Pay LIC Premium | Pay LIC Premium from PF/EPF Account | LIC Premium Payment Online Paytm | How Can I Pay LIC Premium Online

Paying LIC (Life Insurance Corporation of India) premiums on a monthly basis can be a difficult undertaking at times, especially for low-income individuals. If you are a salaried employee with an EPF account, however, you can Pay LIC Premium from your PF/ EPF account. Despite the fact that the facility has been in operation for a long time, few people are aware of its existence.

Table of Contents

Paying LIC Premiums using EPF Corpus

EPF members can direct the EPFO (Employees’ Provident Fund Organisation) to pay their LIC life insurance premiums from their EPF account. By finishing Form 14, you can instruct EPFO to pay the LIC premium either at the time of purchase or at any time after the initial premium payment has been made. Form 14 is an application for financing a life insurance policy from LIC using your contribution to the Employees’ Provident Fund Account that you can get from the EPFO website. Your LIC premium will be automatically taken from your EPF account on or before the due date once your application has been processed.

Limitations to Pay LIC Premium from PF/EPF

When using Pay LIC Premium from PF/EPF service, there are a few important limits to bear in mind.

- Your EPFO account must have been active for at least two years. If you have been a member of the EPF for less than two years, you are not permitted to use the facility.

- Your annual EPF contribution must be greater than your LIC policy’s annual premium payment.

- At the time of application, your share of total contributions to the EPF corpus must be adequate to cover the LIC premiums for your insurance for two years.

- The premium payment will be immediately stopped if there are insufficient funds in your EPF account. As a result, it’s critical that you start paying your life insurance premiums in other ways, or your policy will lapse.

Is it Wise to Pay LIC Premiums with EPF Corpus?

It may not be a good idea to use your EPF contributions to pay your LIC premiums. To begin with, keeping track of both your LIC Premium and your EPF account at the same time can be difficult, especially if your EPF corpus is tiny due to being a new member. In this instance, due to a lack of money in your EPF account, your insurance policy may be jeopardized.

Furthermore, because the EPF corpus was created to provide a long-term retirement fund, depleting the corpus to cover relatively short-term demands is not recommended. However, in times of financial trouble or an emergency, this service may be of considerable assistance in preventing your insurance policy from expiring without the need for emergency borrowing. When your financial situation improves, you can always cease using this service and continue contributing to your EPF retirement account.

Form for Withdrawing PF

Employees’ Provident Fund (EPF) forms come in a number of different forms. The EPF Form would differ depending on the purpose. Different forms are required for a variety of purposes, including funding a Life Insurance Corporation (LIC) policy, advances of EPF funds, and withdrawals of EPF funds.

Various EPF Forms to Pay LIC Premium from PF/EPF

The many EPF Forms available are listed in the table below:

| Form | Purpose |

| Form 2 | Nomination for the EPF and Employees’ Pension Scheme (EPS) |

| Form 5 | Registration form for new employees for EPS and EPF |

| Form 5(IF) | Employees’ Deposit Linked Insurance (EDLI) scheme claim form |

| Form 10C | EPS withdrawal |

| Form 10D | To apply for a pension after retirement |

| Form 11 | Automatic transfer of EPF |

| Form 14 | LIC Policy |

| Form 15G | To save Tax Deducted at Source (TDS) for any interest that is generated from EPF |

| Form 19 | Settlement of EPF |

| Form 20 | EPF settlement in case of employee’s death |

| Form 31 | Withdrawal of EPF |

Required Documents for PF Withdrawal Form

The following are the most usual documentation needed to withdraw your provident fund balance:

- Form 19, 10C, 31 and Form 10D

- Two revenue stamps

- Bank account statement

- Identity proof

- Address proof

- A blank and cancelled cheque (IFSC code and account number should be visible). You should also make sure that the check you supply is for a single account holder.

Filling Out EPF Form 19 Online to Pay LIC Premium from PF/EPF

The following is a list of the actions that must be followed in order to fill out Form 19 online:

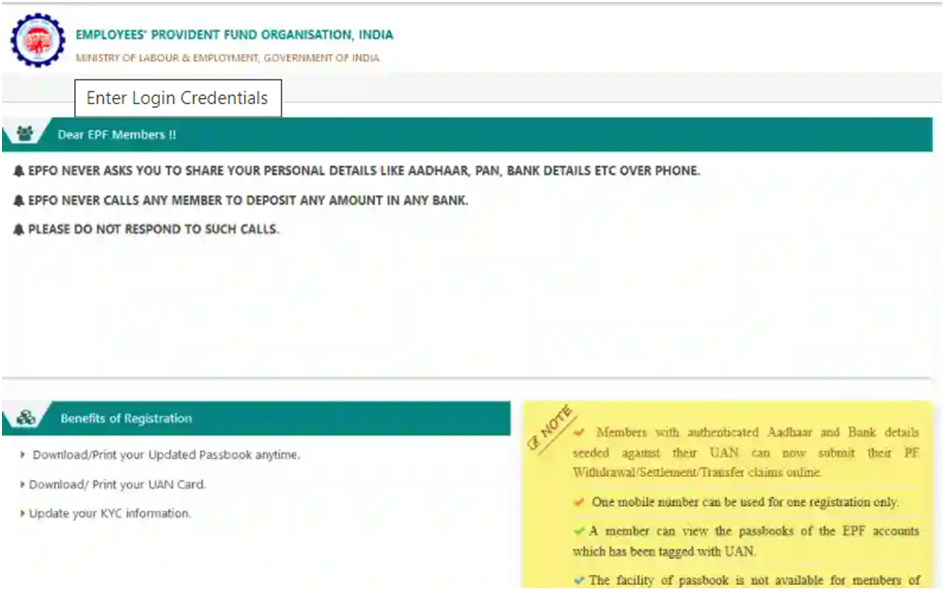

- To begin, enter your UAN, password, and captcha information into your Universal Account Number (UAN) site. The Employees Provident Fund Organisation (EPFO) website can help you with this.

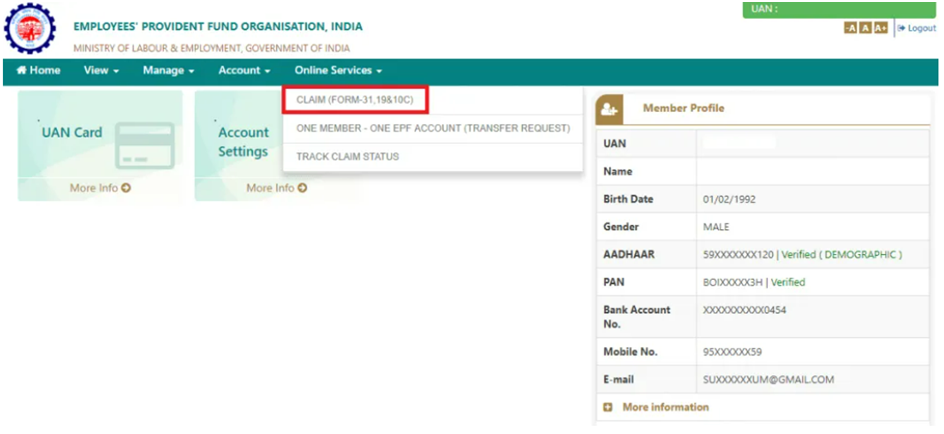

- On the following screen, click the ‘Claim (Form – 31, 19 & 10C)‘ link under the ‘Online Services‘ option.

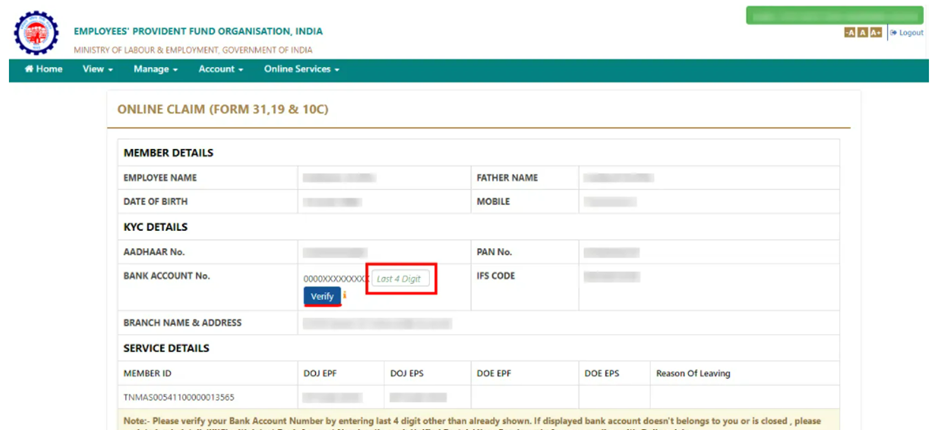

- After that, click ‘Verify’ and enter the last four digits of your bank account number.

- A window called ‘Certificate of Undertaking’ will appear. You must select ‘Yes.’

- Select ‘Only PF Withdrawal (Form-19)‘ from the ‘I want to apply for’ drop-down option.

- Check the disclaimer on the next page before clicking ‘Get Aadhaar OTP.’

- On your registered mobile number, you will receive an OTP.

- After inputting the OTP information, you must submit the application.

- When you submit your application, you will be given a reference number.

Form 19

After quitting your work, superannuation, termination, or retirement, you can use this form to withdraw your PF balance. No business or organization has the authority to prevent you from withdrawing from your provident fund balance.

The following details are needed on the form:

- Your name as it appears on your pay slip

- Names of your father or husband (married women)

- Account number for the provident fund (pay slip)

- Why did you leave your former job?

- The date on which you left the prior service

- Your permanent residence address

- Your preferred remittance method

- Name and location of your business

- For the current fiscal year’s contribution

Employees can also register a claim for PF withdrawal on the EPFO website using Form 19. On the website, a new form can be downloaded, filled out, and submitted.

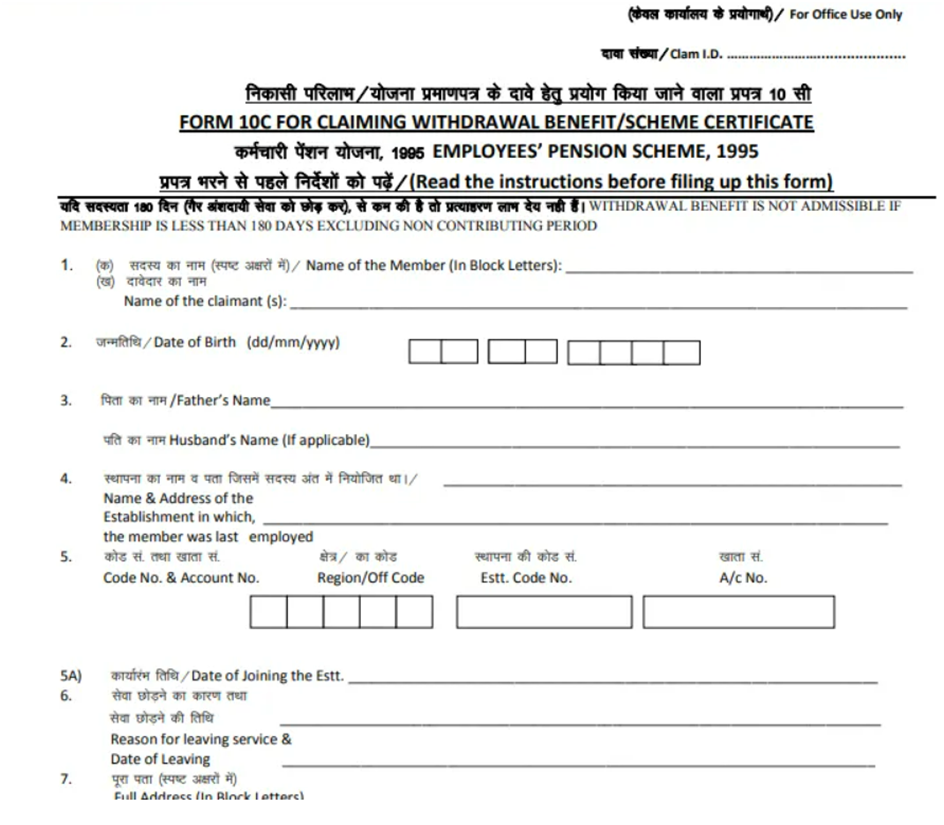

Form 10C

Form 10C is used to file PF withdrawal claims. Employees under the age of 50, i.e., those under the age of 50, are required to fill out this form. For the following schemes, this form is frequently submitted alongside F-19/20:

- Settlement of withdrawal under old Family Pension Fund

- New Employees’ Pension Scheme (EPS 95)

- Scheme certificate for membership retention (under 58 years)

The following details are needed on the form:

- Name of the claimant

- Marital status

- Name and address of the establishment

- Code and account number

- Date of leaving

- Reason for leaving service

- Are you willing to accept scheme certificate in lieu of withdrawal benefits?

Advance Report

When you choose to pay your withdrawal benefit by check, you will receive this.

The EPFO introduced new EPF Withdrawal Forms in 2017 that do not require the signature of the employer. Form 10C UAN, Form 19 UAN, and Form 31 UAN are the three forms. To use these forms, you must have a UAN that has been activated, as well as your PAN, Aadhaar, and bank details seeded with the UAN. In addition, the employer must use a digital signature to validate the employee’s KYC.

Form 10D

Monthly Pension claims are filed using Form 10D. Along with the F-19/20, this form is also filed. If the employee is between the ages of 50 and 58, he or she will be asked to complete Form 10D.

- The following information must be filled out on the form:

- The claimant’s name

- Martial Status

- Adresse Permanente

- Name and address of the most recent organisation

- Date of departure from the previous organisation

- The reason for quitting the previous company

- Advance Reports etc.

Form19UAN

When an employee resigns owing to physical impairments, permanent relocation to a distant nation, or retirement, this form is used. Filling out the form is straightforward. The employee must give all pertinent information, including his or her UAN, PAN, and date of termination. If the individual has been at the job for less than five years, they must additionally file Form 15G or Form 15H. These supplementary forms, however, can only be submitted if the employee’s yearly salary is less than Rs.2.5 lakh.

The employee would also be required to submit a canceled check along with the necessary bank account information for the transfer. After filling out the form and attaching the appropriate documents, it should be signed and submitted to the EPFO office.

Form 10C UAN

When an employee additionally claims the sum collected under the Employee Pension Scheme, Form 10C UAN is submitted simultaneously with Form 19. (EPS). This form is used when an employee leaves their work before completing ten years. This can also be used if an employee resigns before finishing their ten-year term. PAN, UAN, date of joining, and date of leaving should all be filled out completely on the form and sent to the EPFO office.

Form 31 UAN

When an employee wants to withdraw their EPF or needs a loan, they must fill out this form. PAN, UAN, date of joining, and date of leaving should all be filled out completely on the form and sent to the EPFO office.

FAQ’s

Individuals can claim EPF using the offline withdrawal form.

If they do not want an additional tax deducted from their EPF account, they must change their PAN information. If PAN data are not updated and an amount greater than Rs.50,000 is withdrawn, there may be a high tax deducted at source (TDS) of up to 34.6 percent.

Individuals are excused from paying tax if they withdraw their EPF after 5 years of employment. Form 15G/H must be presented to be excused from paying tax for withdrawing EPF before the 5-year period.