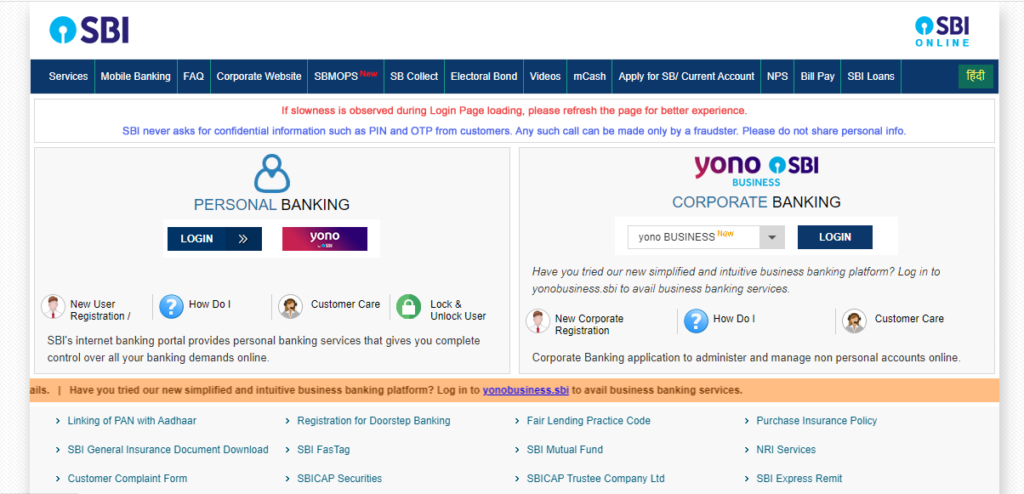

Opening PPF Account in SBI Online

Follow the below-given steps to open a PPF account in the SBI bank through online mode:

- First of all, visit http://www.onlinesbi.com to log in to the SBI’s internet banking portal.

- On the side menu, select ‘New PPF Accounts.’

- You will be taken to the ‘New PPF Account’ page, which will have your name, address, CIF number, and PAN details pre-filled.

- Enter the bank account number and branch code for the PPF account from which you want to make the payment.

- To get the branch name, click the ‘Get Branch Name’ button.

- For verification purposes, your personal and nomination information will be presented. Click ‘Proceed’ after you’re finished.

- Your PPF account will be instantly created, and the account number will appear on the screen.

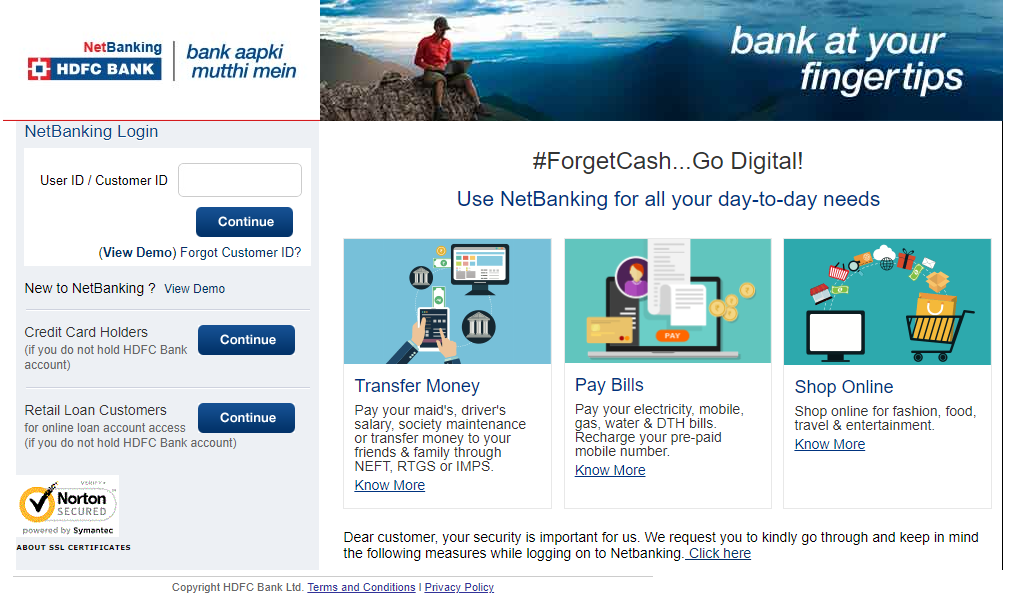

Opening PPF Account in HDFC Bank

Follow the below-given steps to open a PPF account in the HDFC bank through online mode:

- First of all, log in to the HDFC Bank’s internet banking portal

- Select the ‘PPF Accounts’ option under ‘Public Provident Fund.’

- Select ‘Open Now’ from the drop-down menu.

- Enter the PAN number and the bank account details from which you want to pay for your PPF account.

- Check that all of the information you’ve entered is correct, then click the ‘Proceed’ button.

- Check the validity of your Aadhaar number. You can click on ‘Generate OTP’ if your bank account is already connected to your Aadhaar; otherwise, you will need to update your Aadhaar online. There is also the option of e-signing using the Aadhar OTP.

- Your PPF account will be created instantaneously, and the account number will be displayed.

PPF Account Opening in Post Office

Follow the below-given steps to open a PPF account in the Post Office:

- You can obtain an application form at your local post office or online.

- Fill out the form and attach the relevant KYC documents as well as a passport-size photograph.

- Make the needed first deposit to start a PPF account at the post office. Per financial year, the payment might range from Rs.500 to Rs.1.5 lakh.

- After your application has been processed, you will be handed a passbook for the PPF account you have opened.

PPF Interest Rates

The current yearly compounded interest rate is 7.1 percent (for the quarter 1 April 2021 to 30 June 2021; unchanged from the preceding quarter). Every year, the Finance Ministry sets the interest rate, which is due on March 31st. Every month, interest is calculated on the lowest balance between the fifth and last days of the month.

Additionally, you may use our PPF calculator to determine the expected returns on a specific amount invested in a PPF account.

PPF Key Characteristics

Some of the essential characteristics of PPF Interest Rates are as follows:

- Opening Balance: The account can be started with just Rs 100 as an opening balance. Investments of more than Rs 1.5 lakh per annum would not earn interest and will not be eligible for tax benefits.

- Tenure: The PPF has a minimum duration of 15 years, which can be extended in 5-year increments if desired.

- Investment Limits: PPF permits a minimum investment of Rs 500 and a maximum investment of Rs 1.5 lakh per financial year. Investing can be done in a flat sum or for up to 12 months.

- Deposit Frequency: Deposits into a PPF account must be made at least once a year for a period of 15 years.

- Mode of deposit: Cash, check, Demand Draft or online fund transfer are all options for depositing money into a PPF account.

- Nomination: A PPF account holder can name a candidate for his or her account either when the account is opened or later.

- Joint accounts: A PPF account can only be held in one person’s name. It is not possible to open a joint account.

- Risk factor: PPF offers guaranteed, risk-free profits as well as total capital protection because it is backed by the Indian government. The risk associated with owning a PPF account is negligible.

Top Private Banks with Headquarters

Who Can Make a PPF Investment?

- PPF can be invested in by any Indian citizen.

- Unless the second account is in the name of a minor, a citizen can only have one PPF account.

- PPF accounts are not available to NRIs or HUFs.

Working of PPF Account

An adult can open a PPF account for themselves or on behalf of a minor. The account’s lock-in duration is 15 years, and the account’s tenure is 15 years. You can put money into a PPF account for as little as Rs.500 and as much as Rs.1.5 lakh per financial year. Deposits can be made in full or in installments. There are no limitations on the number of installments that can be paid per financial year. The contributions must be made each financial year during the tenure, and they are tax-free under section 80C.To keep the account operational, you must make a minimum deposit of Rs.500 per financial year. The account will be closed if you do not make this deposit. To reactivate the account, you must pay a penalty of Rs.50 and make a minimum deposit of Rs.500.

The deposit earns 7.1 percent p.a. (Q1 FY22) in interest, which is compounded annually. the loan facility is also available on the PPF balance. One can also make partial and premature withdrawals from your PPF account if certain requirements are met. You can choose to prolong the account with or without making additional contributions once your term is up. You can also choose to turn off the air conditioning.

Withdrawal from PPF

Generally, one can withdraw the entire balance of a PPF account only after the account reaches maturity, which is after 15 years. After 15 years, an account holder’s entire balance in the PPF account, including earned interest, can be withdrawn freely and the account closed. However, if account holders require funds sooner than 15 years, the system allows partial withdrawals beginning in year 7, i.e., after completing 6 years.

Premature withdrawals are permitted up to a maximum of 50% of the balance in the account after the fourth year (preceding the year in which the amount is withdrawn or at the end of the preceding year, whichever is lower). Furthermore, withdrawals are limited to one every financial year.

Top 10 Fastest Instant Loan App

Steps of Withdrawal from PPF

If you want to take out a portion or all of the money in your PPF account, you can do so. The procedure for withdrawing from the PPF is as follows:

- First of all, complete form C, the application form, with all necessary information.

- Then take your application to the bank branch where your PPF account is located.

What is Form C

Form C is divided into three sections:

- Declaration:

In this section, you need to submit your PPF account number as well as the amount of money you want to withdraw. You must also state how many years have passed since the account was first opened.

- Official section:

This section is the office use section which contains information like:

- The total amount in the PPF account.

- The date on which the PPF account was established.

- The time when the previously requested withdrawal was granted.

- The signature and date of the person in charge – generally the service manager – are required.

- The total amount of money that can be withdrawn from the account.

- The amount of money that can be withdrawn.

- Bank Details

This section of the form requests information about the bank to which the funds will be credited directly or the bank to which the check or demand draught will be issued. Along with this application, you must also include a copy of your PPF passbook.

Procedure for Closing a PPF Account?

According to PPF account rules, you can only fully withdraw your PPF account balance after the account has been open for 15 years. You can access the entire account amount at the end of the 15 years, withdraw it completely, and close the account. Under any circumstances you cannot, withdraw the entire account balance before the account’s full term. After 5 years, however, a premature withdrawal of up to 50% of the account amount is permitted. This is only permissible in exceptional instances.

Procedure for Transferring a PPF Account?

You can transfer your PPF account to another bank/Post Office branch, switch from one bank to another, or from one Post Office to another. Here’s how to do it.

- First of all, go to the bank or Post Office where you have your PPF account.

- Request the PPF account transfer application form and complete it with the necessary information.

- The branch representative will process your application and deliver it to the new branch, along with a certified copy of the account, nomination form, account opening application, specimen signature, and a check/DD for the PPF account’s outstanding balance.

- Once the new branch has received your application and supporting documentation, you must apply for a new PPF account and send the old PPF account’s passbook. At this stage, you have the option of changing the nominee.

- Your PPF account will be successfully transferred to the new branch once this application is processed.

Find Your PPF Account Number?

When you open a PPF account at a bank or Post Office, you will be given a passbook. The passbook provides all of the relevant information regarding the PPF account, including the account number, bank/PO branch information, account balance, account transactions, and so on. You can get the passbook updated regularly to acquire the most up-to-date information.On the other side, you can use the internet banking interface to access your account. Choose the PPF account from the home page to access account details such as account number, account balance, recent transactions, and more.

Link SBI PPF Account to Online SBI Account?

A PPF account kept with SBI does not need to be linked to an SBI savings account. You will have submitted your existing savings account number to the bank when opening the PPF account, whether online or offline. This means that your new PPF account will be created under the same customer ID as your old one.

Your PPF account will be linked to your savings account by default. As a result, you can access both your savings account and your PPF account details using the same login credentials for internet banking.

Link Aadhaar Number to PPF Account Online

Follow the below-given steps to link your Aadhaar number to the PPF account online:

- Go to your internet banking account and log in.

- Select the ‘Aadhaar Number Registration in Internet Banking’ option.

- Click on ‘Confirm’ after entering your 12-digit Aadhaar number.

- To link the PPF account to the Aadhaar number, select it and click Finish.

- To see if the Aadhaar connecting request has been completed, go to the homepage and click on the ‘Inquiry’ option.

Check PPF Balance

Follow the below-given steps to check the balance of the PPF account online:

- First of all, go to your internet banking account and sign in.

- Check the latest PPF balance and recent transaction data by opening the PPF account details.

How Long may a PPF Account be Extended?

When a PPF account reaches maturity after 15 years from the date of opening, it can be extended in five-year increments an unlimited number of times.

Tax Benefits

The Exempt-Exempt-Exempt (EEE) category includes a variety of investment vehicles, including the PPF. In other words, all PPF contributions are tax-deductible under Section 80C of the Income Tax Act. Moreover, at the moment of withdrawal, the accumulated sum and interest are tax-free. It’s worth noting that a PPF account can’t be canceled before it reaches maturity.

However, a PPF account can be moved from one point of designation to another. However, keep in mind that a PPF account cannot be closed early. Only in the event of the account holder’s death can the nominee request that the account is closed.

How to Get Money Out of PPF Account before it Matures

Follow the below-given steps to get money out of a PPF account before it matures

- First of all, determine whether you are entitled to an early withdrawal.

- If you are eligible, obtain Form C from your bank or the Post Office and complete it with the necessary information.

- If the account is in the name of a minor, you must supply an extra statement declaring that the money is being withdrawn for the minor’s benefit and that the minor is still alive.

- Submit the form, along with any supporting documentation, to your local bank or Post Office.

- The bank or PO will process and release the money if all of the information and papers you have given are satisfactory.

Best Time to Put Money into PPF Account

When it comes to depositing money into a PPF account, there is no set deadline. Depositing money between April 1 and April 5 of a financial year, on the other hand, is advantageous. If making a full year’s deposit at the start of the year is not possible, you can make monthly installments by the 5th of the month to gain the most rewards.

- How Many Max. PPF Accounts can be Opened

A person can only have one PPF account in the country, which can be opened at a bank or a Post Office.

- How Many Max. Times PPF Accounts can be Extended

There are no limits on how many times a PPF account can be expanded.

- What is the Maximum Amount of Money that can be Withdrawn from a PPF Account

After five years have passed since the account was opened, you can withdraw money in part. However, after the fourth year from the date of opening, you can only withdraw up to 50% of the total account amount.

- What is the Procedure for Converting a Minor PPF Account to a Major PPF Account

When a minor PPF account holder turns 18 years old, you can convert the account’s status from minor to major by submitting a revised application form along with the required documentation stating the account holder’s age. As an attestation, the guardian might submit the application along with the signature of the account holder on the application form.

What is a PPF account’s minimum Lock in Period?

The minimum Lock-in Period for a PPF account is 15 years, which is the account’s real tenure.

- How can I Close a Post Office PPF Account?

After 15 years from the date of account opening, you can close your PPF account. The steps are outlined below.

- Fill out Form C with the required information and attach your PPF passbook.

- This should be sent to the Post Office branch where the account is stored.

- The account will be closed after your application has been processed.

- The payment will be made to your connected savings account in your PPF account.

- How to Reactivate an Inactive PPF Account?

You can reactivate an inactive PPF account by following these steps:

- Send a letter to the bank or PO branch requesting that it be reactivated.

- Pay a minimum of Rs.500 plus a penalty of Rs.50 per inactive year for each year you have not made any contributions.

- Your request will be processed by the bank or PO, and the account will be reactivated.

FAQs

After the account matures, you can only extend it for another five years in five-year increments.

You are not required to withdraw your PPF balance after the maturity term, which is 15 years. As long as you shut the account, you can leave the money in the account to earn interest.

Individuals can only close their PPF accounts after they have been open for five years. In addition, to close the account, specific criteria must be met.

You are not required to withdraw your PPF balance after the maturity term, which is 15 years. As long as you shut the account, you can leave the money in the account to earn interest.