Apply Online Pan Card | E Pan Card Online Apply | Check Pan Card Application Status | Instant E Pan Card Registration

PAN card stands for the permanent account number and it is a unique identification number issued by the Income Tax Department of India. It is the document that identifies the taxpayers in India. Your pan card will hold all of your tax-related information and you will be able to use this pan card in order to get a refund of your Income Tax or to link all of your financial transactions. The Income Tax department will maintain a detailed record of all of the residents by using these types of cards. Given below, we are sharing important specifications related to the Pan Card Apply Online proved and also Pan Card Application Form, Online Application Status.

Table of Contents

Pan Card Apply Online

There are two different types of organizations that will help you to apply for a PAN card. You can use the portal of NSDL or the portal of UTITSL to apply for the PAN card. The Income-Tax payers will have to submit original proof of address and proof of identity before successfully applying for the PAN card online in India. the PAN card will be issued to all of the taxpayers within the next 15 days and you will be able to get your pan card through the medium of the courier. You must follow the details related to the eligibility criteria before successfully filling up the application form to get your pan card and it is important to apply for a pan card after you have turned the age of 18 years.

Eligibility Criteria to Apply for Pan Card

The applicant must follow the following eligibility criteria to apply for the PAN card:-

- Any individual, firm, joint venture can apply for PAN Card. For this, there is no minimum and maximum age limit.

Required Documents

You must submit the following documents to apply for the PAN card:-

- Good quality passport size colour photo

- Demand draft/ Cheque of amount Rs.107 (inclusive of service tax) as a fee. The charge for applying for PAN is Rs. 994 (including service tax) for foreign communication addresses.

- Aadhaar card is mandatory

- Xerox copy of proof of identity

- Xerox copy of proof of address

Attach any one document from each of the following lists as proof of identity and for address proof.

- For Proof of identity

- School leaving certificate

- Matriculation Certificate

- Degree of a recognised educational institution

- Depository account statement

- Credit card statement

- Bank account statement/bank passbook

- Water bill

- Ration card

- Property tax assessment order

- Passport

- Voters Identity Card

- Driving License

- Certificate of identity signed by Member of Parliament or Member of Legislative Assembly or Municipal Councillor or Gazetted Officer

- For Proof of Address

- Electricity bill

- Telephone bill

- Depository account statement

- Credit card statement

- Bank account statement/bank passbook

- Rent receipt

- Employer certificate

- Passport

- Voters Identity card

- Property tax assessment order

- Driving License

- Ration card

- Certificate of address signed by Member of Parliament or Member of Legislative Assembly or Municipal Councillor or Gazetted Officer.

Application Fee

The applicant will have to pay a certain amount of application fees in order to be eligible to apply for the PAN card:-

- For Indian citizens

If a Physical PAN Card is Required

While submitting PAN application form, the applicant will have to indicate whether physical PAN card is required. If the applicant opts for a physical PAN Card, then the physical PAN card will be printed & dispatched at the communication address. The e-PAN card in PDF format will be dispatched at the e-mail ID mentioned in the PAN application form if the same is provided. Fees applicable are as follows:-

| Sr. No. | Particulars | Fees (exclusive of applicable taxes)(₹) | Fees (inclusive of applicable taxes)(₹) |

| PAN applications submitted Online using physical mode (i.e. Physical documents forwarded to NSDL e-Gov.) | |||

| 1 | Dispatch of physical PAN Card in India (Communication address is Indian address) | 91 | 107 |

| 2 | Dispatch of physical PAN Card outside India (where foreign address is provided as address for communication) | 862 | 1,017 |

| PAN applications submitted Online through paperless modes (e-KYC & e-Sign / e-Sign scanned based / DSC scanned based): | |||

| 1 | Dispatch of physical PAN Card in India (Communication address is Indian address) | 86 | 101 |

| 2 | Dispatch of physical PAN Card outside India (where foreign address is provided as address for communication) | 857 | 1,011 |

If Physical PAN Card is Not Required

PAN applicant will have to indicate at the time of submission of PAN application if the pan physical PAN Card is not required. In such cases, email ID will be mandatory & an e-PAN Card will be sent to the PAN applicant at the email ID. Physical PAN Card will not be dispatched in such cases. Fees applicable are as follows:-

| Sr. No. | Particulars | Fees (exclusive of applicable taxes)(₹) | Fees (inclusive of applicable taxes)(₹) |

| PAN applications submitted Online using physical mode (i.e. Physical documents forwarded to NSDL e-Gov.) | |||

| 1 | e-PAN Card will be dispatched at the email ID mentioned in the PAN application form | 61 | 72 |

| PAN applications submitted Online through paperless modes (e-KYC & e-Sign / e-Sign scanned based / DSC scanned based): | |||

| 1 | e-PAN Card will be dispatched at the email ID mentioned in the PAN application form | 56 | 66 |

- For Non-citizens of India

If Physical PAN Card is required

While submitting PAN application form, the applicant will have to indicate whether a physical PAN card is required. If the applicant opts for a physical PAN Card, then the physical PAN card will be printed & dispatched at the communication address. The e-PAN card in PDF format will be dispatched at the e-mail ID mentioned in the PAN application form if the same is provided. Fees applicable are as follows:-

| Sr. No. | Particulars | Fees (exclusive of applicable taxes)(₹) | Fees (inclusive of applicable taxes)(₹) |

| PAN applications submitted Online using physical mode (i.e. Physical documents forwarded to NSDL e-Gov.) | |||

| 1 | Dispatch of physical PAN Card in India (Communication address is Indian address) | 91 | 107 |

| 2 | Dispatch of physical PAN Card outside India (where foreign address is provided as address for communication) | 862 | 1,017 |

| PAN applications submitted Online through paperless modes (Using DSC & Scanned documents): | |||

| 1 | Dispatch of physical PAN Card in India (Communication address is Indian address) | 86 | 101 |

| 2 | Dispatch of physical PAN Card outside India (where foreign address is provided as address for communication) | 857 | 1,011 |

If Physical PAN Card is Not Required

PAN applicant will have to indicate at the time of submission of PAN application if the physical PAN Card is not required. In such cases, email ID will be mandatory & an e-PAN Card will be sent to the PAN applicant at the email ID. Physical PAN Card will not be dispatched in such cases. Fees applicable are as follows:-

| Sr. No. | Particulars | Fees (exclusive of applicable taxes)(₹) | Fees (inclusive of applicable taxes)(₹) |

| PAN applications submitted Online using physical mode (i.e. Physical documents forwarded to NSDL e-Gov.) | |||

| 1 | e-PAN Card will be dispatched at the email ID mentioned in the PAN application form | 61 | 72 |

| PAN applications submitted Online through paperless modes (Using DSC & Scanned documents): | |||

| 1 | e-PAN Card will be dispatched at the email ID mentioned in the PAN application form | 56 | 66 |

Pan Card Online Apply 2022

You can fill out the application form for your PAN card by using the official website of the portal responsible for this distribution. Given below, we are sharing the step by step procedure to fill up the application form:-

First Step

- You will first have to click on the link given here to go to the official website of Tax Information Network

- The details of the application form will display on your screen.

- The candidates will have to select the details of Ward/Circle, Range, Commissioner, Area Code, AO Code, Range Code and AO Number related information.

- You can get all of the information mentioned thereby contacting your Income Tax office.

- You have to start filling up the form and mention your address.

- Mention all of the other details related to the applicant information inside the application form and successfully submit the application form by clicking on the confirm button.

- You have to note down your acknowledgement number because it will be a reference number for your pan card application.

- You can use the acknowledgement number to track your pan card status.

- Save and print the acknowledgement form.

Second Step

- After taking a print of the Acknowledgement Form, paste your recent colour photograph and sign the acknowledgement (inside the box provided without touching the sides )

- Use only a black ink ball pen to sign the acknowledgement

- Attach Xerox copy of Proof of Identity, Proof of address and Demand Draft (DD) of amount Rs 105/- as fee with application

- Write your name and Acknowledgement Number on the reverse of the cheque/DD

- If you are paying PAN application fee through cheque then deposit cheque in HDFC Bank in your city

- Please check if the documents indicated in the following checklist is present before sending Acknowledgement Form to the NSDL office:

- Acknowledgement Form (With colour photo and signature)

- Xerox copy of Proof of identity

- Xerox copy of Proof of address

- Demand Draft (DD) of amount Rs 107/-

- Superscribe the envelope with ‘APPLICATION FOR PAN – Acknowledgement Number’ (e.g., ‘APPLICATION FOR PAN – 881010100000097’)

- Application form should be sent to NSDL, ‘Income Tax PAN Services Unit, National Securities Depository Limited, 3rd Floor, Sapphire Chambers, Near Banner Telephone Exchange, Banner, Pune – 411045 (Maharashtra)

- Your acknowledgement, Demand Draft, if any, and proofs, should reach NSDL within 15 days from the date of online application

- Applications received with demand draft or cheque as mode of payment shall process only on receipt of relevant proofs and realisation of payment

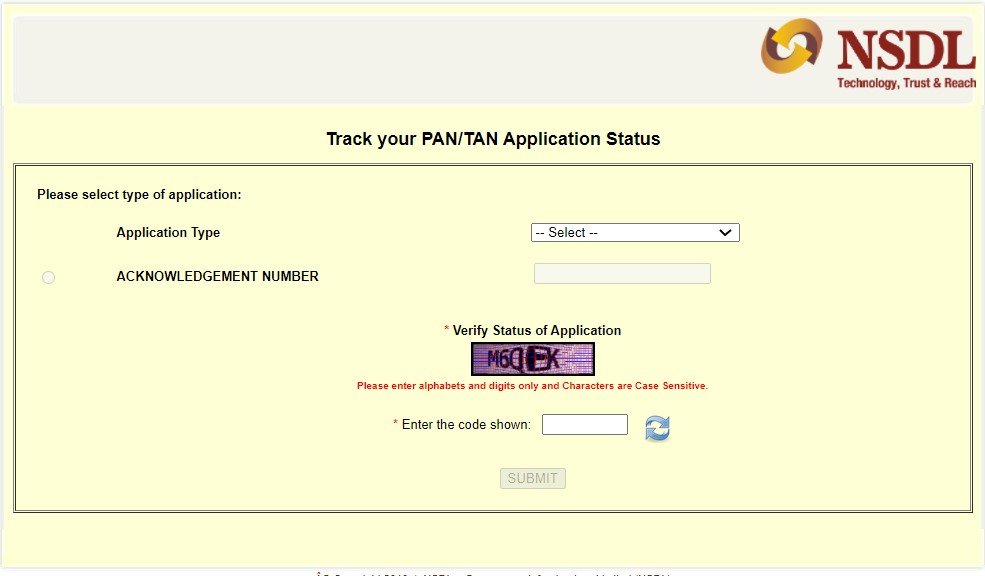

Pan Card Application Status

If you want to check the application status of your pan card then you will have to follow the simple procedure given below:-

- You can check the status of your pan card through SMS or email.

- Send an e-mail to tininfo@nsdl.co.in.

- You can send SMS PAN <space> Acknowledgement No. to 53030 to obtain application status.

- You can also track the status of your PAN card by visiting the official website.

- The web page will display on your screen and you have to select your application type

- You need to enter your acknowledgement number and then you need to enter the captcha code.

- Click on submit and the status will display on your screen.

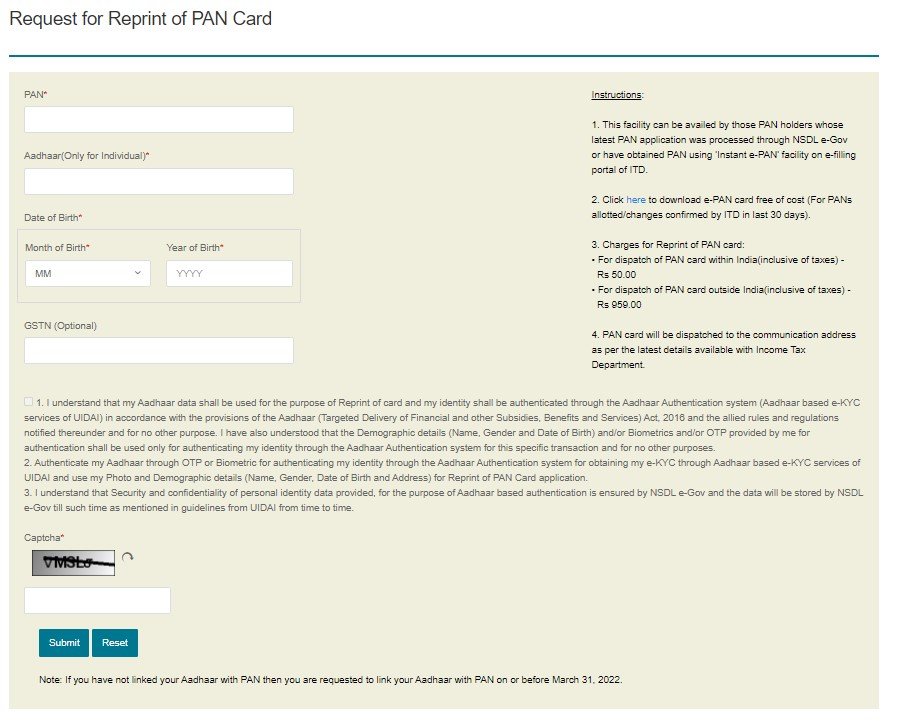

Reprint PAN Card

If you want to request a reprint of your pan card then you will have to follow the simple procedure given below:-

- You will first have to visit the official website for NSDL and the home page will be displayed on your screen

- You have to click on the option called Services and then click on PAN

- A new page with all of the information related to the PAN card will be displayed on your screen.

- You have to now scroll down and click on the option called apply present under the Reprint Pan Option

- A new page with the application form for printing will be displayed on your screen and you will have to enter all of your details.

- Finally, enter the captcha code and click on submit in order to apply for a reprint of the PAN card.

PAN Card Correction

If you want to correct your pan card then you will have to follow the simple procedure given below:-

- You will first have to visit the official website for NSDL and the home page will display on your screen

- You have to click on the option called Services and then click on PAN

- A new page with all of the information related to the PAN card will display on your screen.

- You have to now scroll down and click on the option called apply present under the Change/Correction in PAN Data

- A new page with the application form for printing will display on your screen and you will have to enter all of your details.

- Finally, enter the captcha code and click on submit in order to apply for a correction of the PAN card.

Online Complaints

If you want to file a complaint then you will have to follow the simple procedure given below:-

- You will first have to visit the official website for NSDL and the home page will be displayed on your screen

- You have to click on the option called Customer Care

- A drop down menu will display on your screen and you have to click on the option called Complaints/Queries.

- A new page with the application form will display on your screen and you have to click on the option called complaint

- Enter all of the details mentioned in the application form and give your consent.

- Enter the captcha code and successfully submit the online complaint form in order to give your complaint to the concerned authorities.

Contact Details

- Call PAN/TDS Call Centre at 020 – 27218080

- Fax: 020-27218081

- Write to INCOME TAX PAN SERVICES UNIT (Managed by NSDL e-Governance Infrastructure Limited), 5th Floor, Mantri Sterling, Plot No. 341, Survey No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune – 411 016.