LTC Cash Voucher Scheme Apply Online | LTC Cash Voucher Scheme Calculator | LTC Cash Voucher Scheme Reimbursement Form

Under Section10 (5) of the Income Tax Act, individuals can claim a tax exemption for a journey taken within India for the taxpayer and his or her family. Employees can claim the fare tickets as an exemption under the LTA provided if they travel anywhere in the country India twice in a four-year period. The government has agreed to make the rules for central employees’ Leave Travel Concession (LTC) more flexible. This convenience will only benefit employees who did not claim their LTC until the deadline, which is May 31, 2021. The article contains information about the LTC Cash Voucher Scheme 2022.

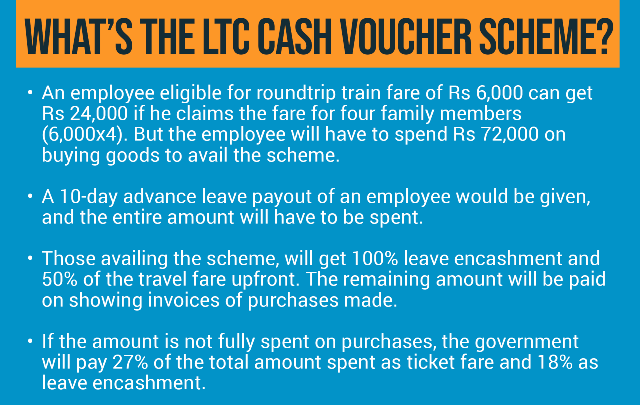

People could not travel owing to the COVID pandemic, therefore employees would have to pay tax on the LTA component of their compensation. The government announced the LTC Cash Voucher Scheme in lieu of the LTA exemption in order to assist salaried individuals in claiming the exemption and to stimulate the sale of goods and services.

Table of Contents

About LTC Cash Voucher Scheme

The LTC is a perk offered by the central government to its employees that allows them to travel to any part of India once every four years. Apart from that, employees can use this scheme to visit their homes twice every four years. Because of Covid-19, travel inside the country and outside the world was restricted, making it impossible to obtain LTC. That is why, in its place, the central government announced the LTC Cash Voucher Scheme. This decision was also made because the coronavirus second wave was at its peak in May, causing many employees to be unable to claim their LTC and requesting a deadline extension. Central employees can use their LTC funds to purchase items with a GST Rate of higher than 12%. Those bills can be claimed afterward. However, the purchase should be paid for online.

The Department of Expenditure under the Ministry of Finance has issued a clarification about the LTC cash voucher system, stating that Central Government Departments and Ministries have been ordered to receive LTC settlement after the due date of May 31, 2021. The Department of Expenditure has also published an Office of Memorandum on the subject. According to the Memorandum, the department has experienced difficulty in settling claims and expenses as a result of Covid-19, which is why the deadline has been extended beyond May 31, 2021.

LTC Cash Voucher Scheme Highlights

| Name of the Scheme | LTC Cash Voucher Scheme |

| Launched By | Finance Minister Nirmala Sitharaman |

| Beneficiaries | Central government employees |

| Benefits | A special cash voucher for central government employees |

| Scheme Objective | Cash Voucher for traveling and shopping in festivals |

| Year | 2020 |

| Scheme Applied | In All India |

| Scheme Published On : | 10/13/20 |

Eligibility to Avail Benefits under LTC Cash Voucher Scheme

To get the benefit under the LTC cash voucher plan, private-sector employees must meet the conditions listed below. The following are the requirements:

- With a GST rate of 12 percent or more, private sector employees will have to spend three times the amount of LTC fare on goods and services.

- This sum must be spent between October 12th, 2020 and March 31st, 2021.

- UPI, Cheque, Debit and Credit Card, and other methods of payment should be used.

- Employees should send a copy of the invoice to their employer, which includes vendor’s GST number and the amount of GST paid.

- If the employee meets all of the requirements, the considered LTC fare that will be paid to the employees will be tax-free.

LTC Cash Voucher Scheme Tax Benefit

Employees in the private sector will receive around Rs. 36000 each individual. The following are the deemed values of the LTC exemption:-

| Particulars | Amounts |

| Number of members in the family | 3 |

| Maximum Exemption Available | 108,000 |

| Expenditure Incurred By The Family | 3,24,000 |

| Expenditure To Be Incurred To Avail Maximum Exemption | 3,24,000 |

| Eligible Non-Taxable Allowance Receivable By The Employee | 1,08,000 |

Objectives of LTC Cash Voucher Scheme

The fundamental goal of the LTC Cash Voucher Scheme is to boost demand and gross domestic production by providing rewards to government and private sector employees. Employees can use their leave travel concession benefits to purchase goods and services with a GST rate of 12 percent or above under this scheme. This will encourage employees to spend money, which will help to enhance the country’s economy.

Benefits of LTC Cash Voucher Scheme to the Economy

The government expects a total demand of Rs 28000 crore from government employees under the LTC Cash Voucher Scheme. Employees in the central government will generate Rs 19,000 crore in demand, while state government employees would generate Rs 9,000 crore in demand. If employers offer this scheme’s benefits to their employees, the scheme’s benefits will be extended to private-sector employees as well.

Benefits of LTC Cash Voucher Scheme to the Government

The GST collection has been significantly disrupted by the coronavirus outbreak. The Cash Voucher Scheme would increase demand for goods and services that have a GST rate of at least 12 percent or higher. Thus GST collections will rise and as a result, the government will be able to obtain sufficient revenue.

Latest Update on LTC

- The Department of Expenditure has said that in order to receive the benefit under this scheme, people can submit a self-attested photocopy of their bill instead of presenting their original.

- They also indicate that existing policies will be excluded from the LTC cash voucher program.

- The central government has declared that the LTC cash voucher plan will cover insurance purchased between October 12th, 2020 and March 31st, 2021.

Key Points to understand under LTC Scheme

- You are not required to travel in order to get the LTC Cash Voucher Benefit. Its purpose is to recompense employees who were unable to travel due to the shutdown while also increasing consumer spending.

- While you are eligible for LTC for two trips over the course of four years, you may only use a cash voucher for one trip.

- You can buy any kind of product or service as long as the GST is at least 12%.

- Purchases can be made on a variety of dates up until the fiscal year’s end. For the purpose of calculating the reimbursement benefit, several invoices are acceptable.To be eligible for the benefit, you must use both LTC and leave encashment.

- If the cash advance is not used or is only partially used, the amount paid must be repaid in whole or to the extent of the unused portion, whichever is greater. According to the Central Board of Direct Taxation’s standards, you’d additionally have to pay interest as a penalty.

- However, you can spend less than the necessary amount and still receive reimbursement, although on a pro rata (proportionate) basis.

- The benefit will be calculated proportionately if you just spend a fraction of the total LTC amount. If you are qualified for Rs 2.1 lakh in LTC but only spend Rs 2 lakh, you will only be entitled for the benefit based on the amount spent.

- If you wish to be eligible for the benefit, you must settle your claims within the current fiscal year. TDS will still apply to leave encashment, which will be shown on the IT Return form under the ‘Income from Salary’ heading. If you claim leave encashment on retirement or when leaving a job, it is tax-free.

- To be eligible for the benefit, you must use both LTC and leave encashment. However, you can spend less than the necessary amount and still receive reimbursement, although on a pro rata (proportionate) basis.

Payment of Premium

The government has announced that premiums for insurance plans purchased between October 12th, 2020, and March 31st, 2020 will be reimbursed under the LTC cash voucher program. It is also stated that voucher bills for this scheme must be submitted before March 31st, 2021. Vouchers and bills must be submitted prior to the superannuation date. Employees are not obliged to produce their original documents; instead, self-attested copies are sufficient.

No Need to Submit Original Documents

To benefit from this scheme, employees must present self-attested photocopies of bills instead of original bills when purchasing commodities such as vehicles and other items. Employees can purchase any goods or services with a GST rate of 12 percent or above, according to the government’s announcement on October 12th. Payment for such purchases must be made by digital mode or check mode on-demand draught or NEFT or RTGS.

LTC’s Impact on the Private Sector

In the coming week, the effects of LTA on the private sector will be obvious. The state’s finance minister stated that a clarification will be made very soon for employees who have accepted the new track system or have already benefited from LTC.

Anurag Thakur discussed the stimulus package and its impact on the economy in an interview with the English publication Times of India. India is the only country in the world where 80 million people would receive free meals for eight months. Furthermore, 68000 crores of rupees have been sent to poor people’s accounts, and many initiatives have been taken to support micro, small, and medium enterprises.

Anurag Thakur had stated in the central perspective that the rural economy is in a better food condition. It’s not just about MGNREGA or agriculture in the rural sector; there’s also infrastructure work going on. People in rural areas are investing in tractor and motorcycle purchases, which are giving new job prospects. And the demand for four-wheelers is steadily rising.

LTC Fare Deemed

The number and value of LTC vouchers given to employees are listed below.

| Employees | Voucher Value |

| Employees who are entitled to travel in business class. | Rupees36000 |

| Employees who are entitled to travel in economy class. | Rupees 20000 |

| Employees who are eligible for any class of rail fare | Rupees 6000 |

What Does The Scheme Indicate For Employees In The Private Sector?

Although, the LTC Cash Voucher Scheme was designed only for government personnel. It was eventually expanded to cover employees employed by private businesses. This explains why the proposal has several major features that only apply to employees in the private sector. The LTC cash benefit, for example, is dependent on the pay grades of Central Government employees. The maximum salary for private-sector employees has been set at Rs 36,000 per individual. As a result, a family of four would be eligible for aRs 1, 44,000 tax exemption (36,000×4).

If a private-sector employee does not use the full amount of LTC, they will only be compensated up to 75% of the total maximum. If you are qualified for Rs 80,000 in LTC, you will need to spend Rs 2.4 lakh (Rs 80,000 x 3) to achieve the entire exemption, and if you spend Rs 1.8 lakh on products, you will only be exempt on Rs 60,000, or one-third of your total expenditure. However, there are several unanswered questions in the idea that the government should address. Private-sector firms, for example, do not often include LTC as a separate component of employee CTC; rather, it is a fixed proportion of gross salary.

In this situation, the current proposal does not specify how the LTC cash benefit is to be determined. You will also be ineligible for the plan if your CTC as a private sector employee does not include LTC.

FAQ’s

If both spouses are eligible for the LTC Cash Voucher Scheme, the couple can calculate their cash amounts based on their individual salaries, produce the necessary invoices, and claim the cash benefit separately.

Yes, you can use the LTC Cash Voucher Scheme in part. This means that half of it can be used to buy the necessary goods and services, while the other half can be used for travel.

There is no limit to the number of products and services that can be acquired as long as they are purchased between October 12, 2020, and March 31, 2021. The full sum can be spent on a single item, or the employees can purchase a variety of products based on their individual needs and desires.

As a result of the pandemic, many businesses have had to lay off workers or reduce salaries in order to stay afloat. It may make sense to spend more in order to take advantage of the tax benefit if you have relatively secure work and enough finances to meet your demands in the short-to-medium term. Those in government jobs, for example, are unlikely to incur salary cuts or job losses and stand to benefit greatly from this arrangement.

Even if the entire sum is not spent on purchases, the employee is still entitled to the scheme’s advantages. The allowance and tax benefit will be distributed on a pro-rata basis in this situation.

Any item with a GST of at least 12% or higher can be purchased by an employee. This can comprise both real and intangible commodities and services.

The LTC Cash Voucher Scheme cannot be claimed by an employee choosing for the new tax regime to file their income tax return since the provisions of the new tax regime prohibit the employee from taking certain tax exemptions and deductions. However, if you choose, you can go back to the previous system while filing your tax returns.

The LTC Cash Voucher Scheme has the same tax advantages as LTC. Employees are eligible for a tax exemption up to a certain amount.