It is necessary to update your government documents as per your current information if you are going to change the number on the PAN card. The majority of the data regarding the candidates’ financial services would be collected by the Indian government using a PAN card. The PAN Card user has to go through various procedures to change his/her mobile number on the PAN card. In this article, we are sharing the step-by-step procedure through which you will be able to take into consideration Pan Card Mobile Number Change Online. We are also sharing the step-by-step procedures through which you can update your Mobile Number on your Pan Card.

Table of Contents

What is PAN Card?

The Income Tax Department issues PAN numbers, which are unique alphanumeric codes. PAN numbers are encrypted on a plastic laminated card known as a PAN card. Using the PAN Card, the Income Tax Department can identify and track all transactions between the PAN holder and the department. These transactions include tax payments, TDS/TCS credits, income returns, specified transactions, correspondence, etc. By using it, PAN holders can retrieve information about their investments, borrowings, and other business activities more easily.

Link Aadhaar Card To Pan Card By Mobile Number

Pan Card Mobile Number Change Registration Procedure

If you want to link your mobile number with the PAN card then you will have to follow the simple procedure given below:-

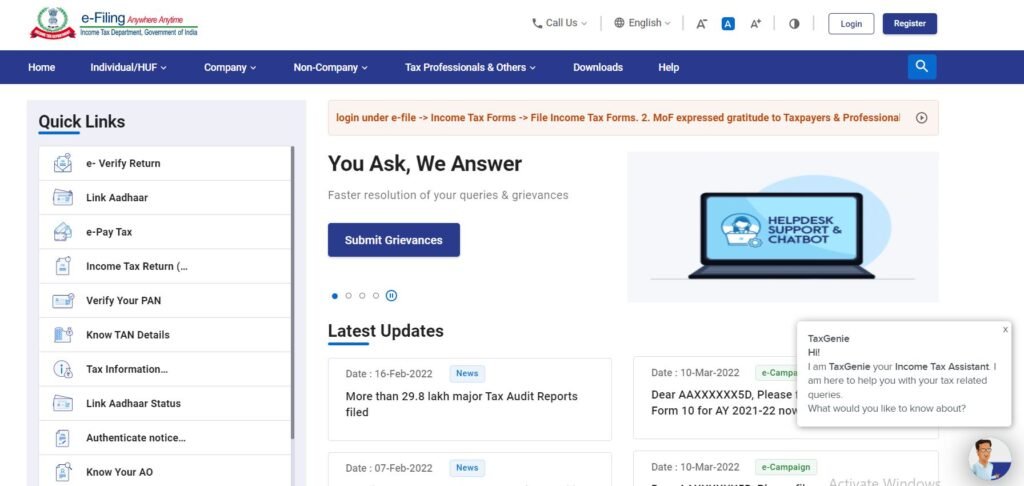

- You need to first visit the official website of income tax official website by clicking on the link given here

- The homepage will open on your screen and you will have to click on the option called Register Yourself.

- You need to click on the option called change PAN card Mobile Number

- Select the user type “Individual” and click continue.

- Add register change PAN card Mobile Number

- Now, enter your PAN Card number, your surname, and date of birth, select Resident and proceed further.

- Now, register your mobile number (primary mobile number).

- You can also add a secondary mobile number and email ID.

- You will receive an OTP on your mobile number and email ID to verify. Enter the OTP

- Your mobile number will be successfully registered.

Update Mobile Number In Pan Card Online

If you want to update your mobile number then you will have to follow the simple procedure given below:-

- You need to first visit the official website of income tax official website by clicking on the link given here

- The homepage will open on your screen and you will have to log in using your details.

- Enter your User ID and login password.

- Click on Profile Settings present under the My Profile option.

- You need to now select your contact details and click on the edit button.

- Enter your new mobile number and email ID and submit. You will receive an OTP on your new mobile number and email ID, enter OTP and confirm.

Track PAN Card Delivery Status

Update Mobile Number In Pan Card Offline

If you want to update your mobile number in PAN card offline then you will have to follow the simple procedure given below:-

- You will first have to download the PAN card request form available at the official website of NSDL by clicking on the link given here.

- You need to fill out the application form in black ink only and you need to upload all of the documents.

- And You need to submit two recent passport-size photographs and then you will have to enclose various documents in the application form such as-

- Demand Draft

- Form

- Address proof

- Identity proof

- Date of birth

- You need to locate your nearest PAN card centre and pay the application fees.

- Submit the documents and your application to the nearest PAN card centre.

Pan Card Correction/ Update Fee

| Particulars | Fee (Inclusive of applicable taxes) | |

| A. If Physical PAN Card is Required: | ||

| Application Type | Dispatch of physical PAN Card in India (Communication address is Indian address) | Dispatch of physical PAN Card outside India (Communication address is foreign address) |

| 1. PAN applications submitted at PAN Centres or TIN Facilitation Centres/online using * physical mode (physical documents forwarded to NSDL e-Gov.)/ | Rs. 107 | Rs. 1,017 |

| 2. PAN applications submitted Online through paperless modes (**e-KYC & e-Sign / **e-Sign scanned based /DSC scanned based) | Rs. 101 | Rs. 1,011 |

| 3. Request for Reprint of PAN card submitted through the separate online link (No Updates) | Rs. 50 | Rs. 959 |

| B. If Physical PAN Card is Not Required: (e-PAN Card will be sent at the email id mentioned in the PAN application form) | ||

| 1. PAN applications submitted at PAN Centres or TIN Facilitation Centres/Online using * physical mode (physical documents forwarded to NSDL e-Gov.) | Rs. 72 | |

| 2. PAN applications submitted Online through paperless modes (**e-KYC & e-Sign / **e-Sign scanned based / DSC scan based) | Rs. 66 |

Instant Pan Card By Aadhar Number

FAQs

You can easily change your phone number for the PAN card by visiting the official website of income tax and editing the details by logging in using your credentials.

It will take around 15 days to get the updated PAN card available on your doorstep

It will require a few documents before you will successfully change the mobile number in your pan card. You have to enter the OTP also.

You can easily locate your nearest PAN card centre by clicking on the link given here.

My pan card number BUQPK5349M

link my mobile number 9966949781