Table of Contents

What is Personal Loan?

| Personal Loan Rejection | It is the loan that is provided to the individual to fulfill any financial requirement. This loan amount can be used to pay any expenses like leisure expenses, medical emergencies, weddings, renovations, etc. The procedure of this loan is very easy as it requires fewer documents. With the help of this loan, the individual can meet his personal requirements also. The interest rate on this loan is very high in comparison to other loans because there is a high risk involved. A personal loan is very beneficial in time of emergency. It is very helpful at the time the individual is facing any financial difficulties.

What is the Purpose of a Personal Loan?

The personal loan can be used for any purpose, it has no limitations. When the individual is left with no other option then he can apply for a personal loan. It can be used to buy electronic products, furniture, holiday, wedding ceremonies, etc.

How Personal Loan Works

A personal loan has similar rules like other loans but it has a different interest rate. Ready all documents, decide from which bank you have taken a loan then apply. After verifying all documents and also after checking your credit worthiness bank will provide the loan. Then you can use it as you want.

How to Avoid Personal Loan Rejection

If you want your Personal Loan to be approved without any rejection, you then must consider below mentioned points while the loan application.

- Good CIBIL Score The lenders keep many criteria in mind at the time of accepting the loan application. One of the criteria is to access the CIBIL score, without accessing the CIBIL score the loan will not be approved. The chances of approving a loan are higher when your CIBIL Score is also on the higher side.

- Clear all Your Bank Related Dues – Pay all your credit card bills on time and also pay all outstanding bills. This will help you to maintain a good image and will build confidence.

- Income Source– Mention all your income sources at the time of applying for a loan. By seeing other sources of income, the lender will build trust that you can repay the loan easily and they will approve your loan quickly.

- Complete the Eligibility Criteria of Loan-There are other eligibility criteria that the individual has to meet. Lenders approve the loan quickly whose criteria match.

- Keep All Documents Ready – As you have decided to take a loan, so keeping your all documents ready should be your priority.

- Apply for a Loan with Only One Lender– When there is an urgent need for finance then the individual applies loan with many banks thinking that it will increase his chances of getting the loan. But this can leave a negative impact also, after knowing that you have applied for a loan at various banks it will show your desperate need for finance. Lenders will come to know about your financial condition, it is possible that they reject your loan application. It will also affect your credit score and will waste your valuable time.

- Only Apply for the Amount, You Can Easily Repay– The individual should only apply for that amount that he knows he can pay back to the lender. This he can decide after assessing his credit repayment capacity.

- Don’t Apply In Hurry- It is known that a personal loan is an urgent need. But don’t apply in hurry, plan every aspect and research a lot before applying.

Top 5 Reasons for Personal Loan Rejection

There are many reasons for Personal Loan Rejection. The individual has to be extra cautious at the time of applying for a personal loan. Every loan has its own term and conditions that the borrower has to fulfill. Here we are sharing the top 5 reasons for loan rejection.

- Low credit score

- Outstanding debts

- Unstable Source of Income

- Not Enough Source of Income

- Not qualifying the Eligibility Criteria

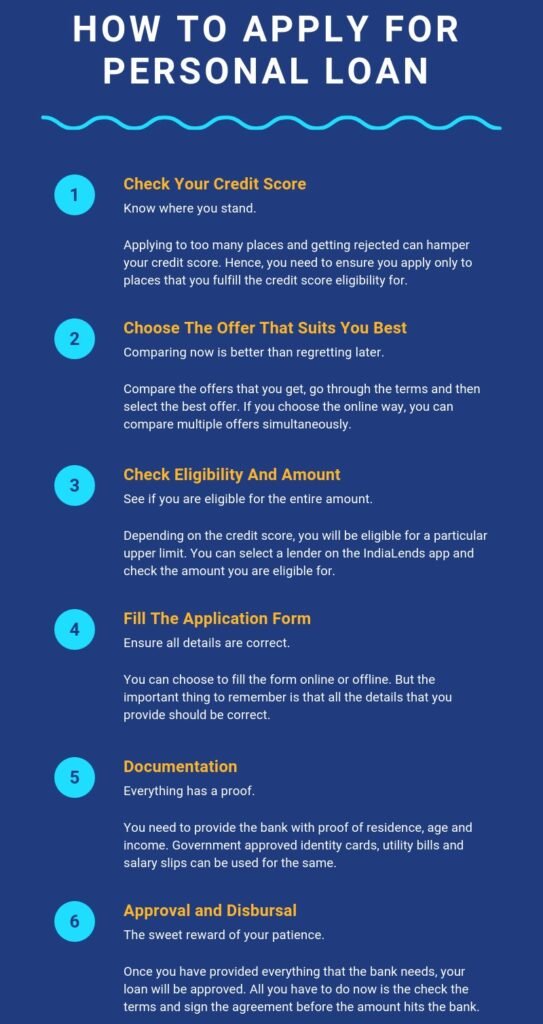

How to Apply for a Personal Loan?

- Visit the website of the bank or company you want to apply for a loan.

- After reaching the home page click on the personal loan option.

- Fill in your name and phone number, receive OTP, and verify yourself.

- Fill in all information asked like age, salary, pan card details, etc.

- You will receive offers, set loan amount, and tenure.

- Set your monthly installments for repaying loans.

- Confirm all terms and conditions.

- Soon you will receive the amount in your bank account.

Conclusion

A personal loan is a facility that provides you with the best solution to manage all your personal expenses. There are many companies and banks that are giving personal loans with less documentation. It is not a lengthy and complex process as it saves time for both borrowers and lenders.